To accompany our monthly BTSX portfolio update, we have another post by the father of Beating the TSX, David Stanley. Personally, I am in the middle of moving, so I appreciate his contribution of content for this site but, rest assured, this is extremely valuable information for the dividend investor. I would even go so far as to say it is essential. We need to have confidence in our investment strategy in both bull and bear markets, yet one of the criticisms of dividend-based strategies is that those very same dividends might not be safe in a market down-turn. Read on as Dave presents hard data that addresses this fundamental question.

Matt

In this column I would like to reply to a recent article in the Financial Post by Tom Bradley. On August 22nd he wrote “Dividend stocks are being touted as a substitute for bonds, but the reality is much more complicated” in which he leveled a serious charge at dividend investing: Stock prices may fall significantly during a downturn, inducing panicked investors to sell at a loss.

I’m afraid Mr. Bradley has failed to appreciate the essence of dividend investing. Stock price appreciation is not the only goal or even the main goal. We all know that capital gains can vanish overnight. No, we know that dividends are a major source of long-term market returns, somewhere close to half over time.

A very common approach to dividend investing is to accumulate shares of dividend-paying stocks while employed in order that these dividends will help to fund retirement. These investors are much more interested in dividends than share price. So, the question should be, “Does a downturn in stock prices result in less dividend income?” In order to explore this issue, I turned to a recent blog post, “How the Dividend Income of Canadian Dividend Growth Stocks Did During the 2008-2009 Global Financial Crisis”.

This was, I think, a very important study since it gives us an idea of what might happen in future financial bear markets. The author looked at 63 Canadian dividend growth stocks during the 2008-2009 financial crisis. The primary finding was:

“Had you invested equally in all 63 stocks, dividend income would have A) Increased by 10.3% in 2008, B) Decreased by 4.4% in 2009, C) Increased by 3.8% in 2010, and D) Increased by 6.0% in 2011”.

I think this should be considered encouraging for dividend investors.

Because of my interest in TURF blue-chip stocks (Telecoms, Utilities, REITs, and Financial stocks) I decided to break out these components (Table 1), and to also consider stock prices (Table 2), All the TURF stocks in this study are components of the TSX60 Index, Canada’s blue-chip index, with the exception of the REITs, none of which have sufficient market cap to be included in the TSX60.

Data Sources: Most of these data came from Reference 1; the remainder from Reference 2.

These data show that the blue-chip TURF stocks produced higher and more consistent dividend increases than the group of 63 and more in line with the TSX 60 index. The results from the TURF stocks showed less variation between years as reflected in a lower coefficient of variation (COV, standard deviation divided by the mean). Perhaps this will help to ease Mr. Bradley’s concern since in each year over year comparison an increase was recorded. So, if someone owned these stocks there income would have actually increased over this period. Only 1 of the 22 companies cut their dividends (4.5%) as compared to 21% of the group of 66.

Now let’s look at actual stock price movements during this period:

Over the period 2007 through 2011 the blue-chip TURF stocks averaged a remarkable 34.8% total return (counting dividends but not reinvestment) compared to -8.3% for the TSX and 2.2% for the XIU ETF (XIU is used as a proxy for the TSX60 Index since the proprietors of this index view all information about its performance as proprietary and is only available for paying customers.)

These returns were achieved through, first, a lower loss during the 2008 selloff and, second, a faster recovery (Figure 1).

It is interesting to note that if we compare total change over the entire 5-year period within the TURF stocks we see that utilities led the way with 89.8% and financials were the laggards with only an average total return of 3.7%. Telecoms (32.0%) and REITs (36.9%) were grouped in the middle. In terms of individual stocks Enbridge dominated with a total 5-year return of 178.4%.

For me, the big lesson of this study was that in a bear market blue-chip TURF stocks sink less and recover faster than other sectors. I think this is because as the price drops and the yield increases investors are tempted back into the market. Blue-chip stocks rarely go on sale and when they do buyers react accordingly. These stocks can certainly weather downturns better than the index.

It seems that dividends are coming into fashion now and some companies are issuing them that probably shouldn’t. The act of having a dividend alone is not enough to justify blue-chip status. Real blue-chip stocks are a valuable addition to an investment portfolio and, as I have said before, in you buy quality blue-chip TURF stocks dividend growth will look after itself.

I will finish by going back to Mr. Bradley’s concern that panicked investors will sell their dividend stocks.at a loss — I would predict they would be buying rather than selling.

References

1. How the Dividend Income of Canadian Dividend Growth Stocks Did During the 2008-2009 Global Financial Crisis. https://www.dividendgrowthinvestingandretirement.com/2019/07/dividend-income-canadian-dividend-growth-stocks-2008-2009-global-financial-crisis/

2. Yahoo Finance. https://ca.finance.yahoo.com/#mediarecentquotesportfolios_rq

3. Various company annual reports.

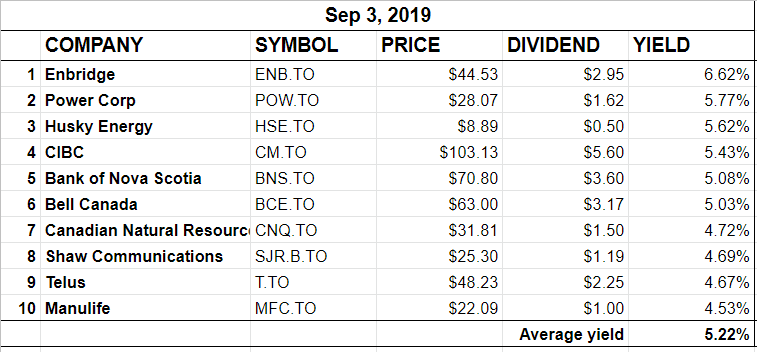

BTSX Portfolio Update

Compelling evidence to stay the course, no matter what the market throws at us. This month, market jitters continued, but our dividend income is steady – even increasing as CIBC and BNS increase their dividends.

Great Post, I think it is good to see, data like this important for new investors to stay invested, TKS David

Matt thankyou for all you do. David what can one say. The voice of reason in a sea of ???. Been dividend investing for many years. I like the TURF moniker. One of my biggest issues over the years has been the realization that commodity stocks are different and do have their season. The older I get the less patient I have become with under performers.

Excellent article – thanks for posting this. There is comfort in your facts as I’m a high dividend ETF investor that lives from the dividends my investments provide.

Just visiting for the first time. Nice article from David.

Just comparing the BTSX portfolio outlined above in the article to Matt’s in the March /April edition of Moneysaver.

They are not the same. Why is Husky there? I thought this company was a no-no.

Anybody worried about IPL or PPL?

Jeff

Hi Jeff, I think you will find the answers to your questions by exploring the site a little, but I will save you the time.

– At the beginning of every month I compile the list of ten stocks that currently meet the BTSX criteria and include it at the end of the blog post. I do this as a public service since there are many people who are making investment decisions throughout the year.

– Husky met the criteria at that time but has since been removed from the TSX60 so will not be included going forward.

– IPL and PPL have been assessed here and here. Starting in 2020 I am going cease the exclusion of previous income trusts, hence they will appear on our list.

Hope that helps and welcome to the blog.