The road to financial independence and through retirement often feels like a menacing dark alley rather than a pleasant rolling country road. As a result, millions of Canadians hand the reins over to financial advisors, assuming expertise comes bundled with the title. The minority choose to steer clear of financial advisors, wary of the conflicts of interest that pollute the financial services industry. Turns out, the real problem with financial advisors is usually incompetence rather than malevolence.

I place a very high value on science and evidence. Most of the time I’m reading and synthesizing from a variety of sources to come up with interesting and valuable blog posts for you. This time David Stanley (thank you) sent me a paper that is so important and powerful, it deserves a whole post.

The misguided beliefs of financial advisors

The paper, by Linnainmaa, Juhani T., Brian T. Melzer, and Alessandro Previtero, is called “The Misguided Beliefs of Financial Advisors”, and is published in the Journal of Finance. For those of you in a hurry, here’s the abstract:

A common view of retail finance is that conflicts of interest contribute to the high cost of advice. Within a large sample of Canadian financial advisors and their clients, however, we show that advisors typically invest personally just as they advise their clients. Advisors trade frequently, chase returns, prefer expensive and actively managed funds, and underdiversify. Advisors’ net returns of −3% per year are similar to their clients’ net returns. Advisors do not strategically hold expensive portfolios only to convince clients to do the same; they continue to do so after they leave the industry.

Linnainmaa, Juhani T., Brian T. Melzer, and Alessandro Previtero, The Misguided Beliefs of Financial Advisors, Journal of Finance, 76 (2), April 2021.

This is not the kind of study that can be ignored. The data spanned fourteen years (1999-2013), almost 5000 advisors and over half a million clients. Let’s dive into these findings one by one.

1. Advisors trade frequently

In spite of overwhelming evidence that frequent trading erodes wealth, advisors are guilty of even higher turnover in their accounts than their clients.

Advisors trade substantially more in general-purpose accounts, with average turnover of 52% compared to 34% for clients.

Linnainmaa, et al.

2. Advisors chase returns

Experienced DIY investors, and dividend investors in particular, have accepted that past performance does not predict future performance. Apparently financial advisors missed that class, frequently chasing future returns based on prior year performance.

Clients purchase funds in the 60th percentile of prior year performance, on average. Advisors display slightly more return chasing, with an average purchase in the 63rd percentile.

Linnainmaa, et al.

3. Advisors prefer expensive and actively managed funds

As is the case with most advisors, the ones in this study were limited to providing advice in the form of asset allocation and investment funds, not individual stocks (reason enough for dividend investors to steer clear). But if your portfolio must be composed of funds, low-fee index ETFs are the way to go. Even Warren Buffet, the world’s greatest “active” investor, says so. In spite of this fact, which is reinforced by SPIVA reports every year, financial advisors opt for actively managed mutual funds in both their own and their clients’ portfolios.

The average client invests almost exclusively in actively managed mutual funds, with only 1.5% allocated to passive funds. Likewise, advisors allocate only 1.2% to passive funds.

Linnainmaa, et al.

Of course, those actively managed mutual funds carry high fees. Yet another surprising finding of the study is that advisors seem even more willing to pay those high fees than their clients. More evidence that the average advisor lacks basic investment knowledge.

Advisors invest in slightly more expensive mutual funds. The average MER is 2.36% for clients and 2.43% for advisors.

Linnainmaa, et al.

4. Advisors and their clients underperform the markets

At this point it should be unsurprising that advisors under-perform but the degree to which they do and the fact that their clients are similarly affected is nothing short of shameful. (When interpreting the following quote, remember that alpha is a measure of performance relative to an appropriate benchmark. An alpha greater than 0 indicates outperformance, less than 0 indicates underperformance.)

Clients and advisors net alphas—computed after management expense charges but before other fees and rebates—are substantially negative. The annualized six-factor alphas are −3.07% (t-value = −3.42) for clients and −3.66% (t-value = −3.79) for advisors.

Linnainmaa, et al.

5. Advisors fail to adapt to their clients’ needs

Most advisors sell themselves by assuring clients that their advice will be based upon the client’s unique needs and circumstances. In a follow-up paper written by the same authors in conjunction with Stephen Foerster from Western University, entitled “Retail Financial Advice: Does one size fit all?” the authors show that financial advisors fail this test as well; rather than catering to their clients, clients end up adapting to the advisor.

We find little support for the view that advisors’ value added resides in tailoring portfolios to clients’ characteristics.

Foerster, et al.

Clients with vastly different personality traits and risk tolerances will end up with remarkably similar portfolios if they share the same financial advisor.

Conclusions

This data is profound. I, like many of you, have always been suspicious that many financial advisors gave bad advice because it was more lucrative for them – and that might still be true in some cases. At the same time, I have friends and family members who are financial advisors and they are, without exception, kind and well-meaning people. The fact that they didn’t understand core concepts like the dangers of frequent trading, chasing returns, the insidiousness of fees, and the irrefutable evidence against active management was always a little baffling – until now.

As shocking as this data is, it reinforces a very important point: financial advisors are first and foremost, salespeople. If advisors knew that frequent trading, chasing returns, high fees, active management and under diversification were bad ideas for their clients, you wouldn’t expect them to commit these blunders themselves. But they do. They’re drinking the poison Kool-aid too, and the dismal returns of their own portfolios prove it.

Advisors give bad advice because they’re misguided, not conflicted. This is the real problem with financial advisors.

A sincere thank you to those who have already donated – I process each one individually and appreciate your generosity. It takes time and real money to maintain this site. If you find this information useful, please consider donating to keep DividendStrategy.ca ad-free. I’m not trying to get rich . . . 20% of donations are given to Doctors Without Borders. Thank you!

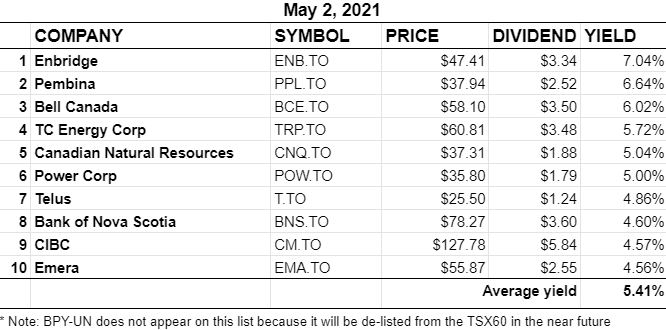

BTSX portfolio update May 2021

Why would one use an advisor to purchase actively managed funds? It sounds like an oxymoron.

Good point.

In fairness to advisors, they really can add value, but it is almost always in the form of financial planning rather than investments – making sure clients are saving, investing, have appropriate insurance, and aren’t making giant financial mistakes. But their services are expensive, can easily be done by the individual who has a little interest, and the majority clearly lack knowledge of basic investment principles.

They are under pressure to do what the firm they work for wants them to do

(e.g. sell a new share offering that the firm is underwriting, or buy shares the firm has bought but now wants to unload without making the price go down).

Plus as the article says anything that is a perk to them (e.g. fees) will have a habit of featuring in their recommendations.

Lastly, observe that this is a guy dragging himself into an office every day, not a genius who is sitting on a beach in early retirement. That should tell you a lot.

Pingback: Weekend Reading – Dividends flowing, avoiding mutual fund salespeople, and more! - My Own Advisor

Pingback: Should you invest in segregated funds? —

Awesome post and very informative!