It’s been a long time since I’ve written about a specific stock. Truth is, I’m not that interested in individual stock analysis because I just don’t see the upside. Even Benjamin Graham, the godfather of fundamental analysis admitted in an interview near the end of his life that security analysis had become largely futile.

. . . in the light of the enormous amount of research now being carried on, I doubt whether in most cases such extensive efforts [of security analysis] will generate sufficiently superior selections to justify their cost

Any stock I’d consider buying or selling has already been vetted by thousands of people with higher IQ’s and nicer pocket protectors than mine. All that data and sentiment has been baked into the stock price long before I get there. Besides, there are far more interesting topics to wrestle with and write about that will be of much greater benefit to you the reader.

When I do write about stocks, it’s usually when something’s gone awry. Most bloggers are out there finding ways to humble-brag about their performance. But the BTSX method sells itself. This is an important point that we’ll come back to. In the meantime, I’m more interested in exploring the challenges we face as self-directed investors.

The Algonquin Power fiasco

Right, so this week AQN happened. You might have heard. A newcomer to the BTSX portfolio for 2022, back in January she seemed to fit right in. A $12 billion market cap, the boring but stable profit growth of a water, gas and electricity utility company, and a nice dividend yield of just over 4% with payments that had been increasing consistently since 2008. What’s not to like?

Were there reasons to worry? Sure, but there ALWAYS ARE, especially with BTSX stocks that are selected based on yield. I bought AQN and felt good doing it. Looking back, the truth is I’d do it all over again.

Investors tend to take losses personally, but there’s a difference between bad outcomes and mistakes. Until you know the difference, you’ll drive yourself crazy.

Nevertheless, things have not turned out well. AQN started the year at $18.27. A week ago, the stock price was $15.30. Now it’s $10.28. Ouch.

What happened was a combination of missed earnings and a downgrading of forward guidance, exacerbated by high debt and high-interest rates. It’s complicated, but it sure isn’t good, at least not in the short term. The dividend is most definitely at risk.

What should investors do?

Buy, sell, or do nothing? Those are your options. Those are always your options. And if you came here looking for trading advice, I have none because, guess what – no one knows where this thing is going.

All the bad news, all the fears, and all the reasons to be optimistic are already reflected in the price. The likelihood of a dividend cut? It’s in there. The chance of a remarkable turnaround? It’s covered.

For big public stocks, the market is efficient enough to render our own opinions irrelevant at best, and dangerous at worst.

“But what about that looming dividend cut, Matt? Haven’t you told us about the research that shows that dividend cutters under-perform even non-dividend-payers?”

Yes, but here’s the rub: Mr. Market is forward-looking. Because almost everyone seems to be anticipating a dividend cut, the chances of one are already reflected in the price. In fact, if/when the cut happens, the stock price may very well increase because the company’s fundamentals will, by definition, improve.

This is what you’ve been training for

What we have here, folks, is one of the most challenging situations facing investors who choose to buy individual stocks rather than a broad-based index fund. This is the price we pay. There is no free ride. Over the last thirty years, our BTSX method has outperformed the benchmark TSX60 index by about 2.5% per year. If you had invested $10,000 using BTSX back in 1987, the first year we have data for, by now you’d have about $340,000. If you’d invested in the benchmark index, you’d have about $160,000.

But there has always been a price to pay for the chance at outperformance and this is what it feels like. Sometimes the method will underperform (remember 2019?). And not all of our stocks are going to be winners.

Not all of your stocks are going to be winners

Don’t breeze by that sentence. It’s extremely important to internalize that fact. Individual stocks will fail to deliver. That does not mean your investment strategy is a failure. And it certainly doesn’t mean you’re a bad investor.

Losses like this feel terrible, but there are two things I think we all need to keep in mind.

- Human beings feel losses far more intensely than equivalent gains. This is a well-established phenomenon called “loss aversion” and probably has to do with the fact that, in nature, bad events tended to have more permanent consequences than good ones. So, if you’re an AQN investor like me, how you feel is likely worse than how you should feel based on the facts.

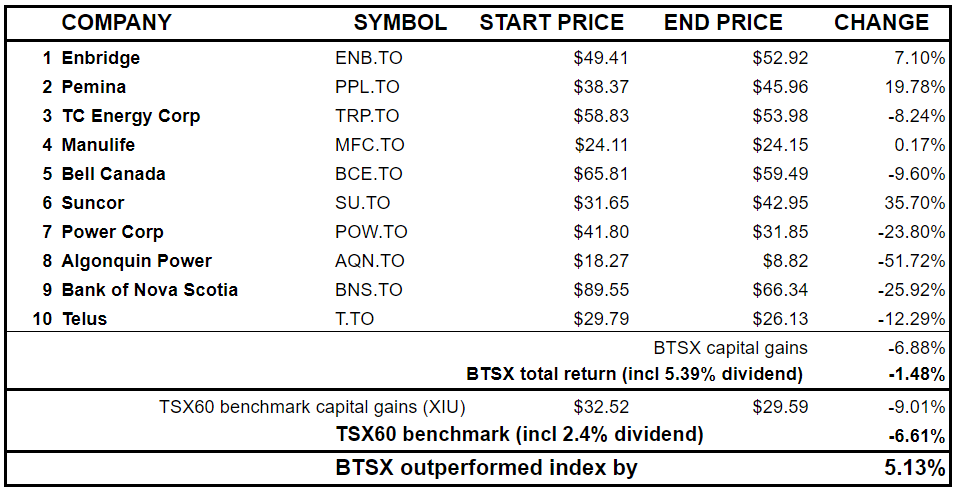

- How any one stock performs is unimportant. It’s the performance of your portfolio as a whole that matters. So far in 2022, even with the AQN fiasco, BTSX is still beating the index by 7% (Edit: The chart that was originally published here contained incorrect data for BTSX and XIU dividends. This chart is updated as of Dec 31st, 2022).

In a recent post about how to think about bear markets, I wrote about how, “We don’t react to the events in our lives. We react to our interpretation of those events.” What has happened to AQN is not a glitch of BTSX, nor does it reflect a lack of good judgement. It is a simple and unavoidable fact of investing in stocks.

We do not control events, we only control our reactions to those events

Watching a “quality” dividend-paying stock unexpectedly drop 44% in less than a year is one of the hardest things dividend investors have to endure. It makes us doubt the company’s fundamentals, the future dividend payments, and often our abilities as self-directed investors. In light of this, I have a few suggestions for how to manage such situations.

1. Always evaluate investments before you buy.

It may sound trite, but don’t chase yield. BTSX has been and will continue to be a great tool to identify potential investments, but always perform your own due diligence. Is the company profitable? Does it fit with your overall investment plan? Does the dividend appear stable? Whether you use the BTSX list as-is, or adjust it based on your circumstances and preferences, it is up to you to make sure you’re comfortable with your portfolio. Perhaps you’ll be able to avoid some risky investments.

2. Understand that sometimes you’re going to be wrong.

But you’re not going to bat 1000. BTSX doesn’t always choose winning stocks. Professional fund managers frequently don’t choose winning stocks. Your investment choices are going to be wrong sometimes. If you are following your investment plan (and we all need a plan), this is not a personal failure. It’s simply the reality of being a stock investor.

3. When the sh*t hits the fan, follow your plan.

There is a 100% probability that BTSX stocks are going to experience situations like this again in the future, so it only makes sense to plan for it. What do you think is the best way to manage individual stock price drops? What about a dividend cut? What about those years when the whole portfolio underperforms the index? Human beings make worse decisions under stress, so if you’re reacting to the drama rather than planning your actions ahead of time, chances are you’re going to feel worse and make worse decisions.

What am I doing with my AQN shares?

My investment process is that I perform portfolio maintenance once a year. Thus, I am neither selling my AQN shares, nor buying more. Is there a dividend cut coming? Seems likely. But that’s already priced in, as are all the other possible outcomes we might see.

Your plan might look different, and that’s okay. Perhaps it involves buying more at depressed prices to rebalance. Perhaps, like previous BTSX writer Ross Grant, your plan is to sell as soon as a dividend cut is announced. I have no opinion on these approaches because I don’t have the data. All I have data on is how the BTSX method has performed overall – and that’s pretty impressive, so that’s what my plan is based on.

I buy individual stocks, but I’m not a stock picker. I got over the illusion that I might have a special ability to assess stocks better than the market can a long time ago. Fortunately, I don’t have to. Beating the TSX has done a superb job of picking the stocks for me. It’s not always easy, but my role is to stay out of the way.

A couple of things before I sign off today.

First, I hope this post has helped you navigate these challenging times. If you would like to support this blog and my work, please consider donating by clicking this button.

Second, Canada’s top online broker Qtrade has recently announced an amazing offer that is only available to select publishing partners like DividendStrategy.ca – $50 sign-up bonus + up to $2000 cashback for new accounts. If you’ve been thinking of giving them a try, click here and use promo code: CASHBONUS2023.

Lastly, on December 1st, 2022 I am being interviewed by TD bank for their webinar series. This is all about dividend investing, how and why BTSX works so well, and my personal experience and opinions as a DIY investor. You can register for free HERE.

But I think a lot of mostly retail dividend investors were sucked in by the AQN story of great ESG (green energy) good dividend and exceptional dividend growth so this was virtue inevesting, doing well by doing good, while ignoring the heavy debt, the Ponzi issuing of new shares to pay the dividend, the excessive payout ratio, and the crap purchases such as Kentucky power.

Thanks for the post, Matt. Since getting on the bandwagon 3 years ago, this is the first bump in the road for me. I still am not sure what to do. With the glass half full, I have fared much better on the Suncor investment than I lost (to date) on the Algonquin.

Thanks for all your insight.

I will definitely be on your webinar on December 1st. (from Mexico).

I am fairly new to the BTSX approach and wonder what most people do every year? Sell the losers and buy the new winners? I can see if it’s a Big5 bank to just hold on but with AQN it seems different. I want to retire soon so keeping a dead stock in my portfolio doesn’t necessarily make sense. I am waiting it out for now….

Hi Sandra, I’ll chime in as a user of the BTSX for 13 years now. What do most people do? Well, they should do as the system says and ignore all the noise such as AQN and rebalance once a year as per the strategy. Some people decide to dump them early, perhaps buy early or off-cycle of the annual rebalance. Others choose to keep the 10 BTSX stocks going but keep the winners in their portfolios (i.e. don’t sell each year). For me, all of this does not make sense. Why? Because the BTSX system is just that – a system with data and statistics that Matt and Canadian Moneysaver publishes. It has a 34 year record of beating by ~3% annually. Why mess with that by making subjective choices? There is no data on what happens if you sell one early or keep some in your portfolio. Maybe it’s better? I don’t know – because there is no data. 13% annual average return, however, is incredible. Plus, I love that the sytem tells me when to SELL, even if I like a stock such as a big bank or a telecom. Selling is way harder than buying IMO, so the system takes care of it for you.

And what about the losses with stocks like AQN? Again, it doesn’t matter and it will continue to happen. I’ve been doing it long enough to remember TECK, and POT, and Goldcorp sneaking their way in to the list, and subsquently crapping the bed. But it doesn’t matter, because the portfolio as a whole is killing it, and of course you’re selling more for profit on average than you are taking a loss. And those profits are used to buy more of the new companies coming in each year.

And retirment looming – my dad has been retired for 20 years and continues to use the strategy. Why not? Bonds have proven to be a waste of time and certainly just as volatile this past year.

Hope this helps, of course you need to do what you’re comfortable with, but for me it’s all about the data and statistics, trusting them, and objectively making decisions.

These are some good points but for some of us there are challenges with selling at the end of the year. For me, 68% of our portfolio is in a non-registered account. Triggering huge capital gains for the sake of moving from one blue chip stock to another to get another point or two of yield is not always a great decision. In our case we invested a modest inheritance starting in late April of 2020 using the BTSX methodology and by year’s end could not afford the capital gains so we held, and continue to hold for the same reasons.

However AQN is perhaps a special case and selling to harvest a loss offers different opportunities.

Thanks James and Chad – I harvested a loss for AQN but because I’m on the fence, I held some of it. If it comes around, great. If it doesn’t, another tax loss harvest for me later. I do have the issue of selling and getting the capital gain in order to rebalance BTSX. Instead I am just adding each year.

Thank you Matt for this article! AQN’s news has been on every blog and investing channel, I’m down 43% on my initial purchase price but I’m holding because I believe that next quarter they have to correct course either by cutting dividends or selling assets , like you said we always overreact on losses never on gains for me AQN represented 4.8% of my portfolio before it crashed but the rest of my holdings are doing good thanks in part to an advise I read once on “My own advisor” from Mark seed which is to keep every holding ~5% so if that one goes bad you still have 95% of your portfolio working for you.

No one can tell the future and a lot of speculation around AQN now some they say it’s done and some they believe in a turnaround but I’m holding because I believe in giving it a second chance if not one of the big boys will buy it and the insiders buy is another positive sign so I’ll be waiting for january to see …untill then I’m a holder 🙂

Thanks for the AQN information. I have using BTSX method for a few years and been very happy with the results. I update once a year and will do the same with AQN shares.

Hi Matt,

In the table above, can you explain how you arrive at 4.17%? I’d like to know the exact formula.

I think this number derives from the 6.13% dividends and the -0.43% capital gains, but I just don’t see how.

Thanks

Fair question – I should have explained this. I used only 75% of the dividend yields for both BTSX and TSX60 because the year is not over. Thus, for BTSX: (6.13 x 0.75) – 0.43 = 4.17%

Good eye, Patrick!

Thank you for explaining.

Would like to know what Prefs you hold ?

I would encourage readers to digest Dave’s response to Jean-Paul with respect to preferred shares. Those insights are far more valuable than any list of holdings.

I am sure Dave and I would agree on this point: Our value is not in telling people what to do, but in giving them the tools so that they can find the right thing to do for themselves.

Will you be doing an update on the latest AQN news about the 40% dividend cut and what we should do with this stock?

AQN’s price drop and now its dividend cut are certainly causing some anxiety. As an AQN shareholder, I sympathize.

But this site never has and never will tell anyone what they “should do” with their investments. My goal is not to tell you what to do, but rather to give you the tools you may need to decide on the right thing to do for yourself.

I hope this doesn’t sound too harsh but anyone who tells you what you should do without an intimate and thorough understanding of your situation, goals and values is someone you should immediately stop listening to.