I have a confession to make. I look for reasons not to be a dividend investor. It’s true. There is no law of the universe stating that dividend investing will outperform forever, so a little self-doubt keeps me in check. There are a lot of investment strategies out there, a lot of smart people doing things differently from other smart people. I take all investment claims, including those about dividend investing, with a high degree of skepticism because, as they say, the grass is always greener on the side that’s fertilized with bullshit. Besides, you have to have a little humility when you’re plodding along with more or less the same basket of big boring dividend-payers year after year.

So, I look for weaknesses in the strategy. I consider the criticisms, analyze them, and determine whether or not a change is warranted.

How do rising interest rates affect dividend paying stocks?

One criticism that is leveled at dividend investing decade after decade is the risk of rising interest rates. I’m simplifying here, but theoretically, there are two big ways that rising interest rates could negatively impact dividend paying stocks.

- Rising interest rates make debt more expensive. For dividend paying companies that are shouldering high debt loads, the higher cost of capital can have a negative effect on profits and cashflow.

- Rising interest rates create yield competition. High fixed income interest rates can seduce investors away from dividend paying stocks.

But there are lots of things that sound good in theory, yet fall apart in the real world. Given that interest rates are at record lows and, presumably, will go up at some point, I had three questions:

- How do dividend paying stocks in general perform in rising interest rate environments?

- How has the BTSX portfolio performed in rising interest rate environments?

- And, most importantly: Is there a practical way to use this information as a DIY investor?

Let’s look at these questions one by one.

How do dividend paying stocks perform in rising interest rate environments?

The short answer is: quite well, actually.

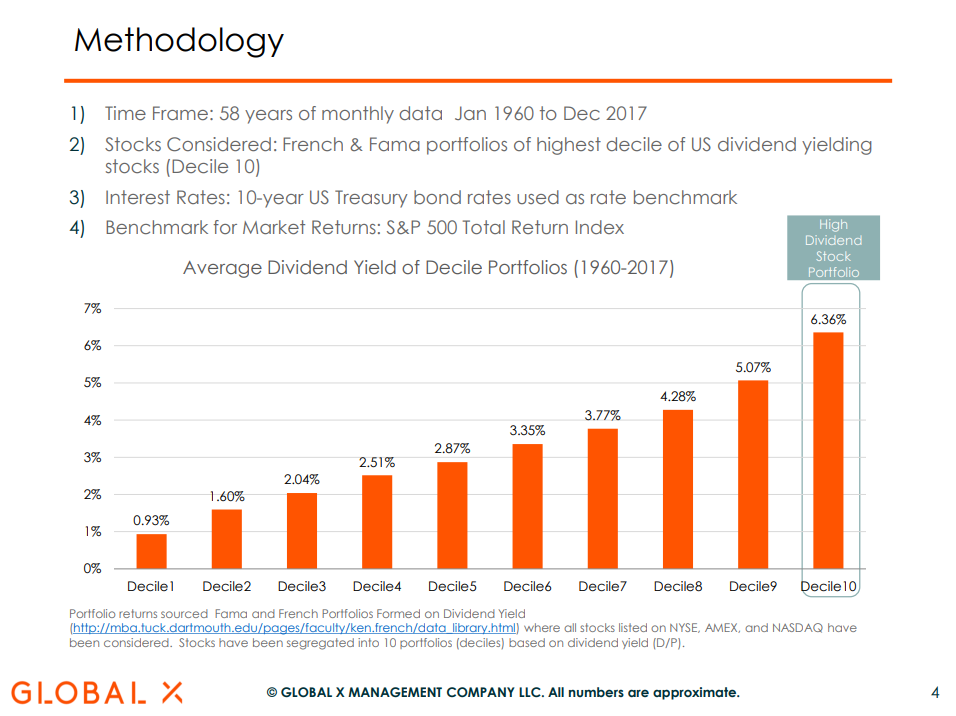

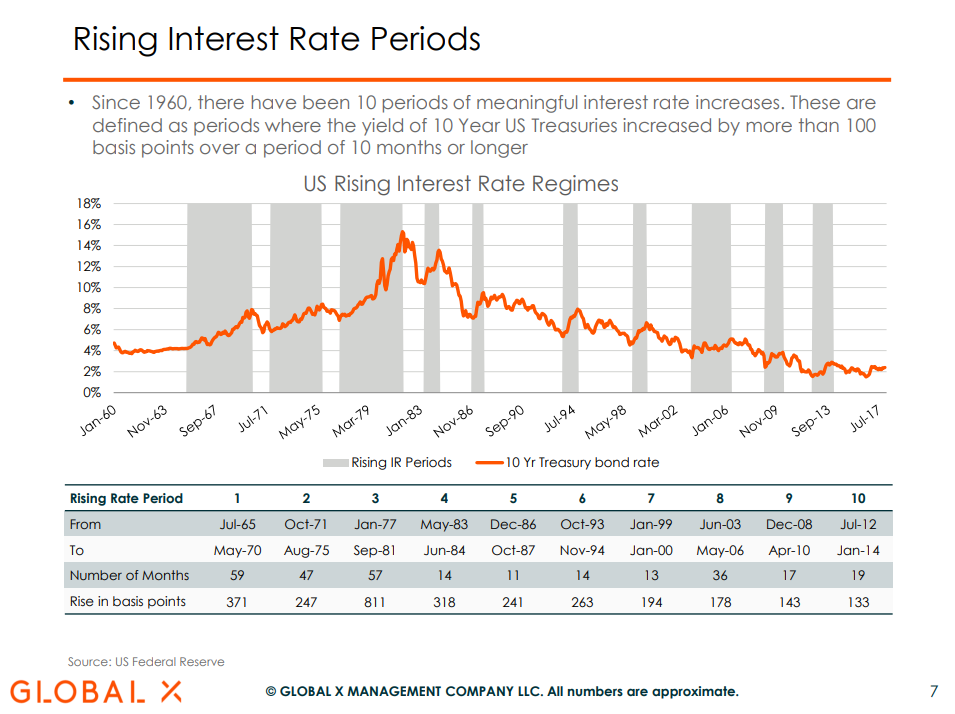

In 2018, Global X Management Company published a paper analyzing the last 58 years of data comparing the performance of high-yielding stocks to the S&P 500.

They identified ten periods of rising interest rates in the preceding 58 years.

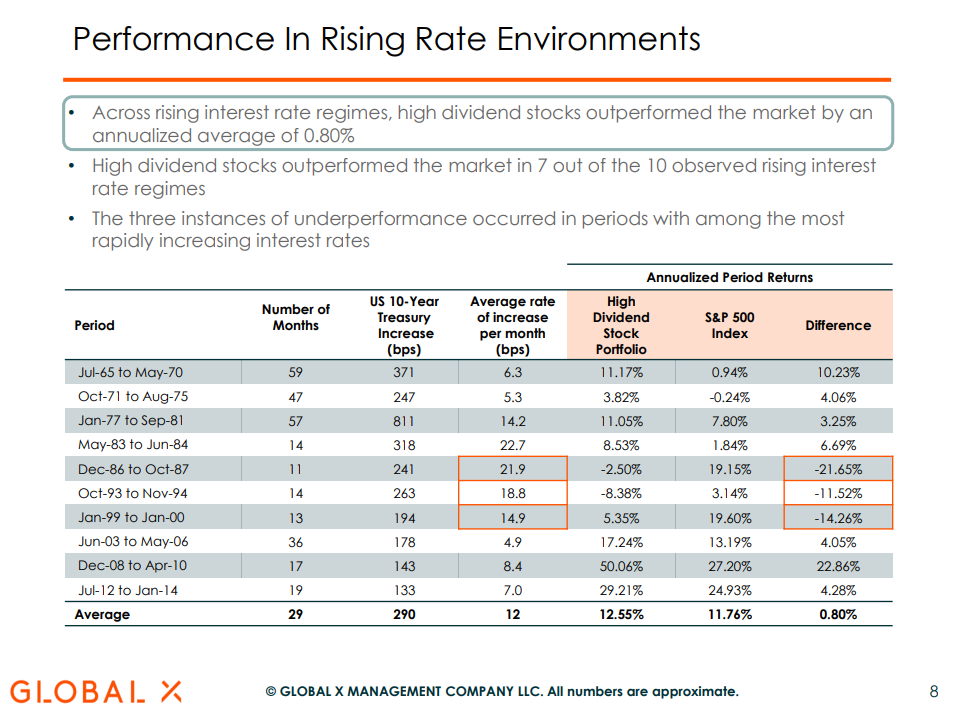

By focusing on the highest yielding stocks of the S&P 500, one might expect the companies to be particularly vulnerable to rising interest rate environments. Instead, the investigators found that in seven out of the ten rising interest rate periods, high yielding stocks outperformed the benchmark.

Of note, however, when they under-performed, they did so fairly significantly. Still, on average, high yielding stocks outperformed the benchmark S&P 500 by 0.8% during periods of rising rates. And the total return for these stocks bested the S&P 500 by an average of 3% per year over the 58 year period.

Dividend growth vs yield

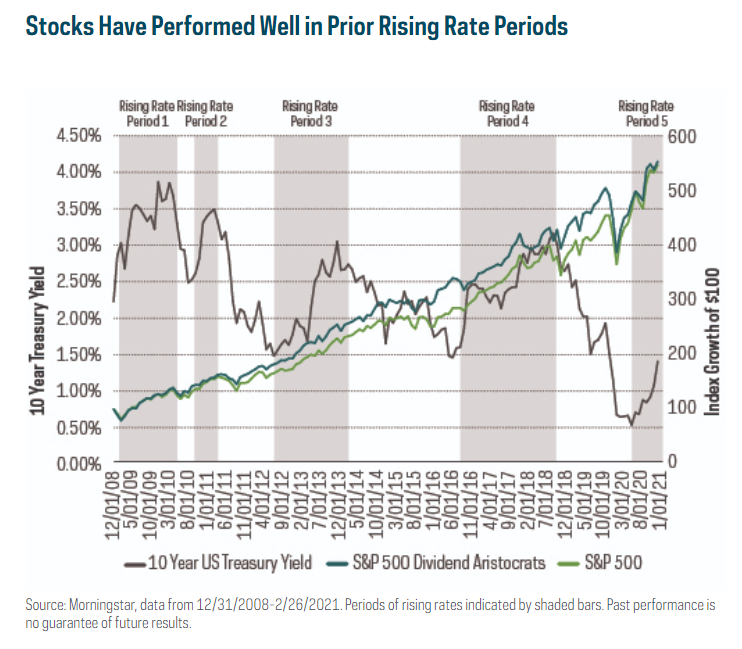

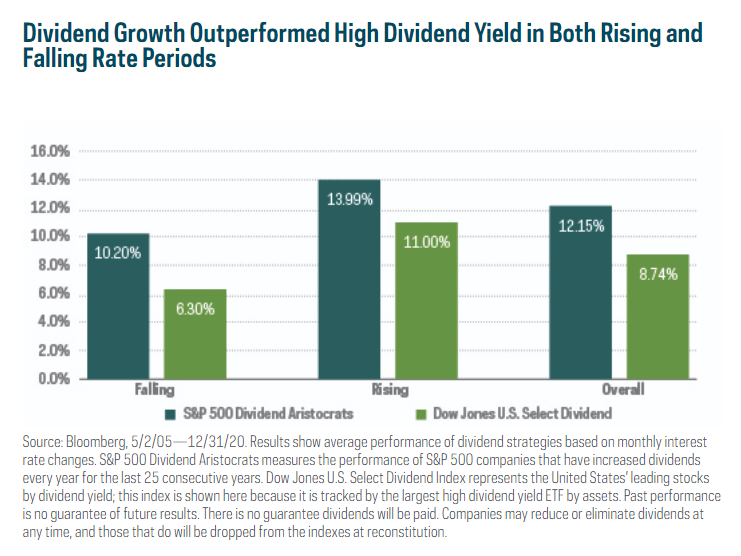

More recently, ProShare Advisors took a closer look at the last 15 years of market data, challenging the assertion that rising interest rate environments are bad for stocks in general and dividend stocks in particular. They found that dividend paying stocks and, in particular, dividend growers were resilient in the face of rising interest rates.

In this period, however, it is interesting that dividend growth stocks outshone high yielding stocks during both rising and falling rate environments.

Based on this data, we can see that the advantage of dividend paying stocks over non-dividend payers is durable even in rising rate environments most of the time. Companies with a long history of stable dividend growth, so called Dividend Aristocrats, have performed even better.

What about our current situation? There are plenty of reasons to believe that rock bottom interest rates will be here for a long time, but even if they do begin to rise, the huge yield advantage we enjoy with Canadian dividend-paying stocks, plus historical evidence suggesting their resilience leaves dividend investors with little reason to change tactics.

But we can do even better by analyzing the BTSX data specifically.

How has the BTSX portfolio performed in rising interest rate environments?

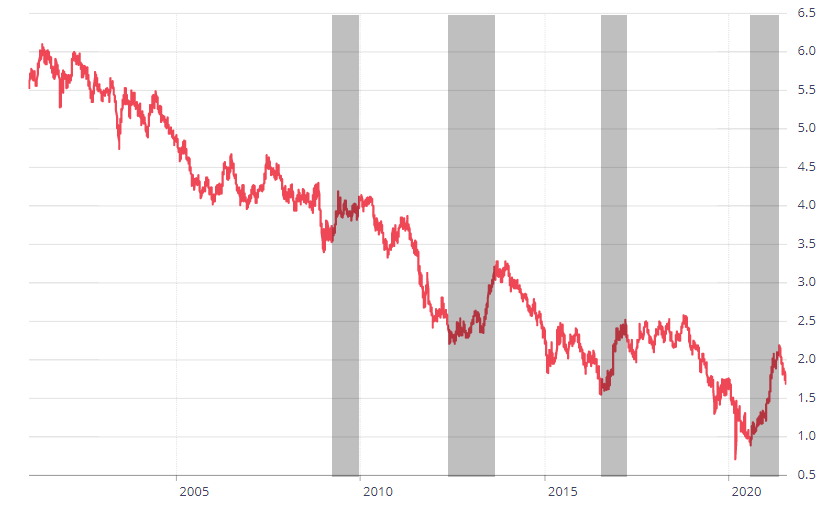

To assess the performance of the BTSX strategy, I first looked at the last 20 years of Bank of Canada 10-year bond rates. As you can see, the overall trend has been one of decreasing rates, with a few exceptions that I have indicated below.

How did BTSX perform during these periods of rising interest rates?

| Period | TSX60 | BTSX | Difference |

| 2009 | 30.2% | 42.9% | +12.7% |

| 2012-2013 | 10.1% | 18.4% | +8.3% |

| 2016 | 21.0% | 25.4% | +4.4% |

| 2021 (mid year update) | 18.6% | 30.7% | +12.1% |

As you can see, the results are quite reassuring. There hasn’t been any reason to abandon a BTSX-based strategy due to concerns about interest rate increases, at least over the last 20 years. (To be fair, the larger trend has been declining interest rates, but the 58 year data from Global X above addresses those concerns quite well, in my opinion.)

Now, on to the most important question:

Is there a practical way to use this information as a DIY investor?

The bottom line is that, based on the evidence, long haul dividend investors need not be concerned with interest rates. A dividend-based investment strategy, especially one that focuses on both yield and growth has outperformed the benchmark index in both rising and falling interest rate environments.

But this data should be a reminder that no investment strategy is bullet-proof. If a company has a high debt level, a high payout ratio, and limited ability to grow profits, their dividends and share price may be at risk. On the other hand, banks and insurance companies, of which Canada has some superstars, tend to do quite well in rising rate environments.

The take-home message here is that companies that have shown an ability to pay healthy growing dividends over various interest rate environments deserve consideration by DIY investors.

Interest rates are unpredictable

But, in spite of all this, if you are still thinking rising interest rates might justify a change in investment strategy, you are now confronted with an even bigger challenge: how do you do that successfully? Because knowing where rates are is not enough; to profit from the assertion that rising rates are bad for dividend stocks, you also have to know where they’re going to go.

Looking at chart after chart of historical interest rates (Figures 2, 4, and 6 are examples) while researching for this post, has taught me a very powerful lesson: interest rates are unpredictable. They go up, down, and sideways in strange and surprising ways, just like the stock market does. I don’t try to time the market, and I won’t try to time interest rates.

And that suits me just fine. As far as I’m concerned, this is one more piece of evidence that the best investment plan is the one where I do less, not more. I’m quite happy to collect our dividends and focus on more important things like family, friends, and long overdue backyard BBQs.

If you are beginning your investing journey, please make use of the free content on this site and grow your portfolio. If you have achieved financial independence and have a few dollars to spare, I hope you will consider supporting DividendStrategy.ca. I’m not trying to get rich . . . 20% of donations are given to Doctors Without Borders. Thank you!

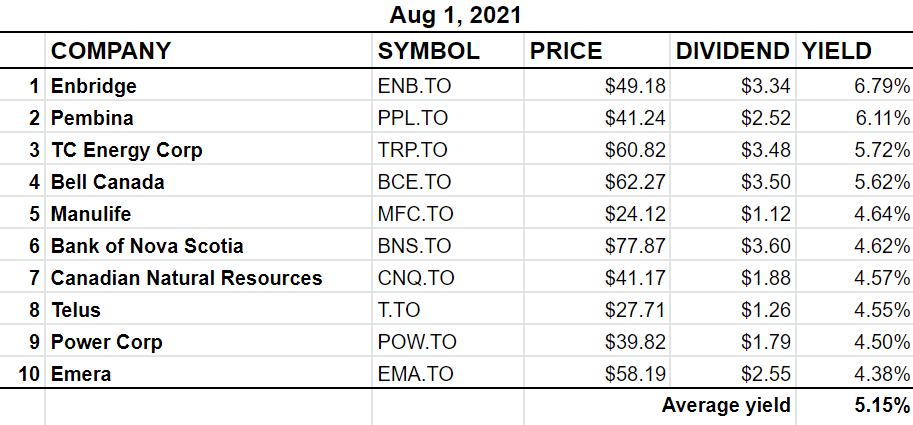

BTSX portfolio update August 2021

another great post Matt keep it up you are such a valuable resource

Thanks, Benj. I appreciate the feedback.

Always thought provoking posts Matt. Always look forward to your latest teachings.

CT

Pingback: Weekend Reading – Taxable investing and superficial loss rule edition - My Own Advisor

An interesting collection of stocks is in the list of stocks in the Canadian Dividend Aristocrats, there are many stocks in this list and to get on the list, the stock must meet certain dividend and other requirements.

Link: https://www.stocktrades.ca/canadian-dividend-aristocrats-list/

Another list of stocks to pluck from for in evaluating stock options.

The ETF CDZ tracks the Canadian Dividend Aristocrats stocks.

Al

Do you worry about re-investing dividends back into the same stock or another stock when you have to purchase that stock and near high 52 week prices?

Hi David – Good question. Some research shows that buying near 52 week highs leads to better returns, other research shows the opposite. My takeaway is that it probably doesn’t matter very much, especially if you are a long term buy and hold investor. Being close to a current 52 week high won’t matter 10, 20, 30 years from now. And there are big risks – playing around with things like this opens a big smelly can of worms. How far below the 52 week high should the stock price be? Are you watching daily? Weekly? How long are you going to wait? Timing the market, which is what we’re talking about, is a minefield. I’ve learned (the hard way) not to do it.

This post is about rules-based investing: https://dividendstrategy.ca/method-vs-madness-the-benefits-of-rules-based-investing/

would you ever consider getting blackrock ishares to put your btsx on line as an etf? as we get older less work is better. or is their a way we can load these stks into an avg daily or weekly price to plot a chart with without a manual spreadsheet? or does an etf already exist that weights the top 10 tsx60 like you do?thanks