Buying a car? You need to know this

Car-buying is a skill you can learn.Aside from a home, the car you drive might…

Beating the TSX Annual Update 2023/2024

It’s that time of year when Christmas decorations are put away and one more row…

End-of-Year Financial Checklist

When I help people one-on-one with their financial planning needs, there is one financial goal…

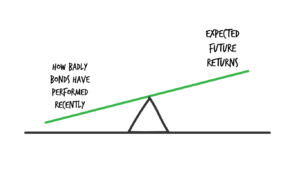

Welcome back bonds

“The 60/40 portfolio is dead!” How many times have you heard this? This statement has…

The Confidence Dilemma

In the world of finance, you need confidence. Without it, you're paralyzed but too much…

BTSX 2023 Mid-Year Update

Reality will pay you back in equal proportion to your delusionWill SmithA few weeks ago…

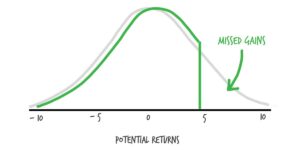

Covered Call ETFs: What you need to know

Tom is recently retired and is taking a close look at his investments. He needs to…

BTSX vs. Dividend ETFs

Spring is here and I’ve been swamped with family responsibilities, springtime jobs around the house…

Bank Runs and Why Zebras Don’t Get Ulcers

“Investing is not a game where the guy with the 160 IQ beats the guy…

"Retirement Income For Life" by Frederick Vettese : Book Review and Summary

I read a lot and I write a lot but, weirdly, I’ve never written about…

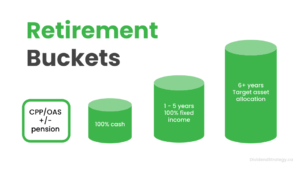

Retirement Buckets: Grow your wealth and safeguard your income

I’ve heard that I should “own my age” in bonds but I’m worried that I’ll…

10 Tips for your BTSX Portfolio

I recently posted the 2022/2023 Beating the TSX update. The updates never fail to…

- 1

- 2

- 3

- 4

- …

- 8

- Go to the next page