There is one investing question that comes up more than any other: Is now a good time to be putting money into the stock market?

The stock market has been on a nearly unprecedented 10 year bull run – how much longer can it continue?

Valuations are high relative to historical averages – they’re bound to come down, right?

Why put money into the market now when I could just wait for the next crash?

Many would-be investors are, instead, anxious waiters; sitting on significant sums of money waiting for the “right time”. Many have been waiting for so long that they’ve missed out on years of capital gains and dividend payments. The growth they’ve missed is depressing but the fact that the anticipated market crash hasn’t happened yet just makes it seem even more imminent. They are paralyzed between depression and anxiety; financial mental illness.

What are the options?

Most of us know we shouldn’t try to time the market, and if these anxious waiters could go back in time perhaps they would invest fully and be satisfied riding out the ups and downs. But somehow faced with this same decision ten years into a bull market feels very different indeed.

The way I see it, there are four options.

- Play the same game: wait until it feels right to invest

- Take the plunge: invest it all

- Dollar cost average: invest in instalments over the next year or two

- Go conservative: invest with a higher bond to stock ratio

Each of these has advantages and disadvantages. No one knows which strategy will prove the most profitable. The problem is that we have to chose a plan without knowing what the market is going to do – but we need to choose a plan because simply reacting to the ebbs and flows of the market is almost guaranteed to be the worst strategy of all.

Too often, articles are written from the perspective that there is one right answer to this conundrum: either based on historical data or the opinion of the author. I believe, that if we understand these options we can choose the one with the greatest chance of success, taking into consideration our own values and temperament. So let’s dive in.

Option 1: Play the same game

Remaining in cash and waiting for stock prices to come down is a tempting option for many. Why buy companies now when so many experts are predicting they will go on sale in the near future? Besides, buying BNS now at $75 when you could have bought it a few years ago at $55 feels suspiciously like a loss.

The game you are playing with this strategy is market timing. If you are going to do it, there are some questions you need to answer for yourself:

- How long are you going to wait for a market downturn? – Months? Years?

- How much do prices need to go down to trigger a buy? – 20%, 40%?

- When you buy, are you going all in, or spreading the purchases out over some pre-determined time frame?

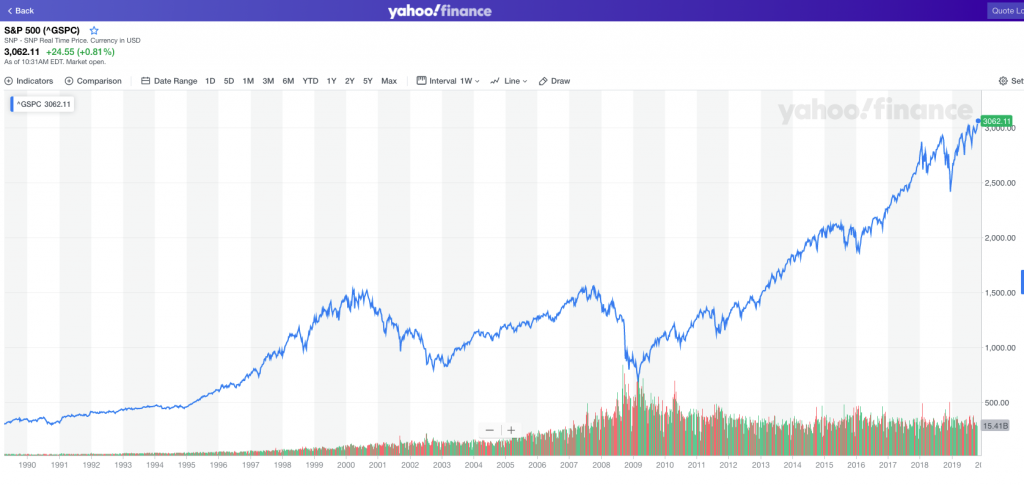

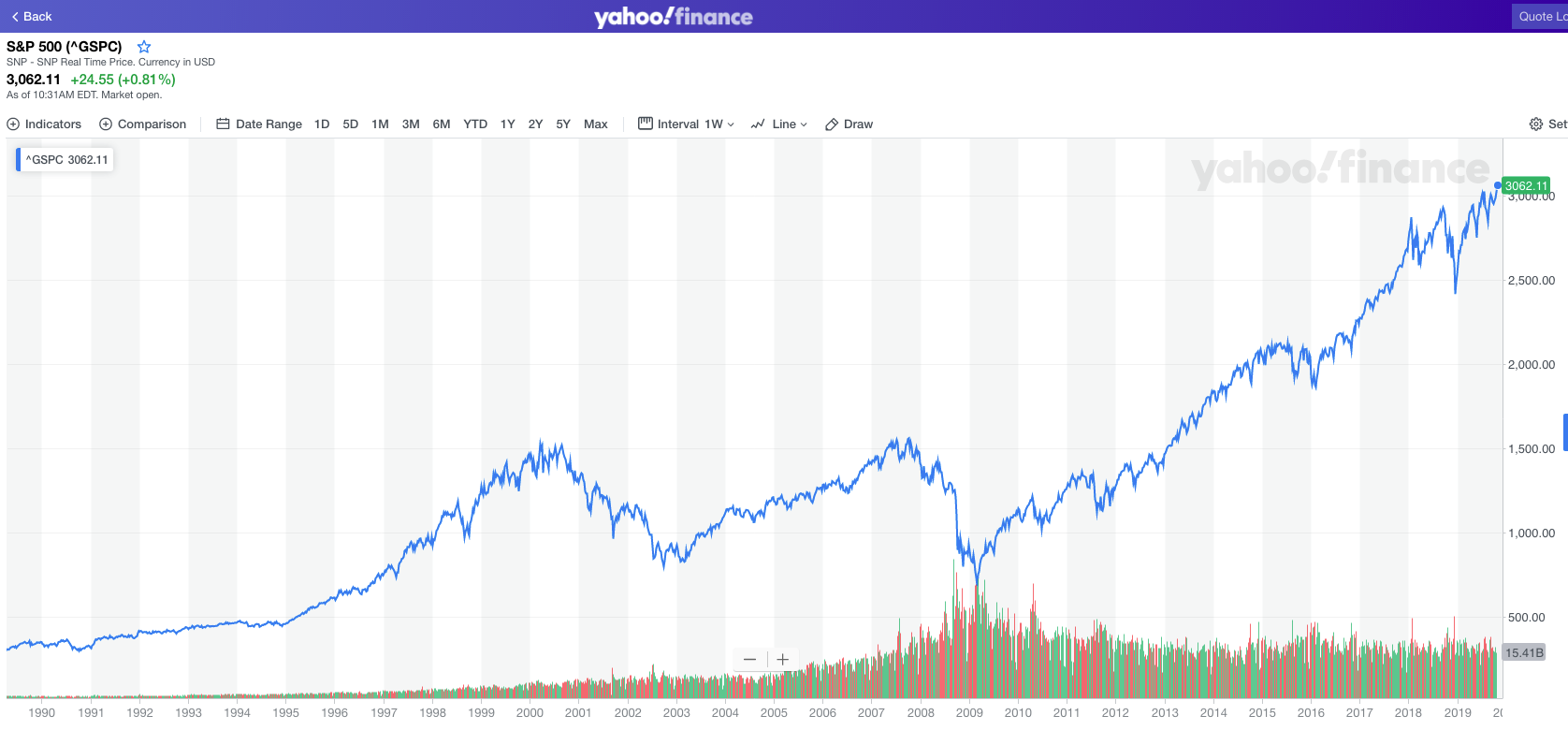

We have all heard the warnings not to time the market, and they’re there for a reason: it’s really hard to do. I know of many people who sold their investments a year or two after the last crash when the S&P500 was oscillating around 1300. There were many reasons to think that the problems that lead to the financial crisis had not been addressed and that the worst was yet to come. Some are still waiting. Think about that: the market would have to drop by over 50% just to get back to those levels (not to mention lost dividends). Canadian markets have not had the same gains during this time period, but the point is the same: the markets will surprise you.

Less than a year ago Canadian and American markets went down about 20%. I, and many others, thought it was the beginning of the crash we’d all been waiting for. I pictured millions of investors just waiting for an excuse to hit the sell button. Apparently not because since then, both American and Canadian markets have bounced back and hit new highs. I’ve given up trying to predict the markets, but if you haven’t, just make sure you 1. understand the market will often do what you don’t expect it to, and 2. have a pre-determined plan for how you are going to react to those unexpected events.

Option 2: Take the plunge

On the opposite end of the investing behaviour spectrum, you might decide to bite the bullet and invest that lump sum of cash according to your target asset allocation; let the market do what it will, just get invested and stay invested.

From a behavioural finance point of view, this approach is the simplest and, therefore, stands the least chance of our cognitive biases undermining our success. And there is good evidence to support this approach. As an excellent Vanguard research paper pointed out, a strategy of lump sum investing (in a 60/40 portfolio) will provide superior returns to dollar cost averaging (over 12 months) about two thirds of the time.

Investors are always fearful that the markets will plunge right after they buy in, but the fact is that historically, investing money when it is available is the superior approach most of the time. This is not surprising since markets have tended to rise over the long term, hence, holding money back means missing out on gains (on average).

But perhaps these are not average times . . .

Option 3: Dollar cost average

The results of the Vanguard paper make a lot of sense to me, but I can’t help but wonder about the applicability of those results to our current situation. Sure, most of the time investors are better off investing their available cash and riding out the market fluctuations. But what about ten years into a bull market with above average valuations? Do those results still apply?

I don’t know; and nobody else does either. But one of my favourite financial bloggers, Ben Carlson of A Wealth of Common Sense tackled this question about a year ago in this post.

Ben wrote:

The S&P 500 stands at the upper end of long-term valuation levels in terms of the cyclically adjusted price-to-earnings ratio. The CAPE ratio stands at roughly 32 times the previous 10 years’ average real earnings, a level only reached before the 1929 crash and in the late 1990s when the dot-com bubble popped. Dollar cost averaging should work better under such scenarios, considering the market experienced enormous crashes in both cases.

Ben proceeded to analyze 12-month rolling returns for lump sum vs dollar cost averaging (investing equal amounts every month for 12 months) only when the CAPE was at 32 or higher.

The results? Lump sum investing still beat dollar cost averaging 60% of the time. This really surprised me, so I looked more closely at his results to understand them. In the fine print, Ben explains that the advantage of lump sum investing is even more dramatic (90%) when compared to dollar cost averaging (DCA) over 36 months rather than 12. On the other hand, the results are much closer when lump sum investing is compared to DCA over 6 months.

Why the difference? I think it is because, in general, market gains happen slowly while crashes happen quickly (as you can see from the S&P500 chart above). The exception, of course, is the “rebound” that often occurs after a crash. Even if you get the timing right, if you are dollar cost averaging over the duration of a crash and it’s recovery, relatively little of your capital is being deployed at those market lows. On the other hand, lump sum investing at the “wrong time” still means all of your money is in the market as it climbs back up again.

So, mathematically, lump sum investing seems to be the way to go, but what if you just can’t stomach it?

Option 4: Go conservative

One option that I started using a few years ago, but hadn’t seen written about much is to use asset allocation to compensate for uncertainty. My target asset allocation may be 80% stocks and 20% bonds but I might be apprehensive about what the market is going to do in the next year or two. As we’ve discussed, I could wait in cash for a better time, bite the bullet and go all in, or dollar cost average over the next 12-24 months . . . but the fourth option is very interesting indeed: invest more money in bonds.

Instead of holding cash or investing using an 80/20 split, perhaps a 60/40 (or 40/60 or 20/80) ratio of stocks to bonds will help you sleep at night. Psychologically, I think this approach has a lot of merit, but is it profitable?

Another excellent financial blogger, Nick Maggiulli (Of Dollars and Data) wrote about this very approach a few months ago and came to a startling conclusion:

My results show that any stock/bond portfolio combination (even a 100% bond portfolio!) would have, on average, outperformed a 24-month DCA into an all-stock portfolio.

If this conclusion shocks you, I highly recommend reading his well-researched post. The numbers don’t lie. Until I read Nick’s study, I had always thought there was merit to the dollar cost averaging approach. Now it’s all about asset allocation for me. These days my investments are more heavily weighted toward bonds than my “ideal” ratio, and I have a plan to sell those bonds and buy more stocks as prices decline – whenever that might be.

Conclusion

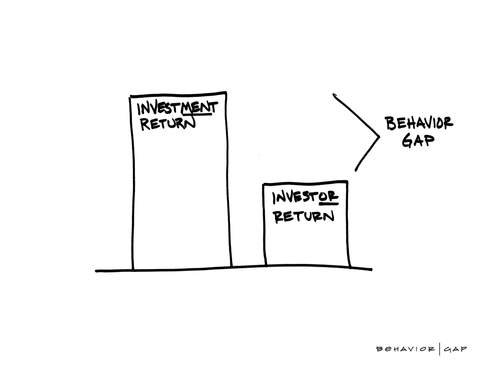

It has been said that “99% of investor returns are due to investor behaviour”. Stock markets – even dividend paying stocks – may be great long term money makers, but our fears and biases often get in the way of us enjoying the full benefit of those returns.

When faced with hard-earned money and an uncertain market, it is often difficult to know what the “right” decision is. Whatever you decide, I hope this post helps you make that decision with more confidence.

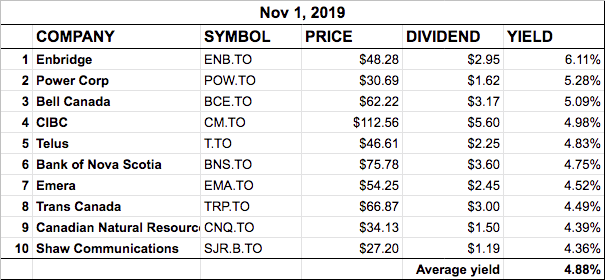

In the meantime, here is our list of BTSX stocks as of Nov 1st, 2019.

Matt, a great summary article and thanks for spending the time and for all the links – Geoff

Thanks for the comment, Geoff. It’s a common conundrum, so I hope this is useful.

The blogs I linked to are gold mines.

According to the constituents list from TMXmoney for the TSX 60 Stocks (^TX60), HSE has been dropped from the index, and KL has been added. Based on the yield of KL, that does not seem to affect the selection list for BTSX stocks.

Al

Right you are, Allen. I took HSE off the BTSX list last month . . . personally, I was happy to see it and it’s inconsistent dividend history go.

Howdy everyone, lots of interesting feedback over the months since our good man, Matt, has taken over from David & Ross;

BTSX is a wonderful blog Matt, thanks for all of your easy to read and informative efforts. Sadly, I must admit that this article is telling everyone about how I invest…….I don’t actually. I sit and wait, sit and wait, and surprisingly, nothing good comes of it, go figure. The fear to jump in becomes more ingrained and paralyzing, followed by more sitting and more waiting.

It is true that we have not lost any money but, because of inflation we have most definitely lost purchasing power; which is the greater risk? Both outcomes, loss of returns & loss of value, are depressing. (a possible idea for a future article?)

Thanks again Matt, you’re the best, stay well, SOL.

Hi SOL, I appreciate your sincerity, and I’m sure many others do too. None of us are immune to those fears, and even if we are invested we have exposed ourselves to a different set of risks. The point is that, to a certain extent, we all feel exposed and vulnerable. I hope the article is helpful in the process of weighing and sorting those fears into manageable constructs.

my take on the BTSX 2020 portfoilo:

BTSX 2020 Portfoilo

now this is as of Nov 24, 2019, a lot of things can change in just over a month.

Al

This is great, Al. I’m looking forward to comparing notes – and, as you allude to, I do think it is time to allow former income trusts into BTSX.

Pingback: What is confirmation bias? —

I have followed the BTSX for a while and think its a great way to start for a DIY investor. Don’t stay on the sideline any longer, dividends will take care of you while you wait for the market. I have been investing for dividends for 20 years now and retired two years ago with more dividends than my salary ever was. see my story at dividend-café-com.