Alpha and beta aren’t just letters in the Greek alphabet; they are also commonly misunderstood investing concepts – not to mention part of the vast lexicon of investing jargon that keeps analysts sounding smarter than they are and leaving DIY investors with an inferiority complex. I wanted to use this post to demystify these terms. What is alpha? What is beta? And how do they relate to dividend investing?

What is alpha?

Alpha is out-performance. Take the performance of your portfolio and compare it to that of the most relevant benchmark. If your portfolio’s rate of return was 10% and the benchmark’s was 8%, your alpha would be 2.0, or 2%.

Alpha is a measure of excess returns, sometimes referred to as “abnormal returns”. Of course, many portfolios under-perform their benchmarks in which case their alpha would be negative. As the annual SPIVA report has illustrated over and over, professionally actively managed investment funds under-perform their relevant benchmarks with alarming frequency. In fact, 88% of equity managers have failed to post a positive alpha over the last ten years.

Compounding the challenges that equity managers have in adding value for clients, it is also important to understand that alpha is calculated before fees. Even if a hot shot manager boasts that he achieved an alpha of 1.0 for his clients last year (certainly in an effort to get his hands on your money), if his fees were 1.5%, those clients would be under-performing a simple index ETF by 0.5%.

What is BTSX’s alpha?

“Beating the TSX” is a simple method of building a portfolio of high quality dividend paying stocks. As the name suggests, it has the goal of positive alpha in its DNA – it aims to beat its benchmark. David Stanley adapted the “Dogs of the DOW” strategy to the Canadian markets almost thirty years ago and took a gamble that the method would live up to its name in the cold white north. David would say it has surpassed even his expectations.

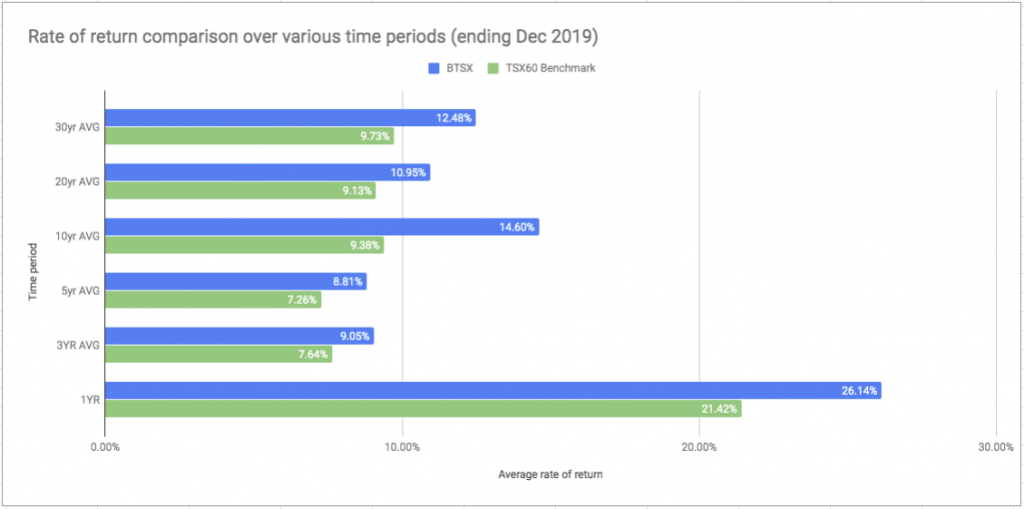

Here are the alpha calculations for BTSX over the last 3, 5, 10, and 30 year timeframes:

| Time frame | Alpha |

|---|---|

| 3 year | 1.4 |

| 5 year | 1.5 |

| 10 year | 5.2 |

| 30 year | 2.7 |

Illustrated another way, here is the performance of BTSX relative to it’s benchmark over various time frames:

The alpha of dividend investing

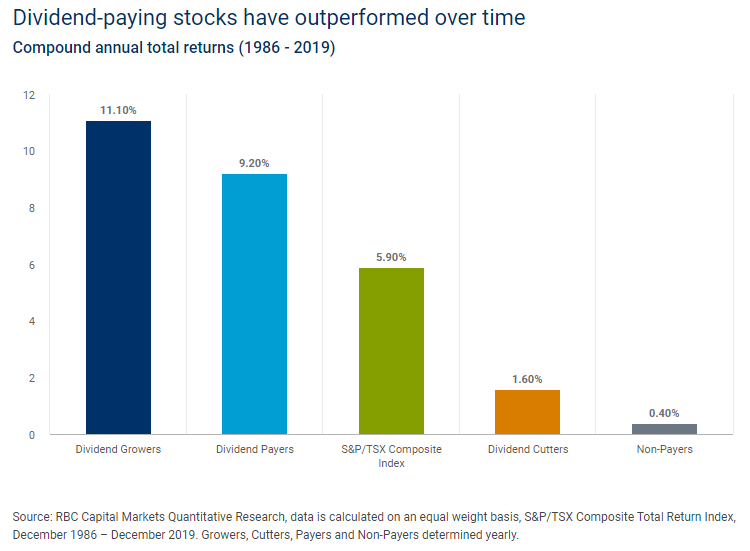

Is the past performance of BTSX a fluke? Or is there something about dividend investing more generally that lends itself to these “abnormal returns”? Fortunately, the data shows dividend investing in general has been very effective at generating alpha for investors. In fact, RBC Global Asset Management has published this report indicating Canadian dividend payers and growers have averaged a little over 10% rate of return over the last 42 years; non-dividend payers? 0.4%.

Does high alpha mean high risk?

Conventional wisdom states that investment strategies that generate excess returns (alpha) also generate higher risk. Like a race car on a track, the faster you go, the greater the chance of crashing.

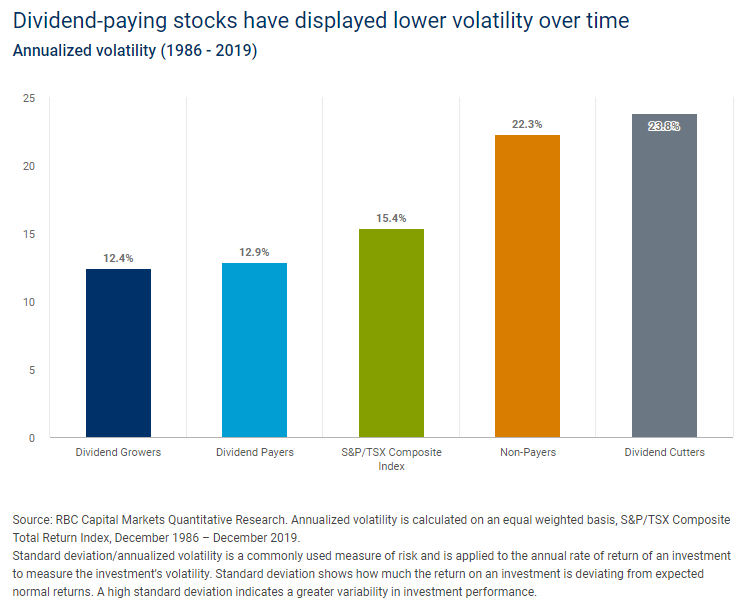

But this performance-risk correlation doesn’t seem to apply to dividend investing. The same RBC report that showed dividend payers and growers out-perform non-dividend payers also reveals that dividend payers/growers are less volatile than non-payers:

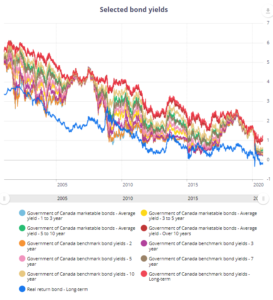

The RBC paper uses standard deviation to describe volatility which compares a stock’s range of returns to its own average. But standard deviation is just one way to measure volatility. Beta is another.

What is beta?

Beta is a measure of volatility compared to the market as a whole, rather than a stock’s average returns. The term “beta” is often used interchangeably with risk or volatility, but this is misleading. Beta is not a pure measure of risk or volatility, but rather a measure of how a stock’s performance differs from that of the underlying index.

Beta is generally calculated using three year data. A beta of 1.0 means the value of a stock (or portfolio), on average over the last three years, has moved in lock-step with the underlying index. If the index went up 10%, the stock did too. A higher beta of, say, 2.0 would mean that a stock has, on average, moved twice as much as the underlying index; a 10% rise or fall in the index would be accompanied by a 20% rise or fall in the stock, respectively.

Beta and Canadian dividend stocks

Many Canadian dividend stocks, including those that have been on our Beating the TSX list, have betas of less than one, i.e. they are stocks that display less volatility than the underlying index. Interestingly, the average beta of the current list of BTSX stocks is 0.8 (find beta for all the TSX 60 stocks here). Historically, the betas of BTSX stocks are even lower, in the 0.5-0.7 range (the recent oil and gas sector rout has significantly affected the betas of stocks like PPL and CNQ).

Is it possible to have a beta less than 0? Absolutely. Stocks such as Fortis, Loblaws, and Metro have betas in the -0.08 to -0.15 range which means that not only are they far less volatile than the index, but the stock prices tend to move opposite to the index itself. These negatively correlated stocks can be particularly useful moderators of portfolio volatility, especially when they have displayed a long history of generous dividend distributions, like FTS.

The low beta anomaly

Back to the relationship between risk and return . . . The central prediction of many financial theories is that higher risk must be compensated by higher returns. As a proxy for risk, volatility should also be compensated with higher returns – but it’s not. In fact, numerous studies over the last few decades have shown that lower beta stock portfolios have experienced greater average returns than those with higher volatility.

Investing in large dividend paying companies is an effective way to take advantage of this well-established low beta anomaly – more evidence that we should sleep well at night using Beating the TSX as a tool to build our own low beta, high alpha portfolios.

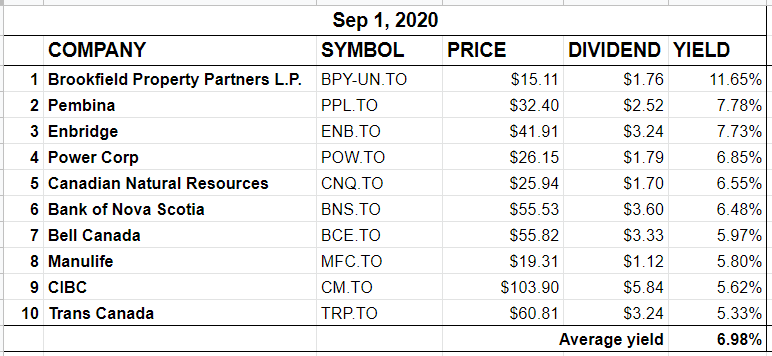

BTSX portfolio for September 2020

Not much change in the BTSX portfolio this month. Personally, I am still waiting for BPY-UN’s dividend cut as it seems unlikely the company will be able to maintain annual dividend payments that are higher than their funds from operations. The term “yield trap” comes to mind.

Of note, all of the BTSX stocks in this month’s list have a beta of less than one except BPY-UN, PPL, CNQ, and MFC (find all the betas for TSX 60 stocks here).

Just to let you know that there is a more up to date link from RBC Global Asset Management that will take the returns up to the end of 2019 versus 2018.

https://www.rbcgam.com/en/ca/learn-plan/investment-strategies/the-power-of-dividends/detail

Thanks so much – I will update the post ASAP

Excellent article and clarifies many of my own questions. As a small DIY investor I follow Matt Poyner’s articles in Canadian Money Saver publication. Invaluable information and I ‘m a big fan of David Stanley. Clear, sound information without all the hoopla of media pundits. Currently I am an indexer but ready to take my first step into dividend stock purchasing from Questrade at the age of 80.

I really appreciate the positive feedback, Eve – thanks. Wishing you a smooth transition into dividend investing 🙂

As a dividend growth investor, I am wondering how come I didn’t find your website before. Lots of useful information and very clean website without ads. You spend your time and energy to educate, really appreciate that.

I am wondering though, are you a follower of this strategy yourself? I feel looking at only yield might lead us to a value trap. E.g. POW wouldn’t be a good holding for people for past a while despite it continues to grow the dividend. But lower yielding Dividend growers like CNR, MRU will be much better choice imho. Looking forward to your opinion.

I wouldn’t put the work into this blog if I didn’t use BTSX myself. I have nothing else to gain – as you noticed, the site is not monetized – other than the satisfaction of sharing information I truly believe is useful for other DIY investors.

So, yes, I have been using it myself for over ten years, building a portfolio of dividend paying stocks. But it doesn’t mean I blindly buy everything that appears on the list. As I have written about many times, BTSX is a tool to identify potential investments, not a dogma to be adhered to. If there is a stock you don’t like, skip it and buy another one. No harm, no foul.

As for the dividend yield vs growth rate debate – the verdict depends very much on time frame and market. Perhaps the topic of a future blog post. But I am happy to share that I also invest in companies like CNR or MRU for two main reasons: dividend growth and, more importantly, sector diversification.

Thanks for the comment, May.

Cool. Thanks a lot for your reply. And thanks again for providing very valuable information for peer investors. BTSX is definitely a good resource to identify potential investments. And I am so happy now there is a site I could come to take a look anytime I need to.

Talking about diversification, I am wondering if you also do asset allocation? How about equities in other markets? How about bonds? I am thinking not to have any FI in my portfolio for my retirement. Also, as my goal is to have dividends covering my living expense, which should be achieved soon, if I don’t retire yet, I am considering to invest extra money in high growth sectors. Maybe HXQ for the tax efficiency. Nasdaq is too expensive now so I will wait.

More great questions. Look for a Q&A blog post soon.

Great article. As a mid 70’s div investor couple looking for income, we have tried to deploy a global diversity of stocks and etf’s. As the tsx is only 5% of world market is the btsx a viable option for our total portfolio or only partly. What % of cash would you suggest holding for upcoming corrections?

Canadian markets are a small proportion of global markets but this is not the only factor to consider in one’s decision to diversify into other markets. I appreciate the fact that the Canadian economy is mature and that the market is well regulated. The selection of high yielding dividend stocks is good. Canadian dividends enjoy preferential tax treatment compared to foreign dividends. And, perhaps most importantly, international markets are so tightly correlated these days that the evidence for international diversification is weaker than most would expect (a blog post in the works on this topic). Not that you should have all of your money in the Canadian market – that is an individual decision – but international diversification, like all investing decisions, should be done thoughtfully.

As for your other question re % cash in your portfolio, I can’t give advice specific to your situation, but this post might help:

https://dividendstrategy.ca/lessons-from-the-covid-crash-and-recovery/

Thanks for the comment

Pingback: Getting personal: Top 5 reader questions about my own investing practices —

Pingback: Do bonds belong in my portfolio? —

Pingback: Dividends over the years: a message from dividend investing pioneer Dale Ennis —

Pingback: The real problem with financial advisors —

Pingback: The real problem with financial advisors – moneySmartMD

Pingback: Risk vs Reward: Dividend investing and risk adjusted returns — DividendStrategy.ca