I know a lot of our readers will be excited to hear your thoughts on a variety of topics, so thank you so much for spending this time with me.

Thanks, Matt for the opportunity to contribute to the blog.

You created Beating the TSX in the 1990s. Can you tell us about the circumstances that led to its creation?

My investment story began in 1995, the year I retired from the University of Guelph after 25 years of teaching and research. Up to that point, I had collected a few mutual funds and some Canada Savings Bonds, usually at the urging of family, friends and colleagues, but I was counting on my defined-benefit (DB) pension to see me through. The first thing I did after retirement was to dig into the plan and discuss its merits with other retirees (yes, I should have done that long before!). The result was that it became clear to me that I would be wise to buttress my income with other investments. This led to a great deal of reading and contemplation. One gift that I was given when I retired was a subscription to the ‘Canadian MoneySaver’, an independent magazine that focussed on advice to individual investors. Then I saw an article that I thought contained an error so I contacted the Editor, Dale Ennis, and that led to his suggestion that I consider becoming a contributor. At that time I had just finished reading ‘Beating The Dow’, a book by Michael O’Higgins in which he laid out a simple approach to dividend investing that had handily beat the U.S. Dow blue-chip index over a long period of time. It seemed so easy that I wondered if it would work in Canada and I decided to find out. I spent several months back-testing it only to find out that it performed even better here with TSX 60 stocks than with the U.S. index. I wrote my first ‘Beating The TSX’ column for the MoneySaver in June of 1996.

My understanding is that this strategy has performed significantly better in Canada than in the U.S., so we’re lucky you were inspired to take on the project of applying it here. The long-term results of BTSX are remarkable, but some investors worry about stock turnover if they were to sell those stocks that drop off the list every year. You and I both prefer to hold many of these stocks rather than sell. What are some of your longest-held stocks and how have they performed?

As a result of the concerns I had about my pension I began investing in Canadian blue-chip dividend stocks in 1995 and continued that until I had acquired a basic ‘hold forever’ portfolio. After studying the Canadian blue-chip index I decided to focus on 4 sectors – my TURF stocks – that consist of Telecom, Utility, Real Estate, and Financial companies. To me, these sectors held the greatest promise of future growth, rising dividends, and stable earnings.

Here are my initial purchases:

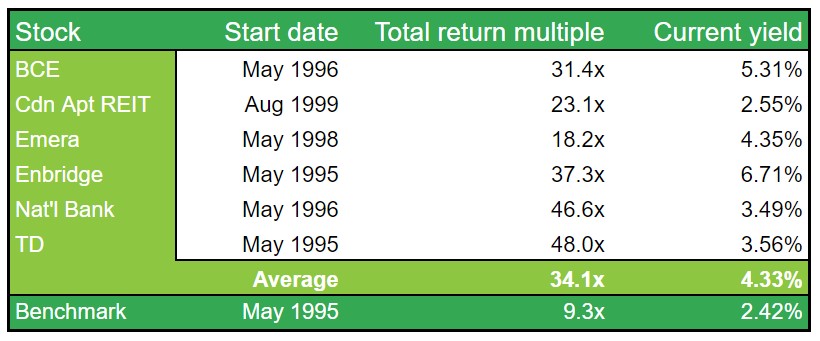

I have held on to those basic six stocks, adding more shares along the way mainly via DRIP accounts. The following table shows the results as of Dec. 31, 2021.

Total return multiple is calculated as ((current price — adjusted initial price)/adjusted initial price). These data were obtained using the Yahoo Canada Finance (https://ca.yahoo.com/) historical data function. Current yield as of January 10, 2022. Benchmark used: XIU ETF and its predecessors are used as a proxy for the S&P/TSX 60 Canadian blue-chip index

I think these results are rather remarkable since they are a result of a very simple investment portfolio whose current value rose to about 30 times the initial investment over a period of 25 years or so. This implies a Compound Annual Growth Rate (CAGR) of about 15%. And, the results beat the TSX blue-chip Index by a factor of about 3.5 times. As you might imagine, a large proportion of these gains came from dividends, demonstrating the importance of this factor to the total returns.

I conclude that my original hypothesis has been confirmed; buying a diversified group of high dividend, blue-chip stocks and holding them over many years is a simple and inexpensive way to accumulate wealth.

Simple? Yes, but not easy. I was tempted many times to get out of the market. Remember the Dot.com Bomb?, the New Normal?, the Global Financial Crisis? All of them were severe tests of my resolve. But, I held on and was rewarded for it. Discipline and patience are the keys.

A few of those stocks haven’t been in the annual BTSX portfolio for a while, yet you still hold them. I write frequently about using BTSX as a tool to identify potential investments rather than as a black and white recipe for portfolio construction. Can you tell us how you use BTSX personally?

That was answered a bit above, but my view of BTSX is that it is a most useful tool for buying dividend stocks when they are exhibiting a high yield, thus implying a reasonable cost. Blue-chip stocks rarely if ever go on sale even though they do exhibit a mild cyclicality, but since the dividend yield and the stock price are inversely related (at a constant dividend) buying when the yield is high helps to make sure you are paying as modest a cost as possible.

You and I both believe that buy-and-hold investing is key to long-term success, but what would cause you to sell a stock? Do you have rules for yourself, or is it case by case?

I started out without any rules, and then Manulife cut its dividend by 50% in 2009. Acting on a knee-jerk reaction I sold my holdings. In retrospect that was unwarranted. We learn by doing. Now, my ‘rule’ is that, with respect to blue-chip stocks, one should hold on in such a situation. Are there events that would trigger a sale? Certainly, but these would have to be irreversible, near-catastrophic, and company-specific, not merely gyrations in the overall market.

You wrote and spoke about Beating the TSX for years before passing on the reins. Clearly, you saw a need to help improve investor literacy. Are there any key ideas or concepts you wish everyone knew?

What a great question! I suppose my overall concern about individual investors is their willingness to delegate financial decisions to advisors without knowing enough about how or if these people have interests that are in line with their clients. We see every day how investors, many of whom are seniors, have been fleeced by unscrupulous financial professionals. Canada’s outmoded approach of provincial rather than a federal securities commission doesn’t help either. During my investment lifetime, a lot of progress has been made in improving financial literacy but these resources continue to be underutilized. It is our obligation as financial writers to spread the word as far and wide as possible.

I’ll keep doing my best to help investors through this site. For those who have started their dividend investing journey, a common concern when it comes to BTSX is poor diversification. Do you share this concern? If so, how do you address it?

I have spoken this far only about my blue-chip Canadian portfolio. I have never advocated that this should be one’s only investment. I own, mainly through plain index ETFs, investments in other sectors and other countries. But, my meat-and-potatoes comes from my BTSX portfolio of blue-chip stocks based in the country where I live and spend.

My approach is very similar. What are your thoughts on bonds and their place in investors’ portfolios?

In my opinion, one should hold an investment with a very low possibility of failure that provides enough income to keep body and soul together if and when bad times hit. For me, that is a combination of my DB work pension, OAS, and CPP. I do not hold any bonds but I do invest in some Canadian high-quality preferred shares. These cannot be called fixed income products, but they do have a bond-like function.

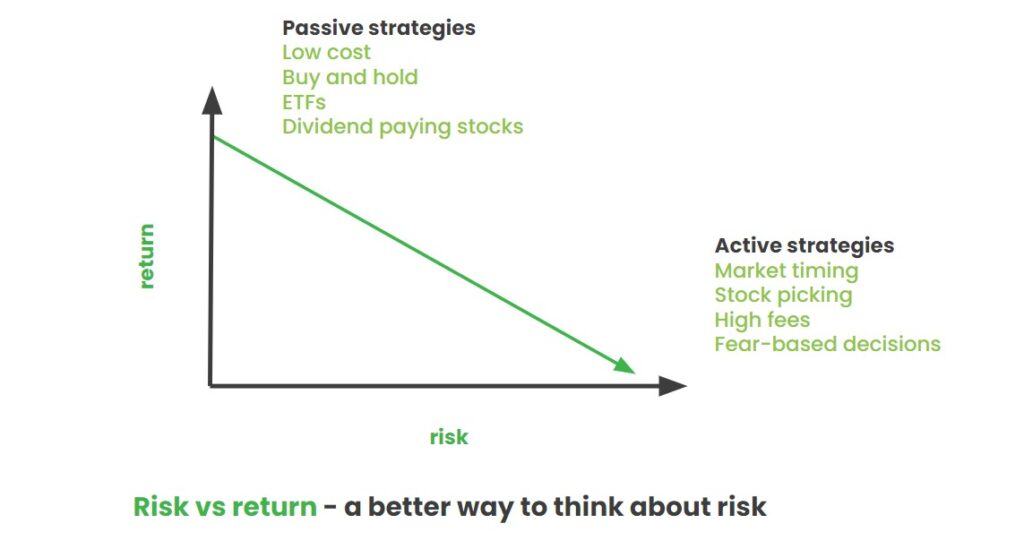

Like them or hate them, bonds are one way that investors attempt to lower the risk of their portfolio, even if it means lower overall returns. I’ve heard you teach a broader concept of the relationship between risk and return that I find very useful. Can you describe it?

I heard a very good presentation to our Guelph ShareClub recently in which the speaker provided this slide:

I think this reflects the situation admirably, the point being that financial advisors will often tell you that a particular investment might be riskier, but the chances of a great return offset the risk. I think this is bosh — my approach is to control the risk initially through the strategies above and the returns will look after themselves.

[David is being modest. He is the one who illustrated this concept for me and I copied it for that presentation!]

I hope you don’t mind me saying so, Dave, but you aren’t a young man. Turns out, that’s good for the rest of us because we can learn from your wisdom! Any advice for older DIY investors in their 70’s and 80’s in terms of planning and/or decision-making?

Yes. I think the most important thing to do is to ensure continuity of your investment plan through viable estate planning. Although we Canadians are living longer these days, of the years tacked on at the end there is often a period of poor health where we might not be able to make necessary financial decisions. Choose your financial attorneys well and make sure someone is keeping an eye on your affairs as you age. A good financial advisor would be a place to start. Having someone who benefits from your demise in this position could be risky.

Last question. I was tempted to ask you for a financial prediction given these crazy times, but we all know how useful those are. Instead, I’ll ask a question that may be even more challenging. In the end, money is just a tool we can use to build a good life. After 80+ years, how would you describe a good life?

Well, Matt, we as a nation are now in the process of entering our third year of dealing with a pandemic/plague. It has disrupted everyone’s hopes, dreams, and plans. I am sure that the retirement plans of many Canadians have been shredded. Time that was supposed to have been spent travelling and enjoying grandchildren has been devoted to worrying about and caring for senior family members and friends. However this health emergency is resolved, you, Matt the medical doctor, know the toll it has taken on us both physically and mentally.

During my retirement, my situation has changed a lot. I have gone from having a wife and a dog to just me. When the grieving is over it strikes you that it is time to make a new plan. My plan included a new dog, interacting with friends, and a re-dedication to pass on as much help and information I can to the community.

Last year a small group of us undertook a garden project where the produce was distributed to a retirement home free of charge. It worked on several levels; As well as fostering personal interactions among folks who had been forced into isolation, it improved their nutritional status and got them back in the kitchen again. And they responded. Thanks to their free-will contributions, over $500 was donated to one of our group who is enrolled in a program to become a certified EMT. We’re looking forward to doing something similar next year.

This may sound kind of trite, but for me, the good life consists of giving back as much as we are able. In these hard times try to be a pocket of joy in a sea of gloom.

I couldn’t agree more, Dave. Imagine how much better things would be if we all made our “pockets of joy” just a little bigger. In the end, those are the things we’ll be remembered for, not our investment returns. I really appreciate you taking the time to answer these questions, for all of your contributions to this site and the dividend investing community at large.

Thanks, Matt for the opportunity to share with the group.

If you found this post informative and/or helpful, please consider donating, as David Stanley does, to help with the cost of running this blog. Don’t forget, half of all donations are given to Doctors Without Borders.

What I've been reading

This blog post by Cliff Asness is a single chart showing that the value spread is higher than it’s ever been, suggesting that value stocks are poised to outperform. He’s got other great articles linked on the right of the page explaining the details.

My friend Mark, at My Own Advisor, tackles the common question, “How to invest for higher inflation?”. It’s a comprehensive review and, of course, Canadian-based.

Lastly, Ben Carlson at A Wealth of Common Sense, updated his favourite performance chart – it is essentially a quilt of sectors, organized by their returns over the last ten years. I’ve been following Ben for a long time and this chart and commentary never fail to remind me that I am terrible at predictions – and that has probably added significantly to our family’s wealth 🙂

Thank you.

I actually sit on the pension committees for a few moderate sized public organizations. While there are similarities between the issues for DB pension management and individual retirement investing, the vast differences in size, scope, and fiduciary responsibilities mean that the most reasonable approaches for both are going to be different.

Over the years I have struggled with how to map DB pension management best practices to practical approaches for individual financial planning in a way that family and friends would be able to understand and apply.

When I found the BTSX site, I felt it was the best expression I had every found of a model that works for the individual. It is simple, sustainable, and suitable for the vast bulk of the population. Over the last couple years, I have passed on links to the site to a number of people and I reference it whenever the conversation turned to management of investments for individuals.

Keep up the great work!

Suggestion: I tend to contribute to sites I find useful and that I return to. I have contributed to the BTSX site, but I have no easy way to know how long ago it was and if it would be a reasonable time to contribute again yet. It might be good if you provided a way to know when (and how much) your last contribution was.

Hi Ted, thanks for the comment. I’m thrilled that this site has been helpful for you and really appreciate the support.

I’ve switched from PayPal to Ko-fi for donations for a variety of reasons. One of the advantages is that you’ll be able to see your contributions, or even choose to donate monthly. I’d never be able to do that securely on the site, so it’s a great feature. I started adding the donation buttons without a lot of confidence that they’d be used, but every time a donation comes in, I see it and it puts a smile on my face. Also, Ko-fi allows me to respond directly to those who choose to support the site, which is really nice.

How delightful to hear from David Stanley again. I too have used CMS publication as a guide to managing my modest portfolio. I chose five dividend stocks to invest in following the wisdom of BTSX. I was 80 at the start of the pandemic and bought when my choices were greatly reduced in price. It has been a wonderful ride and along with these blue chip Canadian stocks I have 2 U.S. and global ETFs and two Index funds. I have a small position in a Bond Index Fund which is the only position I draw on in retirement. This I will do until 85 and only then will I start drawing down my equities. I have let them grow to an amount that should see me to 100. Feeling the way I do now that is achievable. Again, thank you for a fabulous blog.

Wonderful to hear from you again, Eve. So happy to hear that your dividend stocks are treating you well, and even better that, even on the tail end of this pandemic, you’re feeling strong.

Thanks for the great article! Could you explain in more detail the formula used to calculate the returns? Specifically, what is the adjusted initial price and how is it calculated. Thanks again, I really appreciate the info you’re providing

It is an enormous challenge to calculate total returns over several decades, especially with dividend changes and stock splits. Dave and I went back and forth a few times to make sure we got these numbers as accurate as possible. In the end, we thought it best to let Yahoo! Finance do most of the calculations. For any one of those stocks, if you go to “Historical data”, you can find the adjusted closing price for the dates listed. The site states: “**Adjusted close price adjusted for splits and dividend and/or capital gain distributions.” As for the benchmark total return, Yahoo! Finance wasn’t any help since there is no ticker symbol that reflects either the S&P TSX or the TSX 60 that goes back to 1995, at least not one that includes dividends, which would be the only fair comparison. Fortunately, we’ve been tracking this data as part of the Beating the TSX project. Every single year we’ve been collecting total return data for the TSX 60 (or previous equivalents), so we used our own data for that.

I hope that answers your question. As always, if you find any errors, please let me know.

Fantastic interview. I thoroughly enjoyed it.

The comment on Manulife surprised me a bit. For me, I think if one of my holdings cut its dividend like that I’d look at it as an opportunity to buy something on the list I don’t already own. As it stands today, I only have six of the ten on the list. But, having read David’s reflection I’ll think twice if the situation happens to me.

Thank you very much for this interview. I am a big fan of Mr Stanley, I have read every article he has written for CMS magazine. I started with his beating the TSX a few years ago and I’m happy to report that I’m very happy with this process. It has taken away much contemplation of what to hold and for how long. For diversification I also hold dogs of the Dow in equal amounts to beating the TSX, and I have to tell you that beating the TSX has treated me much better. I read Michael O‘Higgins book because of Mr Stanley and also found it to be very informative and instrumental in my investment portfolio. Sometimes all we need is to be pointed in the right direction, I consider Mr Stanley a great mentor. Once again thank you for experience and sharing it with me. (The ideal teacher guides his students but does not pull them along; he urges them to go forward and does not suppress them; he opens the way but does not take them to the place.

Confucius)

Outstanding interview Matt and to David – a BIG thank you.

Canadian investors owe significant thanks to you and your process to achieve great returns over time thanks to some investing guidelines and personal investor discipline. I am one of them 🙂

Best wishes David and thanks once again.

Mark

Is it possible to know what other stocks and ETFs David has?

Thank you.

Hi SD, Dave saw your comment and generously emailed me the following information about his portfolio. These proportions are approximate, specific to his own situation and change over time.

CASH & EQUIV. 33

COMMODITIES 1

CONSUMER 4

FINANCIAL 25

INDUSTRIALS 0

REAL ESTATE 6

TECHNOLOGY 2

TELECOM 7

UTILITIES 22

Thank you.

Pingback: Weekend Reading – High-savings rate edition - My Own Advisor

is it possible for David Stanely to share the percentage allocation across his 5 sectors – Telecom, Utility, Real Estate, Financial and ETF/Index funds

15% annualized return is amazing.

His return speaks volumes. You don’t need to look elsewhere—a tried and successful strategy.

Regards

Taki