Being a self-directed investor has enormous advantages: more control, less complexity, and often higher net returns, to name a few. But there are also risks and one of the big ones is age. How might the aging DIY investor design his/her portfolio so that it is simple enough to remain self-directed, but durable enough to provide the necessary income for life? In my experience, very few bloggers have addressed this topic, so I’m honoured to have David Stanley, the originator of Beating the TSX, back on the blog to tell us about one potential solution – what he calls a “Perpetual Portfolio”.

I want to consider a big problem that all investors will face if we live long enough: the problem of what to do with our investment portfolio in our old age.

If we haven’t outlived our money and if we have followed the precepts advocated in this blog, we will have a portfolio of common stocks that have grown both in value and in dividends over the years. It seems probable that at some point the majority of us will have been ground down enough by our time on this earth that our ability to make the necessary decisions required to prudently control our own finances will be diminished or lost. What to do?

I have discussed with you previously some things we can do to handle this, e.g., hand our financial matters over to a fiduciary, solicit the help of a trusted family member or friend, distribute the assets to our heirs prior to death, etc. But is there another way?

Suppose we could convert all our financial assets into a single perpetual portfolio that would continue to spin out the cash needed for our living expenses but require no human intervention, or at least no professional financial intervention other than what could be provided by a competent tax accountant.

Characteristics of a Perpetual Portfolio

Let’s spend a little time exploring the feasibility of a perpetual portfolio. I think the criteria would have to include:

- A range of investment classes

- Assurance of sufficient distributions to meet our requirements

- A reasonable price and low risk.

That sounds to me like it could be a job for group of low-cost index ETFs.

Part 1 of the Perpetual Portfolio: ETFs

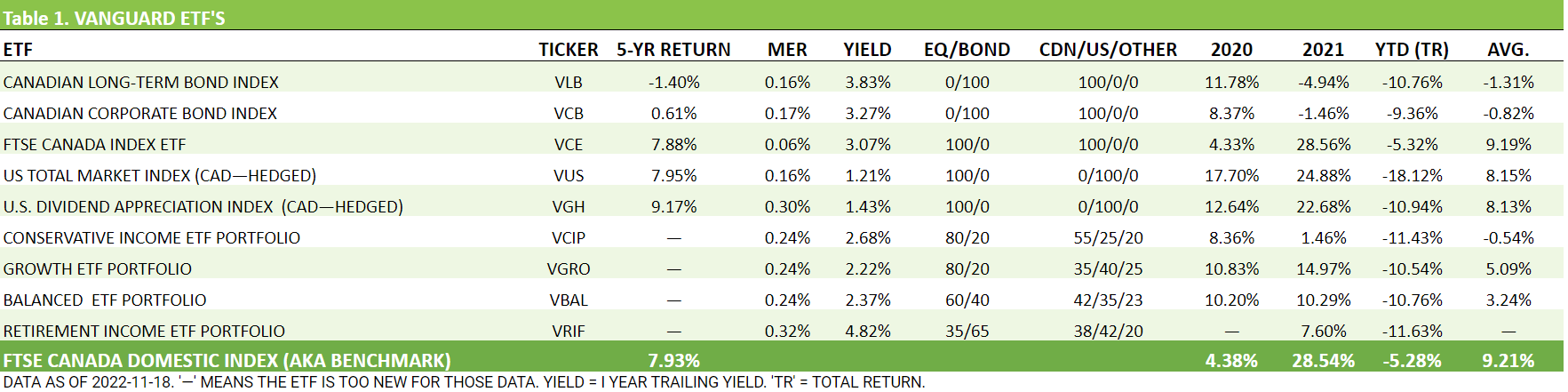

Let’s see what we can find that might fulfill our needs. I have decided to just look in the Vanguard family of funds, but this is only because I am familiar with them from my own investments, and it should not be considered as either an endorsement or an attempt to preclude other fund families that might be able to do a better job at a lower cost.

Table 1 below provides data for nine Vanguard ETF’s as of November 18, 2022. These ETF’s vary as to their bond/equity ratio and the country in which the index is domiciled, but all are denominated in CAD. It is important to note that all them are true index funds. They may be amalgams of different indexes but they are still inherently passive in nature.

When we examine these data it seems that the best returns over this short period come from simply holding the Canadian stock index (VCE), but we must remember that bonds, especially diversified government bonds, add stability and safety to stock portfolios even though their returns are not as high. Also, stock and bond returns have low correlation historically, i.e., when stocks go up bonds tend to go down and vice versa.

Thus, a balanced portfolio should allow us to participate in the stock market’s gain without taking on too much risk. The traditional allocation of a blended portfolio has been in the neighbourhood of 60% stocks and 40% bonds (VBAL). Our limited performance data point to an 80/20 split (VGRO), but I doubt if the difference between these two would be significant over longer time periods.

I should point out in passing that both these ETFs contain about 25% of non-North American equities and bonds providing even more diversification. So, it seems that when thinking about returns, safety, and cost these two ETFs should be considered.

Income matters

But, there is another very important factor we need to look at and that is yield or payout. Will 2.2-2.4% be enough to fund what remains of your retirement? If not, we need to continue planning.

Related: Read about why most retirees are reluctant to sell assets for income

We can get a higher yield by increasing the bond component of the ETF. Thus, VRIF offers a tempting 4.8% but these are unusual times and whether this trend will hold or not is unknown. Higher yields on shorter-duration bonds have flattened the yield curve, which often denotes uncertainty ahead for financial markets.

For me, I would need something closer to 4% return to be confident going into the future, remembering that at any time I or my mate might have to enter a long-term care home for an unknown period of time. In Ontario costs for these facilities are often over $20,000 per year and rising. Yes, one can obtain ‘Long-Term Care Insurance’ but it is very expensive. The future is filled with unknowns for seniors, and having sufficient savings can make a real difference in our quality of life.

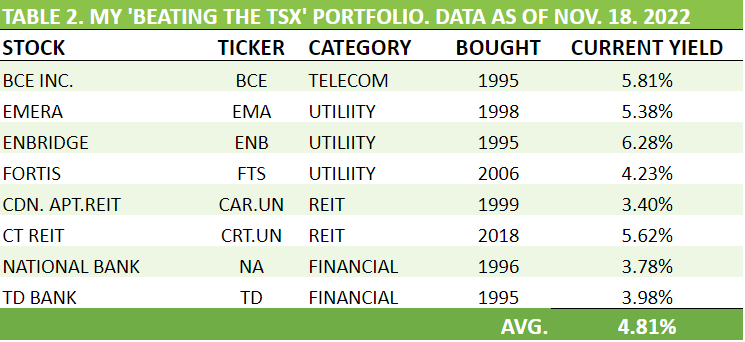

Part 2 of the Perpetual Portfolio: BTSX stocks

How can we achieve a higher payout from our investments going forward? I have decided that rather than convert my entire portfolio into to VGRO/VBAL units I am going to retain the foundations of my ‘Beating The TSX’ TURF portfolio. This is shown in Table 2.

These 8 stocks, most of which I have held for close to 30 years, are to me the epitome of Canadian blue chip companies (yes, the REITs may be an exception but I hold them for diversification and safety). The high dividends (weighted average yield over 5%) from these stocks should help boost my overall return significantly.

And there is another reason to hold onto these stocks. If I were to liquidate them in order to purchase ETFs I would be facing a very large capital gains tax bill. I’m sure you know that in Canada when we sell an investment at a profit, 50% of the total capital gain is taxable at our marginal tax rate. As you might imagine, selling stocks like those in Table 2 after they have compounded for such a long time would make the folks at Revenue Canada ecstatic.

Part 3 of the Perpetual Portfolio: Preferred Stocks

I have one more thought to increase the payout from my ETF portfolio. Currently I own a portfolio of 10 perpetual and rate reset preferred stocks that I started putting together about 15 years ago. They average a yield of close to 7% and I use them as bond proxies. In my opinion they are a safe substitute; also, they pay dividends instead of interest, meaning higher after-tax returns in a taxable account. I would keep these preferred shares since in a rising rate environment the rate resets will only increase in yield.

Final Thoughts

Thus, if I wound up with a portfolio consisting of equal parts of VGRO, VBAL, my BTSX stocks, and my preferred stocks, they would provide me with a yield of a little more than 4% with room for increases, the safety of wide diversification at a reasonable cost, and an autopilot function to ensure peace of mind. Note that neither the BTSX or preferred portfolios need day-to-day supervision.

But what about our RRIF and TFSA accounts? Some seniors will have active RRIF accounts when they hand over the reins while others will not since the mandated withdrawals are age-related. All should have a TFSA account. The investments we have identified here are suitable for either vehicle.

So, how would we set up these accounts? One way could be to utilize a low-cost on-line brokerage. While you would be the owner of record it would important to have someone else who could act if you were to become incapacitated. Obviously, this person must be worthy of your trust and be capable of acting in a fiduciary manner. I would suggest that all these set-up items be dealt with as soon as your decision has been made so that the process can be tested and any alterations implemented while you are still in good health.

There you have it, a first attempt at trying to provide a feasible approach to dealing with your investments when you no longer want to or can’t. Let me know what you think in the comments.

Matt here . . . I just wanted to send out a huge thank you to David Stanley and others who support this site. Your donations are enormously appreciated and go a long way toward keeping this site free. In particular, I wanted to recognize DividendStrategy.ca’s most recent top supporters – thank you!

If you would like to support this site, click here:

In the fall 1984 issue of “The Journal Of Portfolio Management” Robert Kirby proposed something similar. He called it “The Coffee Can Portfolio”. Look around the internet and it should be easy enough to find a free copy.

Moving back to the present my wife and I in our early 70’s and are both dinks, and there’s nobody we can rely or trust regarding our investments. Still in decent health and we both help each other as best we can through life. Do some daily exercise and try to eat healthy.

I keep investments relatively simple.

One indexed global portfolio ETF in each of the TFSA’s and RRIF’s. That’s about it for the registered. We’re lucky in that we can still add the maximum contribution allowed to the TFSA’s each year. The only withdrawals necessary are the government mandated one’s from the RRIF’s.

As for the non-registered portfolio it’s invested in over thirty all-Canadian dividend common stocks allocated across seven sectors. Since I always keep in mind the coffee portfolio mentioned above, I tend to rarely sell. Any dividends received along with savings acquired just get re-invested into any lagging sector to buy more shares and receive more dividends each year. My easy way of fighting back on inflation as best I can with a minor form of value investing thrown in.

I find investing more fun and rewarding in any kind of market by keeping it easy and simple. There will always be the minor disappointments of course, but I just shrug it off and move forward with our plan. No debt since the mortgage was paid off over twenty years now, so no worries there. Oh yeah, and don’t forget to keep a cash emergency fund. That can come in handy in the event of unexpected high expenses without having to sell off part of your portfolio.

I was interested in the Coffee Can portfolio that was mentioned. I did take a look on the web and found <https://www.stockbasket.com/investmans-playbook/coffee-can-portfolio>:that “the idea rolls back to the Old West America when people would put all of their valuable possessions in a coffee can under the mattress and not really touch them for a long time before the ubiquitous banking system was established.” Thus, it is basically a ‘buy-and-forget’ approach. The problem rests with how the stocks are selected. Beyond the well-worn adages such as ‘pick the industry leaders’, ‘keep it diversified to lower your risk’, stock selection is left totally in the hands of the investor. BTSX investors know how dangerous such an approach can be and how advantageous a passive method has proved over the years.

Hello Matt,

I like your approach to this problem but I do not know anything about prefered stocks. Would you have some examples of prefered stocks that you own?

Thanks in advance.

Thanks for your question; it is an important one. I should say at the beginning that I had professional help in selecting my preferred shares. This is because it is a murky category of financial assets and difficult to understand completely. I could spend a lot of time on this subject but instead I’m going to suggest to you (and others) the following introduction to the topic: https://ca.rbcwealthmanagement.com/documents/1435520/1946761/A+guide+to+preferred+shares.pdf/b645e864-6840-4ba9-bac6-c9693469c414.

This will give you a good grounding. Then, go to <https://www.prefinfo.com/> and < https://prefblog.com/>, two sites operated by James Hymas of Hymas Investment Management Inc. Here is what James says: “Preferred shares can be a superb investment for taxable fixed-income investors, but are woefully under-analyzed in today’s market. I aim to fill that niche” and I agree. My portfolio of ten Canadian preferred shares is giving me a tax-enhanced (“Preferreds offer nominal yields similar to bonds of the same quality but they qualify for the dividend tax credit, resulting in more after-tax income in the hands of the investor <https://www.investmentexecutive.com/newspaper_/building-your-business-newspaper/news-37531/>” yield of ~6.5%.

Take your time with preferreds, don’t jump in all at once, and consult a qualified advisor if you need help.

Excellent recommendations👍

I’m 63 and retired living off the dividend income in my cash, RIF, TIF and TFSA accounts. Prior to retiring I was an index ETF investor but once I retired after a lifetime of saving I found it difficult to sell my investments in order to finance my life so I switched to dividend income ETFs.

I have 20% of my portfolio in VRIF and 20% in BMO ZWU. I also have 10% in each of BMO ZWC, ZPR preferred shares ETF, ZWP, ZWB, ZPAY and Harvest HDIF. I don’t mind the higher MERs because of the income and diversity I receive.

Thanks for your comment and I hope your portfolio works out the way you have planned.

Unfortunately my discount brokerage does not have an automatic divestment plan for RRIFs since, in their words, sell orders require confirmation.

Automatic divestment plans are available with mutual funds in some places, but you pay for it through higher MERs both for mutual funds and through not holding them in a direct investment brokerage.

But they are truly hands-off.

Even if your portfolio is large enough to provide enough income to support your needs, increasing RRIF withdrawal requirements as you age will eventually require divestment.

It’s too bad discount brokerages can’t (won’t?) provide for automatic divestment even with easy to liquidate mutual funds.

Yes, the government has the advantage of just sitting back and raking in taxes on your RRIF withdrawals. But, it could be worse for us seniors, we could be living in a country that doesn’t have a universal, publicly funded health system. Discount brokerages are called ‘discount’ for a reason. That is why it is important to have a partner or friend who will stand in for you in case of health problems, etc.

Any thoughts on what are good prefered shares and where do you go to find these?

See above

Which preferred stocks would be suitable?

Thanks David

See above

Really cool article Matt / David,

I’m currently in the process of working with my dad to have a plan to take over his portfolio for when the time comes that he won’t be able to manage it anymore. He is my original investment mentor, and I’d call him a “David Stanley BTSX OG” as he has been following it ever since David started writing about it in Moneysaver. I’m keen to keep it rolling along for my parents as per the strategy, but these ideas of increasing the simplicity of it down the road are quite interesting – especially for the non-Canadian side of things.

These articles on retirement planning are really useful and appreciated. I find the investing part easy (by design) once you get going with BTSX and US indexing; however, retirement planning is a whole different complicated beast that I feel will be the most challenging part of DIY money management / investing as my wife and I approach that magical date…Thanks again!

Well, it has been a while since I have been called ‘cool’. Now it is usually ‘Sit down Grandpa you are blocking the TV’ or, when I’m sleeping on the couch after a big meal, ‘ Grandpa are you in a food coma or is it a real coma?’

Ever since I heard about the BTSX portfolio I considered it a perpetual portfolio. We have a portfolio of 30 dividend paying stocks and a couple of others like BRK.B. 20% is in US stocks, the rest CDN. We are not re-balancing or anything else, just collecting what we need in dividends and re-investing the rest. As for future planning I have my son now starting his own portfolio and am teaching him how to handle mine when needed. Also working on an instruction book now with details on how to access our accounts and how to handle sales of equities and divest to minimize taxes. As far as an emergency fund we have a line of credit on the house that seems to never be needed. Just dipped into it to buy a very expensive car, but will pay it off next month. Perpetually content.

Hello and thank you for the great article. Where can I find more information on “perpetual and rate reset preferred stocks”? Thank you.

David provided some links in another comment that you might find helpful.

My take on preferred shares is that they are a somewhat complicated hybrid between a stock and a bond. They may work for some investors, particularly those who have professional guidance like David, but my preference is for simplicity. Finding the right balance between stocks and fixed income (bonds, GICs) and organizing those holdings so that one is protected from market downturns is a very effective strategy with fewer moving parts.

Would you consider including covered call etf’s in this portfolio. The yield are higher as you know. I’m aware that the upside is limited but if the focus is income and the principle won’t be touched then it seems the I can ride out the ups and downs without worry or much oversight.

Here is what ‘The Motley Fool’, an on-line community of investors, said about them in 2000:

“Many people look at covered call writing as a “safe” way to make extra money off their stock holdings. In reality, covered call writing is a short-term trading strategy that requires one to out-think the majority of option traders in the hopes of making a series of small profits, all the while overcoming considerable transaction costs.”

I agree; if you are thinking about using this or other option strategies make sure to educate yourself and become aware of the risks.