For last month’s BTSX update I started to address the question of whether previous income trusts should be included in our Beating the TSX portfolio by taking a closer look at IPL (Inter Pipeline Ltd). In my opinion, and that of most of the commenters, IPL is a solid company with an impressive dividend history and would seem to fit right in among the banks, telecoms and utilities that make up the remainder of our list.

But what about the other previous income trust with a top-ten dividend yield on the TSX 60, Pembina Pipelines? What’s is their business? How are their finances? And, most importantly, is their dividend safe?

Here’s the quick and dirty on PPL:

- Dividend yield: 4.92% (as of July 1, 2019)

- converted from income trust in October 2010

- steadily increasing dividends for 12 years

- Dividend payout ratio: 101%

- P/E ratio (trailing): 21.91

- Market Cap $24.9 billion

Business overview

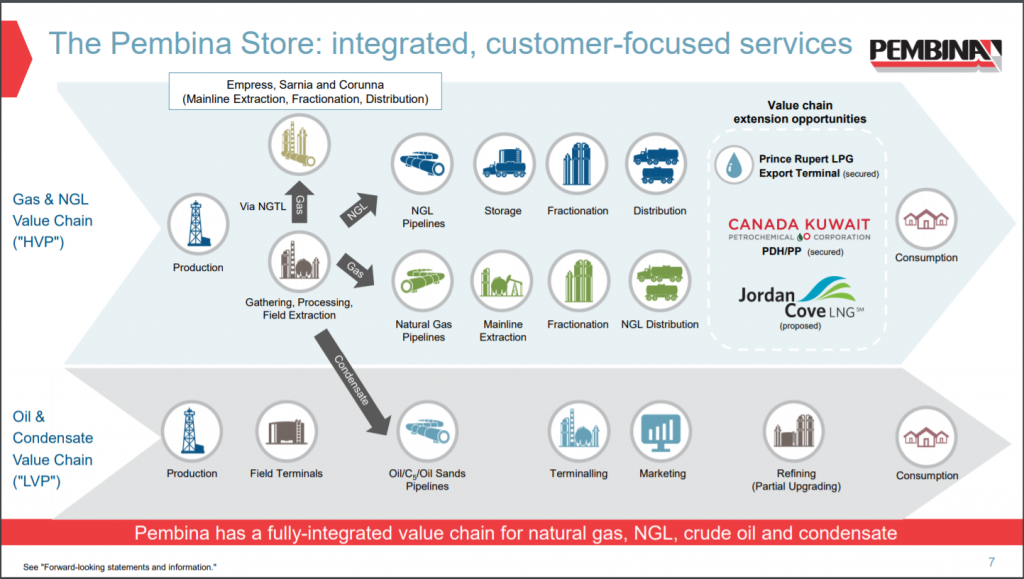

Pembina Pipeline is a Canadian transportation and midstream energy service provider, based in Alberta. It has fully-integrated value chains for natural gas, natural gas liquids, crude oil, and condensate.

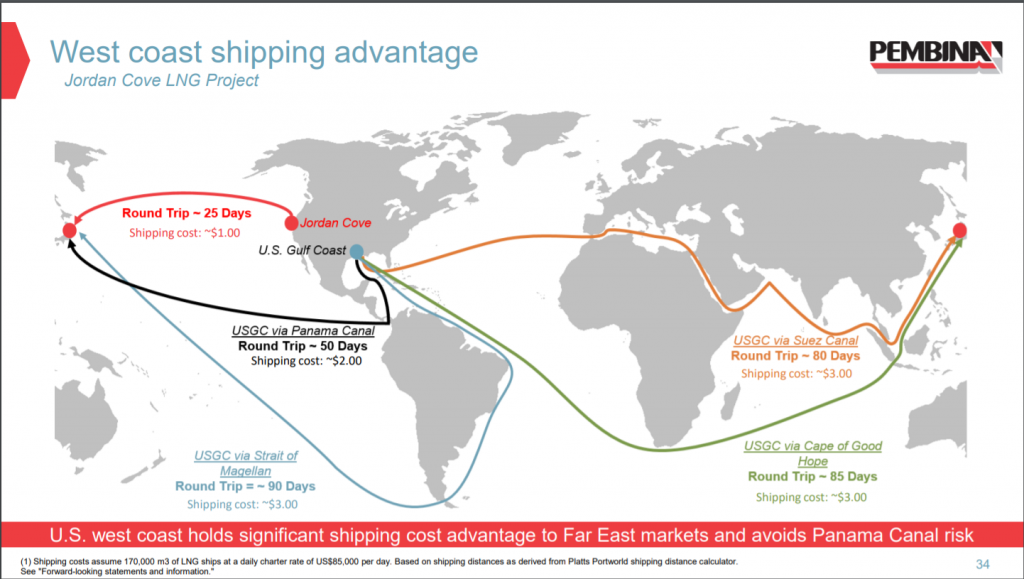

Pembina has grown its storage, processing and transportation capacities steadily over the past ten years. It continues to invest billions in new projects (Canada Kuwait and Jordan Cove projects) with plans to leverage its strategic geographic location on the west coast to access more lucrative markets overseas.

Pembina’s market capitalization of $25billion reflects its significant size and scale as an integrated energy player in Western Canada. In fact, pipeline capacity is up about six-fold in the last 22 years. Even so, with the strong headwinds that the oil and gas sector has faced more recently, it is important to assess the profitability and durability of this growth.

Pembina’s financial picture

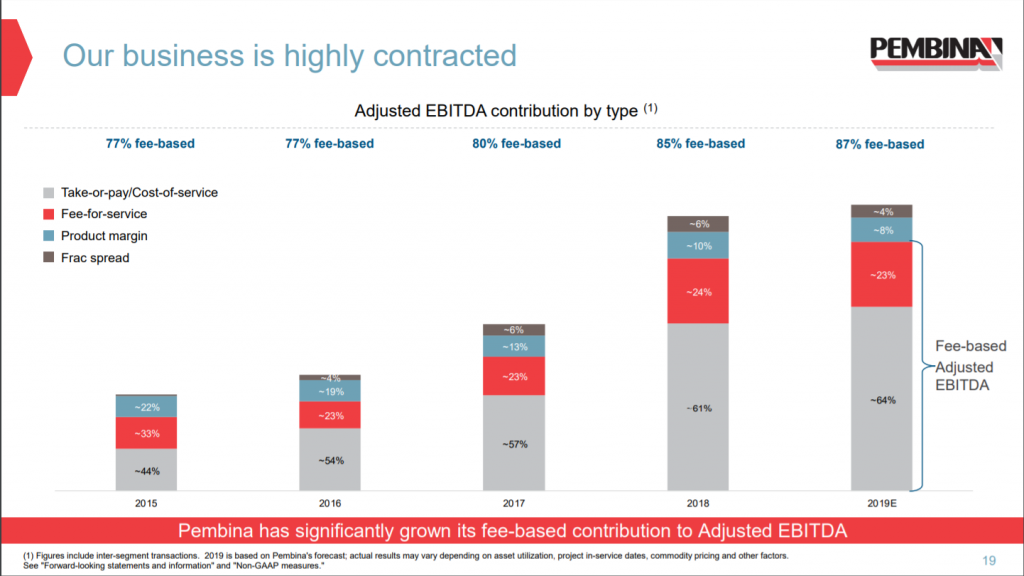

In the case of PPL, over 85% of EBITDA (Don’t know what EBITDA is? Click HERE) is derived from fee-based revenue which is more stable than non fee-based revenue. (I did note the fine print which reads “Figures include inter-segement transactions”, and the entire slide show is prefaced with a disclaimer that non-GAAP measures are used – not being an accountant, the significance of this is unclear to me)

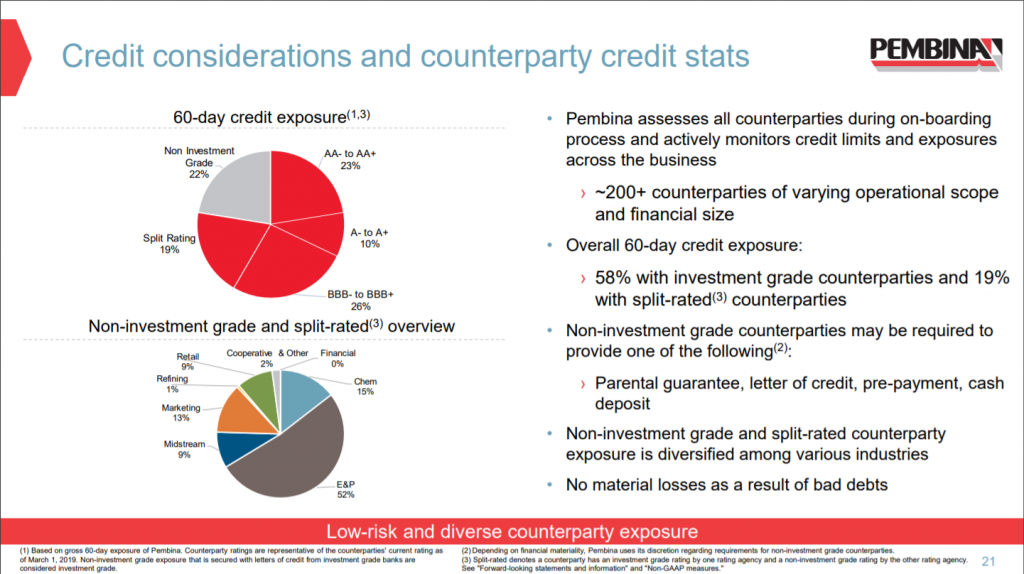

Analysis of the creditworthiness of their counterparties reveals that 58% are investment-grade with a further 19% having a split rating.

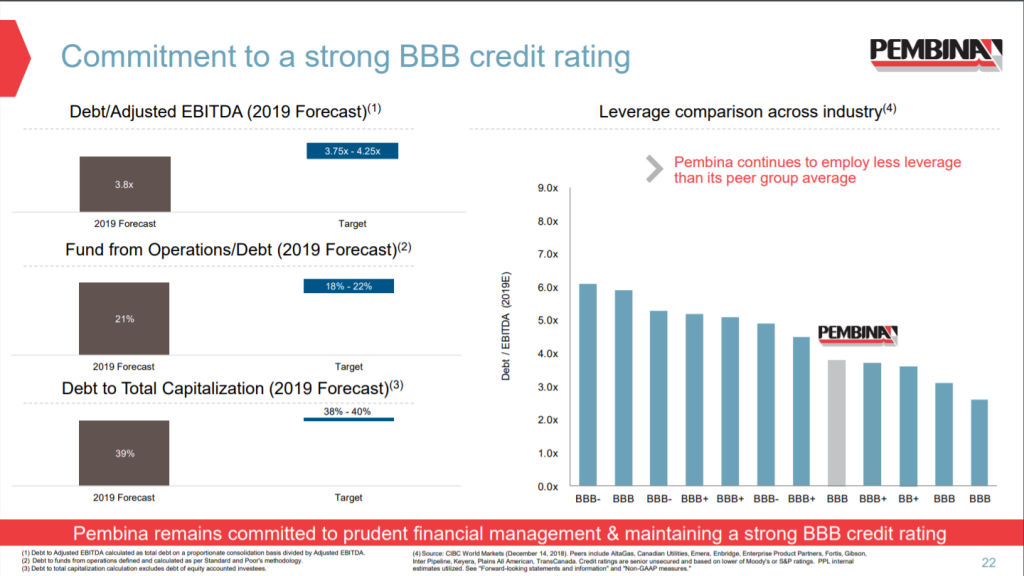

Pembina itself has sustained a high credit rating within the industry (BBB) by keeping its debt to EBITDA, funds from operations, and debt to total capitalization within parameters acceptable to their business model, and less leveraged than many of their peers.

Pembina as an investment

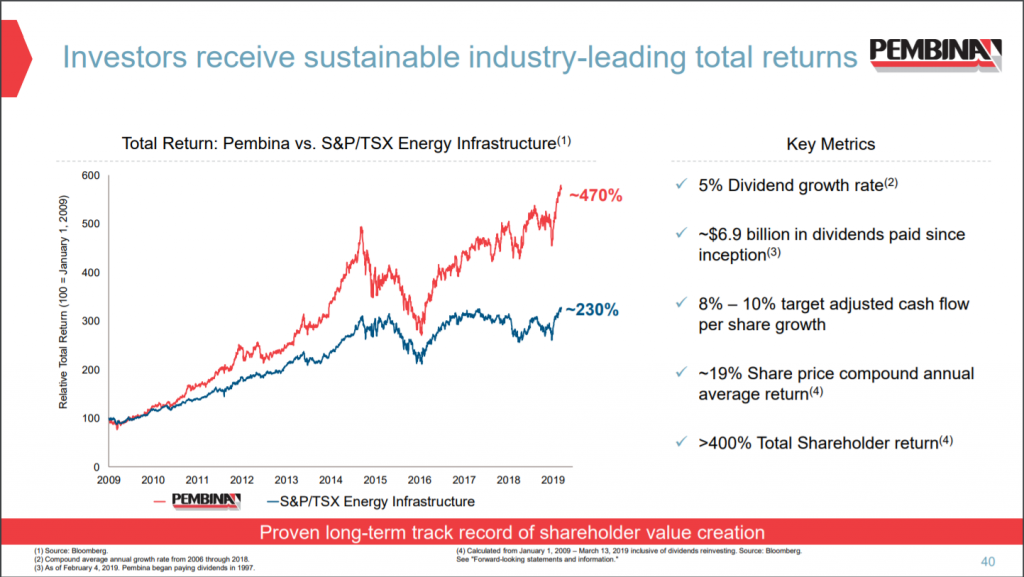

Over the past ten years, PPL been very profitable for shareholders, as compared to the energy-infrastructure benchmark, as shown below.

Even before converting from an income trust to a corporation in 2010, PPL has paid consistent monthly dividends with an average dividend growth rate over that time period of about 5%.

With a payout ratio around 100%, is the dividend sustainable? As we discussed last month with IPL, we need to understand that dividend payout ratios are calculated based on company earnings. Earnings include non-cash depreciation of assets. In the case of PPL and other energy infrastructure companies, it is essential to understand that by nature of their industry, they own significant long-lived assets like pipelines, storage tanks, and processing facilities. These depreciation charges impact the earnings figure making it difficult to compare metrics such as P/E and DPR with companies in other industries.

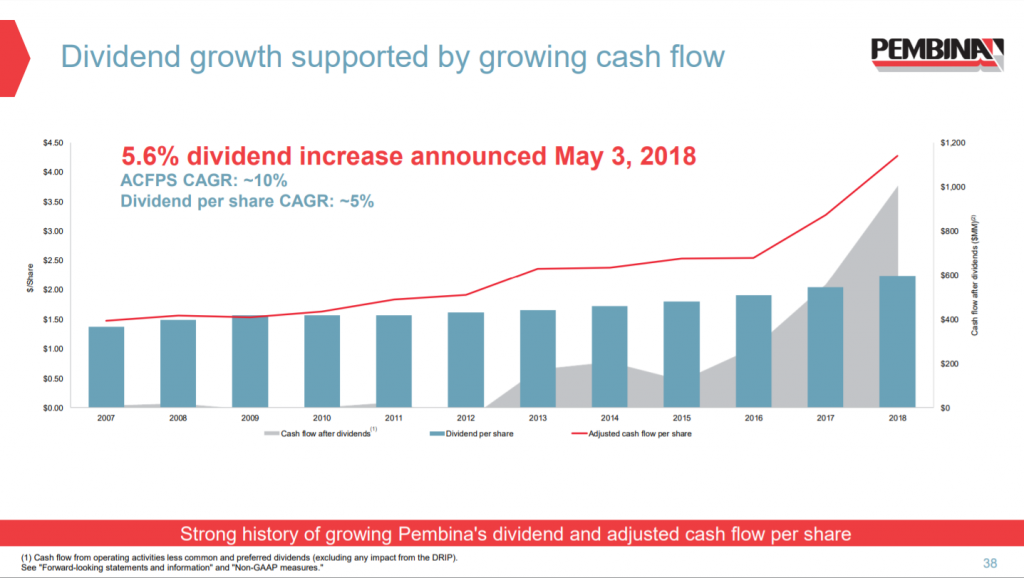

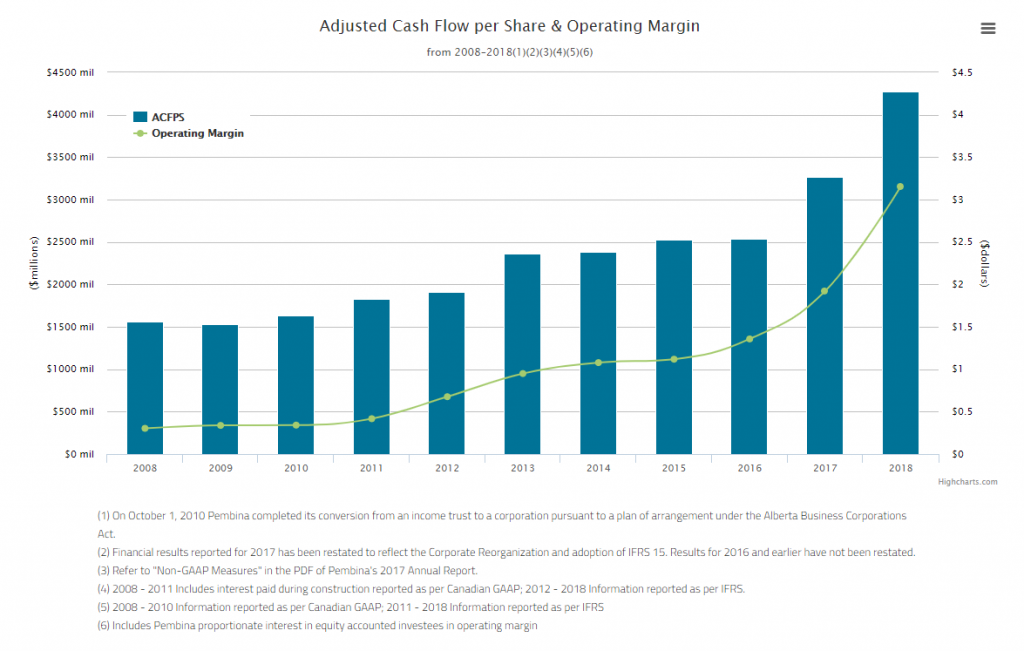

In fact, from the published data, Pembina’s dividend is safer than ever as these distributions are now more than covered by adjusted cash flow from operations, which has increased over 10% in the last twelve years.

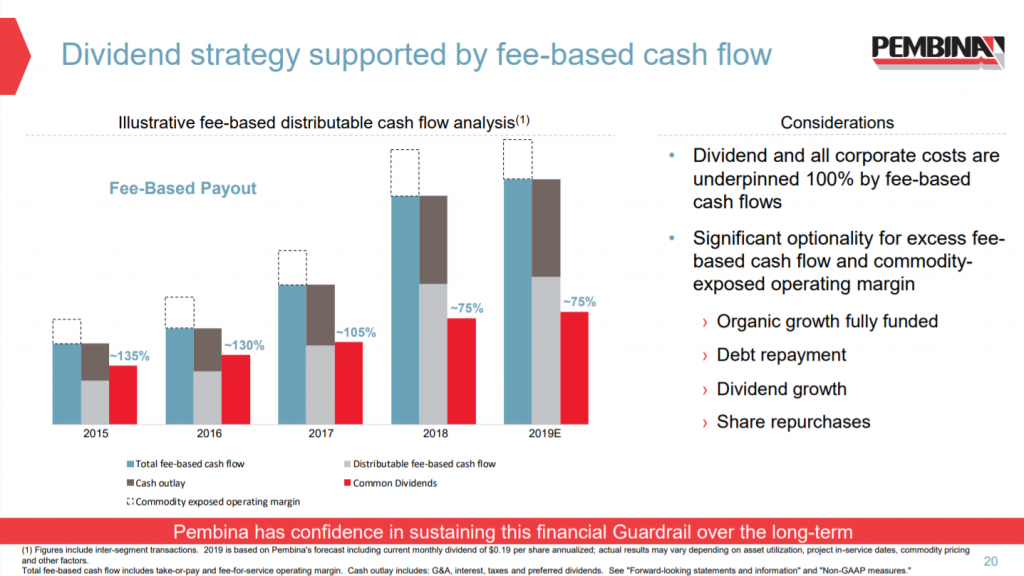

In fact, Pembina points out that it’s financial health is so strong that dividends and all corporate costs are now 100% covered by fee-based cash flows.

Furthermore, Pembina’s operating margin, which is essentially a measure of profitability, has grown even faster than the adjusted cash flow. All this places PPL in an excellent position to both grow the business and the dividend, as they have shown a commitment to in the past.

Risks

- Commodity prices pose some risk in connection with its non-contractual revenues (i.e. non fee-based)

- Significant increases in interest rates (debt servicing)

- Project development risks, including regulatory, permitting, technical and cost overruns

Does PPL belong in BTSX?

I’d love to hear your input on this, so please let me know what you think in the comments. Here’s a summary:

- PPL has a long stable history of dividend payments and dividend growth

- at just under 5%, the dividend yield is attractive

- Pembina has a proven track record of solid business growth

- PPL’s financial picture has improved significantly in the last few years in spite of the oil and gas headwinds, with dividends and corporate costs being fully covered by adjusted cash flow

- in spite of this growth and profitability, the business model is conservative with >85% revenues being fee-based (i.e. not linked to commodity prices)

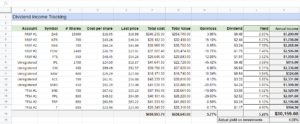

Last, but not least, in case you are in a position to add to your investments, here is the current list of BTSX stocks (not including previous income trusts):

(I spent some time updating the TSX60 and BTSX spreadsheets today and was pleased to see that several of the Beating the TSX stocks have raised their dividends recently: Power Corp, Telus, and National Bank. This nudges our total yield over 5% – at least for now.)

It appears there is a strong argument to include both IPL and PPL in the list of BTSX stocks.

The other to consider is Brookfield Asset Management (BIP). Including these three would definitely increase the yield of the BTSX portfolio.

At what point is there a change to the philosophy and tracking to say that the BTSX stocks are the 10 highest yielding stocks in the BTSX60 period?

What would be the risk to moving in that direction instead of keeping the traditional methodology where former income trusts are excluded? (I currently still exclude former income trusts however I admit the temptation to include former income trusts is there due to the higher yield)

All very good points, Phil. I’m interested to hear what other readers think.

Would this kind of analysis of Brookfield Infrastructure be helpful?

I think it would be helpful to have an analysis of BIP as well. To me however; the major burning question would be how would the traditional BTSX methodology compare against a BTSX methodology where former income trusts are included? (This could be over a 10, 5, 3, 1 year time periods)

I agree, Phil! The problem is not the calculations, but getting the relevant data, i.e. snapshots of the TSX60 organized by dividend yield over the last ten years. Still, I will try to take this on since the data would be valuable for us.

I’d be happy to help out. Send me an email if you would like some help.

Thanks for the great articles! 🙂

I basically agree with Phil but in addition to an equal weight BTSX portfolio, I do hold IPL PPL and BIP. That said, I also hold an equal weight “Couch Potato” portfolio from back when Money Sense promoted the idea. The couch is a number of ETF’s with 4 main sectors rebalanced periodically to the prescribed % allocations. Bonds/fixed income, CAD equity, USA equity/Foreign holdings. The BTSX is new to me as of the beginning of 2019, so I am still getting my feet wet! I really appreciate Matt’s commentary and the S&P TSX 60 daily updates. Great resource – thanks.

Thanks for the comment, Geoff.

Buy and hold index investing (aka Canadian Couch Potato) is a very sound investment strategy in my opinion. More simple than buying individual stocks (especially with the new all in one funds), and you’ll still beat ~80% of professionally managed funds. Dividend investing a la BTSX has shown a performance advantage over the last three decades, which seems quite durable to me, but it does require a little more work (not much) and a degree of comfort buying individual stocks. But there’s no reason anyone has to choose between the two; many people employ both strategies, including me. Some index investors enjoy villifying dividend-based strategies, but I won’t be slinging any mud in that direction.

As a person and professionally, I always challenge the statut quo. Processus and systems need to be looked at and revised to make sure that we keep up with what is happening today and try to improve for tomorrow. PPL and IPL were income trust and today they’re not. In my income portfolio I have IPL. I am more than happy to collect the dividend but with an eye on the future with their new facility that is in construction. I have been following BTSX since the beginning of this year. I like your work.

Thanks

Hi Paul, welcome to the site and to BTSX. I’m reading a great book right now called “Range: Why generalists triumph in a specialized world”. Many, many, lessons in there but one of them is that those who rigidly adhere to an idea or belief system perform more poorly than those who seek out new information – even conflicting information – and can adjust and adapt to it. This is as true in life as it is in investing.

It certainly seems that PPL can create a decent dividend yield for a long period of time, and the future looks good. And generating dividends is the what BTSX is about so I will be adding this stock to my list.

Keep the good up Matt.

Thanks for weighing in, K B!

As David Stanley has pointed out to me before, including these previous income trusts may cause the energy sector to be over-weighted in our stock selections – another reminder to use the BTSX method to find suitable stocks for a well-diversified portfolio, not necessarily to define the portfolio as a whole.

Pingback: What is confirmation bias? —