Have DIY investors been able to achieve superior returns relative to the index? The simple answer is a confident YES when a strategy of dividend investing has been employed. Here is the evidence.

Dividends drive stock market returns

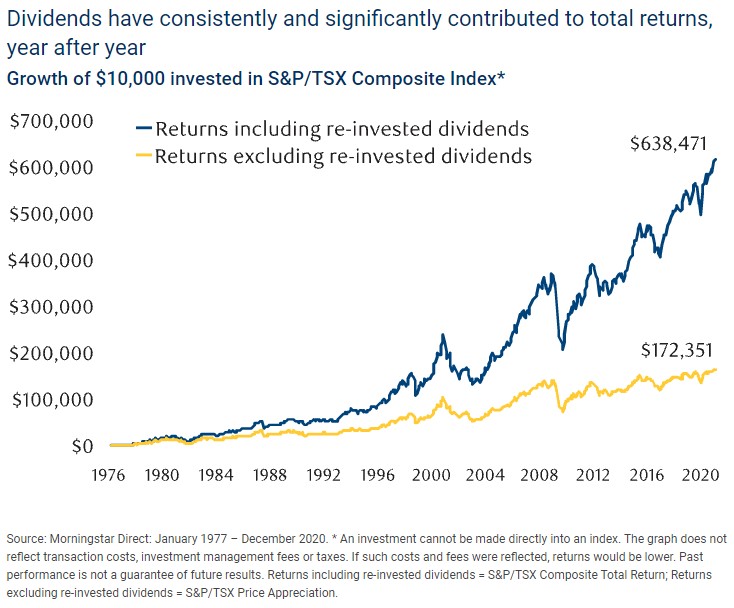

Dividends are a major component of overall stock market returns. According to a Hartford Funds white paper, over a 50 year time period, dividends accounted for over 80% of the total return of the S&P 500. Canadian dividend payers are even better: RBC Global Asset Management shows that without dividends, returns from the S&P/TSX Composite Index would have been 73% lower since 1977.

Dividend paying stocks outperform non-dividend payers

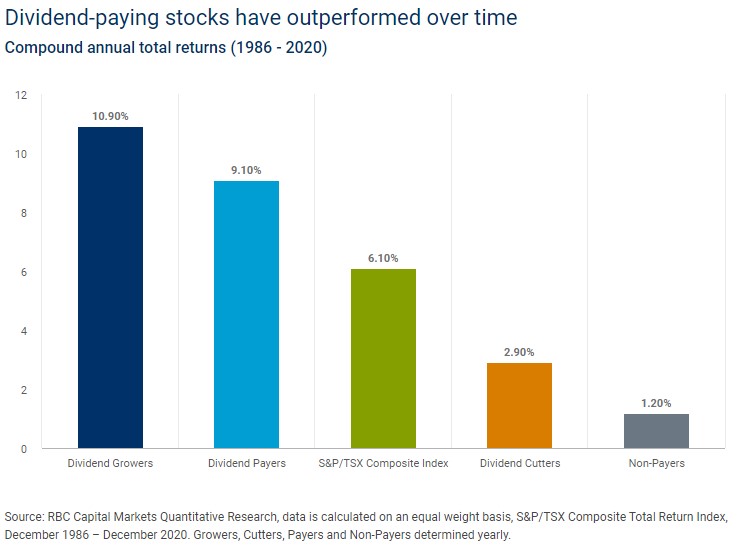

RBC Global Asset Management published data showing that over the last 35 years, a dividend- based strategy would have handily outperformed index-based strategies. As the table below shows, from 1986 to 2020 dividend growers of the S&P/TSX had a compound annual growth rate (CAGR) of 10.9%. Dividend payers as a whole returned 9.1%. Non-dividend payers? . . . only 1.2%. Dividend-paying stocks have been the foundation of stock market returns.

How to choose dividend paying stocks

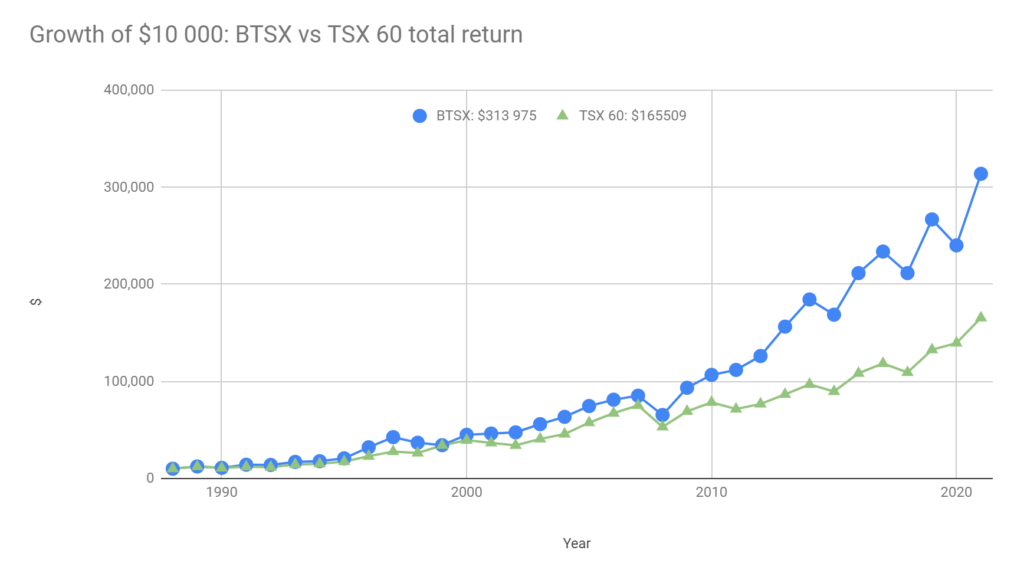

But what dividend-paying stocks should you actually buy? We invest in large Canadian companies with relatively high yields (usually 3 – 6%) and a long history of consistent and rising dividends. A quick look at the 30 year returns of our “Beating the TSX” strategy illustrates the power of this method.