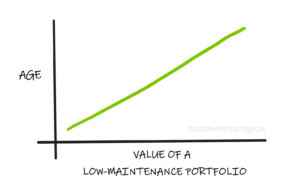

You’ve worked hard for your money. You’ve accumulated wealth by being responsible with your spending and saving decisions. Why? So that you can use that money to enjoy a long, happy retirement. But, contrary to most financial planning assumptions, research shows that few retirees manage the decumulation of their assets well. Most are leaving money on the retirement table.

Some people call it the “Decumulation Paradox”, others call it “The Retirement Savings Puzzle”. What both of these terms describe is the observation that the vast majority of retirees don’t spend down their assets nearly as much as they could. In fact, many retirees don’t spend down their assets at all.

According to research by the Employee Benefit Research Institute,

“Across all wealth levels, 58 percent of retirees withdraw less than their investments earn, 26 percent withdraw up to the amount the portfolio earns, and 14 percent are drawing down principal.”

That means eighty-six percent of retirees are not drawing down their principal, even when it would be reasonable to do so.

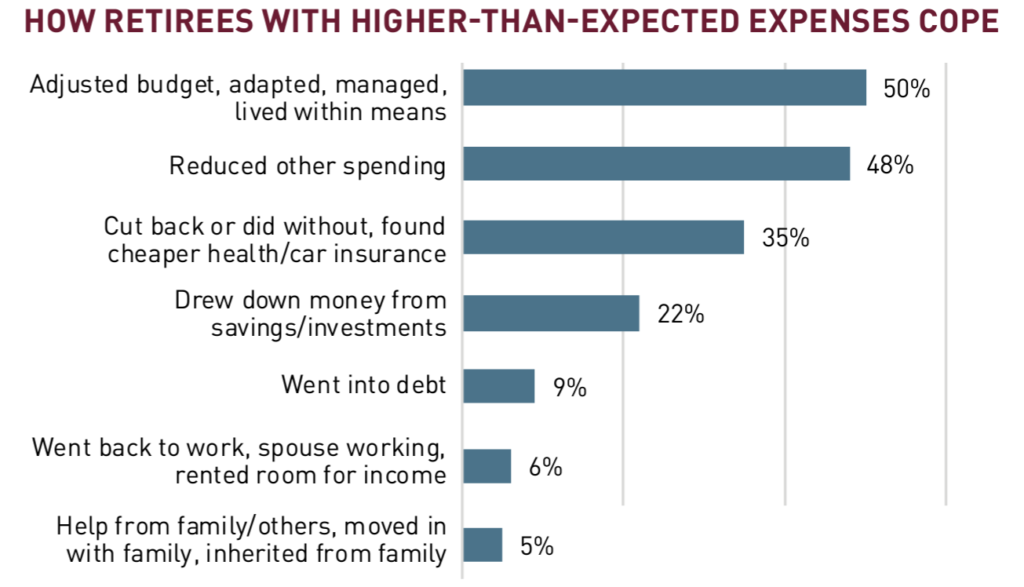

In fact, when retirement expenses increase unexpectedly, only a small portion of retirees opt to tap into their principle, as economic theory would expect. Instead, the vast majority choose to adjust their budget and decrease expenses.

This is not an isolated finding. A white paper by Blackrock showed that most retirees still had 80% or more of their pre-retirement savings left after almost two decades of retirement.

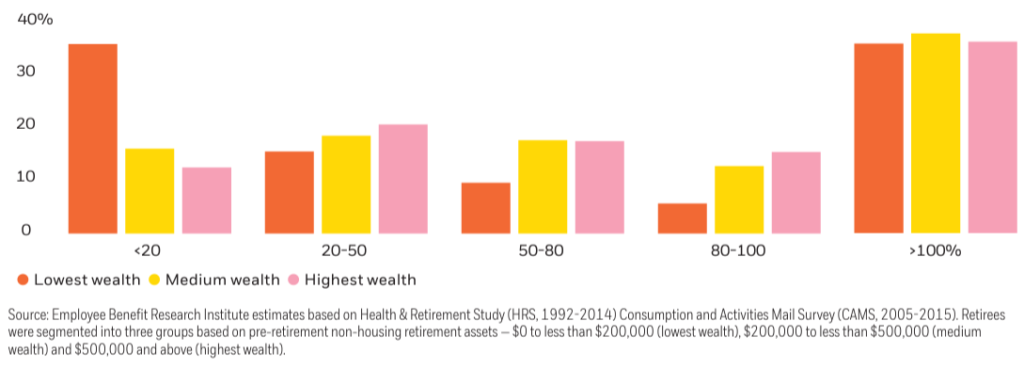

Percent of assets remaining after 17-to-18 years of retirement

Making sense of “irrational behaviour”

Popular headlines and statistics about the widespread underfunding of retirement might make this look like good news. But what it reveals is a deep-seated uncertainty among retirees, regardless of wealth. This conservatism may come at the cost of truly enjoying the retirement lifestyle that many retirees worked so hard to secure.

It’s another example of the divergence between academic research and what happens in the real world – an area of research I find fascinating. One of the pillars of modern economic theory is Modigliani’s 1954 “standard life-cycle theory” :

“The idea that people make intelligent choices about how much they want to spend at each age, limited only by the resources available over their lives. By building up and running down assets, working people can make provision for their retirement . . .”

- https://www.princeton.edu/~deaton/downloads/romelecture.pdf

In other words, while they are earning, rational individuals should save only as much as they need to save and those assets should be consumed, i.e. spent, in retirement.

But real people don’t do this. As the charts above show, most retirees spend far less than they could. There is a “consumption gap” between what retirees can afford to spend and what they actually do spend.

Why are retirees leaving money on the table?

A closer look at the research reveals a common theme: retirees tend to use investment income to fund their lifestyles, but appear reluctant – even unwilling – to sell assets.

The EBRI research showed that only 18% of retirees were spending more than their household income (pensions, social security, interest, dividends, etc.). This dropped to fewer than 15% of retirees with more than $500,000 of non-housing assets.

It’s that “income” word that makes all the difference. Economists can make an excellent case that retirees shouldn’t care whether their income comes from capital gains versus dividends, interest income, annuity payments or pension payments (tax considerations aside), but retirees clearly have a preference. The research shows that they are much more likely to spend income from those latter sources than capital gains generated from the selling of assets.

“So rather than determining their basic and discretionary expenditures and creating dynamic strategies to fund them, many retirees appear to be taking the opposite approach – determining their guaranteed and steady income sources and adjusting their lifestyles to fit within that budget.”

– From: The Decumulation Paradox: Why Are Retirees Not Spending More?

For retirees, financial security is more important than spending

Leaving money on the table might not be ideal, but spending down your principal too quickly is even worse. Security trumps lifestyle. But what the data shows is that in many cases there is a lot more lifestyle that can be enjoyed without sacrificing security. The problem is that, without a clear understanding of what a rational and safe decumulation strategy would be, most retirees defer to emotional decision-making. They do what “feels right”.

Our brains are simply not wired to optimize complex systems like a retirement decumulation strategy. So we end up making decisions using mental short cuts. But short cuts are risky – there are over 180 cognitive biases that interfere with how we perceive reality, process data, and make good decisions. Here are a few examples.

Some cognitive biases impacting retirees:

Loss aversion is a universal cognitive bias that makes the average person feel losses about 2.5x more intensely than equivalent gains. Research has shown that retirees display “hyper-loss-aversion”, feeling losses 5 to 10 times more intensely than gains. This may cause retirees to view withdrawing principal as a loss, whereas income from dividends, interest, pensions, etc. is viewed as a gain that can be spent.

Familiarity bias is the tendency for individuals to prefer what is familiar. After years of accumulating assets in their working lives by spending less than they earn, it can be challenging to reverse this mindset. Transitioning from a net saver to a net spender is unfamiliar and uncomfortable – even when it’s the rational path.

The endowment effect is the tendency to assign more value to the assets we own than what they would be worth on the open market, resulting in an unwillingness to give them up. Achieving a specific savings goal, retirees can become attached to that value, preventing them from spending down those assets.

Making the switch

I meet a lot of people close to or in retirement who are still focused on maximizing investment returns – even if they already have more than enough. I think most of them are locked in the accumulation mindset and think more money will give them the feeling of security they are seeking. How much money will it take to accomplish that? There’s usually just one answer: more.

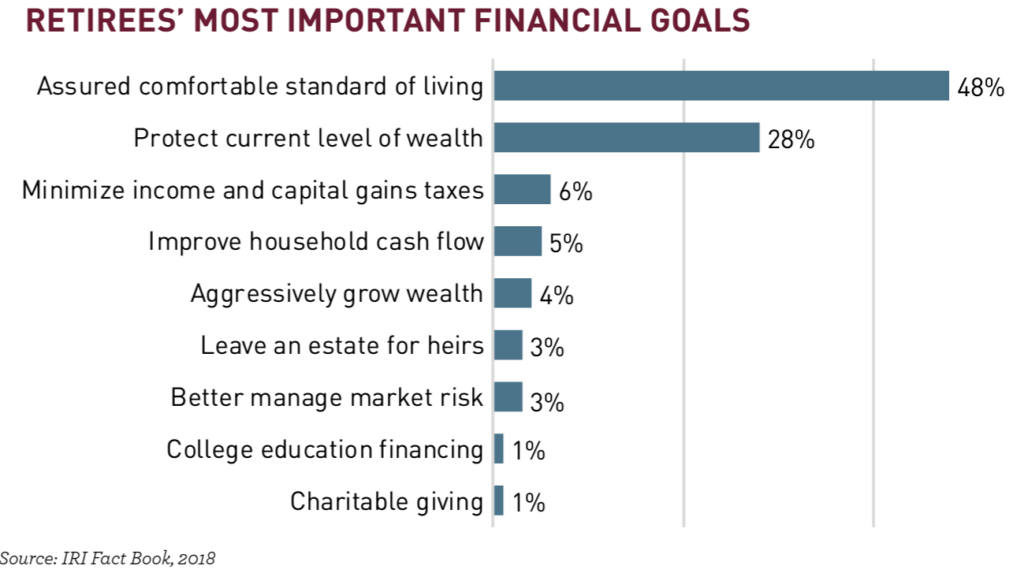

Financial security is a worthy goal, but taking on more investment risk in hopes that higher returns will follow is usually a misguided approach. More money doesn’t change how we think about money. What most retirees actually want is assurance that their wealth and standard of living will be protected.

What is often missing is an understanding that financial security is two things: an emotional state, and a mathematical one. This is the root of “the decumulation paradox”. It’s not enough to have a mathematically sound decumulation strategy. That strategy has to take into account your personality and emotions.

Finding the sweet spot

What most retirees need is a decumulation strategy that minimizes risks, is practical to implement, and allows you to maximize your happiness during the retirement years. Here are five ways retirees can get the most from their money and their time:

- Maximize income – If your retirement assets are sufficient, consider designing your retirement portfolio with income in mind. Depending on your time frame, risk tolerance, and goals, a combination of dividend-paying stocks, bonds, GICs, and possibly annuities may be appropriate.

- Delay CPP – Delaying CPP from age 65 to age 70 increases payments by 42%. This can be an excellent way to manage longevity risk. For more information, read THIS POST.

- Consider insurance – Long-term care can be expensive but studies show that only half of us will need it. For some people, paying for long-term care insurance rather than saving a lump sum “just in case” improves retirement cash flow.

- Maintain active income – Just because you’re retired doesn’t mean you can’t work. Having a part-time job or money-making hobby keeps many retirees active and engaged. And even a small amount of active income can make a huge difference to your cash flow. A job that earns $2,000 per month is roughly the equivalent of having saved an extra $600,000.

- Plan your retirement – The best thing you can do to optimize your retirement is to plan it out. It’s impossible to know that your wealth and standard of living are safe and secure without running your numbers through some kind of planning software. This is where DIY investors have been left in a lurch by the traditional financial services industry in which essential financial planning is chained to expensive investment management. What are DIY investors to do? You can either become a spreadsheet expert and do the analysis yourself or simply go HERE and check out Option #2 where I will run your numbers on my professional planning software, discuss the results with you during a one-hour zoom call, and you will leave with a full understanding of your retirement plan supported by detailed charts and reports – all for a fraction of what you would pay a traditional financial advisor.

Summary

Many people save and invest diligently over the years only to not spend it in retirement. Studies show that this is much more of a psychological issue than a financial one. Most retirees are reluctant to spend down their principal, i.e. sell assets, but are much more willing to spend income. Understanding and accepting this reality is essential to designing a decumulation strategy that optimizes both life satisfaction and wealth security.

I just wanted to send out a huge thank you to those who support this site. Your donations are enormously appreciated and go a long way toward keeping this site free for those who need the information but are not in a position to contribute. In particular, I wanted to recognize DividendStrategy.ca’s most recent top supporters – thank you!

If you would like to support this site, click here:

Great article as always Matt. For the sake of discussion let me present some opposing views. You seem to think that the reason us seniors appear to be hording our resources is an irrational one. Well, I disagree; I believe there are some very important and rational reasons behind this behaviour including:

1. Taxes

2. Inflation

3. Legacy giving

4. Future medical spending

5. ‘Fear of the unknown’

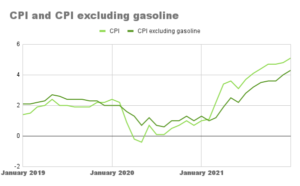

Let’s take these real risks to my total net worth in order. Nothing is as sure as taxes, and that they will increase. Now into my 84th year, the government requires me to withdraw 8.08% of my RRIF and to pay income taxes on this amount. This will not decrease as I age but in fact will increase each year. Meanwhile, this country is in the grip of stubborn high inflation that shows no sign of abating while the government continues to spew out money. It seems obvious to me that the government will have to make up the shortfall by increasing taxes in some way, or else run the risk of accelerating the plunge of the Canadian dollar by issuing more/buying back government bonds. I need to set aside more of my assets for increasing taxes.

I have already mentioned inflation. It is the ‘silent killer’ of retirement funding. While the government struggles to find a way to wrestle it down, inflation continues to reduce my purchasing power by ~8%/yr. This topic continues to be debated but it is clear that I need to set aside more of my assets for increasing inflation.

I have been very fortunate during my retirement in that during the accumulation phase the market rewarded me. My spending is modest and thus far I have not had to draw down any of my initial investments. ‘Beating The TSX’ has, as Matt continues to show, served and continues to serve me well. The end game has always been ‘legacy giving’ to my family and others. I now have eight great-grandchildren so the need is real. Reckless spending at this point on unneeded consumer goods would be counterproductive to my plan. Rather than wait for the inevitable, I have already started helping some family members and causes that I believe in. ‘Better from warm hands than cold hands.’

In Canada we are blessed with wonderful tax-supported medical coverage, the envy of many other countries. Yet, seniors can still be faced with ancillary costs for medical expenses over many years. Yes, we continue to increase our life spans, but in many of the final years we incur high costs for home nursing and other expenses. I need to have the resources to ensure that I can cover these costs.

Finally, seniors find themselves in a rapidly changing world, one that is becoming more difficult for us to understand. Events that occur far away from Canada geographically impinge on us financially. For example, it is, in my opinion, very important that we provide as much help as possible to Ukraine in its struggle for survival. Closer to home, our neighbours to the South are now engaged in a momentous struggle to determine their political future. Who knows how this resolve itself, how that will impinge on Canada, and what the ultimate cost to us might be? We live in uncertain times and it behoves us individually to prepare as well as we can for any outcome.

There you have five reasons I am not rushing to draw down my limited assets. Once they are gone they are exceedingly difficult to replace. All of us want to retain as much financial independence as we can for as long as we can. Some may think it is hording but I call it good planning.

Only irrational from the point of view of economic theory. I’m not judging anyone’s decisions but I do think being aware of this phenomenon can help retirees balance mathematical financial security with psychological financial security.

I’ll leave it there in hopes that others might join the conversation. Thanks for furthering it, Dave!

“Security trumps lifestyle” says it all. After a lifetime of saving, you’ve seen the havoc that world events and arrogant/greedy/misguided politicians can wreak upon your financial situation. And no one looks out for your own security like you do for yourself.

Absolutely, Neil. Glad you picked out that sentence because it really does sum up the issue.

Thank you so much Matt for this great article. I’m 13 years away from retirement and I can see the challenge of adapting my brain to go from accumulation to decumulation mode , one thing also I always thought about is that I want to leave something for my kids but thanks to reading ” Die with Zero” from Bill perkins although I don’t agree with a lot of his ideas 🙂 but one thing that opened my mind to is helping my kids now rather then leaving them money when we pass because by then they probably don’t need it as much so this is what we’re doing now covering their university expenses so when they graduate they have no debt.

You’re welcome, Gus! “Die with zero” may not be reasonable in the literal sense, but that particular tip – early inheritance – is a great one to consider. Dave Stanley brought it up in his comment also.

Dear Matt,

Would like to work with you. I am a retiree and have been told by experts over & OVER

not sell good companies in a down market and lose money. The old saying:

“you cannot time the market”. After losing 30%, coupled with high fees, I’m fed up but

don’t have the confidence to invest on my own. I’ve tried to sign with you but run into glitches.

Dave Stanley, you’ve encapsulated the dilemma/frustration most retiree’s face.

I confess it feels like our government wants to force us out of our homes with higher and higher property taxes, higher income taxes, and take what’s left of our savings.

We need forward thinkers, educated leaders with Gravitas, Charisma, to penetrate

the sleeping/dead brains of Canadians.

Many Canadians are now Aping Neighbours to the South desperately in need of lobotomies to prepare them for the dictators lying in wait.

Ann

Well, I agree with those experts. But it’s not easy!

You can always reach me at contact@dividendstrategy.ca

I didn’t see the link in the article that would let the reader choose option #1 or #2 and the forward the required information. Did I miss something?

No, you didn’t miss anything. I prefer people to email me directly (contact@dividendstrategy.ca) so that we can have a little direct contact before making a final decision. Thanks for pointing out the lack of clarity there – I have added my email address under both options on that page.