“The 60/40 portfolio is dead!”

How many times have you heard this? This statement has been repeated so often, that many investors have taken it as truth without understanding the fundamental principles involved. But repetition doesn’t make it so.

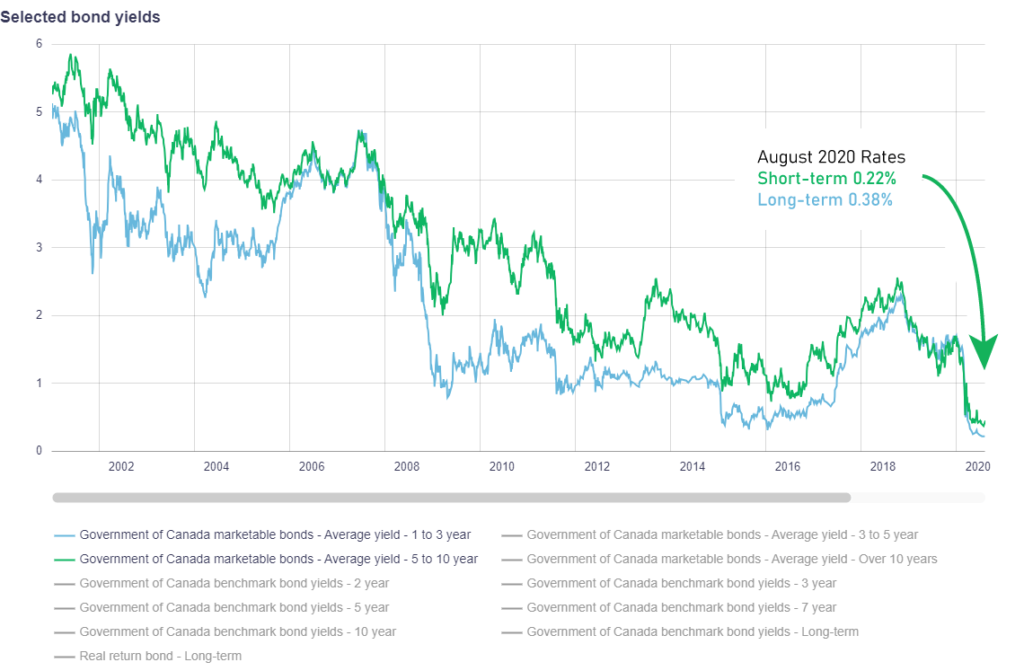

I understand the sentiment. On the surface, investing in bonds has been a dismal proposition. When interest rates were low, bonds offered little appeal. Back in November of 2020, I wrote, “bond prices are too high to be safe and yields are too low to provide income.” Bonds were simply not fulfilling their traditional role in investment portfolios. These were the yields on Canadian government bonds around that time.

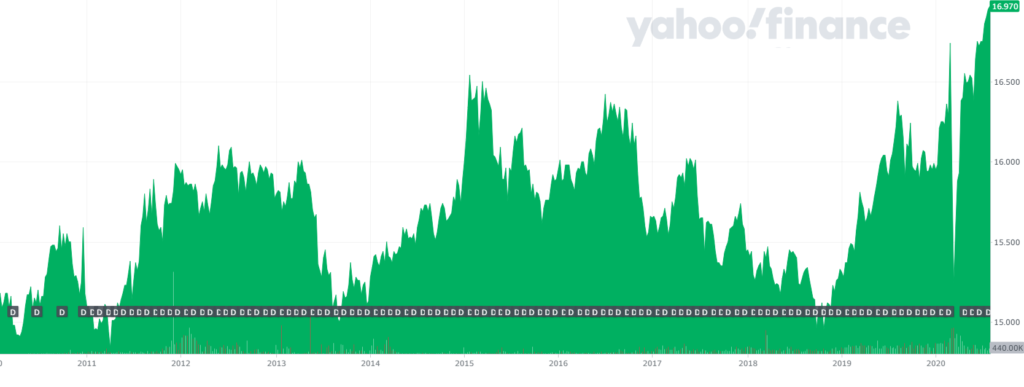

As yields went down, prices went up. If you were a bond holder you might have felt very reassured when popular bond ETFs like ZAG had returns like this:

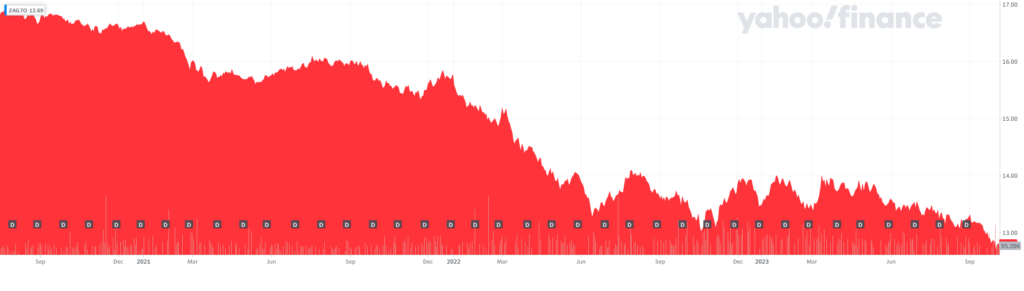

Leading up to mid-2020, bonds had been going bananas. But since then investors have been punished with one of the biggest and baddest bond routs of all time. Just look at how ZAG, one of Canada’s largest bond ETFs, has performed since 2020. The “safe” portion of millions of investors’ portfolios dropped a whopping 24.6% from August of 2020 to October 2023.

If you didn’t think the 60/40 portfolio was dead before, surely now we can all agree that bonds should be thrown out with VHS tapes and leaded gasoline – things that seemed reasonable in the 80’s but turned out to be useless junk.

Right?

Not so fast. For the first time in years, bonds are finally back in my portfolio. Yes, bonds are back. Understanding why requires a quick review of how bonds work.

How do bonds work?

We’re going to limit our discussion to investment-grade bonds – the only kind I would consider investing in.

Bonds are contracts in which one party loans money to another. The contract has a term, i.e. a maturity date when the principal (face value) will be returned to the lender, and a coupon rate, i.e. the interest that the bond pays annually to the lender (divided semi-annually for Bank of Canada bonds).

You could buy a bond and hold it until maturity, but a bondholder doesn’t have to do that. They can sell it on what is called the secondary market. And this is where things get interesting.

Why bond prices and yields move in opposite directions

Imagine James bought a $1000 10-year bond with a 3% coupon (interest rate). One year later interest rates have gone up and new 10-year bonds pay a 4% coupon. If James wants to sell his bond, a potential buyer would need to be compensated for the fact that James’ bond has a lower coupon than current rates by paying a lower price. In this case, James’ bond would only be worth $925. The new “yield” of the bond, 4%, is a combination of the original coupon and the discounted price.

This is why bond prices fall when interest rates rise, and vice versa. When interest rates were at rock bottom in 2020, bond prices were so precariously high that they really only had one way to go – down.

Some bonds are more sensitive to interest rate changes than others. This sensitivity is measured by something called “duration” (not to be confused with maturity). The higher the duration, the more sensitive a bond’s price is to interest rate changes. If a bond has a duration of 8, then a 1% rise in interest rates will tend to lower the price of the bond by about 8% and a 1% drop in interest rates will cause an 8% rise in the bond’s value. Bonds with lower coupons and longer maturities tend to have higher durations – i.e. they are more sensitive to interest rate changes.

The role of bonds in a portfolio

Historically, government bonds have returned about 2% more than the rate of inflation vs. about 5% for stocks. But growth wasn’t the primary role of bonds in investment portfolios – that’s the job of equities.

Traditionally, bonds had three main roles in a portfolio:

- Steady income

- Lower overall volatility

- Improved portfolio risk-adjusted returns due to being relatively uncorrelated to stocks

When interest rates were low, not only were bonds not providing significant income for investors, but they were also more risky. Even if the volatility of bond prices remained low for a long time, which it did . . . until it didn’t, many investors learned the hard way that there was far more downside risk than they realized.

Sure enough, when interest rates rose, bond prices were decimated. We’re used to seeing 20%+ corrections in stocks but a 20%+ crash in bonds . . . that is truly unsettling. What is even more unusual is to see stocks and bonds crashing at the same time. Holders of traditional 60/40 portfolios were crushed in 2022 like they’ve never been crushed before.

Does that mean bonds are a bad investment going forward? Absolutely not. Those are sunk costs. Investing is about the future.

What about now?

When the stock market dips by 20%, do we abandon stocks? No. We know that we should just keep buying, taking advantage of lower prices.

When it comes to stocks, it’s all about future earnings. When it comes to bonds, it’s all about yield. Current yield is the best indicator of future bond returns. Bonds are looking pretty good to me at current yields:

Even if rates stay the same, you’ll get those nice interest payments. And if rates go back down – due a recession, for example, you’ll benefit from higher bond prices. The bottom line is that expected future returns for bonds are better than they have been for 15 years.

Reasons to consider bonds in your portfolio

Perhaps, like me, you have been underweighting or even eliminating bonds from your portfolio for years. Now may be a good time to consider the merits of a more traditional portfolio that includes bonds.

Here are the reasons I think bonds are worth considering:

- Bonds are producing income again. Even if rates stay where they are, investors will enjoy positive returns from interest income

- If interest rates go back down, there is upside potential on bond prices

- Higher interest rates means lower duration and, therefore lower overall volatility

- Bonds have higher expected future returns than they have in a long time

Where do dividend-paying stocks fit in?

Until recently, investors had few good options for safe, income-producing assets. Increasing your allocation to large, blue-ship dividend-paying stocks was likely one of your best options. This is what I did, with a particular focus on big, boring utility companies with low betas. I got stung doing that, along with many other investors.

Dividend-paying stocks – and BTSX stocks, in particular – still play a large and important role in my portfolio but I am much more comfortable finally having some diversification into an asset class other than equities.

Personally, I have moved about 10% of our portfolio into bonds using a simple, low-cost Canadian bond ETF (I don’t recommend junk bonds, speculative bond trading, or buying individual bonds). At nearly 50 years old, there’s a good chance I’ll add to that allocation over time.

If there is a fire sale on stocks, I’ll be happy to have these funds to mobilize and, in the meantime, I will enjoy a steady stream of interest income along with improved risk-adjusted returns for our portfolio as a whole.

Thank you so much to those of you who have chosen to support me and this blog with your donations. Your generosity has a huge impact on the quality of this site. You can support this site by clicking below or by sending an e-transfer to contact@dividendstrategy.ca.

Question, my bond index fund will wind down in the new year draw from RRIF. I have not touched equities as yet and calculate I have 10 years of income without adding home equity to the balance. I am 83 and still investing small amounts in Cdn blue chips. Does a bond ETF in my TFSA make any sense at my age?

Hi Eve – Potentially, yes. It depends when you are going to need that money. I consider both bonds and stocks long-term investments – i.e. money that you won’t need for the next ~5 years. I really like a laddered GIC for money that will be required in the next 1 – 5 years. I wrote about this approach here: https://dividendstrategy.ca/retirement-buckets-grow-your-wealth-and-safeguard-your-income/

Hi. Would you be able to share which low cost bond etf you added?

Hi Bruce. There are a handful of very reasonable options with slight variations, which is why I didn’t want to single one out in the post. My friend Bob from Tawcan wrote a good post on bond ETFs recently (https://www.tawcan.com/best-canadian-bond-etfs/) that might be helpful. For what it’s worth, I bought ZAG, but also considered XBB and VAB.

Thank you

You’re very welcome, Bruce

Great article Matt!

Thanks, Mike!

Not only are bonds back…but Matt’s back! Great to see another great article. Thanks.

Ha ha – thanks, Chad. Apologies for the hiatus.

I echo the sentiment. Thanks for the article Matt !

You’re welcome!

Matt’s Back Baby! We missed ya!

Thanks, Brent!

Glad you’re back Matt. I was awaiting another insightful post. And you are so right, now is the time to be adding more bonds. I have not been happy using utilities for income and much prefer bonds now.

Hi Matt

Thanks for this informative post. I note you are 50 and have added 10% bonds. What was your master plan for an asset allocation as you glide to retirement from an estate planning point of view. Bonds to me are most a tool to handle to behavioural aspect/ ie decreasing volatility- on an after tax , after inflation basis they offer no return

If sppreciate your input

Hi Lyndon – Not sure it would be practical to try to outline my financial plan in the comments section, but I think I can answer your question. You’re right, bonds are a tool to improve the behavioural aspect of portfolio management. But they are more than that. Markowitz, who gave us the insights of modern portfolio theory, showed that risk-adjusted portfolio returns, which are far more important than absolute returns, are improved by holding uncorrelated assets. For example, a 100% bond portfolio is actually MORE risky than a portfolio that is 90% bonds and 10% stocks, even though stocks are more volatile than bonds. Similarly, a 100% stock portfolio may have slightly higher absolute returns but WORSE risk-adjusted returns than a 90/10 portfolio. Pretty fascinating, right? Lastly, if you were so inclined, holding bonds offers the tactical opportunity to take advantage of temporarily depressed stock prices.

Hope that explanation helps.

Thanks Matt for the timely explanation about risk adjusted returns. This begs the question what’s the optimal risk adjusted split 60/40, 70/30, 80/ 20 ?. 25 years ago The Financial post developed FPx indexes, the growth index was 70/30. Nowadays Vanguard has VGRO at 80/20 and VBAL at 60/40. There is a school of thought that says VBAL EVERYWHERE ie 60/40. The rationale is that 80/30 is not much of a diversifier in terms of risk . Your comments?

My understanding of the empirical data is that, from a purely mathematical point of view, a ~10/90 bond/stock portfolio has often provided optimal risk adjusted returns. BUT the returns of a 10/90 portfolio are unlikely to be sufficient to provide for the long-term income needs of the average person. So, higher allocations to equities are necessary – with the understanding that we must endure the volatility that comes along with it.

The bottom line, as I see it, is to increase your equity portion as much as you have to to achieve the growth necessary – but not more.

Don’t take risks you don’t need to take – an axiom some DIY investors forget in their quest for ever-higher returns.

Great questions!

For investors that have been following the dividends for income plan, isn’t buying bonds now timing the market? We now need more expertise to know when the right time is. As you pointed out, someone owning bonds last year lost a lot.

We have never had bonds and will be sticking with dividends. For 2023 we will have a 7.5% increase in dividends. A boring strategy but it works. We have not sold or bought anything again this year. And a good donation strategy we’re using is giving shares that have large capital gains. You get the full value as a tax receipt and pay no capital gains tax.

Hi DivInvestor, thanks for chiming in. I was waiting for the resistance!

Not timing the market at all, simply returning to a more evidence-based portfolio construction in which we can benefit from relatively uncorrelated asset classes (modern portfolio theory). The fact that bonds underperformed recently is not a strike against them – just the opposite. Over the long term, an all-stock portfolio should be expected to beat one that contains bonds, but at what cost? The risks must be taken into consideration and poor diversification across asset classes is a big risk.

Dividend-paying stocks are not a substitute for fixed-income – they never have been. They are fundamentally different. Many of us chose them over bonds for all the reasons I wrote about, but the situation with bonds has fundamentally changed. This, in my opinion, is cause to reevaluate previous decisions which may no longer be optimal.

Hi Matt, Comparing a bond ETF like XBB to a GIC, it would seem the GIC offers a higher return of around 5%, compared with a 3% yield on XBB. I assume this must mean you are expecting the bond ETF to appreciate over time? Or are you buying bond funds to have the flexibility to sell anytime?

Hi Brian – It was beyond the scope of my post, but we are living in unusual times in that the yield curve is inverted. This means that short term fixed income is paying higher rates than long-term. This combined with the illiquidity of GICs relative to bonds results in the higher yields. But I always come at these decisions from a long-term perspective because short-term tactics often backfire. Historically, GICs have barely kept up with inflation, whereas bonds have tended to beat inflation by about 2% per year.

There is nothing wrong with GICs though – particularly with rates where they are. And I wouldn’t argue with anyone who is choosing them over bonds at the moment – just that history has shown it’s not a great long-term strategy. And, yes, I want the liquidity for rebalancing purposes.

Good question!