My last post, Why I am not a Bitcoin investor, sparked a surprisingly positive response both in and out of the comments section – thank you to those who reached out. Even the Canadian Moneysaver is going to pick it up for an upcoming issue. It seems there are a lot of investors who share my reservations about cryptocurrencies and are looking for validation.

But not everyone was happy with the article. One comment got caught in my Matt-it’s-your-blog-and-you-don’t-have-to-publish-every-comment filter. Here’s an abridged version:

Why the negative attitude? It sure sounds like “old man yelling at the internet”. Keep an open mind if you want to see the future…not sure if you are familiar with the internet? Amazon? Google? Electric cars? Just sayin, how can you be so sure it WON’T perform better than your ENB stock…. Change is hard and so is new stuff. Keep questioning and keep learning.

I have no interest in debating this person because insults and ad hominem attacks are rarely the foundation of productive discourse, but the fact that we are clearly so far apart on this got me reflecting on the role of optimism, pessimism, and realism when it comes to investing.

Optimism vs. pessimism

Merriam Webster defines optimism as being “an inclination to put the most favourable construction upon actions and events or to anticipate the best possible outcome.”

Pessimism, by contrast, is “an inclination to emphasize adverse aspects, conditions, and possibilities or to expect the worst possible outcome.”

Optimists are lovely to be around. They’re hopeful, encouraging, and inspiring. They can find the silver lining in any dark cloud. Most people prefer optimists over pessimists because they make us feel better.

Pessimists, on the other hand, see what is wrong and what could be improved. They’re hard to be around because they point out what is lacking and give us work to do.

Investors are optimists by definition . . . and pessimists

As investors, we must be optimists. The only reason to invest, fundamentally, is because we believe the future can be better than today. Otherwise, why not just spend your money now?

But pessimism always plays a role. Recognizing shortcomings and areas for improvement is integral to the process of making things better. The rose-coloured glasses of optimism don’t lend themselves well to this dirty work. Progress means not being satisfied with the status quo. And change is messy.

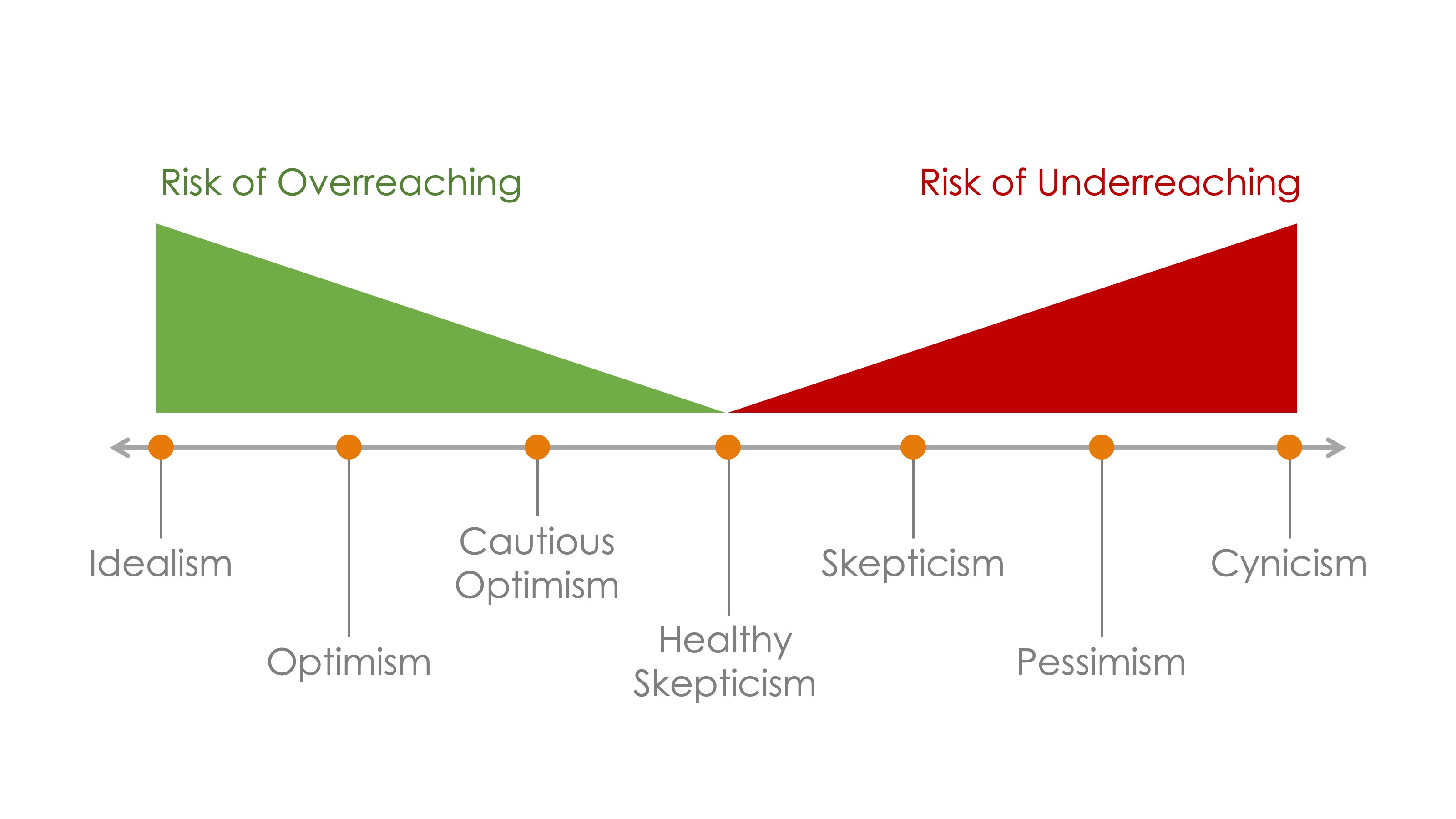

Clearly, pure optimism and pessimism are extremes. I’m sure the comment’s author would object to being labelled a blind optimist as much as I would resist being called a crypto pessimist. Optimism and pessimism, like so many other things, exist on a spectrum.

If a pure pessimist is someone who refuses to believe (a cynic) and a pure optimist is someone who believes in spite of anything (an idealist), a skeptic is someone who is willing but reluctant to believe. I identified myself as a skeptic in the post, and I think that’s true. Becoming a well-informed skeptic is the challenge I have taken on.

What optimism and pessimism have in common

What optimism and pessimism have in common is a reluctance to look at all the data, to appreciate the full spectrum of conditions and possibilities. This is rampant in finance: perma-bears focus on all the reasons why markets are vastly overvalued and dismiss possibilities for continued growth whereas bulls in various sectors see all the potential and brush off the risks. Unfortunately, extreme views are highly correlated with popularity and ad revenue, so the moderates tend to get squeezed out of the conversation.

Confirmation bias plays a big role in both cases: the tendency to interpret new information as confirmation of one’s existing beliefs. We seem to be wired to prioritize opinions over evidence and it takes a lot of conscious effort to be truly open-minded to the full range of possibilities and risks.

So you think you’re a realist . . .

Realism is a mindset in which we try to see things as they really are. Realists are skeptics who are willing to put in the work to evaluate and balance the problems and potentials. It is an ideal to strive for. We can never be free of our cognitive biases, but we can humbly acknowledge their existence and try to limit their influence on our opinions.

Pessimists think they are realists because pessimism is usually seen as a personality defect. Optimists think they are realists because they don’t want to be seen as naive or flaky. But being a true realist is much more difficult than either pessimism or optimism because it’s not just the middle ground between the two, it encompasses both.

Labels vs. actions

In the end it’s not the labels that matter but our actions. One of the best things about blogging is the satisfaction that comes from putting my thoughts and knowledge into words and having people like you who find it worth your time to read all the way to the end of each blog post – what an amazing thing.

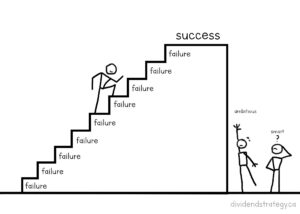

But as a writer, I also feel a duty to you; not to tell you what you want to hear, but to become a better realist with every post. To me, that means openness and skepticism in equal parts plus a willingness to put in the work of challenging assumptions and finding those gems of truth that will help us be better investors. This will always be a work in progress, but it is work that I enjoy.

Strong opinions, loosely held

Marc Andreessen, an icon of Silicon Valley, once described his process of testing ideas in the face of complexity and uncertainty as “Strong opinions, loosely held”. He would embrace his gut reaction, make the strongest and most cogent argument in favour of it, then – and this is key – listen carefully to the dissenters, being open and humble enough to change his opinions as new evidence comes to light or conditions change. Although it’s often misinterpreted as license to be stubborn and rigid, “Strong opinions loosely held” is a call to elucidate clearly, listen actively, and evolve intelligently.

I think there’s something to that approach because these are the behaviours that make us better investors – and better people.

Lastly, if you disagree with me on Bitcoin or anything else, please understand you’re not likely to change my mind by calling me an “old man yelling at the internet” (I’m only 46, by the way). Bring your A-game. Write a compelling rebuttal. I will happily read it and share it because that’s how we all get better. And that’s what I really care about.

Thank you so much to those of you who have chosen to support me and this blog with your donations. The fact is that as the blog grows, it gets more expensive to run. I want you to know that your generosity and the thoughtful notes that are often attached to them have a huge impact on the quality of this site.

If you are so inclined, no matter the amount, you can support this site by clicking here:

Hi Matt

it is a strange phenomenon of the internet that some users feel free to use rude, abusive or otherwise unpleasant language in commenting on others’ contributions. I am sure that most of these people are actually quite nice and reasonable, but something takes over when they can write behind the shroud of the net. It can be damaging to otherwise helpful contributors. I guess it is a sign of the times, with little prospect of improving in the foreseeable future. All I can add are the words of Chuck Yeager: Press on!

Hi Mark, it is certainly unfortunate. It’s kind of like road rage: looking into each other’s eyes face to face, I think the commenter would have taken a different approach. Bloggers like you and I just have to find a way to navigate the reality that we are resources for many and targets for some.

To encourage discussion without assumptions I adhere to, “Not right”, “Not wrong”, “Just different”. Rudeness shuts down the opportunity to learn something new.

Was it Mark Twain who said, “You can’t learn that which you already know”? On the other hand, sometimes people really are wrong in their opinions and assessments. In those cases, however, those erroneous conclusions are usually a result of their particular life experiences. Understanding their perspective is the only way to have a productive conversation. In my experience, people are inconvincible if they don’t feel understood. Thanks for your comment, Eve.

Hey Matt,

My comments weren’t meant as an insult at all…was just more of the ‘just keep an open mind’ type thing I was going for….

I apologize that it came across as an attack because it sure wasn’t my intention….Either way, at least you have some content to write about I guess.

I too have TFSA chocked full of dividend stocks, precious metals and assorted other hard assets and a DB pension. Just playing the field and wanted to get that across, that the new stuff isn’t necessarily ‘bad’. That was my point. I could care less if anyone is deemed to be ‘right’ or ‘wrong’ because there is no such thing…

My sarcasm doesn’t come across well in text and it is obvious it didn’t in this case. Take care and keep up the good work!

And btw, I am quite a few years older than you! Born in the ’60’s I am…

Cheers

Gregg

Hi Gregg – it took a lot of courage and openness to write this comment and I truly admire that. Thank you. Don’t worry, I didn’t really take your original comment as a personal attack. And I hope you didn’t take this article as a counter-attack, but rather an exploration of an important theme that your comment triggered.

We should all bear in mind that it’s all too easy to label those who disagree with us as “closed-minded” and be done with it. This ad hominem argument allows us to avoid doing the work of actually looking closely at the content of the discussion – the hard work of a realist. In the case of Bitcoin, the optimism has been ubiquitous; “keeping an open mind” means getting acquainted with the skeptics and their perspectives – at least in my opinion. That was the whole point of the piece.

In the end, if you are a Bitcoin investor and I am not, that’s okay. The goal is to take in the relevant information as objectively as possible, put it through the filter of our values and goals, then make the appropriate decision for ourselves. That middle step is key – If our values and goals are different, we will likely make different decisions based on the same information – that doesn’t mean either one of us is closed-minded. Regrets happen when our information is incomplete; the problem is not too little information, but too much and being unable to filter it effectively. This is a particularly big problem for people considering investing in crypto.

To be clear, I don’t know what the price is Bitcoin is going to do, I just know it’s not an investment that fits with my values and goals, and there are a lot of reasons to be wary. Having said all that, I promise to do my best to keep an open mind and I really appreciate your willingness to participate in the discussion.

#4 would be the engineer. The glass is too big.

There’s always another perspective we haven’t thought of yet!

It’s impossible for a glass to be half empty. Empty = zero; 50% of zero = zero. Ergo, a glass half empty is empty.