It’s that time of year when Christmas decorations are put away and one more row is added to my Beating the TSX Results spreadsheet. It’s like writing a story, one sentence every year. This narrative began back in 1987, the first year David Stanley started tracking the results of this simple but powerful investment strategy. Since then, there have been ups and downs, twists and turns, doubts and exuberance. Over 36 years, a story has emerged: individual investors can outperform professionally managed funds.

The secret lies in the words of the world’s most quotable investor, Charlie Munger:

This is the key to successful investing and the key to Beating the TSX. Counterintuitively, brilliance can be a hindrance because it often leads to over-confidence. If you want to be a little bit smarter than other investors for a long, long time, my suggestion is to arm yourself with an investment plan that is easy to understand and simple to execute. You don’t have to be smart as long as your plan is.

Beating the TSX is a simple method of selecting Canadian dividend-paying stocks that rarely offers spectacular short-term returns. In fact, in 2023 it lagged the index by about 3.5%. But, on average, it’s performed better than the index by a few percentage points – 2.66%, to be exact – and, as Munger says, that’s what matters in investing.

Beating the TSX: How it works

Created by David Stanley in the 1990s, BTSX is a simple method that anyone can use to identify Canadian blue-chip dividend-paying stocks that might be worthy additions to your portfolio. I’ve been using the method personally since 2008 and writing about it since 2018. There are just three steps:

- List the stocks on the TSX60 by dividend yield

- Purchase the top 10 yielding stocks in equal dollar amounts

- Hold for a year and repeat

The method usually results in a portfolio of stocks with several appealing characteristics:

- They are large and usually stable companies with low volatility

- They have a high dividend yield

- Most have a long history of stable and growing dividends

- They are often purchased when their stock prices are depressed

Beating the TSX 2023 Results

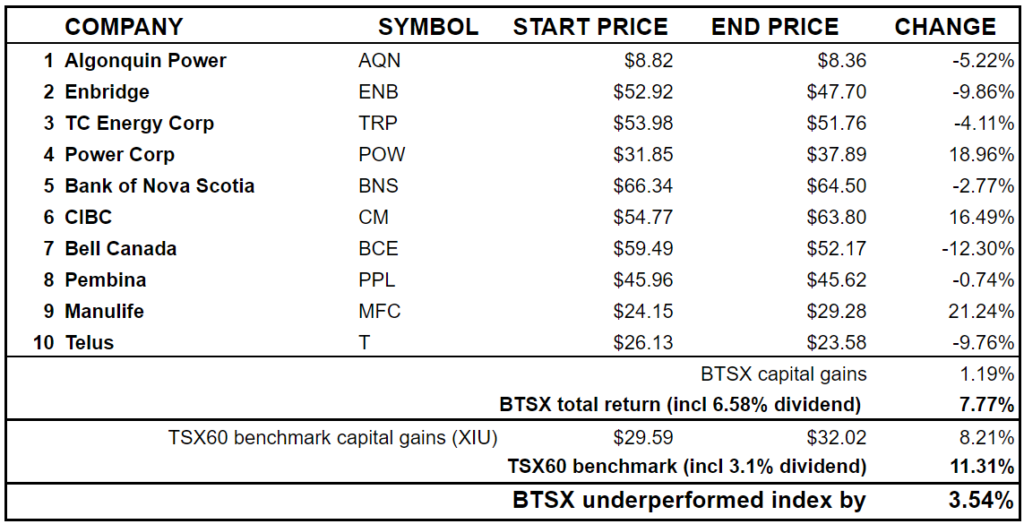

Every good investment strategy will have periods of underperformance. After two years of beating the index, the recent weakness in dividend-paying stocks has caused BTSX to lag the TSX 60 by 3.54% with a total return (price + dividends) of 7.77% vs. 11.31% for the benchmark.

Figure 1: 2023 Beating the TSX Results

*Note that the TSX 60 benchmark is represented by the XIU ETF which tracks the TSX 60. Dividend yield for both BTSX and TSX 60/XIU is as of Jan 1st, 2023.

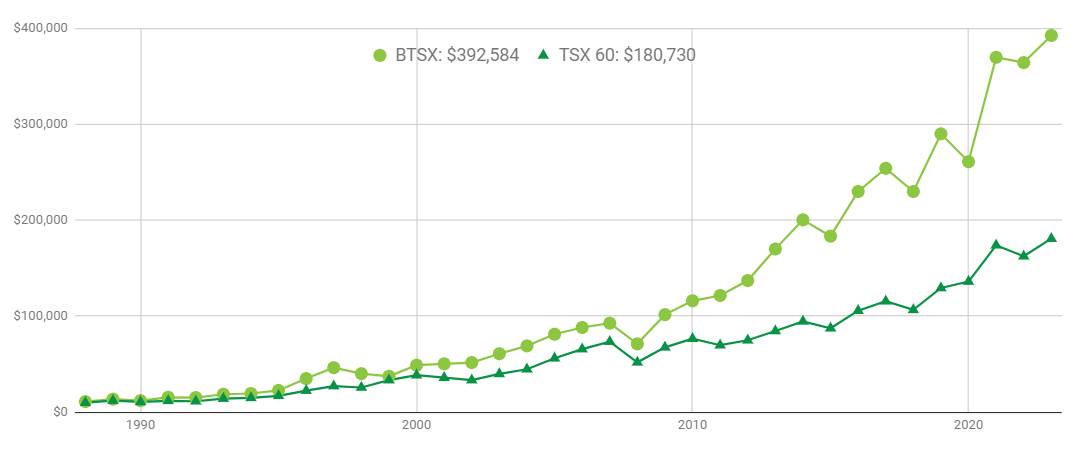

Thirty-six years of BTSX returns

If you’re tempted to dismiss Beating the TSX based on this year’s returns alone, let’s put them in context. In investing, it’s decades that matter, not years. Over the last 36 years, BTSX has displayed an average annual outperformance of 2.66% over the TSX 60. This means that, if you had invested $ 10,000 in BTSX stocks 36 years ago, you would now have $392,584 – over double what a TSX60 index investor would have (in both cases total returns re-invested).

Figure 2: Growth of $10,000 using BTSX vs. the benchmark TSX 60 index

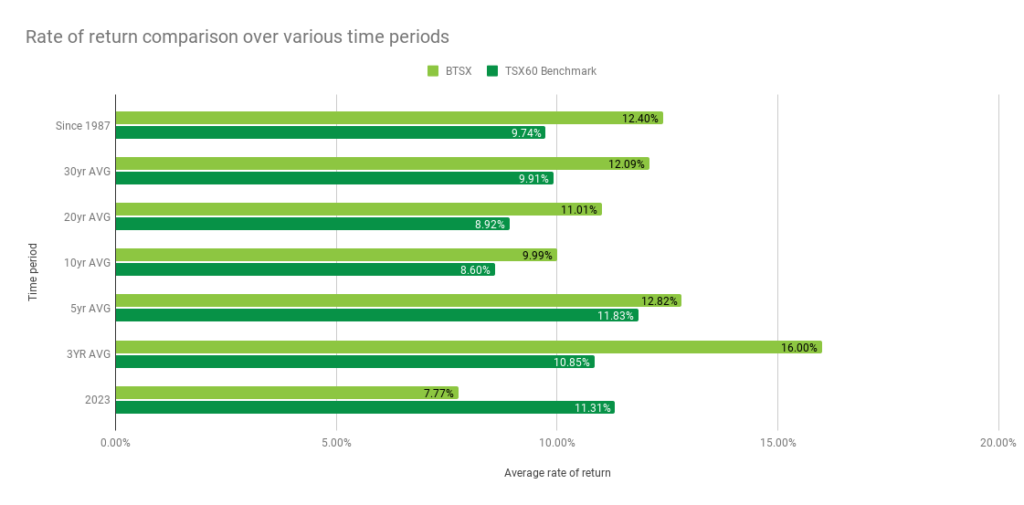

What about periods less than 36 years? Even though Beating the TSX fell behind the index last year, it has beaten the benchmark over the last 3, 5, 10, 20, and 30-year periods. How many mutual funds do you know of with a track record like this?

Figure 3: Average rate of return over various periods; BTSX vs. the benchmark TSX 60 index

BTSX: Strengths and Weaknesses

Results are always compelling but performance is just one factor that investors must consider. Beating the TSX stocks offer many advantages including:

- They tend to be large, stable, profitable companies

- They are purchased at attractive valuations

- They provide high dividend yields

- They tend to raise their dividends over time

But BTSX has limitations as well, including:

- The possibility of dividend cuts

- Suboptimal sector diversification

- Not all BTSX stocks will be winners

- The BTSX portfolio doesn’t always beat the benchmark

If you’re going to use Beating the TSX successfully, you need to be aware of these limitations. Have a plan for dividend cuts, to achieve adequate diversification, and understand there will always be individual stocks and individual years that will take some of the shine off the method. If the goal of any investment strategy is to be a little better than average over long periods, it’s important to prepare yourself for temporary underperformance like we saw in 2023.

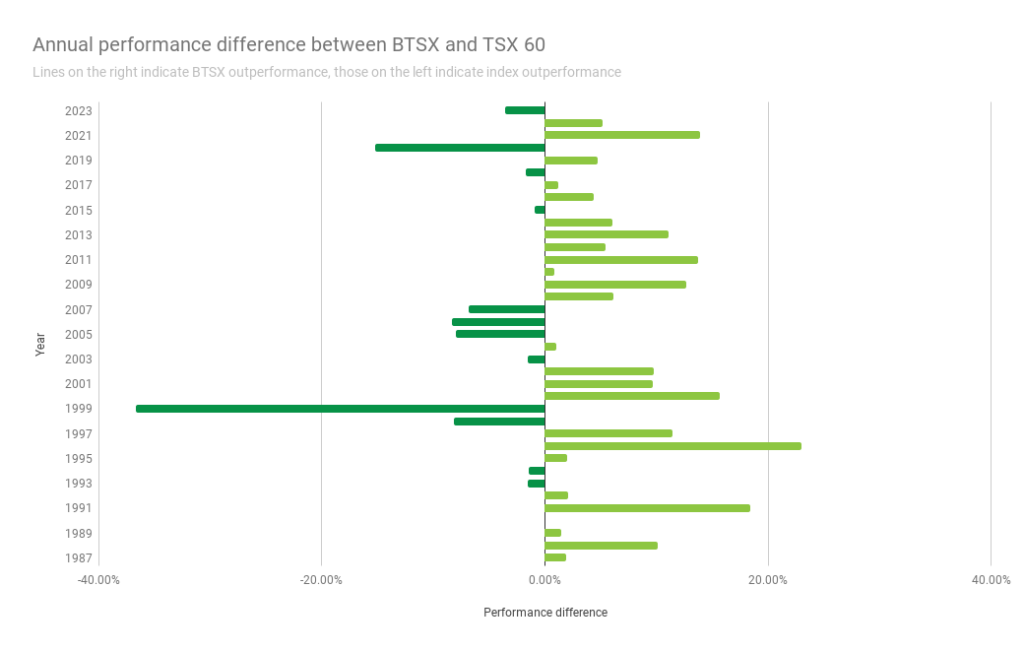

The following chart will help you understand the ups and downs of BTSX’s performance over time. It shows how BTSX has performed relative to the TSX60 index year by year; 2023 is at the top and 1987 is at the bottom.

Figure 4: Annual outperformance vs. underperformance of BTSX vs. TSX 60 benchmark

The finance author Morgan Housel explains wealth generation as “investment returns to the power of time”. Time is the exponent. Time is the multiplier. Beating the TSX has had years far worse than 2023 but it is a long-term strategy. Committed investors who have held through the down years have been handsomely rewarded.

BTSX Dividend Income

Many investors are attracted to Beating the TSX because of the dividend income. Not only are dividend-paying stocks less volatile than non-dividend-paying stocks, but investing for income makes sticking to your investment plan more likely. Even though the market may be down and the headlines full of doom and gloom, dividend investors are incentivized to hold rather than sell. In fact, as prices fall, reliable dividend payers get even more attractive because their yields go up.

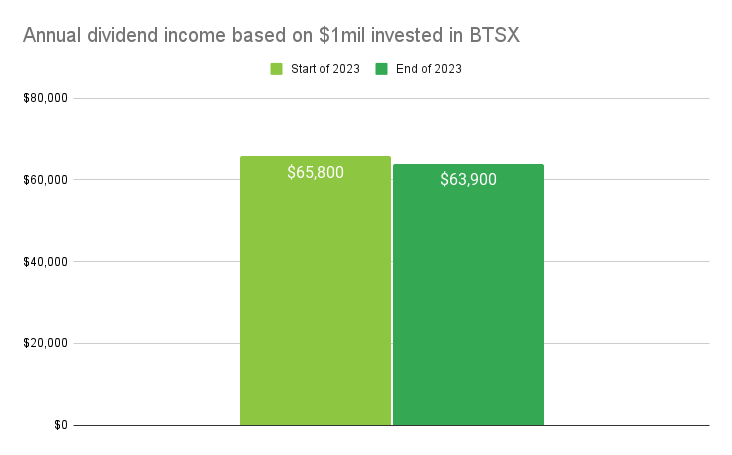

BTSX started 2023 with a very juicy average dividend yield of 6.58%. Since then, every stock on the list raised its dividend with the exception of AQN which, predictably, cut its dividend. But even with that 40% dividend cut, the total dividend yield for the portfolio remained at a very respectable 6.39%. What this means in real dollars is that if you had $1mil invested in the ten BTSX stocks, your annual dividend income would have gone from $65,800 at the beginning of the year to $63,900 at the end.

Figure 5: Annual dividend income based on $1mil invested in BTSX

Beating the TSX 2024

Investing can get very complicated very quickly. Although some of us find the details interesting, the fact is that complex investment strategies are associated with worse returns, not better. The best thing about BTSX is its simplicity. DIY investors have been able to access exceptional returns with no special skill required.

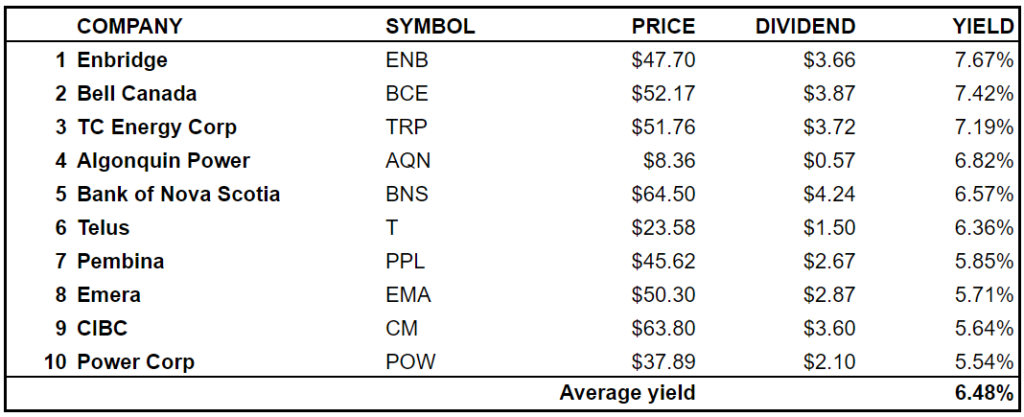

Here is the list of stocks for 2024 including their forward dividends.

Figure 6: 2024 Beating the TSX Stocks

As always, this post is for information purposes and is not investment advice. Beating the TSX can be a powerful tool to identify potential investments but should always be used in the context of a complete financial plan.

For more details on how I use Beating the TSX myself, go HERE.

Wishing you all the best in 2024!

Thank you so much to those of you who have chosen to support me and this blog with your donations. Your generosity has a huge impact on the quality of this site. You can support this site by clicking below or by sending an e-transfer to contact@dividendstrategy.ca. Half of all donations are donated to Doctors Without Borders.

Matt, thanks for this update on Jan 1st! I am a happy investor using the BTSX strategy. In the year 2023, Manulife was the top winner with 21.24% gain in share price plus about 5% annual dividend. Since Manulife has fallen out of the top 10 dividend yields in 2024 and Telus became the only new entry in the top 10, would you sell Manulife and buy Telus now?

Hi Steve. I don’t automatically sell stocks if they’re off the list in one particular year, as long as they still fit with my investment plan. MFC still has a good yield of 5%, so I’m holding it for now. I have to admit, however, of all the big bank/insurance co’s it’s one that I’m least comfortable with for a variety of reasons.

Small side point: Telus was in the top 10 last year. Emera is the new entry.

Hi Matt,

Thanks for the post and Happy New Year! My husband and I are considering this investment option. The question I have is what happens at year 2, 3, 4 etc – Say there are 7 companies on the top ten list that are the same as the first year. Do we sell the other three that no longer make the list? Do we just buy the three new ones? OR do we take our total amount we want to invest and then divide by 10 and invest 1/10 into each stock (therefore adding more investment to 7 of the same companies)?

Best, Jenna

Hi Jenna, and welcome. There are many ways you can use this investment tool we call BTSX. New companies that appear on the list deserve consideration, but not automatic inclusion. Similarly, companies that have fallen off the list need not be automatically sold if they still pay a good dividend and fit with your investment plan.

This article might help explain things further: https://dividendstrategy.ca/how-to-use-btsx-in-real-life/

Hi Matt, thanks for sharing the “how to use BTSX in real life” article. What if I don’t want to buy/sell BTSX stocks once a year like in January? What if I have new funds (monthly from salary or quarterly from dividends) and want to buy BTSX stocks every month or every quarter? Would it make sense to do so to have more “time in the market” and to “cost average”? PS: my trading platform does not charge any commission so there is no trading cost so it’s not an issue. Thank you in advance for your comments.

Absolutely – one way or another, I would recommend getting that money invested as soon as possible. You could look at your holdings relative to your investment plan targets and rebalance month by month. Personally, I prefer to keep it simple and just use ETFs because it keeps the decision-making (and, therefore, potential behavioural errors) to a minimum. Then I do one big reassessment and rebalance at the end of the year.

BTW, here’s another post with more details you might find useful: https://dividendstrategy.ca/ten-tips-for-your-btsx-portfolio/

Hi Matt

Please I need a clarification about the selection of the stocks for the BTSX strategy for 2024

Why these stocks are not included if they have higher dividends and also are dividend growers

Examples are:

Allied Properties Real Estate AP-UN.TO at &.92%

Canadian NET REIT NET-UN.U at 7.13%

First National Financial Corp FN.TO at 7.13%

CT Real Estate Investment CRT-UN.TO at 6.13%

Capital Power Corp CPX.TO at 6.5%

Am I missing something

Regards

José Pinedo

Hi Jose,

They are not eligible for the BTSX list because they are not blue chip stocks – i.e. they are not listed on the TSX 60 (Canada’s 60 largest companies).

How do you consider the tax basis for this strategy? If someone bought the TSX and held there would be tax on the dividends and potentially some small amount of cap gains from etf rebalancing. However, buying the top 10 div yielding stocks in equal amounts means taking some meaningful cap gains every year. I see your comments on selling is optional, but is it a fair comparison of strategies if you don’t actually rebalance every year.

Thoughts on the post tax returns?

Hi Michael, Tax considerations must always be made on a case by base basis. Many people invest in registered accounts with no tax implications for rebalancing. If held in a non-registered account, the tax implications vary widely, depending on other income, benefits, use of registered accounts, etc. You’re absolutely right to point out that it is after-tax returns that matter but, unfortunately, there’s just no way for me to make meaningful comparisons in a general way here on the blog.

Valid point, though – thanks. I hope others will read your comment.

Hello Matt, I’m a new member and found your site on the “My own advisor” news letter. I was wondering why TD, CNQ and NTR were not included in the 2024 list of stocks to purchase. They are in the top ten list on the TSX 60. Each stock increased their dividends and have a long history of increasing there dividends.

Is there a metric I’m not seeing. Looking forward to using your system, Thank you

David

Hi David – They simply weren’t in the top 10 on January 1st, 2024. To be scientific about our tracking, we have to be consistent. So we use the calendar year. Practically, if you are buying at any other time, the “Current BTSX Portfolio” is more helpful.