You’ve seen the evidence that dividend-paying stocks outperform non-dividend paying stocks. You want to take control of your financial future and invest your own money. The brokerage account is open, your cash is there, and you’re ready to build a dividend-paying portfolio that will carry you through the good times and the bad. But there’s a problem – should you invest for dividend yield or dividend growth?

Even though much of this blog centers around the Beating the TSX method, which is based on dividend yield, many investors believe that dividend growth is a better way to choose investments. Is there room for both? I think it’s useful to examine our own biases, to listen carefully to dissenting opinions, and have the courage and humility to acknowledge the merits and weaknesses of our positions. As you will see, the debate between dividend yield and dividend growth rate is fertile ground to grow our financial wisdom.

Rearview mirror investing

Two investors want to add a new dividend-paying stock to their portfolios. Investor A suggests that BCE would be a great choice.

“BCE has a dividend yield of 6%, and it’s been paying dividends for over 20 years!”

Investor B replies, “Yeah, but the dividend growth rate for BCE has only averaged 5% over the last 13 years. I think CNR is a better investment. The yield is only 1.6%, but the dividend growth rate over the last 13 years has been 15%!”

So, who’s right? By the end of this post, you will be in a better position to decide for yourself whether you side with Investor A or Investor B. For now I want to point out something more fundamental: dividend investors place a high value on the historical behaviour of the businesses they invest in. This doesn’t mean we think past performance is always indicative of future performance. But, when it comes to dividends, we make inferences about a company’s future dividend payments and growth rate based on what they have done in the past.

Most of the time this is reasonable because dividend-paying companies have a vested interest in keeping their investors happy. On the other hand, it is important for investors to realize that both yield and dividend growth rate are based on past payments, and may not reflect what will happen in the future.

Investing for dividend yield

Beating the TSX is a stock selection method that is based on high dividend yield. Yield is calculated by dividing the annual dividend payments by the stock price.

Thus, yield goes up when dividends go up; but it also goes up when stock price declines. As such, some stocks have high yields (eg. >7%) because they have paid healthy dividends in the past (say, in the 4-6% range), but now investors are concerned about the business, pushing the stock price lower; dividend payments may be unchanged, but yield, as a percentage, increases.

What this means for investors who choose stocks based primarily on yield is that they are also de facto value investors. Lower price = higher value. As long as those companies have the ability to recover, and your time horizon is long enough to see that through, these high-yielding companies can be great investments. The fact that BTSX stocks have an average total return of 11.4% over the last thirty years is largely due to this value factor.

Disadvantages of investing for dividend yield

There are two main challenges for the investor when focusing on yield. If the yield is unusually high due to stock price decline, one must try to determine if the business is fundamentally at risk. When it comes to blue chip dividend-paying companies, stock prices are often driven down because of temporary headwinds, while the underlying business model and management remain strong. On the other hand, if there are serious concerns about the viability of the business, long term investors might want to steer clear.

The second question to ask is whether or not the dividend is safe. Remember, dividend yield is based on what has happened in the past. Management can change their dividend policies with a single meeting. This happened with IPL in 2020; not only was the dividend cut by 72%, but the stock price declined by a similar percentage – and it still hasn’t recovered.

In fact, in preparation for this post, I looked at the last ten years of BTSX data and found that there have only been six instances (out of 100) when BTSX companies have cut their dividends. These were always stocks with very high yields (at the top of the list), and usually without long histories of consistent dividend payments. I think there’s a lesson to be learned from this.

How to judge the safety of dividends

There are various ways that investors can judge the safety of dividends: dividend history, payout ratios, cash flow, etc. It’s important to remember that companies need investors and some work hard to establish a reputation for consistent dividend payments in order to keep investors happy (and invested). But dividend cuts are always possible and are often accompanied by precipitous price declines – a double whammy for dividend investors.

In spite of these risks, historically, higher yielding dividend stocks have outperformed lower yielding stocks. This is especially true when selecting from blue chip stocks (as BTSX does from the TSX 60 index) because the companies tend to be large and established, thus somewhat mitigating the risk of business failure and/or dividend cuts. More on this shortly.

Investing for dividend growth

Rather than focusing on dividend yield, some dividend investors make their investment decisions based on dividend growth rate. They are willing to accept lower dividend payments if the company has shown a dedication to consistently raising those payments over time. Tom Connolly, who I have interviewed for this blog, and Henry Mah, are two well-known Canadian dividend investors who subscribe to this model.

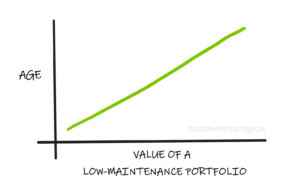

Even though historical dividend increases don’t necessarily reflect what will happen going forward, both Tom and Henry have written about a reliable phenomenon: over time, stock prices rise as dividends rise. This is why the yield of quality dividend paying stocks stays relatively constant over time.

Dividend growth drives capital appreciation

Companies that raise their dividends over time also reward shareholders with capital appreciation. This makes sense when we remember that the present value of any investment is simply the discounted value of the future income it will provide. In contrast to the value factor that dividend yield investors implicitly take advantage of, the capital appreciation that dividend growth investors enjoy tends to be more gradual and is due to another factor: quality. Dividend growth reflects earnings growth – a sign of a healthy business.

But there is another advantage to investing for dividend growth that is particularly appealing to retirees: For those investors who want to live off their dividend income, a growing income stream in the form of rising dividends is fantastic protection against inflation and a safeguard against being forced to sell stock in down markets.

Disadvantages of investing for dividend growth

The first potential disadvantage of dividend growth investing is analogous to the fact that dividend yields are not guaranteed; similarly, dividend growth is not guaranteed. Just because CNR’s dividend growth rate has averaged 15% over the last 13 years doesn’t mean it will continue at that rate. Does the company have the capacity to increase earnings in line with their dividend growth rate?

Secondly, even in the context of high dividend growth, a low current yield may be the result of an inflated stock price – i.e. poor value.

Lastly, if one is looking to retire solely on their portfolio’s dividend income, lower dividend yields now may mean a larger amount of capital is needed before one is able to stop working. It can take a very long time (decades) for a low-yielding dividend grower to match the fat payments of a stable high-yield stock.

Yield vs growth: who is the winner?

As with almost everything in investing, there is no winner or loser here. Depending on what stage you’re at with investing and whether you place greater importance on value vs quality, you will gravitate toward yield or growth. I was unable to find any evidence showing one to provide superior returns over the other. Both approaches are valid.

The truth is that most dividend investors I know pay attention to both yield and growth, and find their own sweet spot. Most of us have “chased yield” at some point and were burned, learning the painful lesson that very high yields can be risky. On the other hand, even if a company has a history of generous dividend raises, if the yield is too low (~1%), it may not generate the income we require.

How do I invest?

When I started dividend investing, I followed BTSX religiously – and there’s no problem with that; the performance history speaks for itself. But over time, my investing style has evolved to be more wary of companies whose dividends appear to be at risk, and to look beyond the BTSX list for companies with slightly lower yields but stronger dividend growth histories.

Nassim Nicholas Taleb (of ‘The Black Swan’ fame) is fond of saying, “Don’t tell me what you think, tell me what you have in your portfolio.”

In this spirit, I will tell you that I never bought the highest yielding stock on the TSX60, BPY-UN, because I didn’t think the dividend was sustainable (they are now going private). I also don’t own SJR-B because they haven’t raised their dividend for six years.

I do own a handful of companies that have lower yields, but higher dividend growth rates like Magna (MG.TO) with a 10 year dividend growth rate of 23% and Canadian Tire (CTC-A.TO) with a 10 year dividend growth rate of 19%. The other advantage this confers to our portfolio is exposure to sectors that are not well represented by BTSX stocks. This is my sweet spot.

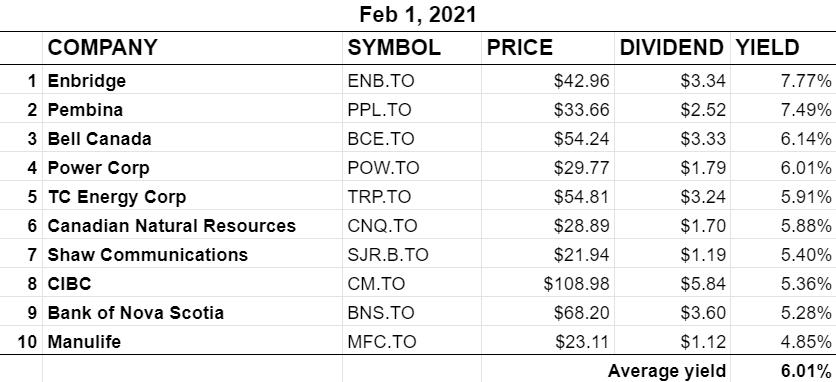

BTSX portfolio update for February 2021

As usual, I will close out this blog post with the current BTSX list:

It takes time and real money to maintain this site. If you find this information useful, please consider donating to keep DividendStrategy.ca ad-free. Thank you! (I’m not trying to get rich . . . 20% of donations are given to charity)

Matt, You are the best. So far it is working.

Leslie Dobos

Thanks Leslie

“I also don’t own SJR-B because they haven’t raised their dividend for six years”. Agreed.

But it appears in the BTSX list.

Perhaps it’s time to adjust the parameters for inclusion in the list ?

We are all free to use the list as we see fit, but it’s important that the BTSX method remains clean and consistent. “Perhaps it’s time to adjust the parameters for inclusion in the list ?” – is a common comment on this blog. I hope reading the following post will provide a satisfying explanation for why I will not be adjusting the inclusion criteria:

https://dividendstrategy.ca/method-vs-madness-the-benefits-of-rules-based-investing/

Exactly right. I owned Shaw for a brief time years back but price keeps depreciating while the Shaw family exectuives continue to overcompensate themselves at ridiculously generous levels. Stick with a Telus as superior option (and their superbly better customer service for consumers).

Hi,

I stable upon your blog, and it’s fantastic, and so simple. I only have a question, at the end of the year, do you sell the stocks that don’t make it to the top 10? Or every end of the year you just sell all the stocks, and buy the new top 10 next year? How’s that work? Thank you for your time and efforts in putting this together!

Hi Gus AR, I think you will find this post helpful:

https://dividendstrategy.ca/how-to-use-btsx-in-real-life/

Thank you for the article! I appreciate it.

Unfortunately CNR only increased their dividend by 7% Jan 26th (same percentage increase as last year). I own shares but not great for a company that normally gives a yield of only around 1.5%. I own a few other Canadian low yield equities, but the majority of our dividend growth stocks in the taxable account are much the same as in globeinvestor John Heinzl’s model portfolio (minus the REIT’s).

For Telecom I only own BCE and Telus. Shaw Communications I sold after no dividend increases for a few years, and I’m now looking for an excuse to dump Rogers for the same reason. I hang on to companies that seem to be shareholder friendly.

I quite often check the “current BTSX” to look for any dividend growth bargains and read whatever is posted here, so keep up the great work.

Fair assessment of those companies, DividendsOn. There are always lots of dividend-growers on the BTSX list – banks, telecoms, utilities . . . And when they are there, it often means we’re getting relatively good value too.

Thanks for stopping by.

Very similar to what I did. We had CNR for a long time in the accumulation years but then sold it when we got close to retirement. It was a good trade to get something that paid more dividends. Also sold Shaw and am sticking with BCE and Telus.

For me, it also depends on the different phases in our life and the change in the size of the portfolio.

I began with the goal to live off dividends once we retire. So both dividend yield and dividend growth are pretty important as dividend yield will provide for daily expenses and dividend growth will provide protection for buying power with inflation. But I don’t need to have a dividend growth of 15% to achieve that, probably 3-5% will be good enough. For this reason, I have both low yield high growth dividend stocks and high yield low growth dividend stocks in my portfolio. I try to put lod yield high growth dividend stocks in my taxable accounts for now as dividends will be tax leaking there. Once my investment income becomes enough for my projected expenses, I will tilt even more to low yield high growth dividend stocks.

These might be some ignorant questions (since I just moved to Canada), but what platform do you use to trade? Do you trade from within your TFSA funds or outside? I am about to start my TFSA investing journey with RBC but it isn’t clear to me that I can pick and choose specific companies to invest in (I see mutual funds, GICs, your ordinary saving account).

Hi Kaye, I use QTrade, but there are other discount brokerages that are also good.

One of the advantages of investing with one of the big banks like RBC is that you should be able to talk to someone about the accounts they offer. This might be very beneficial if you are less familiar with Canadian investment options. I don’t advertise this because I have aspirations to make a dividendstrategy youtube account, but I made a video on my personal channel a few years ago called “Canadian investment accounts explained in ten minutes” – you might find it helpful:

https://www.youtube.com/watch?v=6B6UkD3inaA&t=6s&ab_channel=MattPoyner

Best of luck.

Pingback: Dividend investing and interest rate uncertainty —

Pingback: Canadian dividend investors got a raise in 2021 (+ a history of BTSX dividend hikes and cuts) — DividendStrategy.ca

Pingback: How to use BTSX in real life — DividendStrategy.ca