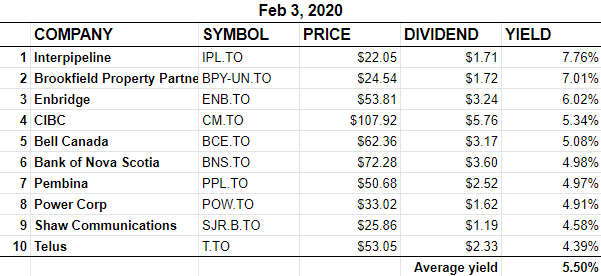

I am no stock analyst, I just play one on this blog (from time to time). With a recent shake-up of the TSX 60 index, Encana (ECA) is out and Brookfield Property Partners L.P. (BPY.UN) is in. BPY sports an impressive 7% dividend placing it second in our BTSX portfolio. This is the first time that a real estate company has appeared in the BTSX, but is it a good investment?

This is my quick take on BPY.UN as a DIY investor who is primarily interested in healthy, growing dividends. This is not meant to be an exhaustive analysis, rather a concise (amateur) investigation of the relevant factors as I see them.

Here’s the quick and dirty on BPY.UN:

- Dividend yield: 7.03% (as of Feb 3, 2020)

- primarily a U.S. commercial real estate company, with international holdings

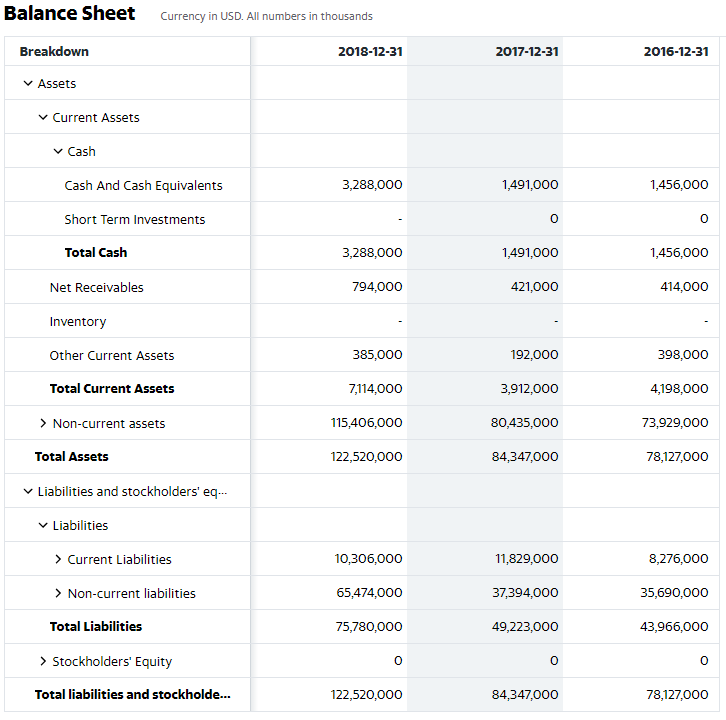

- approximately $122 billion in total assets.

- paying dividends since 2013

- dividend growth rate approx 4%

- Dividend payout ratio: 87%

- P/E ratio (trailing): 17.54

- Market Cap $23.5 billion

Business overview

Brookfield Property Partners is the wholly owned real estate subsidiary of Brookfield Asset Management. It was spun off from its parent company in April 2013. The following description is from their website:

Brookfield Property Partners (NASDAQ: BPY, TSX: BPY.UN) (“BPY”) is a diversified global real estate company that owns, operates and develops one of the largest portfolios of office, retail, multifamily, industrial, hospitality, triple net lease, self-storage, student housing and manufactured housing assets.

https://bpy.brookfield.com/

The company’s core business consists of 136 office properties and 123 retail properties totaling over 200 million square feet. This represents 85% of its balance sheet. BPY also has 13 million square feet of additional projects underway. The majority of BPY’s holdings are in the U.S. with additional properties in countries such as China, the UK, Australia, Dubai, and Canada.

BPY tries to buy real estate at a steep discount that is out of favour with other investors. It then develops these holdings and attempts to sell them at fair market value down the road. The huge acquisition of General Growth Properties in 2018 was a great example of this contrarian approach: as an owner of a large collection of enclosed malls GGP may turn out to be the deal of the century or a casualty of the retail apocalypse. Brookfield is betting that the fears are overdone. Investors should understand the risks involved.

BPY’s financial picture

Click HERE for the recently published full year 2019 financial results.

When it comes to REITs, a good way to gauge financial health and stability of the dividend is a metric called “funds from operations” or FFO. Funds from operations is a standardized industry term defined by the National Association of Real Estate Investment Trusts. It’s defined as GAAP net income + depreciation and amortization – gains from property sales. FFO is more important than earnings for REITs because depreciation and amortization are deducted from net income.

BPY’s funds from operations for 2019 were $1.5 billion (vs. $1.6 billion for 2018). With roughly $1.3 billion being paid out in dividends, BPY’s dividend payout ratio is 87%.

Brookfield funds new projects with debt. I can’t find data for 2019 yet, but in 2018 total liabilities increased by 50%, the majority of which was an increase in long term debt.

Of course, interest payments must be made on this long term debt. BPY is also obligated to pay its parent company, Brookfield Asset Management a management fee of approximately $45 million annually. On top of this, there are operations and maintenance costs involved in running their real estate empire. So, even though funds from operations seem adequate to cover the dividend, there are reasons to question it’s sustainability.

Brookfield Property Partners as part of BTSX

A common criticism of Beating the TSX is that it lacks diversification. I am working on a blog post explaining why I don’t think this is necessarily a weakness, but for those who accept the premise that more diversification is better, having some real estate exposure in the portfolio may be a positive development.

If you’re seeking exposure to the real estate market, specifically the commercial market, BPY might be a good option. With assets of $122 billion and a market capitalization of $24 billion, it is one of the largest players in the field. Because the company is only seven years old its dividend history is short, but the 7% yield is attractive.

Brookfield Property Partners as an investment

BPY grows its business by borrowing money and investing it in the real estate market. As such, it has certainly benefited from it’s strong BBB credit rating and the low interest rate environment of the last decade – a decade in which real estate valuations have grown considerably. Still, the stock price has stagnated since it was spun off from Brookfield Asset Management in 2013. Is this a great contrarian buying opportunity or a warning to stay away? Here are some things to keep in mind when considering BPY as an investment:

- Pressure on bricks and mortar retailers, especially from online competitors, has lead to increased bankruptcies of BPY’s tenants. Although they report 75% of the vacancies have been re-leased, will this trend continue?

- BPY is highly leveraged with debt

- BPY is obligated to pay its parent company fees and distributions of roughly $45 million per year

- Profits will suffer if interest rates rise faster than BPY can raise rents

- The “dividends” paid by BPY.UN are not like the dividends paid by other stocks on our list. These distributions are mostly a combination of capital gains and foreign dividends (click HERE for the details). If you hold BPY in a non-registered account, be aware of the tax implications and remember that a T5013 will need to be filed.

Conclusions

It’s probably clear by now that I am apprehensive about Brookfield Property Partners L.P. as an investment. The company is young, the dividend history short, and the degree of leverage makes me uncomfortable. But, as I said from the start, I am no stock analyst and I would be happy to hear from others who may have come to different conclusions.

In the meantime, here is our Beating the TSX portfolio for February:

Greetings! I’m a bit confused. First you say you’re apprehensive about this stock (with good reason), but then you include it in your updated BTSX list, bumping EMA. Now, I know what I’m going to do, but I’m unclear on what the BTSX methodology would advise us to do at this point. Should a religious adherent to the methodology sell EMA and buy BPY-UN.TO today? I am under the impression that, barring any dividend cuts, the list of stocks is reconstituted only once annually, on January 1st. If true, I think it muddles things a bit to show BPY-UN.TO in the current BTSX list.

I hear you, Bjorn, and I struggled with this. BPY is on the list for the same reason the other stocks are: it meets the BTSX criteria. This is not a list of my favourite stocks, it is a list based on a method. I don’t have the ability to choose stocks with a 30 year average return over 12%, but the BTSX method does. As I see it, a big part of my role is to safeguard the integrity of the BTSX system and not let my opinions drive the portfolio. But this does not mean I have to buy every single stock. BTSX is useful to all of us as a starting point, but no method should be followed blindly; it is important to feel comfortable with our investments.

I hope these monthly BTSX updates are useful and that publishing my analysis of certain questionable stocks is, in balance, more helpful than confusing. If not, I’d be happy to hear it – wading through corporate announcements and financial statements isn’t much fun!

I agree. See my separate comments below.

Thanks for the input. I appreciate all the work that goes into this website.

Good information in this post!

I bought $50K of BPY.UN over 2 weeks in January 2020 because 1) I wanted some real estate exposure in my portfolio 2) the price was right @ $23.60 or so 3) everything else was expensive 4) it pays 7% dividends and at 60 I’m retired and living off the dividends of my investments.

It may not be perfect but nothing is.

Sounds like you are invested for the right reasons and, most importantly, as part of a planned strategy. “Nothing is perfect” and the imperfections are usually baked into the price. I sincerely hope it turns out to be a winner for you.

I have been following and investing using the Beat the TSX portfolio for many years. Although investing in stocks is more risky than other conventional investments, I have always felt that Beat the TSX is reasonably safe. However, when you introduce stocks such has Interpipeline and Brookfield Property in the portfolio, you increase your risk substantially. There is a reason why these two stocks pay a higher yield, namely 7.76% and 7.01%, it is because the risk is higher. Personally I prefer the conventional method of investing in Beat the TSX. I do however like to hear different point of views. Thank you for the excellent work.

I also agree with this. I asked same question and requested that we maintain two version of BTSX…one with old rules and one with current rules and compare it few years to convince that new strategy does work.

Great idea. If anyone would like to do this work, I’d be happy to link to it or post it on this blog.

I would be happy to do it but will need some knowledge and help.

Thanks

Good idea

I also like to hear different points of view, so thanks for yours, Roger.

Does high yield always mean high risk? Historically, stocks with top quartile dividend yields have underperformed those with yields in the middle two quartiles – but not by much. The worst dividend investments are those who cut their dividends – of course we can’t identify those ahead of time, but we can look at the fundamentals and make an educated guess. So, there is reason to be cautious of stocks with very high yields, but mostly due to the risk of a cut. BPY is not safe enough for me; IPL is.

I don’t believe BPY.UN belongs in BTSX. This company is just a proxy for its US counterpart where most of its real estate is held. Furthermore, it does not pay a dividend, but rather a distribution made up of interest, foreign income, ROC and some dividends. Though the distribution is close to 7%, its growth rate is low and the stock price is in a slow long term downtrend. Simply compare BPY to any number of Canadian REIT alternatives (GRT, CAR, etc.) and you’ll see better & safer choices. Plenty of ‘talking heads’ and some analysts claim the stock price is undervalued, and perhaps it is, but I’m a bit skeptical. Despite all of the above, I do own a small position of BPY in an RSP account, representing 6.5% of my overall REIT holdings.

I do own most of the other BTSX constituents, representing 25% of my total investments.

Thanks for your comment and the clarity of your reasoning, Ed. It is becoming clear that many of us are skeptical of this stock.

The thought that is brewing in my mind is that BPY could be excluded from BTSX not because of discomfort with the fundamentals, but because it’s not really a Canadian company. Sure, it trades on the TSX, but the head office is in Bermuda and the vast majority of the business and employees are outside of Canada – not to mention the non-eligible, non-Canadian “dividends”. This makes it fundamentally different from other BTSX constituents.

I am interested to hear what others think about this – especially from those who disagree.

BPY.U: Have owned for almost 3 years now and yes the stock price has been flat. I made a decision to hold Brookfield through BPY, BEP, BIP and BAM. 15% allocation. Other than the BPY the rest have been great. An alternative asset manager on the cheap, smart managers. Global holdings. My biggest concern is cost of capital. If rates increase I will review. As mentioned the dividends are not really dividends as the yield broken up into less tax advantaged streams.

BPY is a 2.5% holding. There are indications that the Brookfield group might move more of their entities to corporations.

I will go along with Roger, BPY.UN has too much dept and being American does not belong in the BTSX!

I have been investing all Brookfield stocks for more than 5 years, and I think BPY is the worst of all Brookfield stock. The real reason behind this (in my guess) is that investor are not buying the promising future of the realtor for office and retailor malls. It generate steady cash flow but never any inspiring future. BPY used to be at 28-30 for a long time with no change. Then it pays big money to acquire another big realtor GGP, since then it’s price went down below 28 and never comes back for the last few years.

My opinions, $23 is a good time to invest in BPY, but you don’t expect too much gain of stock price but only divident for this investment. However, the principle is relatively safe (that does not mean you will not lose some priciple in stock price when you want to sell it, but that should be very gent then).

As of today (Feb 11, 2020), I note that SU (Suncor), has crept into the top 10 list for BTSX. I guess the same question asked about BPY-u and its applicability to the BTSX list can be asked of this stock?

Al

Thanks, Al. Nice dividend increase. The TSX 60 page has been updated to reflect this change.

I have been purposely staying out of the conversation here for a bit, wanting to see where the discussion went. BPY is not just a stock; for those interested in BTSX it represents the more fundamental question: What do we value more, the BTSX method or our judgement?

After corresponding with David Stanley and Ross Grant in the last few days, I have come to a conclusion. There will be another blog post about it in the near future.

Thank you for keeping the BTSX alive. I respect the effort you obviously put into it. I started with Canadian Money Saver in October 1994, and unfortunately do not have paper copies any more. However, in the dark recesses of my memory, I recall variations of the Dogs/BTSE included not only the ten stock selections but also a five stock version, and, pertinent to the subject, a four stock version. This four stock version excluded the number two stock based on the concept that it might have got there by being in a time of hard luck, hence low price and high dividend, and therefore at high risk of cutting that dividend. Maybe BPY.UN could be excluded in the actual decision making process of buying the securities? We need to remember that the BTSX has never included fundamental analysis but has used the simple mechanism of filtering by low price and high dividend to pick the stocks for the next year

Over the years, I gradually adopted elements of BTSE and later BTSX in my core investing, taking flyers outside the core on less stable stocks. NOT a good idea! The core BTSX has stood the test of time.

What has also served me well was my excursion into ETFs to replace Mutual funds. Since 2013 (in my holdings) the BMO ZLB Low Volatility ETF with about 40 Stocks and a distribution of “Only” 2.3% has returned me 12%. BMO claims annualized return since inception in 2011 of 13.72%. Worth a look for those who are just starting and can’t afford a whole whack of ten stocks.

Thanks for your comments, Ian – great memory. I had to go back through the Canadian Moneysaver archives to find reference to the alternate BTSX portfolios (the one I found was summer 2001). It is a good reminder that a 10 stock portfolio can be a starting point rather than an end point. I have consulted with David Stanley and Ross Grant and will be writing a follow-up post on the BPY issue.

I have also gambled on “flyers” over the years – fortunately few. I have also come around to the reassuring stability of big steady dividend-payers. I’m quite happy to leave the gambling to poker night with friends.

Index funds have a place in many of our investment accounts, but are especially useful for those with less than ~$50k – agreed.

I just bought some at around 13$/share! Looking forward to receiving the dividends.

Quite the price bump even in the week since you wrote this comment. I hope the dividend is safe, but I wouldn’t bank on it.

Pingback: Getting personal: Top 5 reader questions about my own investing practices —

Pingback: Beating the TSX 2020: looking back and staying the course —