To bear trials with a calm mind robs misfortune of its strength and burden.

Seneca

Last year wasn’t just a year of hardship; it was also a year of lessons. The pandemic forced us to change how we work, how we play, how we interact with each other and how we take care of ourselves. This virus has wreaked havoc on our lifestyle, our health (mental and physical), and, for many of us, our investments. We can hate the pandemic, work ourselves into a frenzy of resentment, but the virus doesn’t care. As Seneca advises, our challenge as individuals is not to fight in vain against misfortune, but to control our reaction to it.

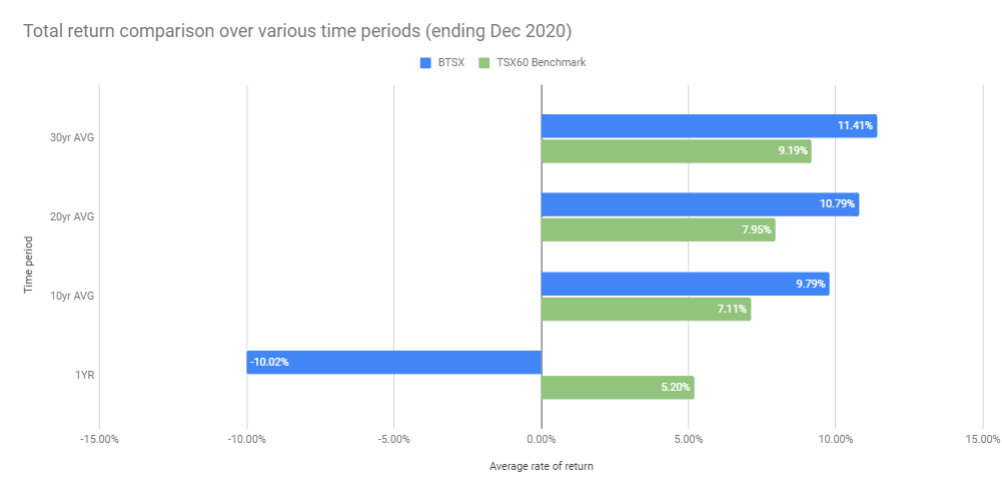

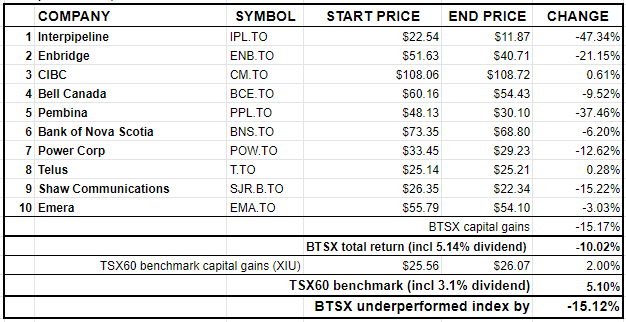

Dividend investors in Canada had an especially tough year. In 2019, Beating the TSX trounced the benchmark index. Unfortunately, the BTSX 2020 portfolio didn’t fare so well; the pandemic and crashing oil prices decimated some key BTSX stocks like IPL, PPL, and ENB, pulling the whole portfolio down. Only two stocks from our January 2020 list had positive returns, CIBC and Telus, and even those were barely positive. Overall, the BTSX total return was -10% for the year vs. +5% for the index.

No one likes negative returns, but they are inevitable if you invest in the stock market. An underappreciated investment skill is the ability to process bad news in good ways. In light of these results, here are three things dividend investors should remember.

1. Don’t be blinded by short term numbers

We are long term investors, so single year numbers are of limited utility. Sure, this blog tracks the annual performance of the BTSX portfolio, but one year is just one data point. Ask yourself: What is my investment time horizon? If it is less than five years, you probably shouldn’t be invested in the stock market at all. Even though our short term returns this year aren’t great, the 10, 20 and 30 year BTSX returns are solid.

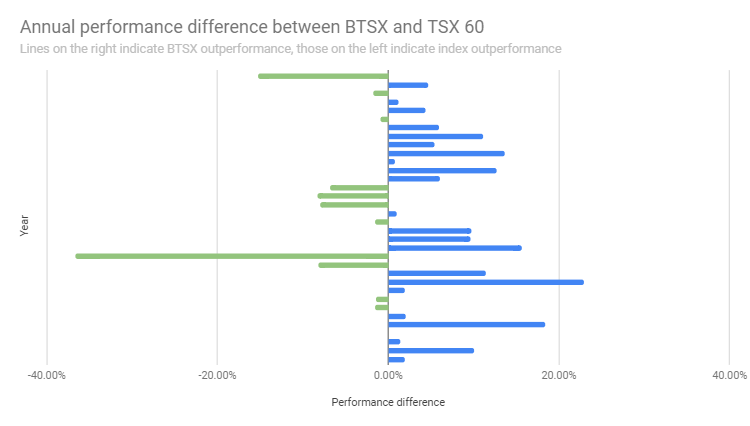

I don’t like the one year returns on that chart either, but it’s deceiving; remember one year is just one year, and we have over 30 years worth of data for BTSX. The following graph shows the performance of BTSX vs the benchmark index for the past 34 years; 2020 is at the top and 1987 is at the bottom. As you can see, BTSX has a strong history of beating the index, with a few notable exceptions – more on that in a moment.

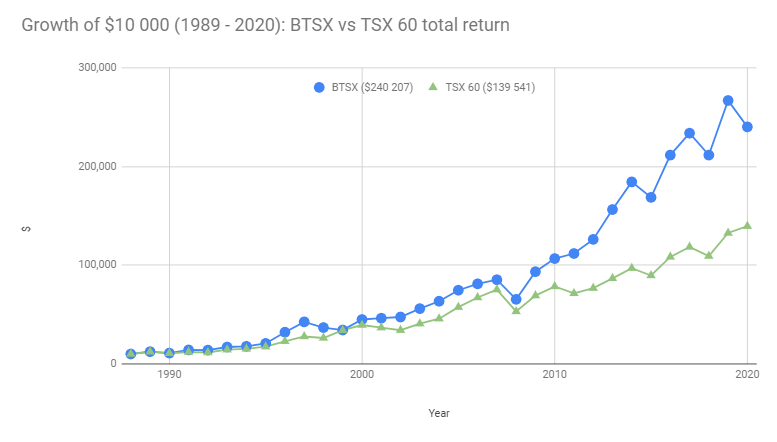

Viewed in an even more meaningful way, consider the growth of $10 000 over the last 30+ years using BTSX vs a TSX 60 index fund. In spite of the minority of years that BTSX lost to the index, sticking with a BTSX-based investment strategy would have resulted in a 72% larger investment balance.

Do not let one year of lackluster returns derail your investment plan. Every good investment plan will have periods of underperformance. When it comes to dividend investing, wealth comes to those who wait.

2. BTSX shines after bad years

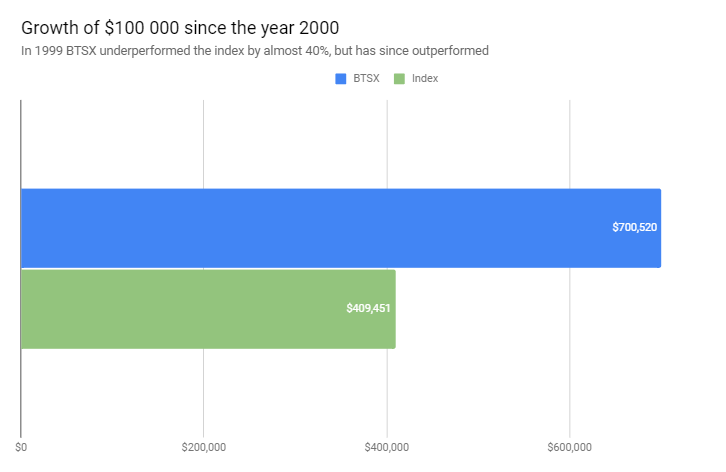

Furthermore, Beating the TSX has an incredible track record of bouncing back after bad years. Consider 1999: that was BTSX’s worst year on record with a return 37% worse than the index. Horrible, yes, but if one had invested $100 000 using the BTSX method starting right after this horrendous performance, by now it would have grown to over $700 000 vs. only about $400 000 if one had chosen an index fund.

2020 was BTSX’s second worst year, but my bet is that investors who stick with a dividend based investment strategy like BTSX will be glad they did. When we re-focus on timeframes that actually matter, dividend investing is clearly the way to go. A good investment plan is not one without periods of underperformance, but one that is durable enough to recover and outperform.

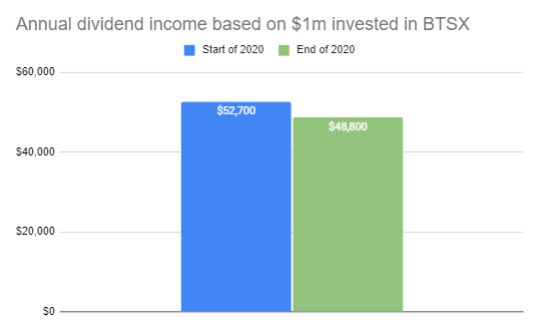

3. Dividend investors have the luxury of ignoring stock prices

Lastly, it’s important to remember that stock prices are just stock prices. When you are invested for the long term and funding your living expenses primarily with dividends, it doesn’t matter what stock prices do. As I described in this post, it’s the dividend payments that matter – and BTSX stocks rarely cut their dividends. Even though IPL did cut its dividend payment by 72% this year, this was largely offset by six other BTSX stocks (ENB, CM, BCE, PPL, POW, and EMA) raising their dividends in 2020.

Your results could be better

Beating the TSX is a tool, not an instruction manual. Some will follow the method exactly; most will adapt it to suit their needs by:

- holding on to good stocks with slightly lower yields

- avoiding stocks with worrisome fundamentals

- buying more or less stock based on personal assessment

- investing in stocks other than BTSX for diversification

For example, when I reviewed IPL on this blog in 2019, some readers expressed concern that the dividend payout ratio was too high and weren’t comfortable owning it. In hindsight, their assessment was right. Foresight is another story.

There is value in following a rules-based investment strategy, but investors need to be comfortable with their investments. I mention this for two reasons. First, to emphasize that Beating the TSX is a means of identifying potential investments for your portfolio and does not need to be followed dogmatically. And, second, in case these one year results seem scary, don’t let them dissuade you from dividend investing in general. The evidence for a dividend-based investment approach is sound and you can customize your own approach.

Performance of BTSX vs TSX60 in 2020

For those who are chomping at the bit for details, here is the full accounting of the 2020 BTSX portfolio. For the purposes of data tracking, this list is based on the stocks that appeared in the portfolio on Jan 1 2020 (for a description of the BTSX stock selection method, go here).

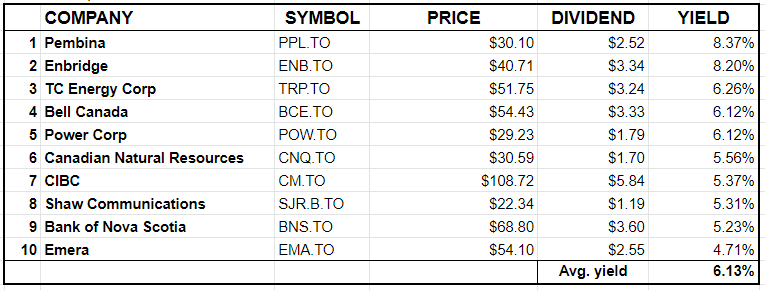

Beating the TSX 2021

Here is this year’s list of stocks, generated based on closing prices and yields on December 31, 2020 (EDIT: BPY-UN was removed from this list on Jan 6, due to news that it would be going private; it was replaced by EMA):

The average yield for the current portfolio is a generous 6.13%, far higher than anything investors can find in fixed income these days, with the added benefit that dividends receive preferential tax treatment.

Final thoughts

If you felt stung as a dividend investor in 2020, you are not alone. I own IPL, ENB and PPL, so I feel your pain. On the other hand, it’s just one year. I hope this post helps you understand how to keep these inevitable periods of underperformance in perspective.

In summary, remember these three things:

- Don’t be blinded by short term numbers; it’s the long term that matters

- Beating the TSX has a history of out-performing the index, especially after bad years

- Dividend investors have the luxury of ignoring stock price fluctuations; even in 2020, dividend income was remarkably stable

The longer we dwell in our misfortunes, the greater is their power to harm us.

Voltaire

It takes time and real money to maintain this site. If you find this information useful, please consider donating to keep DividendStrategy.ca ad-free. Thank you! (I’m not trying to get rich . . . 20% of donations are given to charity)

Matt, I have recently joined your “Blog”, appreciate the easy read of your articles! They are well written, factual, honest and educational-thank you for providing more information on BTSX strategy for 2021. Question, do you have articles for self directed investors regarding best platforms to utilize or consider such as Q-Trade, Quest Trade or how to reduce fee’s with investment brokers? Thank you again.

I have not covered this yet because I think it is pretty well addressed elsewhere on the Internet. Personally, I use QTrade and am very happy with them. I have close friends who use Questrade and are equally happy. My feeling is that it’s far more important to just get started with a sound financial/investment plan than to choose the “perfect” discount broker. Pick one that consistently rates well (both of those I mentioned fit the bill), fill out the forms and get familiar with their platform.

Long story short sold a number of assets in fall of 2019 as was offered more than I could say no to. I spent time reading your recommendations but never acted as I thought prices too high but then March 2020 happened and by the 24th made my first sojourn into the market but not small . Yes CIBC was as low as 67 but as I bought it up it went . ( average price 80.12 ) your recommendation on Interpipeline I almost bought but when they dropped dividends so dramatically I went with your basic element . I have only six but have a 34per cent increase and dividend doing well . TFSA full and from seventies to over 104000 so even better than I thought .The full portfolio bought at 453000. Now 620,000. Plus dividends at over forty thousand a year and climbing ( Enbridge increase ) . So I’m most pleased the accidental timing and thanks to you the selection of stocks though I added another which I felt comfortable buying at 65 .. BMO ..

Happy to hear things are going so well for you. Thanks for the kind words.

What great timing to start investing. I also invest for dividends and depend on them for my living expenses. Even with some bad years my average annual total return is 11%. And dividend growth of 5.3% in 2020. My portfolio is not the BTSX exactly as I try to avoid some companies, and stay more with the banks, utilities, telcos, as well as some US dividend payers.

Hi there, Happy New Year!

Thanks for the nice post, comforting after a difficult year with the value of our BTSX portfolios. I needed reinforcement of the purpose and objectives of this strategy so i can stay the course.

Is your graph on point 3 wrong? Isn’t the amount of dividend higher at the end of 2020 than the start, 6 up for one down?

The graph is correct – IPL’s 72% cut more than offset the increases of the other 6 companies.

I’m happy to hear the post served its purpose though.

You say if your investment horizon is less than 5 years you probably shouldn’t be invested in the stock market at all. If that’s so then what is a person supposed to invest in to live off of? Fixed income will not do it

Yes, this is a conundrum with interest rates so low. Of course one needs to consider their own unique situation, but it’s unfortunate to be forced to sell stock at a loss, without the ability to wait for a stock market recovery. One huge advantage of dividend investing, of course, is that with enough capital, one can live off dividend income without having to sell in down markets. If dividend income is not enough to live on, I would suggest most people should have alternate funds (cash, bonds, GIC’s, pensions, etc.) rather than having to sell stock in the next 5 years or so.

As Admin mentioned already this is a conundrum. But as someone said, yesterday was the best time to invest but today is the second best time. If your investments are enough that you get the income you want from dividends, then why not build a portfolio now? You can average over 5% with a couple of banks, BCE, and Emera. That gives you start. Then look at others from the BTSX that you are comfortable with.

Talking about a bad year for “Beat the TSX” investors in 2020 is not all bad for every investor. It depends in part when one does his or her annual re-alignment. I do mine in April each year as opposed to January in your example. My annual rate of return for the year 2020 was a modest +3.07 % for the period 01 Jan 2020 to 30 Dec 2020. I incurred 4 small losses and 6 small positive returns. Certainly not great, but all is not negative for everyone. Have a good day.

Good Evening Matt, I am a longtime Globe and Mail subscriber and new to your blog and I am very impressed with all that I have read on your blog. I have been a dividend investor for a long time, I have never followed your strategy in the past but I will now that we are at the beginning of January. My question is, what would your strategy be to start your selection of dividend stocks off for 2021? For example for a $100,000.00 portfolio or $200,000.00 portfolio or any portfolio value, would you equally dollar cost average in your 2021 shares selection over a period of X, or would you just buy all stock position at once and invest the full value of the portfolio right now so you would be fully invested from the beginning of the year. Thank you for answering my question. Regards, David

Hi David – you might have guessed, there is no “right answer” to this question. There is risk either way, which is why it’s a difficult one to make.

I hope you will find this post (“Is it a good time to invest in the stock market?”) useful: https://dividendstrategy.ca/is-it-a-good-time-to-invest-in-the-stock-market/

I have yet to even bother looking at my portfolio value and worry if it was up or down, and likely won’t. Agree that “it’s the dividend payments that matter” and whether ones income from their holdings meet their expense needs. If they do, all else is irrelevant.

There is so much value in a system that is designed to keep the investor as hands-off as possible.

Thanks for the comment, Henry.

Hi Matt,

The first stock in your 2021 list BPY… I heard the news that Brookfield Properties is being bought out by their parent company BAM and the dividend drops fron 7.89% to 1.21%…. do you still recommend buying this stock?

Thanks!!

I read the news too. Since it looks like a done deal, I am removing BPY-UN from the BTSX list, replaced by ENB at the top of the list, and EMA comes in at the bottom.

If I was to adopt the BTSX investing strategy today, would I utilize the above stock list which was generated as of December 31, 2020, or the current BTSX portfolio (Manulife was substituted for Emera in the current portfolio). Also, has anyone weighted the portfolio based on analysts’ price targets as opposed to investing an equal dollar amount in each of the 10 stocks; would the total return be higher, or are analyst price targets unreliable in that regard? Or weighting the portfolio based on dividend yield… Why is an equal weighting preferable? Thanks.

Hi,

Am planning to follow this strategy starting this year as getting 10% returns from TSX seems to be impossible task. Is it possible for you to post what 10 holding where there in the last 30 years so that I can run them in portfolio tracker and analyze their 1 year performance. According to this article : https://www.dividendgrowthinvestingandretirement.com/2020/12/double-your-dividend-income-with-dividend-growth-triple-it-with-dividend-reinvestment/

I think your returns dividend + beating TSX looks betters.

They are close to what DividendEarner 12.5% each year as he claims. https://dividendearner.com

thanks

Pingback: Using BTSX to build your portfolio: a step by step guide —

Pingback: BTSX mid-year update: back on track —