I have been slow to get on the Bitcoin train. OK, actually I’ve kept a safe distance and watched that shiny Bitcoin engine gain speed and momentum, hurtling through space, careening around corners, all the while gaining more and more white-knuckled followers, hanging on for dear life.

But not me – I’m a skeptic. I can’t help it. Something so new, so volatile and, most importantly, so hard to understand is just not where I feel comfortable putting my money. Not understanding an investment is a good reason not to invest, but I wanted to understand, so I kept waiting for some good critical analysis to balance the hype. Finally, the last year or so has produced some thoughtful and balanced commentary.

The internet is full of Bitcoin sensationalism. But this is the article I’ve been wanting to find for years: a concise rational explanation of Bitcoin and a summary of why it might not be a good investment. I couldn’t find that article, so I wrote it. I won’t pretend to be an expert. This is also not an exhaustive analysis – there’s just too much to cover. But for those who share my skepticism, I hope this will help you understand why your doubts are likely well-founded.

A short history of Bitcoin

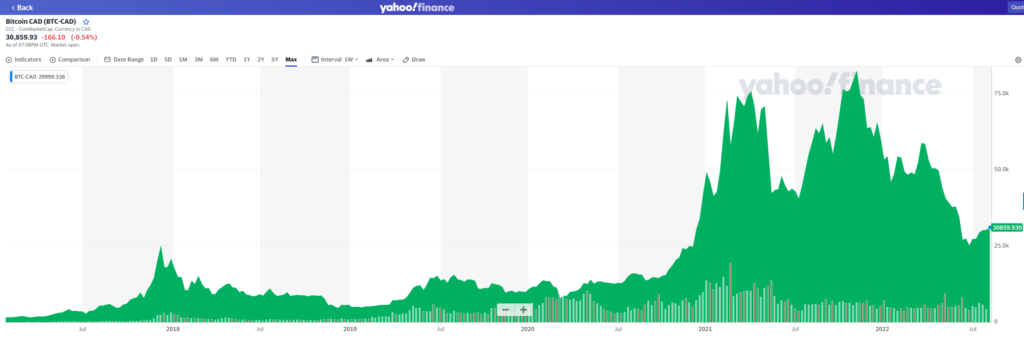

Even though it’s been around since 2009, Bitcoin really hit my radar in 2017 – that was the year it gained traction in popular culture and, not coincidentally, the year its price started to skyrocket. There is no more interesting story in finance than new price highs and the value of a Bitcoin went from about $1300 to $22,000 that year. Bitcoin millionaires popped up all over the internet almost overnight. Forbes called 2017 The Year of Bitcoin.

Then it all came crashing down. By the end of 2018, Bitcoin had lost more than three-quarters of its value. We’re likely all familiar with the story since then: depending on how you look at it, either a thrilling or nauseating series of surges and crashes. Since the start of 2017, Bitcoin has had a rate of return of 59%. But that’s a little deceiving since it has lost 50+% of its value six times in the last ten years and is currently sitting at only 36% of its peak value just a few months ago.

Who is investing in Bitcoin?

I’ve talked to a lot of people about Bitcoin and cryptocurrencies over the last five years. Some were Crypto Converts: usually in their 20’s and 30’s, they were clearly drinking the crypto kool-aid and talked about it with frenzied enthusiasm. Others, the Crypto Curmudgeons, were usually 50 + years old, and saw it as a fad that they didn’t really understand but didn’t really need anyway. But most were Crypto Curious – they’d heard enough to be interested and even though they didn’t understand how any of it worked, they’d salivated over the success stories and were afraid of missing out on what might be “the next big thing”.

If it seems like a lot of people bought Bitcoin for the first time in the past year, that’s because they did. It’s hard to watch an asset class rocket higher and higher and not try to grab your little piece of it. FOMO investing is alive and well among crypto investors. According to this study, published at the end of 2021, 55% of investors who currently owned Bitcoin, began investing within the previous 12 months when Bitcoin was at all-time highs with an average price over double what it is presently. So, even though Bitcoin’s long-term rate of return is impressive, the fact is that the average Bitcoin investor has been crushed.

Why I’m skeptical about Bitcoin

Like tulips, railways, and dot-com start-ups of years gone by, Bitcoin fever has been nothing if not contagious. In my hunt for the other side of the story, I have come across ten big reasons to remain skeptical of Bitcoin as an investment. Most of these apply to other cryptocurrencies too.

1. Bitcoin ownership is highly concentrated

One of Bitcoin’s primary value propositions is decentralization but its ownership is actually highly concentrated with 95% of Bitcoin being controlled by just 2.4% of the accounts.

2. Bitcoin mining (i.e. processing) is geographically concentrated

The processing of Bitcoin transactions, commonly referred to as “mining”, is also highly concentrated – although the location of that concentration can change rapidly. By September 2019, 75% of mining operations were located in China. Due to government crackdown, China’s mining operations are now about 20% while 49% are in the U.S. with Kazakhstan and Russia also having large operations. This concentration poses risks not just to investors but also to the environment.

3. Bitcoin is an environmental disaster

This is a big one. The verification of every single Bitcoin transaction is dependent upon solving ever more complicated math problems. This verification process is called “Proof of Work” and is baked into the design of Bitcoin. Bitcoin “miners” compete to solve these problems and certify the transaction. The fastest miner wins and receives a small amount of coin in return. As more people use Bitcoin, the complexity of the problems accelerates along with the environmental impact. To make matters worse, 99.99% of the computational work is thrown away since there can be only one winner. Bitcoin’s wasteful processing currently consumes as much energy as the country of Argentina (population 45 million) – an environmental nightmare on a global scale.

4. Massive price volatility

We all know crypto is volatile but how volatile? In 2011 Bitcoin lost 99% of its value in one day. From December 2017 to December 2018, Bitcoin lost 84% of its value. It’s common to have gains of 5 to 10 % in a single day but BTC volatility is higher than FX, gold or silver. Even after 13 years of public access, Bitcoin has failed to develop price stability. I believe this is because it lacks real utility and so remains primarily a means of speculation. Tulips anyone?

5. Bitcoin transactions are too slow and getting slower

Related to the computational burden inherent to Bitcoin is the fact that transactions are brutally slow – and getting slower as blocks are added to the chain and more people attempt to use it. The average transaction takes from ten minutes to two hours. Sometimes they can take 1 – 2 days. Currency must be fast and fluid to be functional in the modern world. Visa’s transactions per second (TPS) is between 1500 – 2000. Bitcoin’s TPS is about 5 – clearly not a candidate for widespread use. And with more users, the system would get slower, not faster.

6. Bitcoin transactions are expensive and lack price controls

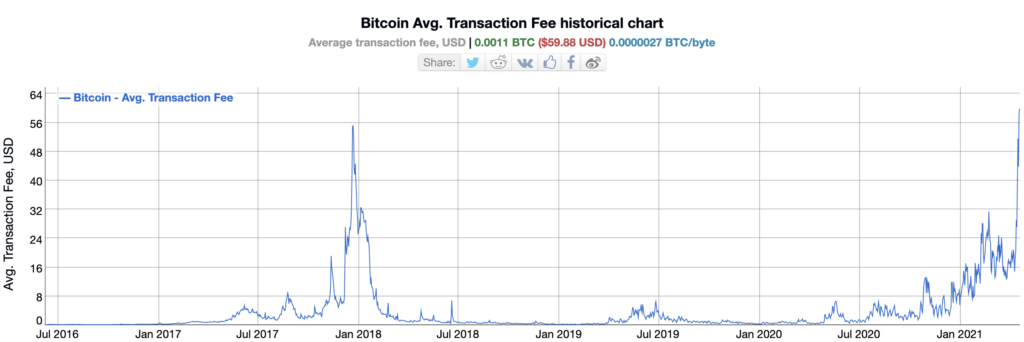

The cost of Bitcoin transactions depends on both the size of the transaction and congestion on the network. Miners, the ones who process transactions, preferentially select those with the highest fees attached. Thus, when there is a high load of transactions, supply and demand has driven the cost of those transactions up as the following chart shows. I fail to see how Bitcoin could become a common currency when this is built into the design.

7. Bitcoin lacks regulation and oversight – i.e. user protection

Perhaps the biggest argument in favour of cryptocurrencies is that blockchain technology allows transactions to take place without the need for oversight by commercial banks, central banks or governments. This populist narrative is appealing because the current system certainly has its problems (it is particularly appealing to Libertarians and criminals). But the current system also works, and it works largely because the existence of trusted third parties makes things like crime, ransomware, extralegal gambling, and sanctions evasion very difficult. Lack of oversight with cryptocurrencies means groups involved in such activities are using them more and more – a net negative for society.

8. Bitcoin is no longer an uncorrelated asset

In the early days, Bitcoin lacked correlation with equity markets, so you could at least make the argument for including it in your portfolio based on diversification. These days, however, Bitcoin and other cryptocurrencies are positively correlated with stocks and commodities. One less reason to add Bitcoin to my portfolio.

9. Poor user experience for Bitcoin holders

Using dollars is so easy we take it for granted. Using Bitcoin is hard. You need to choose a “wallet” – either “hot” which is online and vulnerable to hacking or “cold” which is offline and vulnerable to hardware failure. Then you need to be able to navigate crypto exchanges. Finally, since Bitcoin is not widely accepted as currency – and seems to lack the characteristics that would allow it to be – nearly 100% is exchanged for fiat currency, i.e. dollars. I’ve heard multiple financial industry insiders tell of their own time-consuming and frustrating experiences trying to use crypto and warn that unless you are willing to spend a significant amount of time and energy learning the systems, fraud and accidental loss are very real risks. And with cryptocurrencies, transactions are irreversible.

10. The biggest threat to Bitcoin: New, better cryptocurrencies

There are currently more than 19,000 cryptocurrencies and dozens of blockchain platforms in existence – and there is nothing to stop new ones from popping up. Bitcoin may be the first and most well-known but history is full of stories of first-to-market failures. Remember Atari, Palm Pilot, Netscape . . .? If cryptocurrencies have a role in the future, who knows which one(s) will gain widespread acceptance? Even if crypto is going to be part of our lives, it also seems likely that central banks will want to defend their territory and that might mean tough competition from superior central bank digital currencies (CBDCs).

The bottom line

It’s far from perfect, but the fact is that our current monetary system works. So, the real question is this: What problem does Bitcoin solve? Cut through all the hype and the best use-case scenario is that cryptocurrencies can exist independent of government regulation. But unregulated markets lead to widespread fraud and people getting hurt. When that happens, regulation becomes necessary. So the best use-case scenario is self-defeating. The Bitcoin snake is eating its own tail and I believe we’re starting to see this play out in the last few months.

Cryptocurrencies are early – painfully early. The potential for blockchain technology is real, but staking good money on a prediction of where this is going to lead seems foolhardy to me. It’s like hearing in 1983 about computers being able to talk to each other over long distances and predicting Amazon.

I would never criticize anyone for having a little play money in crypto – it’s fun to be involved in something so new and exciting. But it’s not for me, and I hope this article elucidates the reasons why.

If you are looking for a more detailed analysis of cryptocurrencies from the skeptics’ side of the aisle, I strongly recommend the writing of Stephen Diehl, and this article in particular.

If you’re a podcast lister and have some time, the guys at The Rational Reminder have put together an excellent series where they interview numerous experts on the subject of cryptocurrencies: Understanding Crypto. Their last interview with David Gerard was particularly good.

If the increasing complexity of the financial world is making you nervous, fear not. The most important factors in financial success are big simple concepts, as we discussed in the last post. Nevertheless, if you feel like you would benefit from unbiased, personalized financial advice, feel free to contact me about my one-on-one financial mentorship program.

Lastly, I wanted to let you know that Qtrade, a trusted affiliate of this site, has agreed to extend its offer of 50 Free Trades for DividendStrategy.ca readers. I’ve been using Qtrade for over ten years and think they are the best all-around investing platform out there. Access this promotion and give Qtrade a try by clicking HERE and entering code “50TRADESFREE”.

Thank you so much to those of you who have chosen to support me and this blog with your donations. You can support this site by clicking here. Every donation counts!

Good stuff, Matt.

I’ve thought of similar things, and you beat me to this type of post.

I cite the following, similar reasons:

1. The environmental waste is horrific. I don’t want to support that.

2. Poor utility – I can only own it for any potential gains, not spend anything really? Huh?

3. The evolution in this space is fast moving – hard to keep up – new entrants, new potential players, etc. How can you hit a moving target??

4. Very unpredictable pricing, capital gains, and supporting infrastructure seems fraught with hoops and challenges for retail investors. Too much time to navigate with too many risks. This makes no sense to me.

Good stuff my friend.

Mark

Great summary, Mark. Hopes for future uses aside, crypto’s current role is almost solely as a means of speculation. I feel for all those who piled in last year and fear that the worst is yet to come. It wouldn’t surprise me at all if Bitcoin dropped back under $1000 within the next five years.

Absolutely will not touch Bitcoin for all the reasons you mentioned and then some. Time will prove it to be an epic failure. Not for me!

Great summary Matt. I have been watching the Crypto story unfold and am amazed it has lasted this long. I have never been able to make any sense of it. Last time I looked there were 1500 Cryptocurrencies and now you are telling me it has grown to 19,000 +. Crazy! There isn’t any value in something that has no barrier to entry. I don’t know if people realized Crypto is just a computer file full of 1’s and 0’s. At least with a few ounces of gold could hold your door open or keep papers from blowing off your desk if no one wanted to buy it from you. 🙂

I can see there is money to made in Crypto if you are the creator of a new currency or you can buy low and sell to another at a higher price. Ponzi scheme quickly comes to mind.

I try to image how it is all going to end. I usually picture some messy ending with a lot of unfortunate stories. There will be a lot of regrets I am sure. I am also well aware that some of the Crypto investors and related companies will have borrowed money from some of the banks I own shares in and so I suspect we will all bare some of the pain. 🙁 The end of the story is yet to come. I can’t image we get to 100,000 Cryptocurrenies in existence and still have the same level of interest that exists today.

Thank you, what a good article! Would you be interested in republishing this in invrs? You can link it to your website and perhaps get more followers? I think it’s valuable information and people on our platform will appreciate it. We’re trying to help people improve their financial outcomes with good data and information.

I’m keeping all my money in Tulip bulbs; the price has to recover one day, hasn’t it!

Excellent post. Thanks

Ha ha – totally!

I read this yesterday…very well researched, and thoughtfully presented. I am not a Bitcoin or crypto currency investor. I was tempted by a blockchain ETF (with a very small sum) a couple of years ago. I have since sold it, taken my lumps and put the money to better use in a quality dividend grower. I hope this article reaches the folks who may be tempted to purchase – and to at least be aware of what they are getting into. As you said, perhaps a little play money if your situation allows, but this certainly does not seem like a viable, long term investment plan. Thank you!