Reality will pay you back in equal proportion to your delusion

Will Smith

A few weeks ago I was interviewed again by TD Inside Investor to discuss some lessons I have learned as a BTSX investor. You can watch the interview HERE.

We talked about the importance of diversification, the pitfalls of trying to make market predictions, and how to manage dividend cuts, among many other things. In hindsight, the underlying theme of the conversation was one of transparency. I firmly believe that we make better decisions when we have good information – and sometimes good information is about things that make your job harder. DIY investing doesn’t have to be complicated, but anyone who tells you it’s easy is either delusional or has something to sell you.

I just think it’s better to be aware of these things sooner rather than later. And because BTSX isn’t a product I’m selling, I am quite happy to discuss these things.

Even though BTSX has been a powerful tool for DIY investors to build their wealth over the last several decades, it is not without its challenges. If you pretend they don’t exist, “Reality will pay you back in equal proportion to your delusion,” as Will Smith warns.

So, with that in mind, let’s have a look at the mid-year (or, at least, mid-July) Beating the TSX performance.

2023 Mid-Year Update

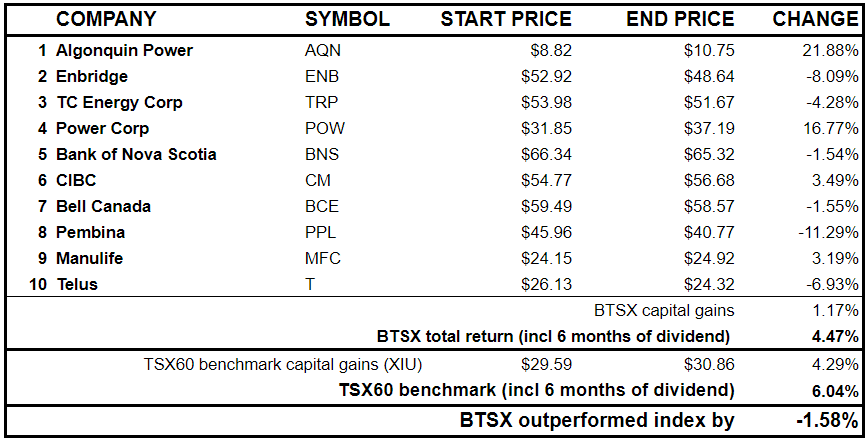

Even though BTSX beat the benchmark TSX 60 index by 5% in 2022, overall returns were underwhelming, to say the least. And, so far in 2023, things aren’t much better with a total return of only 4.47% for BTSX and 6.04% for the TSX 60.

When I did the TD interview about a month ago, BTSX was beating the index. At the time of writing this post, however, it is slightly underperforming. Undoubtedly, prices will continue to fluctuate and it’s anyone’s guess where we’ll end up in another six months.

Dividend Update

What doesn’t fluctuate nearly as much as stock prices are dividends. I have written extensively about the behavioural benefits of focusing on dividend income rather than stock prices. But that doesn’t mean the news is always good or that our effectiveness as individual investors won’t improve if we learn to anticipate the bumps in the road and plan for them.

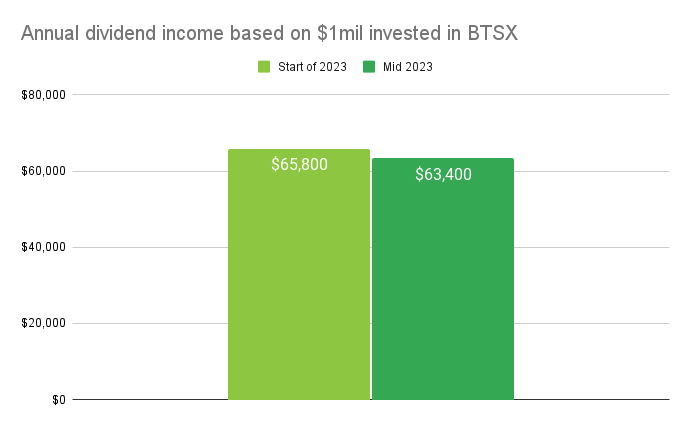

The good news is that eight out of the ten BTSX stocks have increased their dividends in 2023. Enbridge (ENB) has simply maintained its dividend – probably good news for investors since the dividend is quite high already – and Algonquin Power cut its dividend by 40% at the beginning of the year, as many of you will be aware (I wrote about anticipating this cut HERE). Even with AQN’s cut, total dividend income has only decreased by about 4%.

AQN: A learning experience

I discussed how I think about dividend cutters in detail during the TD Inside Investor interview because it is both challenging and interesting for DIY dividend investors. For me, the bottom line is this: don’t overthink it. Dividend cuts are going to happen and the market knows it long before you do. That’s why the stock price goes down first: all available information is baked into the price. The occasional dividend cut doesn’t mean you did something wrong; it’s simply part of being an investor, particularly a dividend investor.

Still, AQN provides a unique learning experience. The price cratered in late 2022. By the end of the year, AQN was trading at $8.82. No dividend cut was announced until early 2023. Was the cut bad news? AQN has gained 22% since the beginning of the year – better than any other stock on the list. In fact, in early May it was up 35% from its earlier lows. So, the “worst” stock from a dividend perspective has been the “best” stock from a capital gains perspective. Humbling.

I don’t know what AQN is going to do from here. No one does. But it’s clear to me that the market is better at predicting dividend cuts than I am and BTSX is better at picking stocks. Personally, I’m holding my AQN for the year then will reassess.

The long view

One of my favourite lines from finance writer Morgan Housel goes like this:

“There are three legal investing strategies: you can be smarter than others, luckier than others, or more patient than others. That’s the whole list.”

The market with its myriad contributors is smarter than almost any individual. This is known as the Wisdom of Crowds. Being smart confers no advantage unless you have rare inside information.

Luck is for the casino. It is not something I want to hang the financial security of my family on.

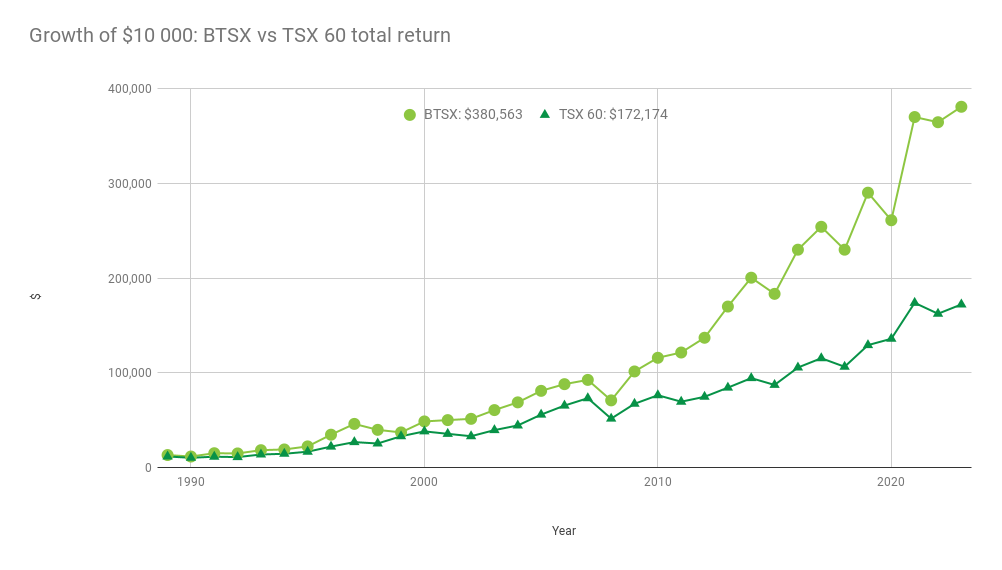

So, I am left with patience. Fortunately, the evidence shows that taking the long view is perhaps the single greatest advantage we as DIY investors have over the pros.

Turns out dividend investing, and BTSX in particular has proven to be an extremely effective long-term tool as this updated long-term performance chart shows:

As nice as that graph looks, “Be patient” sounds trite. How do you actually do it?

Rather than rely on willpower, create a system in which the right decisions are the easiest decisions. Make a financial plan that is clear, organized, and based on data rather than emotion. It doesn’t have to be perfect, but it should be simple and as automated as possible. Put the plan into action, then take yourself out of the equation. Plant a garden, visit with family, spend time outside. Don’t watch financial news. Don’t think dividend cuts or market downturns mean you did something wrong or should change course.

You are only in control of your process, not outcomes. So, take this mid-year update for what it is – an interesting data point and a catalyst for some useful reflection.

How are you feeling about your investment plan these days? What do you find most challenging about being a DIY investor? I’m interested to hear your thoughts.

As always, I hope this blog post finds you well and helps you in some small way.

Thank you so much to those of you who have chosen to support me and this blog with your donations. The fact is that as the blog grows, it gets more expensive to run. I want you to know that your generosity and the thoughtful notes that are often attached to them have a huge impact on the quality of this site.

If you are so inclined, no matter the amount, you can support this site by clicking here:

Thanks for the mid-year update, Matt. I have part of my TFSA invested in this “long-term” strategy so this is helpful. While AQN has done well this year, I noticed that Telecom and Energy sectors are down, likely due to energy prices variation, BOC rate increases and recession fears. It will be interesting to see how these stocks perform for the rest of the year, as I stay patient to collect dividends.

“Long-term” and “stay patient” – words to live by. Thanks for the comment, Tom.

I purchased extra AQN stock Nov 22nd when a dividend cut was predicted and a price fall had ensued. The price was $9.97. So it’s helpful in minimizing the loss from the initial purchase. It was a bit risky, but I liked their story with renewable energy. The cash flow was always going to be there. When interest rates start falling I can I think expect a bigger return.

Hi Geoff – as long as it fits within your overall investment plan, purchasing more shares of good companies while their stock price is depressed can certainly be a winning strategy. The challenge is that we never really know whether the price depression is temporary or permanent. Hence the need for diversification. Here’s the key: Never have more money in one investment than you can afford to lose without it affecting your standard of living.

I’m new to DIY investing starting about 2 years ago and so far have only purchased ETFs as they are free to buy with Questrade, the broker that I am currently using. I’ve been trying to learn about different investment approaches since I now manage my own portfolio, and I’d love the try the BTSX approach to investing (I’m in my accumulation phase with ~20years to go until retirement). However, the costs to buy individual stocks with Questrade have stopped me so far. I’m wondering how you manage the costs to buy/sell stocks to maintain your portfolio with this approach?

Hi Rose – welcome to DIY investing and my little website!

You’re right to think about trading costs. Here’s how I think about it: Estimate the cost of the trades you would need to do annually for the Canadian portion of your portfolio (since BTSX is only Canadian) and compare this to the MER for a Canadian ETF like XIU.

For example, if you estimate your trading fees to be $100/yr using BTSX (this depends on several factors like number of accounts, etc.) and take the MER of XIU to be 0.18%, $100 divided by 0.18% = about $50,ooo. Thus, from a fee point of view only, you should probably have about $50,000 to invest in Canadian equities before buying individual stocks. Once you have your portfolio set up, particularly if it is in a single account like an RRSP, you can probably do even fewer trades on an annual basis because there tends to be low turnover in the BTSX portfolio year over year.

Hope that explanation helps.

Use Wealthsimple. No trading fees.

That’s definitely an option, but Wealthsimple lacks the tools, resources, and customer support that other, more highly ranked platforms have. And switching platforms is a real PIA. Thanks for the comment though – good to consider all the options.

Hi Matt,

Actually I think Enbridge did increase it’s dividend for 2023. Declaration date was Nov 30, 2022. Payable date was March 01, 2023.

https://ca.dividendinvestor.com/historical.php?no=3267

Thanks for all you do.

Thanks DividendsOn – Yahoo must not have had the increased dividend recorded at year end. To be as consistent as possible, I use their values for dividends even though they are sometimes delayed.

Interesting data point. You always state your opinions clearly and they are well researched. I tell everyone that will listen that the BTSX is the best method of investing for someone just getting started. As you have stated in the past, once you become more knowledgeable there is less need to rotate this list annually. Once you have a good company that fits your investing profile, just keep it. We have 30 companies in our portfolio and don’t buy and sell much at all. Since retiring 5 years ago our dividends have grown 42%. So these data points of our overall performance of the portfolio are not that important. As to the cost of investing, when you have a long term plan I believe you can slowly build your portfolio. Don’t buy all 10 companies, buy on each year, or as you have the money. Diversification can be built slowly. No need for ETFs. But to each there own.

Hi

I just read your interview with David Stanley from May of this year. I question the logic on the example given, ie the 10% drop in share price, now giving an effective yield of 5.41% as compared to 4.86%. if you hold the BTSX stocks for 1 year and don’t buy anymore like the protocol suggests isn’t your yield still only 4.86%? The increased yield is only for new money which is not the case if you hold the stocks and don’t buy anymore. The dividend is the same no matter what the changing yield is. So its still better then the 3.32% the bond is yielding, but not as much as the example suggests. Am I right or am I missing something here?

Thanks

Hi Jeff. If I am understanding your comment correctly, you are pointing out the difference between yield on market value (dividend divided by current price) and yield on cost (dividend divided by purchase price). This is a very important distinction to make and a topic that I’ve frequently deserves a post in itself. From what I can see, your logic is sound. I also know that David Stanley is well aware of this distinction. If you can provide a link to the post you’re referring to, perhaps he or I can provide a fuller explanation. We’ve done numerous posts together and I’m not sure which one you were reading. Nevertheless, thank you for the comment.

BTSX stocks for 2024. Please!

Coming soon