I recently posted the 2022/2023 Beating the TSX update. The updates never fail to generate a flurry of interest in the method, particularly when the results are good, as they were last year. Investors want to understand the method, figure out how to make it work for their situation and put it into action.

I wrote How to Use BTSX in Real Life two years ago and it is a great resource, but today I thought I’d sit down and give you a fresh take. Here are my answers to the most common questions I get about how you can use BTSX to build your own portfolio and how to maintain it over time.

Bear in mind, this is not a complete guide to investing, rather a resource to help you move forward. But, first things first . . .

1. How does Beating the TSX work?

Beating the TSX is so simple that anyone can do it. Here is the method:

- Organize the TSX 60 index by dividend yield (I’ve done it for you HERE)

- Select the top-10 yielding stocks from that list

- Buy those 10 stocks in equal proportions and hold each one for a year

- Lastly, revisit the TSX 60 Index at the end of the year and repeat the process, selling stocks that are no longer in the top-10 and buying the new members on the list

This is the “pure” BTSX method – i.e. the one that I use to track the results of Beating the TSX with clarity and consistency. As you will read, however, it is not necessary to follow it strictly in your own portfolio. Here is how I use BTSX now, some difficult lessons I’ve had to learn, and how I think about the most common questions.

2. How often do you buy stocks?

I rarely buy individual stocks more than once a year. This is intentional. Years ago I would watch my holdings more closely, looking for “opportunities” to buy or sell during the year. Eventually, I came to the realization that the extra effort wasn’t just pointless, it was counterproductive. When I compared my performance to a simple buy-and-hold approach, it was clear that I would have been better off leaving my portfolio alone in between annual reviews.

Set it and forget it. Success is about time IN the market, not timeING the market.

On that note, you might have noticed that I publish a “Current BTSX Portfolio” on this site in addition to the annual updates. The purpose is to provide an up-to-date list for those of you who do your portfolio maintenance at other times of the year, not to encourage more frequent trading.

3. Do you buy every stock on the list?

No. But I will admit I’m on the fence about this one.

When I started using BTSX in 2007, I would buy every stock on the list because I’d been burned picking stocks myself and was happy to rely on a method with such a strong track record. As time went on, however, there were a few BTSX duds that made me rethink that approach. I began looking more closely at the stocks that would arrive on the annual list and would exclude those that I was uncomfortable with from my portfolio. Usually, these were companies that had an inconsistent dividend history. Makes sense, right?

There is a lot to be said for building the portfolio that helps you sleep at night – even if it’s not “perfect”. But over the last few years, I’ve noticed a funny pattern: some of those companies that I was least comfortable with turned out to be the biggest winners (ex. Suncor last year, Shaw the year before). Turns out, the companies that cause the most worry are often “on sale” – i.e. their prices are depressed and have more potential upside.

Bottom line: I am coming back around to the idea that sticking to the “pure” list will likely be at least as effective in the long run as my flawed attempts to improve upon it. But that doesn’t mean this is the right approach for you. BTSX is a tool we can use to build a portfolio, and we can use that tool in different ways. You are responsible for your own portfolio, so make sure you’re comfortable with your decisions.

4. Do you research every stock on the list?

This might surprise you. If there is a company I don’t recognize, I will look into it, but otherwise, I don’t engage in a lot of fundamental research. Frankly, there is zero evidence that fundamental analysis helps DIY investors make better decisions and I have better things to do with my time.

Even the godfather of fundamental analysis, Benjamin Graham, admitted at the end of his life that markets had evolved to the point where prices almost instantly reflect all available information (i.e. they’re efficient) and further analysis added no value. Yes, THE intelligent investor said that. Since then, asset pricing has only become more efficient.

This is another example of something I’ve tried and, upon honest reflection, have had to admit was worthless – at least in terms of juicing returns. Sure, it helped me understand balance sheets, cash flows and various investment metrics, but it didn’t add dollars to our accounts. In fact, as the Dunning-Krueger Effect tells us, a little bit of knowledge can cause us to overestimate our own competence.

5. Do you always buy them in equal amounts?

Not always, but usually.

The BTSX method is based on buying the stocks in equal dollar amounts (not share numbers). In my efforts to be as rules-based and objective as possible, I almost always follow the method, but I don’t worry about being super-precise. Being too rigid can be particularly labour-intensive when stocks are held in different accounts like ours so, personally, I’m quite happy with “good enough”.

As for individual stocks, I try to never buy more or less of one stock because I have “a feeling” it’s going to outperform but I will occasionally buy less of a stock that I have serious concerns about. That might sounds like a contradiction, but the goal is not to be tactical but rather to build a portfolio that I’m comfortable sticking with for the coming year. For me, sometimes that means taking a 50% position in one stock or another. That’s what I’m doing with AQN this year, for example.

Sidenote: I’ve had a few readers ask if there are any downsides to buying “odd lots” of stocks (i.e. a number of shares not divisible by 100). I’m not aware of any, particularly for the high-volume stocks we are considering.

6. What stocks do you sell at the end of the year?

There is no need to sell your entire portfolio at the end of the year in order to buy the next year’s BTSX portfolio. Most of the stocks on the list in one year tend to remain on the list for the following one. In fact, 9 out of 10 stocks on the BTSX list for 2022 remained on the list for 2023 (usually it’s about 6 out of 10).

I do not sell a stock simply because it has fallen off the list. If the company is still paying a good dividend, chances are it is off the list because the stock price has gone up. If it still fits within my plan to diversify across Canadian sectors, I’ll generally hold on to it. Besides, there’s a reasonable chance it’ll make its way back into the top ten at some point anyway.

I will sell stocks that have fallen off the list if they have either cut their dividend or they no longer fit within my targets for sector allocation.

7. What do you do with the dividends?

One of the great things about dividends is that they give you choices. I have used all of these options at one point or another:

- Withdraw the dividends for living expenses

- Enroll in a dividend-reinvestment plan (DRIP) through your broker: This is a powerful way to compound investment returns over time (best avoided in non-registered accounts due to complicated accounting).

- Allow dividends to accumulate as cash to be used as “dry powder” when a buying opportunity comes along (Personally, I have learned not to do this. Again, it’s time IN the market, not timING the market).

- Use dividends to rebalance, i.e. purchase more of the BTSX stocks that have gone down in value since the beginning of the year.

- Buy a low-cost index fund (such as XIU) on, say, a monthly basis and do your comprehensive rebalancing at the end of the year.

8. What happens if a company cuts its dividend?

If a stock on the BTSX list cuts its dividend, it will stay on the list for the remainder of the year. This keeps the method simple, consistent, and transparent. It also discourages us from watching our stocks too closely which leads to bad decisions.

But let’s face it, dividend cuts are one of the trickiest situations for dividend investors. Unfortunately, by the time the looming cut is apparent, the stock price will have already been slashed so it’s not clear to me that selling on the announcement of a dividend cut is a viable strategy.

I discussed the topic of dividend cuts recently in the context of Algonquin Power. It’s a great example of the usual series of events with these things: At first, the stock appears to be stable. Then the price plummets. Then we learn why it plummeted. And, finally, the dividend cut is announced – and the stock price doesn’t move much.

Dividend cuts and the brutal capital depreciation that accompanies them are always painful but remember: the long-term results of Beating the TSX include that 6 – 7 % of companies that cut their dividends. Of course, it also includes that 73% of stocks that have raised their dividends.

9. What else do you have in your portfolio?

Beating the TSX has been a powerful tool for building a dividend-based Canadian portfolio but it would be foolhardy to base our entire investment plan on it. The two big issues are 1. BTSX is only Canadian and 2. BTSX stocks tend to be concentrated around just a few sectors (financials, utilities, and telecoms).

The first issue of international diversification is easy to solve with low-cost ETFs. Vanguard, iShares, and BMO all have extensive families of low-cost, high-quality ETFs to suit just about any need. I simply buy an ETF that excludes Canada but holds thousands of companies spanning the rest of the world. Just use the Googler: “all world ex Canada ETF” and you’ll find them.

The second issue of sector diversification within Canada is a little more complicated. Because Canadian high-yielding stocks tend to be concentrated in just a few sectors, my approach is to hold dividend growth stocks from other sectors like consumer discretionary, industrials, and railways. Look at the TSX60 list for ideas.

It’s worth noting that another benefit of using an “All world ex-Canada” ETF is that you get exposure to sectors like technology and healthcare that are not well-represented in Canada.

10. What is the most common mistake investors make when using BTSX?

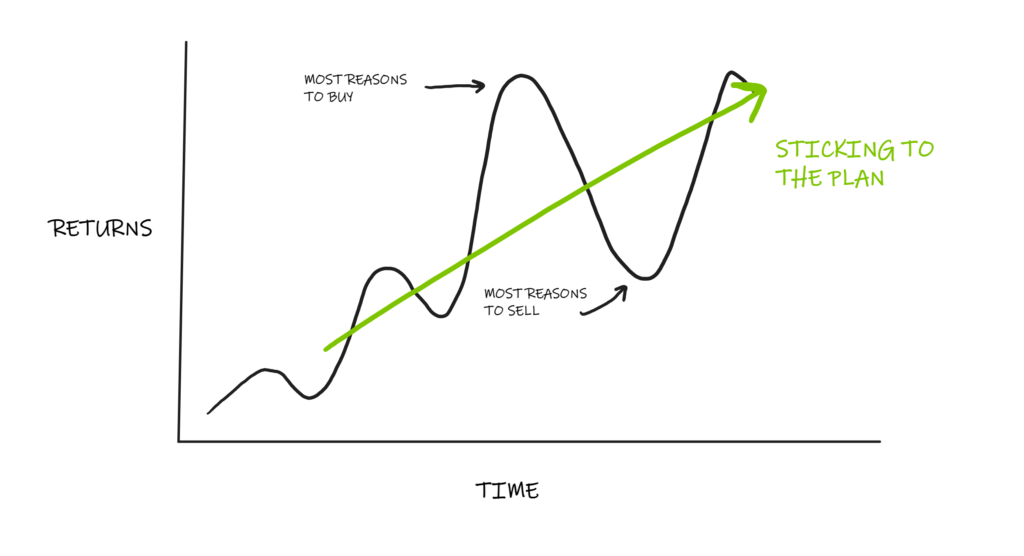

This is an easy one: Not sticking with your investment plan. Whether you use Beating the TSX, index funds or some other evidence-based method, the worst thing you can do is abandon your plan when it starts to underperform. Yet investors do this all the time.

We all know we shouldn’t let “fear and greed” dictate our investment decisions, but it’s incredibly hard not to. This applies to stock investing in general or any kind of portfolio, but take BTSX as an example. When do we feel the most comfortable investing using BTSX? When it’s had a good run of consistently high returns. When does it feel the most “right” to abandon the plan and try something else? When the strategy has underperformed, of course.

It’s not so much about “fear and greed” – we know those are usually irrational motivations. The fact is that buying high and selling low simply feels right compared to a buy-and-hold approach. But we must do this to enjoy the long-term returns that Beating the TSX has to offer. Temporary underperformance is the price we must pay for the rewards we’re seeking.

I hope you found these ten tips and tricks helpful when building and maintaining your own dividend portfolio. Now two quick notes: first a thank you and second, a new resource you might be interested in.

Thank you!

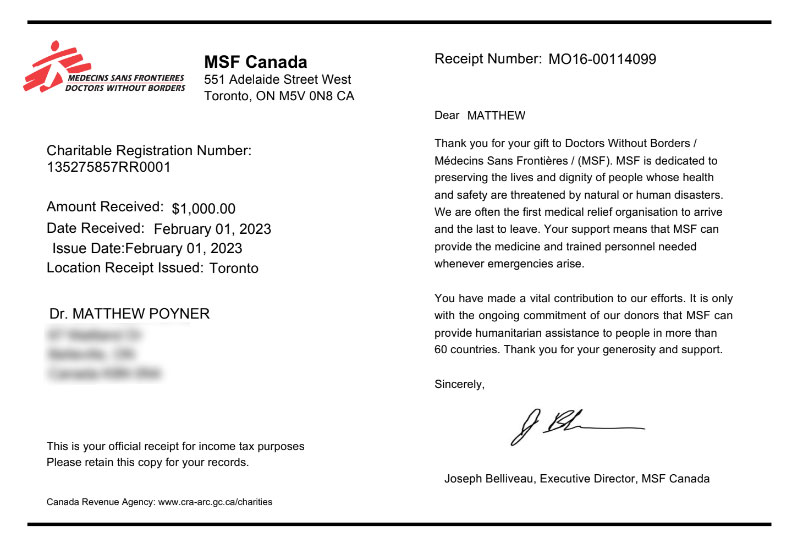

A huge thank you if you chose to donate to DividendStrategy.ca in 2022 – I truly appreciate it and the gesture motivates me to keep writing! When I started offering the ability to donate in 2021, I said that I would use 20% of the funds to make a donation to Doctors Without Borders. Later I increased that to 50% and we ended up making a donation of $848!

I am very pleased to announce that, thanks to your generosity, I am able to make an even larger donation this year – $1000! Here is a screenshot of the receipt.

Thank you so much for your support! As usual, if you are just starting out on your investing journey, feel free to use all the resources on this blog completely free of charge. If you’re a little further along and would like to support my efforts (and Doctors Without Borders), click this button to make a donation.

A new resource

If you would like to see the 35 year historical total returns of BTSX vs. the benchmark TSX 60 index, I have added the table on the BTSX Results page. This data has been published annually in the Canadian MoneySaver magazine and is the raw data that I use to calculate historical returns. I’ve been asked for this information a few times and am happy to share it in the interest of transparency and helping other DIY investors.

Great post Matt. It’s always worth revisiting the premise and adding some details / context to the process. Thanks for your hard work.

Thanks for the feedback, James. Those are questions I get frequently, so I hope it proves useful.

The current article in the Moneysaver “Beating the TSX” and this is one are both excellent thank you for your time and hard work. I will be using both for future references.

You’re welcome! I like the cover they chose for the magazine for this year’s update.

Have you thought about doing this for the DOW 30 or the U.S. stock market as a whole? For diversification purposes it would seem for an RRSP this would work while an investor kept his BTSX stocks in his TFSA.

Hi Geoff, if you Google “Dogs of the DOW”, you will find an entire site dedicated to a parallel US approach.

A lot of investing is related to interpretation. When I first start investing in the early 80’s after reading Graham’s “Intelligent Investor”, for some reason I thought I should be an “Enterprising Investor”. Although I did ok, considering I didn’t have a lot of money to throw into the market, it took about two decades to realize I would have been better off being mostly (not all) Ben Graham’s “Defensive Investor”.

In fact, I don’t think of myself as being an investor in the traditional sense anymore, but an owner of dividend paying companies in various sectors where I can sell any company into an open market if management is not performing in a way that I think it should be moving forward. I much prefer to just buy and hold for many years, but it doesn’t always turn out that way, for at least one or two firms every couple of years or so. I own shares in just over thirty other Canadian enterprises so the pain isn’t too bad, when I feel it’s time to sell. Not interested in trying to beat the market but enjoy adding to what I already have or buying a new dividend paying company whenever I have enough cash from a combination of dividends and any savings. High yield, low yield, it doesn’t matter to me as long as the company looks interesting enough, that I want to buy into it. This miraculously seems to add to our supplementary income each year in retirement and also seems to beat out inflation which has always been my goal. Capital gains are nice to have when I get them, but I only think of them as a bonus.

Thanks for keeping the current BTSX up to date, Matt. Occasionally I do scan the list, but lately I’ve been slowly building up three other Canadian sectors that never seem to appear on the BTSX.