I’m not one to pick a fight, but when good people are being taken advantage of, I’m also not one to sit around and let it happen. I had an experience recently that was a wake-up call for the importance of financial literacy. First impressions were slick and convincing, but scratch the surface with a bit of well-informed skepticism and it all started to stink.

We recently discussed all the ways mutual funds are a bad deal for investors. This time we’re addressing “free” financial seminars. Even if this doesn’t apply to you, you might find the story interesting and possibly relevant for someone you know. Feel free to share.

I’m quite comfortable managing our family’s investments and have been doing so successfully for several decades. But a lot of people aren’t and they’re looking for help. When a professional-looking email or ad offers a FREE seminar to discuss the very financial topics that you’re concerned about, it’s totally understandable that a lot of people would want to sign up.

In this case, the email was titled, “Roadmap to Retirement”. We would learn how to achieve our retirement goals faster, how to live our dreams without running out of money, and how to use our various investment accounts effectively – sounds great, right?

High income earners are particularly juicy targets for obvious reasons. Being trained as a physician, I’m familiar with the marketing we’re exposed to, but I suspect many others are aggressively targeted too (let me know in the comments). I’ve created a course about money for doctors called moneySmartMD, so, naturally, I’m very interested in knowing what information physicians are getting elsewhere. So I signed up.

Boy, was I ever disappointed.

The presentation was by a portfolio manager named J who has been in the business for “30+ years”. Perhaps that should have been the first warning sign – if you’ve been at something that long, why are you aggressively looking for new clients? Red flag number one.

A few minutes into the talk came the disclaimer: He would be showing us numbers and charts, but “the lawyers in the audience” needed to understand that those numbers and charts may not be completely accurate. Hmm. Red flag number two.

Then he really got rolling with a litany of financial disasters just waiting to decimate our futures: inflation, underfunded government programs, longevity risk, unplanned expenses in retirement . . . the list went on and on and on. Playing on an audience’s fears is the oldest sales tactic there is. Red flag number three.

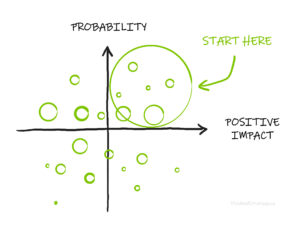

Perhaps the second oldest sales tactic is to undermine the competition. Rather than differentiate himself respectfully, J repeatedly put down other managers. In terms of strategy, he knew exactly what he was up against – the dreaded “Cookie-cutter portfolio” (gasp). What are cookie-cutter portfolios? Well, they are broad-based, low-cost, well-diversified portfolios. They are what “everyone else uses”, but they aren’t good enough for J. Why? Mediocre returns. JS is going to beat the market. The problem is that all the evidence says active management will NOT beat the market over the long term. Red flag number four.

Over and over again, J insinuated that he was the one who could obtain superior returns. He appeared uber-confident that his unique “Portfolio Boost” strategy would handily outperform those silly cookie-cutter portfolios. “No one else uses these strategies” . . . Wait. If they’re so good, why is no one else using them? Red flag number five.

Then came the charts. Beautiful lines curving ever-upward, leaving the competition in the dust. I could practically hear the saliva of the other attendees dripping onto their keyboards. Was I the only one who remembered the disclaimer that these charts “might not” be accurate? Was I the only one who saw the word “hypothetical” right on a slide?? Red flag number six.

When it comes to money, attention to detail matters. At one point J asked if we knew what the largest company in Canada was. He answered his own question: Alimentation Couche-Tard Inc. (ATD-B.TO), and proceeded to make some point about investing. But I don’t remember that point because I was busy wondering if ATD, a convenience store company, had somehow managed to grow bigger than the banks, telecoms and oil companies without me noticing. Nope. ATD is NOT the biggest Canadian company – it is 56th. Red flag number seven.

Perhaps the biggest red flags of all, however, were what was NOT mentioned.

Do you know what’s more important than what you choose to invest in? Financial planning. Even though the title of the talk was “Roadmap to Retirement”, I can’t remember any content about planning, which makes me wonder if J does it at all. Or, if he does, is it done well? Red flag number eight.

There was no mention of how the manager-client relationship works with his firm. Would physicians have access to J himself or one of his staff? How often does he meet with his clients? What does the onboarding look like? The only thing J mentioned was how easy they would make it to get our money into his hands. Shocker. Red flag number nine.

Perhaps most conspicuous of all was the complete absence of disclosure around fees. The importance of fees cannot be overstated; they are the single greatest factor in wealth accumulation that we have control over. But J didn’t mention them. Not once. Even worse, no one in the audience asked about them either. There’s plenty of room for improvement when it comes to financial literacy.

Not wanting to cause a scene at the time (I was a little riled up at this point), I decided to email J to inquire about fees a few weeks later.

Me: I was at your webinar a few weeks ago and was wondering if you would send me some documentation around your fee/compensation structure.

J: My fee structure starts at about 1.95% [of assets under management] and goes down according to account size in a tiered manner.

Me: Thank you. I’m just doing some research at this point. I think fees are really important, so I’d be interested in seeing those tiers, if possible.

J: Fees only count in the cookie-cutter portfolio solutions offered by the investment industry where they are the only real differentiator. My portfolios are uniquely constructed and I could charge 4% (I won’t) and still have better returns. I am not prepared to send any additional details at this point.

That’s a big red flag for number ten.

On a million-dollar portfolio, 1.95% is $19 500 every year, or almost $100 every single working day. And as for “better returns”, well, the grass is always greener on the side that’s fertilized with BS.

Portfolio managers like J exist in a different world than we do. They are running a business. They don’t have training in evidence-based anything. And they know that, when it comes to money, most people are easy to scare and too busy to care. We are the fish and they know what lures we like.

It’s time to change this dynamic and empower people to ask the right questions, demand transparency, and insist upon an evidence-based approach to managing the money we work so hard for. That’s my mission.

What I've been reading

Here are three blog posts that I recently found particularly interesting/useful:

Michael Kitces wrote about how rebalancing one’s portfolio actually reduces long term returns. Wait, what? I thought rebalancing allowed us to sell high and buy low?? This is the kind of mathematical truth that is just subtle enough to evade the majority of investors, but true nonetheless. But don’t stop there; as the title says, it’s still good risk management. The post is a few years old, but super relevant. I learned a lot from this piece.

I retired as a full time professional almost four years ago. The biggest reason was to spend more time with my family and I feel SO lucky that I have had this opportunity – most don’t. But I did it not really knowing how it might affect my four kids in the long term. This is an honest and heart-warming report of someone who grew up in a family like the one my wife and I have created. Sure, it’s anecdotal, but validating too.

A shout out to Bob Lai who’s been blogging about life and dividend investing in Canada for longer than I have. This time he tapped into his network of dividend-growth bloggers and put together a comprehensive list of American dividend-paying stocks to consider. The US market as a whole might be over-valued, but there is some value to be found among dividend-payers and, in general, much better sector diversification than we have access to here in Canada.

Matt, you are so right on about the MISLEADING HYPE offered by free financial webinars/ presentations.

Regarding red flag #7, ATD.B-T WAS the largest cap company on TSX, surpassing Royal Bank about 5 years ago. But that’s ancient history now..

Keep up the great work with BTSX.

Thanks for the kind words, Edward.

Any chance you have a reference for Alimentation Couche-Tard being the largest cap company in Canada at some point in the past? I have been looking and can’t find anything. Just want to make sure I have my facts straight 🙂

This little piece of Cdn history surprised me too!

https://www.theglobeandmail.com/business/rob-magazine/article-couche-tard-is-now-canadas-largest-company-how-a-chain-of/

PS Keep up the good work Matt – it is appreciated by many of us out there!

Thanks, Jason. I really appreciate that you looked into this for us. Maybe it’s a small point, but, as I said in the article, I think details matter! More importantly, if I’m going to criticize someone like JS, those criticisms need to be fair.

I saw this G&M article too, but the actual content of the article doesn’t back up the title. In fact, I think there might be a typo in the title – perhaps they meant to say “largest convenience store”? Here’s why:

Looking back at the stock prices and shares outstanding for May of 2018, when that article was published, ATD had 1.128B shares @ $27.07 for a market cap of 30.53B; RY (usually Canada’s biggest ex Shopify) had 1.42B shares at $98.00 for a market cap of 139.16B. So, Alimentation Couche-Tard was about five times smaller than Royal Bank.

If anyone can see fault in my data or logic, please let me know!

Matt, thanks for what you are doing. As far as ATD.b being larger mkt cap at some point than RY I don’t think that is true.

ATD.b market cap history.

https://companiesmarketcap.com/alimentation-couche-tard/marketcap/

Similar for Royal Bank.

https://companiesmarketcap.com/royal-bank-of-canada/marketcap/

Great resource – thanks for the confirmation, Richard

You are so so right Matt. So much misinformation and targeting out there on the internet. Glad you are making others aware. Thank you for putting out such a great blog (which I follow!). Appreciate your wisdom & guidance.

Comments like this keep me going, Sil – thanks 🙂

Great post Matt,

You do a great job with BTSX and showing people an easy way to invest themselves. I especially find the Portfolio Rebalancing comment here interesting. Conventional wisdom says you must re-balance regularly, but I have never believed it, or done it. My next post is going to be about building a dividend portfolio to last. No re-balancing required.

Pingback: Weekend Reading – Financial Independence Update edition - My Own Advisor

Pingback: The Sunday Best (01/02/2022) - Physician on FIRE

Hi Matt: was directed to your site from POF blog and congratulation on your journey. I am also a Canadian physician and would love to read about your experience.

Welcome to the blog, Brian. The site where we wrote about our travel experience is here: http://www.big-family-small-world.com