It’s been almost two years since I started this blog. In that time I’ve received questions from readers on a variety of topics related to DIY investing, dividend investing, and BTSX in particular. Sometimes the questions are personal – How do I handle my own investments? Sometimes they are practical – How might readers put this information into practice? And sometimes the questions are challenging – Wouldn’t it be better if we did X, Y, or Z instead?

As the blog and its readership grow, it has become a little more difficult for me to respond to these queries individually, so I thought I would create two blog posts with answers to the most common questions I receive.

In this post I will answer questions about how I personally manage my investments. In the next post I will answer more general questions about dividend investing and Beating the TSX.

Here we go.

1. Do you use BTSX to choose your own investments?

Yes. I started my investing journey in 2002 and, like many people, went through phases of high-fee mutual funds and taking fliers on hot stock tips before gradual transitioning to index funds. I still think buying and holding broad-based index funds are a very reasonable way to invest, but once I started reading David Stanley’s Beating the TSX articles in the Canadian Moneysaver, I couldn’t ignore the evidence. At that point he had accumulated two decades of data showing that a simple method of selecting high yielding Canadian stocks had out-performed the index.

I started investing in BTSX companies blindly; I didn’t have the confidence or familiarity to assess the companies individually, but I had faith in the track record of the system. It’s amazing to look back and see that I still hold about 75% of the stocks I bought when I started: great dividend paying and growing companies like RY, TD, T, BCE, and NA. For a while I still tried to stock-pick – as I look back at my statements, RIM and HPQ were pretty effective at showing me that I’m no good at it. Lessons that I had to learn in order to have confidence in a dividend-based strategy.

Today stocks that have, at one time or another, been on the BTSX list make up about 80% of my portfolio.

2. How often do you buy/sell stocks?

I reassess my portfolio about once per year, usually at the beginning of the year. If there is a market correction partway through the year, I may take that opportunity to take advantage of lower prices and reinvest some accumulated dividends. Similarly, if I become aware that one of the companies I am invested in has fundamentally changed, I may re-evaluate my position in it.

To be clear, I do not buy or sell any time the BTSX list changes. The monthly BTSX portfolio updates I publish here on the blog exist as a resource for those with money to invest, not to stimulate unnecessary trading.

3. Do you buy every stock on the BTSX list?

When I started using Beating the TSX to choose dividend paying stocks, I bought all ten stocks that appeared on this list and held them for the year – just like the method on which our long term data is based. Nowadays I’m more picky, but that’s not to say I’m smarter or that my performance is significantly better. It’s more of a comfort level thing.

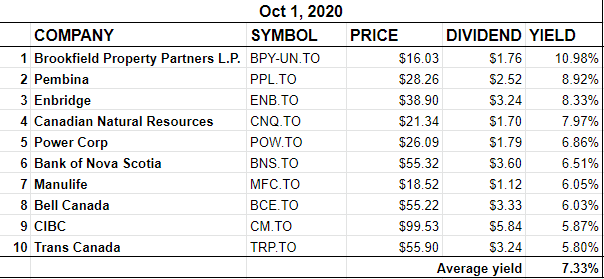

For example, at the top of the current list is Brookfield Property Partners (BPY-UN) with a 10%+ yield. I don’t own it because the company is highly leveraged and I don’t think that yield stands a chance of being sustainable. Another stock that has frequently appeared on our list over the years is Shaw (SJR.B). I don’t own it because they haven’t had a dividend raise in over five years and the stock price has done almost nothing in the last 13 years.

Could one or both of these companies prove me wrong and provide massive profits to investors? Sure, but I’d rather take that risk and buy a few stocks with slightly lower yields but better fundamentals.

Beating the TSX is a tool to identify potential investments. There is no need to follow the list dogmatically. Which leads me to another common question . . .

4. What other investments do you have outside BTSX stocks?

A short list of my investments that fall outside BTSX-type stocks:

- A small position in an international index ETF – for diversification purposes

- A small position in a broad based index fund – mainly used as a place to park cash until I’m ready to sit down and make dividend stock purchases

- Other dividend paying stocks – these are all stocks from the TSX 60 (i.e. Canadian blue-chips) that have a history of good dividend growth and diversify my portfolio across sectors not represented well by BTSX stocks. Examples include Magna (MG), Metro (MRU), Canadian Tire (CTC-A), and Nutrien (NTR). About 10-15% of the portfolio.

- Bonds? Not in my portfolio for a few years now for two main reasons: first, yields are brutally low, and second, some dividend paying stocks (FTS and MRU come to mind) are so poorly correlated with market movements that they accomplish a similar goal to that of bonds (discussed more here).

It’s important to understand I am not endorsing this approach for anyone else’s portfolio and my portfolio might look different in five or ten years, but it works for me right now.

5. Do you ever feel drawn to trying other strategies?

At this point in my investing career, I am satisfied that the evidence supports a dividend-based strategy and, frankly, Beating the TSX has an unbeatable track record – remarkable, given that it is also simple, low maintenance, and essentially free (no fees).

Having said that, I am always on the lookout for new information and sound alternatives. Most alternatives can be discarded out of hand: timing the market, trading hot stocks, stock tips from talking heads on TV or the internet. But there are two approaches I think are worth considering.

First, dividend growth investing, made famous in Canada by the venerable Tom Connolly, has a lot of merit and a few of my holdings are dividend growth stocks. Second, broad-based index ETFs are especially useful for those with less than 30-50k to invest or who have little interest in buying individual stocks. I am particularly happy that the industry is now offering all-in-one ETFs that take care of asset allocation and automatically rebalance – all for a very low fee.

There you have it – an inside look at how I think about my own investments. Was this useful for you? Do you have more questions (please bear in mind, I can’t give individual advice)? Feel free to leave a comment. In the meantime, here is the updated BTSX list for October (not much has changed from last month).

BTSX portfolio update for October 2020

I understood the BTSX meant holding the listed stocks for the year, yet you list monthly holdings. Am I misunderstanding something here? Thanks,

As per question #2 I hold for at least a year – often much longer. The monthly lists are published for those whose “year end” is different from mine or perhaps came into some money they would like to invest (bonus, inheritance, sale of assets, etc.).

What are some good dividend growth ETF’s you are referring to? Thanks

I don’t own dividend growth ETFs, although I think a few exist (try Googling dividend aristocrat ETFs). I have a handful of stocks that don’t have the highest yields but do have a good track record of healthy dividend increases.

Perhaps a future blog post comparing a dividend stock portfolio to dividend ETFs would be useful?

I always read your letters with great interest. I prefer individual stocks versus ETF’s as I find it easier to analize. My portfolio is not all dividend stocks. I targeted a 25% weighting in the USA market to access healthcare, technology and some industrials that are not available in Canada. I have a data sheet with standard fundamental metrics which I run all my stocks thru quarterly. I identify stocks that are LTH (long term holds) and others that I will sell if objectives are met. I currently hold 32 stocks of which 56% met the BTSX criteria. My target is 70%. This discrepancy is explained by higher cash levels but also because of gold holdings as a defensive move. I do monitor my sector weightings regularly.

Pingback: Answering the top 5 reader questions about BTSX —

BTSX is a sound strategy and I followed it for a period, but then I discovered The Connolly Report and found it suited my personal feelings about investing, a dislike of trading and rebalancing. I was still in the accumulation phase at the time and found the constant need to look for new or better stocks frustrating. Once I began sticking with dividend growth and gained a greater understanding of the strategy, I began to realize I did not need to need to sell any stock which continued to pay and grow my income. I could add new stocks when I found a good one, but I found it easier to just add to those I already owned, when they offered a reasonable yield.

Over time I looked to further simplify the dividend growth strategy and eventually put my opinions on paper. One thing that I definitely became adamant about was the ETFs would never be part of my investments.

Thanks for sharing your perspective, Henry. Fortunately, we don’t have to choose between BTSX and dividend growth. There is a huge amount of overlap between both kinds of portfolios. In fact, in discussions with David Stanley and Ross Grant (previous BTSX authors), we would estimate that the average annual dividend growth rates of our BTSX-based portfolios is 5-7% over the last few decades. It just so happens that a lot of high yielding BTSX stocks are also dedicated to growing their dividends. I don’t think the method would perform so well if that weren’t the case.

I also share your dislike of trading and rebalancing. I adjust our portfolio once per year – that’s it. And I tend not to sell good dividend-paying (and growing) companies that are not on the “new” list. I just use accumulated cash to either add to existing positions or buy a new company that BTSX has identified for me. I think we would both agree that for stable, established companies, yield can be a great indicator of value (as price goes down, yield goes up – as long as the dividend is sustainable).

Thanks again for weighing in. I respect your opinions and look forward to future comments.

Is there an ETF that follows the BTSX strategy, like SDOG in the US?

Not that I’m aware of.