Inter Pipeline Ltd. (IPL) and Pembina Pipeline Corp (PPL) both sport dividend yields that place them in the top ten of the TSX 60 index. Understandably, I am frequently asked why they are not included in the BTSX portfolio. The answer is simple: they used to be income trusts and the previous authors/caretakers of Beating the TSX excluded them out of concerns that the dividends of such companies may not be stable over time. I have followed suit.

But Inter Pipeline completed this conversion in 2013; Pembina in 2010. Isn’t it about time we reconsider whether these big Canadian dividend-payers should earn a place in our BTSX portfolios? To do so, we are going to engage in a little fundamental analysis. We’ll take on IPL this month, and PPL next month. What’s is their business? How are their finances? And, most importantly, is their dividend safe?

Here’s the quick and dirty on IPL:

- Dividend yield: 8.3% (as of June 1, 2019)

- Ten years of increasing dividends

- Dividend payout ratio: 110%

- P/E ratio (trailing): 14.82

- Market Cap $8.41 billion

Business overview

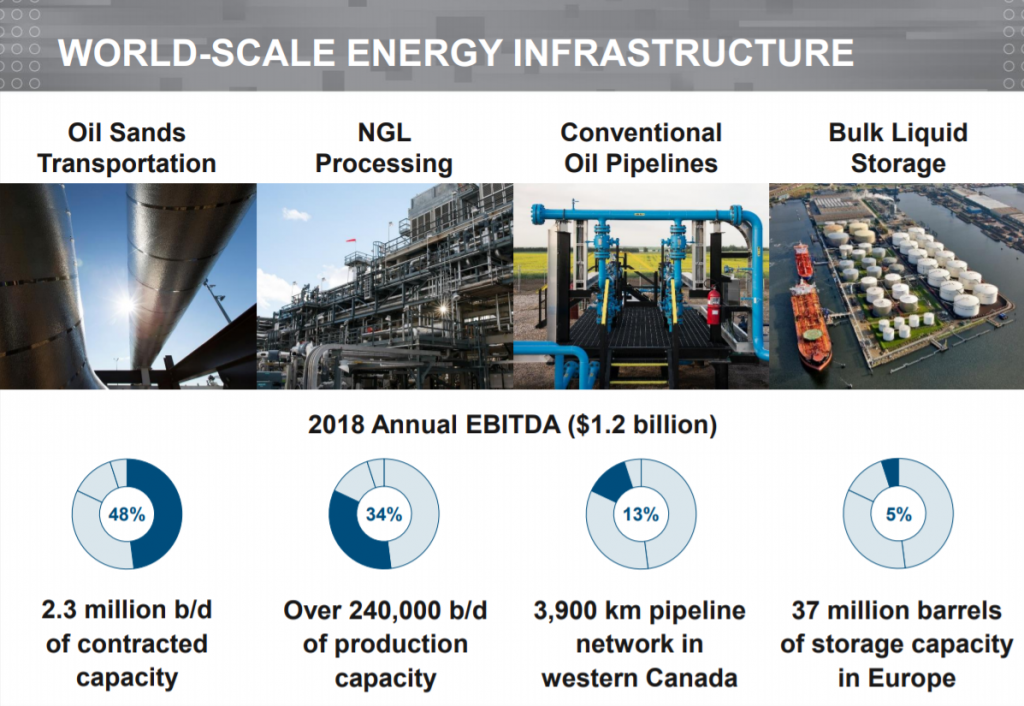

Inter Pipeline is a Canadian energy infrastructure company, based in Alberta. It currently has four distinct business segments:

- Oil Sands Transportation (48% of EBITDA)

- NGL Processing (34% of EBITDA)

- Conventional Oil Pipelines (13% of EBITDA)

- Bulk Liquid Storage (5% of EBITDA)

Don’t know what EBITDA is? Click HERE.

More details about IPL’s business can be seen below:

Source: Inter Pipeline March 2019 Investor Presentation

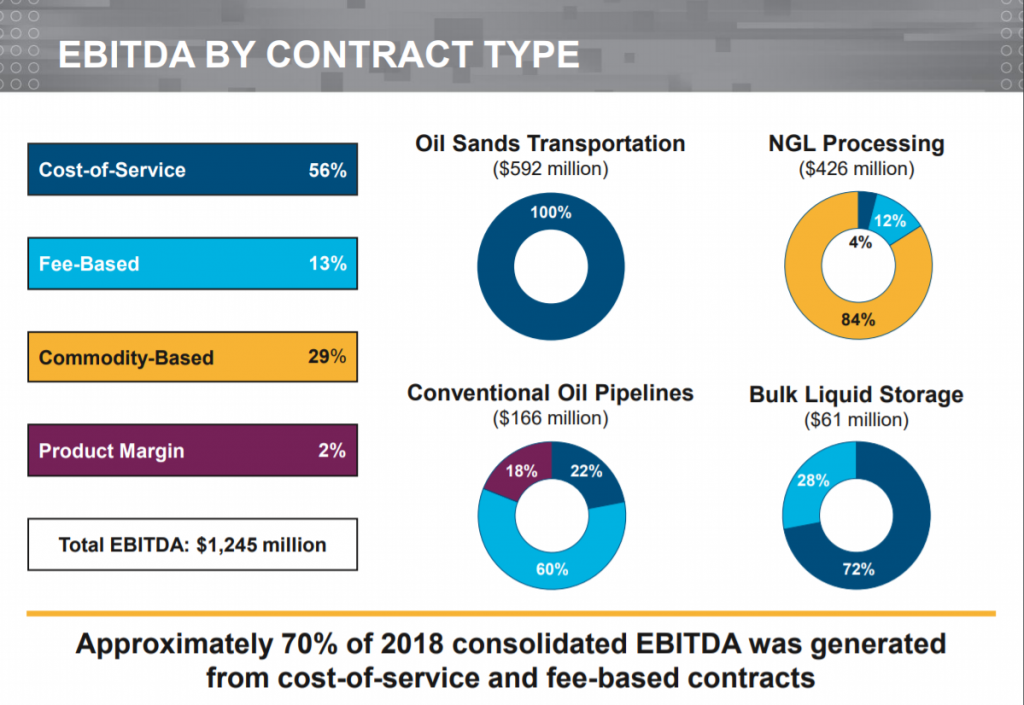

Inter Pipeline currently operates in Western Canada (95%) and Europe (5%). Over 80% of revenue is generated from investment-grade entities – i.e. their contracts are with solid, stable companies who are likely to honor their commitments. Furthermore, supply and service contracts are long-term, as the slide below outlines.

Source: Inter Pipeline March 2019 Investor Presentation

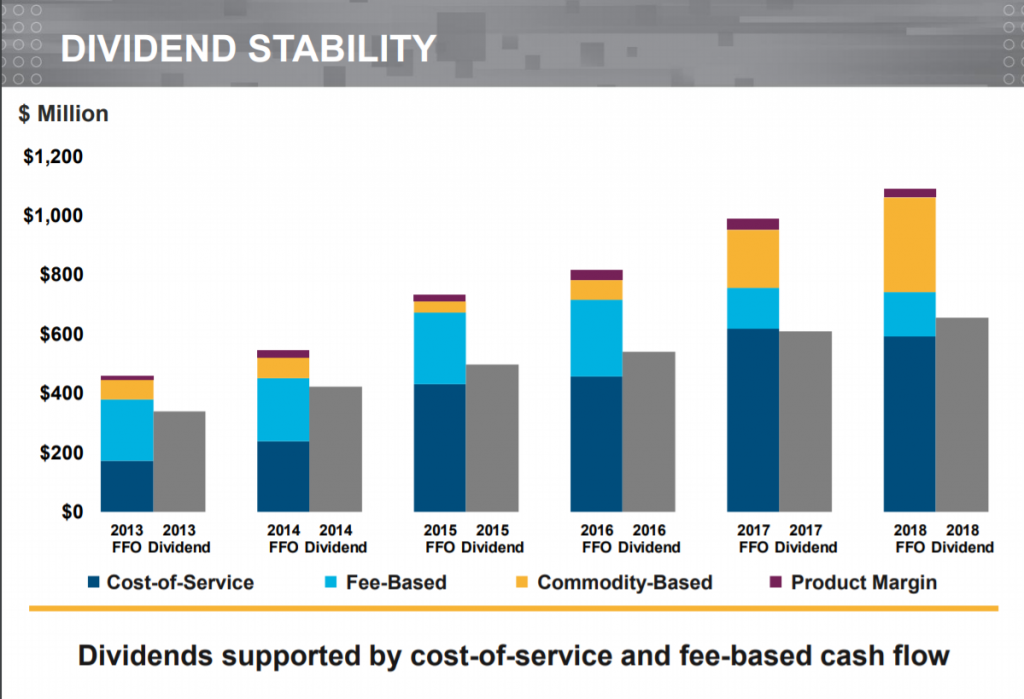

This low risk business model wherein 70% of EBITDA comes from cost-of-service and fee-based contracts should result in robust recession protection, as it has in the past.

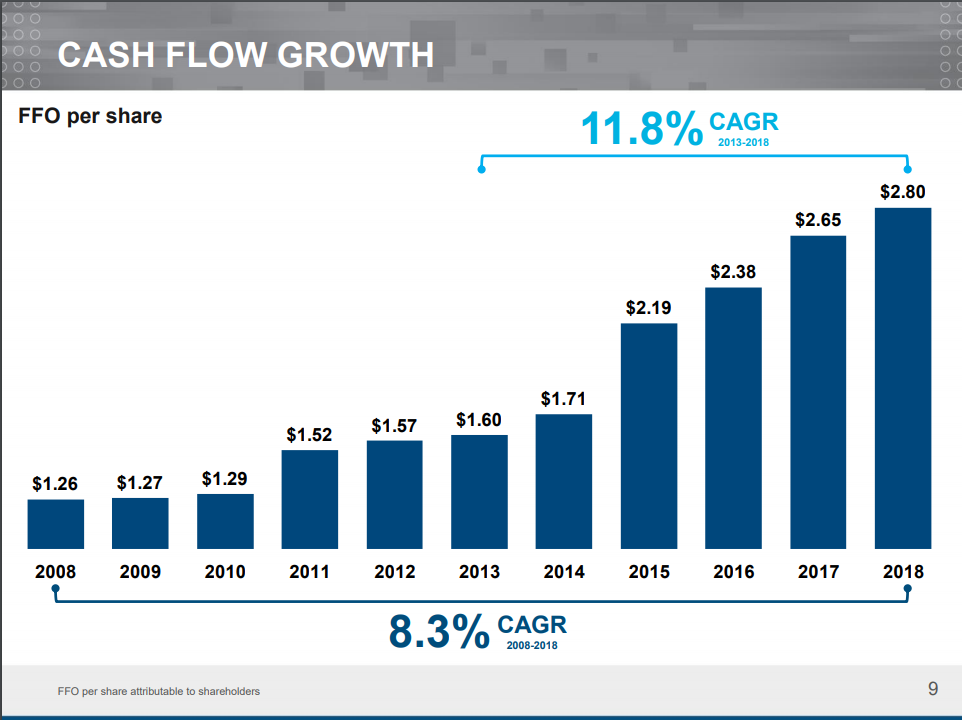

Historical profitability

Inter Pipeline has a proven track record of growing their funds from operations (FFO) on a per share basis. Over the last ten years, FFO has grown 8.3%. The last five years has been even better at 11.8%.

Source: Inter Pipeline March 2019 Investor Presentation

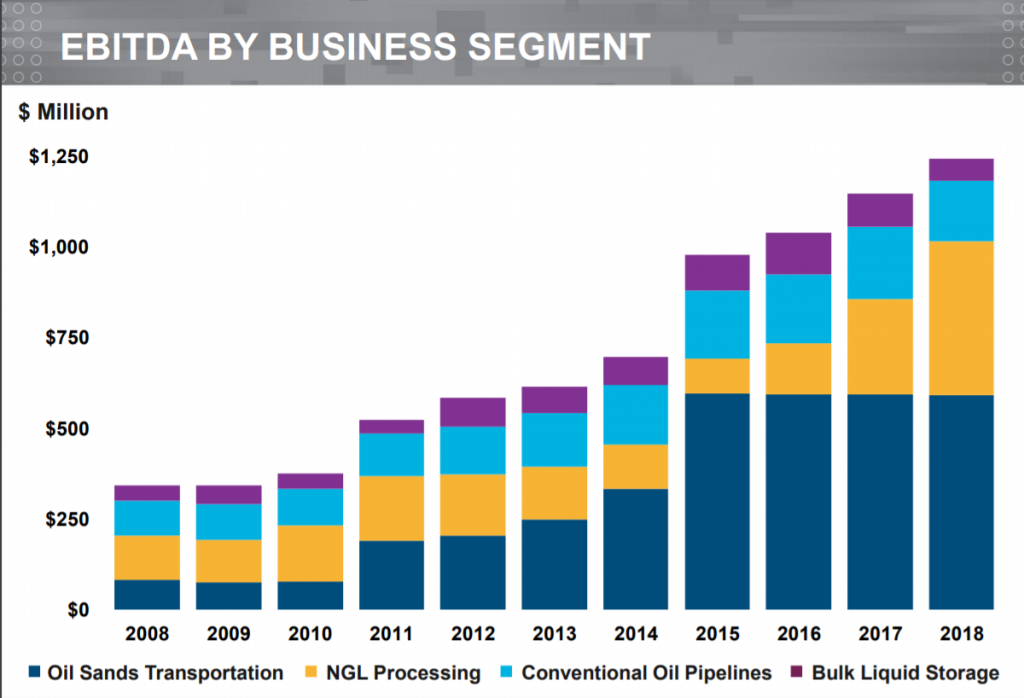

EBITDA has also been growing consistently over time:

Source: Inter Pipeline March 2019 Investor Presentation

Future prospects

Will IPL be able to maintain this EBITDA and cash flow growth? This is a key question for investors since dividends are paid from these funds.

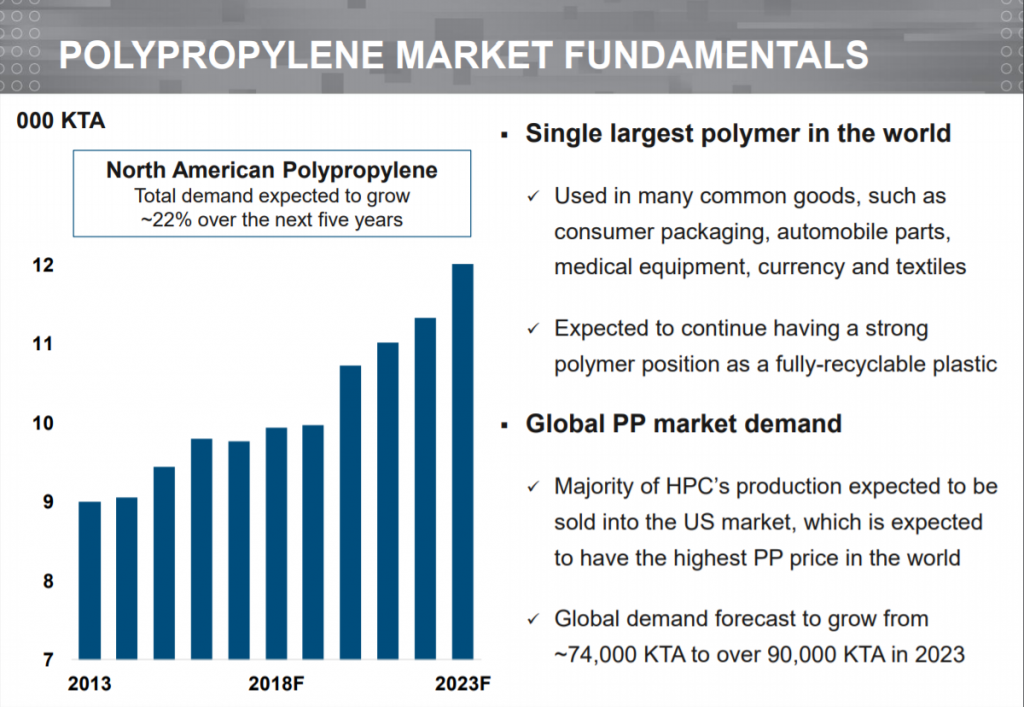

IPL’s existing business segments (transportation, processing, pipelines and storage) have been profitable, but the company is also investing heavily in Canada’s first integrated propane dehydrogenation (PDH) and polypropylene (PP) complex, which will add a fifth segment to the business.

The Heartland Petrochemical Complex will take advantage of the long-term oversupply of propane in Western Canada, producing ~525 kilotonnes per annum (KTA) of polypropylene (PP). Delivered PP costs are anticipated to be some of the lowest in the marketplace with profit margins among the highest. It is anticipated that when the Heartland Petrochemical Complex starts production in late 2021 it will add $450 to $500 million per year in long-term average annual EBITDA (about 40% of 2018 EBITDA).

Source: Inter Pipeline March 2019 Investor Presentation

Is the dividend sustainable?

With a current dividend yield of over 8% (paid monthly) and a payout ratio of over 100%, it behooves us to have a closer look at the sustainability of IPL’s dividend payments.

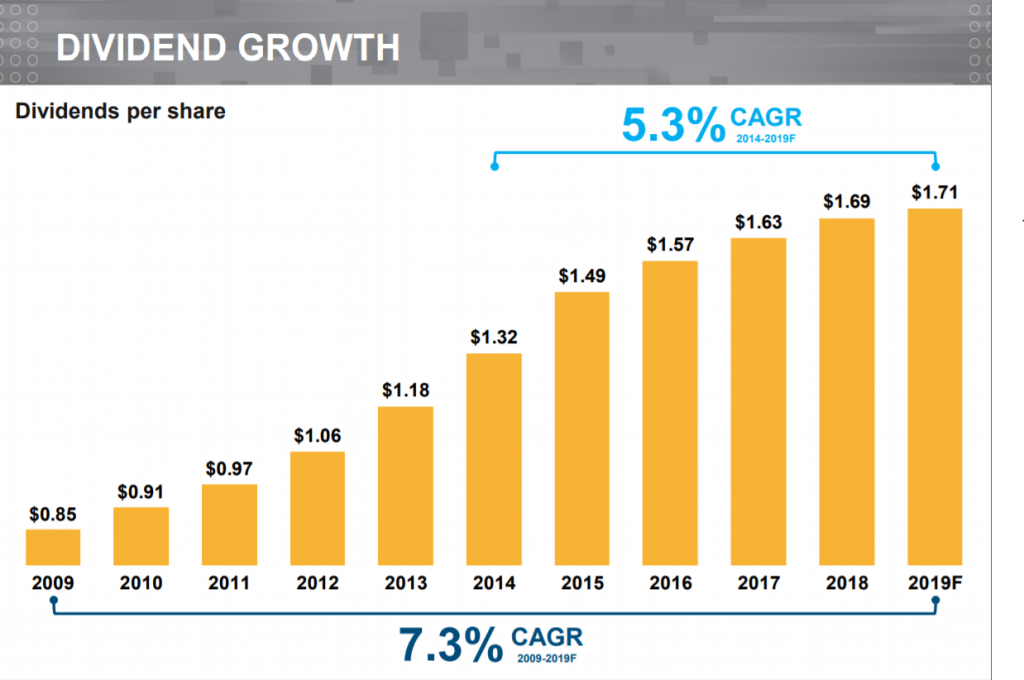

As we mentioned at the beginning of the article, IPL has a ten year history of steadily increasing dividends. The dividend compound growth rate over this time period has been 7.3%.

Source: Inter Pipeline March 2019 Investor Presentation

So far so good, but with a dividend payout ratio (DPR) of 110%, should investors be concerned? To answer this question, we need to understand that dividend payout ratios are calculated based on company earnings. Earnings include non-cash depreciation of assets. In the case of IPL and other energy infrastructure companies, it is essential to understand that by nature of their industry, they own significant long-lived assets like pipelines, storage tanks, and processing facilities. These depreciation charges impact the earnings figure making it difficult to compare metrics such as P/E and DPR with companies in other industries.

In such cases, a more straightforward means of assessing dividend stability is to compare dividend payments to funds from operations (FFO) since these are the funds from which dividends are paid. As you can see from the figure below, since 2013 the dividend payments have been more than covered by FFO. Using this metric, IPLs payout ratio based on recent FFO would have been ~63%.

Source: Inter Pipeline March 2019 Investor Presentation

IPL’s high dividend yield of over 8% is the result of share price depreciation over the last few years (it is trading near 6-year lows). But, given the 5-year average yield of 5.4%, and the apparently solid fundamentals, I believe IPL is likely trading under its fair market value (given the depressed stock price, however, there are clearly many investors who disagree!).

Does IPL belong in BTSX?

Now that we are familiar with Inter Pipeline’s business, future prospects and the factors affecting it’s dividend, do you think it belongs in the BTSX portfolio? Is it time to allow previous income trusts back into the BTSX club? Please feel free to leave a comment.

Last, but not least, in case you are in a position to add to your investments, here is the current list of BTSX stocks (not including previous income trusts):

Thanks Matt — Great column! I am going to try to answer your question about IPL from my perspective. First, let me reveal that I own this stock and have owned it for almost 6 years. My plan is to continue to own IPL; I do think it is a BTSX stock and here’s why. I define a BTSX stock as a Canadian blue-chip stock that has been around for a while and is paying a significant and growing dividend. IPL checks these boxes, being founded in 1997, having a market cap of $8.4B, and being a member of the TSX 60 Index, Canada’s blue-chip portfolio. As for the dividend growth Matt has detailed that nicely and also explained how the high payout ratio might be misunderstood. Looking at the IPL chart over the past 5 years might be scary for potential investors but you have to remember what has happened to resource stocks, especially petroleum-based companies over that time. Comparing IPL to, for example, ENB, shows approximately the same pattern and we have seen Enbridge come back into favour recently. Remember how pipelines operate; they build a conduit for liquid product and charge a toll for companies to move their raw material from the wellhead, thus providing a wide moat against competition. IPL is the pipeline for the Canadian oil sands projects. And don’t forget their new petrochemical plant. So, for me, IPL is an important part of my BTSX portfolio. Of course, you should do your own research and what I have said here should not be construed as a recommendation to buy or sell any stock. Dave Stanley

Thanks for weighing in, Dave. Happy to hear we have similar perspectives on IPL. An 8% dividend is pretty sweet compensation for waiting out this weak phase in the industry. The fact that IPL is still profitable in spite of it is quite reassuring.

If the earnings or FFO history is solid and supports growing distributions over past 10 years while maintaining reasonable debt levels / balance sheet, then yes, it ought to be a candidate for BTSX.

OK, thanks for your opinion, Edward 🙂

Thanks for this timely commentary from you and David.

Half-way through this year I have decided to sell my Fortis holdings. It was a hold-over from an earlier BTSX (as you note in another spot, one doesn’t have to sell something just because it is not on this year’s BTSX list). It has been an excellent buy (original investment up over 60% from 2014 purchase date to selling this week). But I needed to rebalance my BTSX given that the success of holding FTS, EMA and ENB was making my utilities taking up far more room than they should – a happy consequence of the great growth in these stocks and their nice dividends. FTS lost out due to its lower dividend.

But what to do with the proceeds?

I had communicated with Ross in January 2018 about using IPL in place of TRP in the BTSX list (much better dividend and a very good, if smaller, company like TRP). His comments were similar to the above discussion so I had bought a tentative amount to experience the stock. Their price has slipped (while TRP has grown) but the dividend is nearly twice that of TRP. While TRP’s share price is at an all-time high, IPL is languishing but taken historically is middling. Your discussion has helped me move forward adding more IPL as part of my BTSX portfolio, as opposed to an outlier purchase.

Thanks Matt for putting together the IPL information in such an easy to follow format. I have held IPL for many years and have benefitted. I don’t see any reason to sell anytime soon. Since your BTSX inspiration, I started to monthly track the top 20 div of the S&P 60 for my records in Excel. This I find this useful as I can see the temporary shifts or displacement of the base (start of year) BTSX 10 holdings that can fluctuate above & below the 10 top line as well as having IPL typically as #1 that pushes other strict BTSX positions into 11th, 12th etc. Only if I see a position falling further it would prompt a review to determine cause and possible action. I hope this makes sense!

Keep up the great work Matt and I really appreciate your almost live S&P60 list. Kind regards, Geoff

I currently hold IPL in my TFSA and will continue to based on solid fundamentals already mentioned in your analysis and the comments above!.

Happy investing!

Pingback: What is confirmation bias? —

Hi Matt

I’m just wondering if you think any differently about IPL given the latest market developments and that its yield is approaching 13%?

Ahem….now 22%?

Is the dividend at risk? Definitely. Is IPL a bad investment at these prices? I have no idea but I have not sold my shares.

Pingback: Lessons from the COVID crash and recovery —

Pingback: Beating the TSX 2020: looking back and staying the course —