Beat the TSX Gained 16% in 2024 But Still Couldn’t...

Read MoreAre dividends tax efficient?

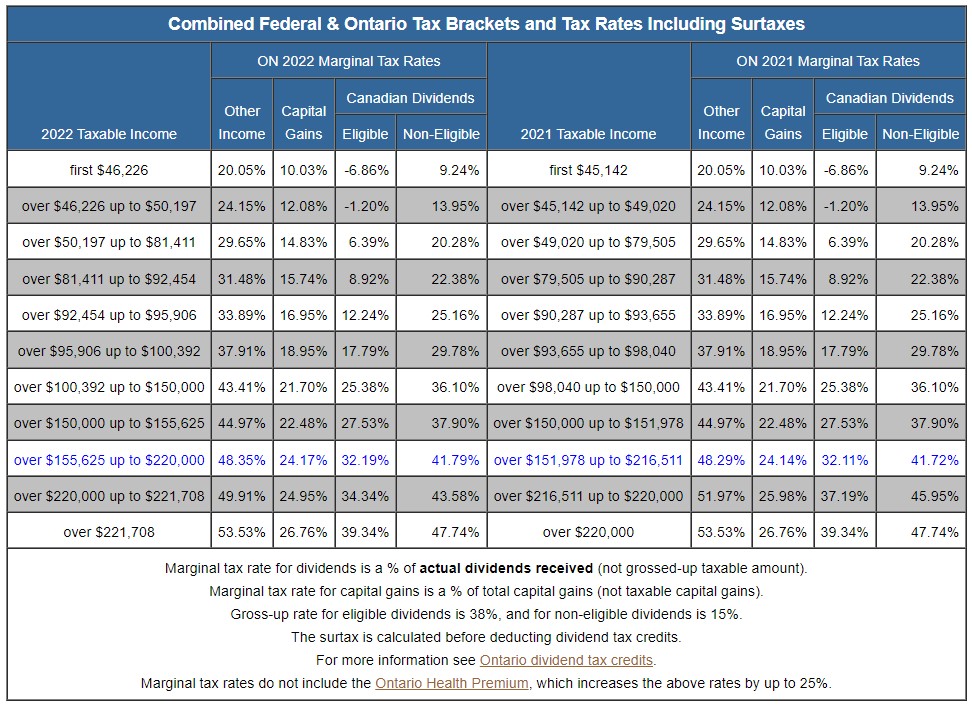

Dividends can be extremely tax efficient because of something called the Canadian Dividend Tax Credit. Have a look at the table below and you will see that dividends are always more tax efficient than regular income (which includes interest), and below $100 000, dividends are even more tax efficient than capital gains.

Very high income earners are a special case, but consider a more realistic example, say a couple with a $100k per year lifestyle. Here is what they would need pre-tax to meet their needs:

- Interest: $132 000

- Capital gains: $108 000

- Dividends: $101 000

That’s right – if there are no other sources of income, individuals can collect up to about $55 000 in eligible dividends almost tax free. In fact, up to about $110 000 dividends are taxed more favorably than capital gains. Beyond this, capital gains have an edge.

As is always the case with taxes, however, real life is more complicated. I wish I could give you all the answers, but tax planning is what accountants do best. A decent accountant is worth the money.

Why are taxes on dividends so low?

Essentially, the companies that pay dividends have already paid tax on that money. Thus, dividends are taxed less when they are transferred to investors. This minimizes double taxation and encourage investment in Canadian industry.

What are eligible vs non-eligible dividends?

Non-eligible dividends are paid out by small private corporations. If you are an incorporated small business owner you should already have an understanding of non-eligible dividends. As investors, however, we are only concerned with eligible dividends. These are paid out by large corporations. They are “eligible” for the enhanced dividend tax credit because the company has already paid a higher rate of corporate tax on them.

How are eligible dividends taxed?

Because dividends are paid out of funds that have already been subjected to corporate tax rates, they receive preferential treatment in the hands of investors. This is based on a principle called integration. In order to achieve this, however, the CRA does something very confusing. First they “gross up” the eligible dividend by 38% to reflect the corporate income earned, then an “enhanced dividend tax credit” is applied which gets us down to the low tax rates we love.

What are the negative effects of the “gross up”?

The biggest downside of the “gross up” for Canadians is the effect it can have on OAS. If you are 65 years old or more and have income less than $76 000 annually, you are entitled to the full OAS amount. As your income increases above $76 000, the OAS is gradually “clawed back” until at $123 000 of income it is gone.

Because it is the “grossed up” dividend amount that is used to calculate OAS, the clawback would start at $55 000 of dividends (assuming no other income).

Two notes on this: First, above $55 000 overall taxes on interest income is still much higher than dividends. Second, capital losses can not be used against capital gains to decrease the OAS clawback (since they are considered “adjustments” and are calculated after the OAS benefit). More details.

What about dividends from American companies?

This blog is about investing in Canadian dividend paying stocks, but many investors will want to hold some quality American dividend payers too. The American counterpart to the “Beating the TSX” list is Dogs of the DOW.

Be aware, however, dividends from non-Canadian companies are subject to an extra tax: the dividend withholding tax.

What is the dividend withholding tax and how do I avoid it?

The dividend withholding tax is a 15% tax that is automatically deducted from US dividend payments before they even arrive in your account. Yikes.

Fortunately, there are two workarounds: one easy, one hard.

The easy way to eliminate this tax (and the most common solution) is to simply hold non-Canadian dividend payers in your RRSP. No withholding tax will be applied.

Alternatively, if you hold US dividend-paying stocks in a taxable account, you may apply for a refund of the tax. More information.

There is no way to recoup the dividend withholding tax if the US stocks are held in a TFSA or RESP.

Debunking Dividend Bunk

In the world of DIY investing, particularly when it comes...

Read MoreBuying a car? You need to know this

Car-buying is a skill you can learn. Aside from a...

Read More