I heard someone smarter than me say on a podcast recently, “We don’t react to the events in our lives. We react to our interpretation of those events.” He was talking about mental health and mindfulness. But that wisdom, which I think might be Stoic in origin, can also be applied to investing.

As I write this, the S&P/TSX is down 3% on the day. The DOW and S&P 500 are not much better. Year to date, the S&P/TSX is down just over 16% – dangerously close to the bear market territory that American markets hit a few months ago and after a brief rally, are testing the bottom of again.

Is this normal?

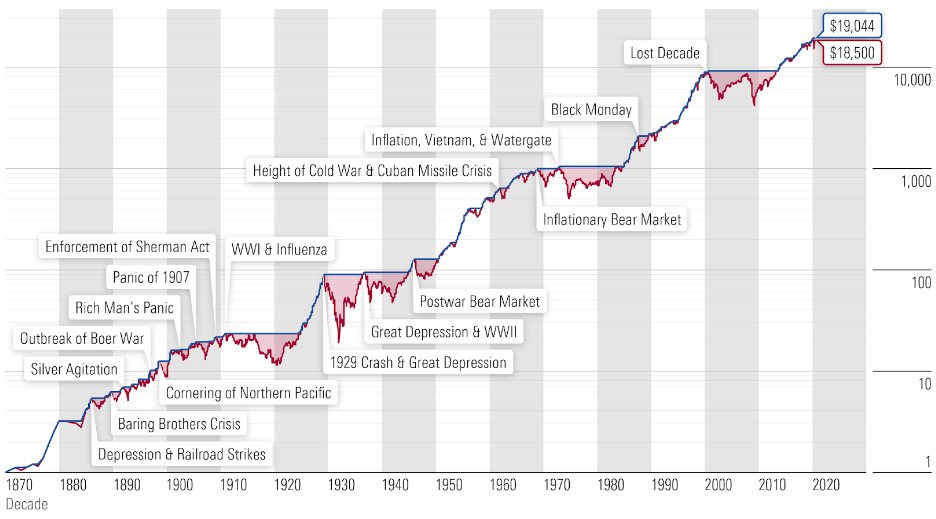

Yes. Every bear market is different, to be sure. We’ve never experienced this combination of a grinding pandemic, red hot inflation, and a nuclear super-power that threatens to destabilize a continent and, possibly, the world. But, as different as this may feel, the last 150 years has been an endless series of conflicts, disasters, and narrowly avoided catastrophes.

But through all of this, progress has been relentless and the stock market has remained the most effective means of growing wealth. As you can see from the chart, the stock market spends most of its time below previous highs (the red-shaded areas), and there are always compelling reasons to think it’ll drop further. But when it comes to investing, worry and opportunity go hand in hand; the best times to invest were also the scariest.

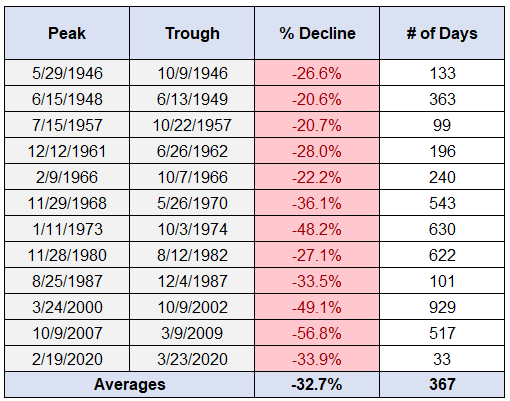

So, is this normal? Absolutely. Just look at more recent history. Since WW II, the S&P 500 has had twelve 20%+ drops, not including the current one.

We’re not wired for this

Logic is not enough though. We’ve all seen those charts of long-term stock performance a million times, but it’s hard to focus on the long term when prices appear to be collapsing. Human beings are wired to be short-term thinkers – it’s a biological imperative that served us well for millions of years . . . until we invented money, saving, and investing where long-term thinking rules.

Our biology is so maladaptive for good financial decision-making that we even have this quirk called “loss aversion” which makes us feel losses more intensely than equivalent gains. So, losing $1000 feels a lot worse than gaining $1000 feels good. In fact, most of us would have to gain 2 – 3 x as much as we lost just to get over the anguish. We are strange creatures.

Related: Coping with a market correction

Fees vs. Fines

It’s no wonder that on days like today, a lot of investors are feeling a little unwell because we forget how normal this is. One of the best finance books I’ve read in the past few years is “The Psychology of Money” by Morgan Housel. One of his many brilliant observations comes in Chapter 15, entitled “Nothing’s Free”. He says:

Like everything else worthwhile, successful investing demands a price. But its currency is not dollars and cents. It’s volatility, fear, doubt, uncertainty, and regret – all of which are easy to overlook until you’re dealing with them in real time.

Housel empathizes with our discomfort but advises us to view that discomfort, not as a punishment that the markets dole out, but as the price we must pay to get access to the amazing long-term returns that stocks have offered. Volatility isn’t a fine for a bad investment decision, it is a fee we must pay to access higher long-term returns.

He goes on to offer sage advice:

The inability to recognize that investing has a price can tempt us to try to get something for nothing. Which, like shoplifting, rarely ends well.

Say you want a new car. It costs $30,000. You have three options: 1) Pay $30,000 for it, 2) find a cheaper used one, or 3) steal it. In this case, 99% of people know to avoid the third option because the consequences of stealing a car outweigh the upside.

Reminds me of the Napolean Hill quote, “The one who tries to get something for nothing usually ends up getting nothing for something.”

There are many professional and retail investors who are trying to reap the benefits of high returns without paying the price. It’s called active management. But the price must be paid and those who try to avoid it usually end up paying double.

Related: Why now is a good time to invest

Bear markets: don’t just survive – THRIVE

The good news is that we don’t have to be able to predict bear markets to be successful investors. Volatility is not a quirk of stock investing, it’s a feature. Here’s what we can do to thrive as investors in the stock market while paying the fee to be there.

- Convince yourself that the fee is worth it. Stop trying to game the system. Don’t try to steal the high returns of the stock market without paying the fee of volatility and uncertainty. Dig deep, change your perspective, accept it. It’ll be worth it.

- Pay less attention. Declines of 20% or more happen every few years. On any given day, stocks are almost as likely to be down as up. But remember loss aversion – we feel the drops more intensely than the gains and that often leads to bad decision-making. Avoid that behavioural risk by paying less attention to the markets.

- The power of planning. Watching markets and your account balance drop is nerve-wracking if your financial plan was not designed with volatility in mind. Having confidence that your financial plan is durable, suited to your risk tolerance, and capable of supporting your short, medium, and long-term goals is essential to successful investing through bear markets. (I love helping people build financial plans they can be confident in – feel free to contact me)

- Bullet-proof your life with a well-funded Liquidity Strategy. We know stocks are going to swoon on occasion, but they also bounce back. The time to recover from bear markets can range from 4 to 40 months. Having 3 – 5 years’ worth of cash, bonds, or GICs can allow you to ride out almost any kind of market conditions.

- Focus on dividend income, not stock price. Dividend-paying stocks have rewarded investors with higher long-term total returns with lower volatility, but one of the major advantages of being a buy-and-hold dividend investor is the behavioural advantage of being able to focus on the income that our portfolio is generating rather than the stock prices. Not only are dividend payments far more stable than stock prices, but the incentive to simply buy and hold to protect that income allows us to keep a level head during uncertain times.

By the way, if you are interested in building your own portfolio, you might want to consider using the same online brokerage that I use – Qtrade. They make everything easy to set up and have the best customer support out there. (If you use this link, I get a small commission that helps support this site).

Lastly, I just wanted to send out a huge thank you to those who support this site. Your donations are enormously appreciated and go a long way toward keeping this site free for those who need the information but are not in a position to contribute. In particular, I wanted to recognize DividendStrategy.ca’s most recent top supporters – thank you!

If you would like to support this site and the work I do, click this button:

Yes, I use Qtrade. Very good.

I am not a big fan of using past stats to justify current action. Too many variables come into play such as tech and access to markets. I am satisfied to do bottom up fundamentals to guide my decision making.

Dividends. A life of experience has led me to a heavy weighting in dividend stocks and the cash flow they provide. Strong cash flow allows me to buy yield at great discounts these days.

Casey

What has happened in the past can certainly inform our decisions now, but it would be a mistake to assume that history will repeat itself. I think we would agree there.

Glad you have found a process you’re comfortable with re: assessing fundamentals. Personally, I don’t do this anymore – at least not to any great extent. The main reason is that whatever assessment I can make has already been made by thousands of other analysts and has already been reflected in the price. At least for the big companies I am interested in – there may be a role with smaller, more thinly traded stocks. So I stick to a big picture assessment of dividend yield, growth, and sustainability. Even so, BTSX, which does none of that, has had superior performance!

Lots of room for different approaches, though. That’s what makes this space so interesting. Thanks for your comment.

Your comments are always valued. I appreciate the big picture as well.

Love this post Matt! and loved the quotes .

It’s so true that our brain are wired to react differently when we gain 1000$ or lose it but at the end of the day we have to think that we actualy won’t lose anything unless we sell , because if we believe in the companies that we hold a recovery is unquestionable so why worry.

Getting those dividends every month keep me calm and reminds me that at the end of the day it’s the growing income that I generate from my investment is what matters not the share price of my holdings.

Thank you for the kind words, Gus. And you’re exactly right – there is no real loss until we sell or the dividend is cut. Hopefully, neither of those will happen!

Everything is correct in this article for long term investing. Although I’ve studied the markets for over 20 years, this site helped me focus properly years ago. Thank you.

This paragraph is the take away for me:

Focus on dividend income, not stock price. Dividend-paying stocks have rewarded investors with higher long-term total returns with lower volatility, but one of the major advantages of being a buy-and-hold dividend investor is the behavioural advantage of being able to focus on the income that our portfolio is generating rather than the stock prices. Not only are dividend payments far more stable than stock prices, but the incentive to simply buy and hold to protect that income allows us to keep a level head during uncertain.

This stops the caveman thinking that we are all programmed for.

However there is opportunities in dividend as well as growth stocks, when extreme negativity hits the market. This provides a one time opportunity for the little guy, assuming you have the mental stamina. 2001/02, 2008, 2020 were big drops where I borrowed large amounts of money on secured line of credit to buy the market. This brings significant risk obviously so I only buy very good quality , usually dividend payers , and something I will hold a long time if required in line with this article. Usually Canadian banks are good for this trade(I don’t trust American banks lol). When the market tanks growth stocks like Apple, google, Microsoft, Disney, etc provide huge opportunity if you have USD.

Sone of these are way down at support now such as Disney.

Your always learning when it comes to investing!

Cheers

Thanks for taking the time to write such a thorough comment, Gareth. I’m flattered that my writing is considered a valuable resource for sophisticated and experienced investors like yourself.

Regarding opportunities – yes, I think it’s inevitable that we will look back on late 2022 and think, “Wow, what a great time it was to buy!”. Many great stocks are in the red even though they are the same great, profitable companies they were last year. Would I borrow to invest in them? No. But I’m happy to be using whatever cash I have to buy and reinvesting dividends as they come in.

Hey Matt,

Once again an awesome, thoughtful post. I have found it interesting hearing a few folks around the proverbial watercooler saying things like “Ugh my portfolio is down 18%, it’s killing me.” One coworker asked me what I thought, and I said that Yup, my portfolio will be down as well but I’m LOVING this bear/down market. Confusion in his eyes. I explained that whereas I have experience short bear markets in the 13 years I’ve been investing on my own, I haven’t experienced a prolonged bear (at least in the US it is). I have been so excited to actually test my investing philosophy – because if you don’t have a plan that can stand up to down cycles, if you don’t have a plan that results in a negative return and be ok with that (and perhaps still beat the market with BTSX), then you simply shouldn’t be in the market at all.

I do have a question: I religiously rebalance once a year, mirroriing yours and the Moneysaver date of Jan 1. Are you at all tempted to do a full rebalance now given yields are so juicy? Or are you opting just for more general adding to positions….

Kudos Chad – you’re thinking about this exactly the right way. These are the same companies they were last year, just now they are on sale.

To answer your question about rebalancing, I usually try to encourage people to pay less attention to their portfolio rather than more. But if you’re paying attention anyway, yes, I think now is a great time to rebalance with the full understanding that things could get worse before they get better.

This could take the form of a full rebalance, adding to stocks you already own or, in my case due to time constraints, I just bought some XIU and XAW in various accounts that had cash balances. For now I just want to get invested and I’ll figure out the details later. This may seem strange to some, but totally reasonable if the alternative is sitting in cash when I know I want to be invested.

Great comments though, Chad. Really appreciate your perspective.

Awesome Matt thanks for the reply. And not strange at all…I’ve taken the same approach to nibble away at some BTSX and their respective higher dividends, knowing that the math will have me scratching my head in late December, but will all get sorted in the wash while capitalizing on the situation right now. And yes, I fully agree that things could be even more down in 3 months (who knows?)

….but it’s about value, not fishing for that bottoms!! Cheers.

Hey just a heads up Matt that I wrote the reply above (not Gareth). Not sure why that happened….

Sorry – appears to be a WordPress glitch since I have no control over the names associated with comments. Very strange indeed, but thanks for the clarification, Chad.