Dividend investing, and Beating the TSX in particular, have an excellent long term record of providing investors with returns superior to the index. With a little interest and discipline, DIY investors can use the free information on this site to manage their own investments and beat the pros. But it’s important to remember that BTSX is simply a method of identifying potential investments. It should be used as a tool, as part of a rational investment plan that suits your situation. Here is a step by step guide to using BTSX to build your portfolio.

Step 1: Make a plan and write it down

A financial plan is more important than an investment plan, so do this first. I know it might seem like an unnecessary hassle, but unless you have a written financial plan you are driving with your eyes closed. You will never achieve financial independence if you spend more than you make. Exceptional performance in your stocks won’t matter if you didn’t fund the portfolio properly. A financial plan doesn’t have to be complicated, but it needs to be rational and suited to your particular circumstances.

Simple financial plan template:

- Current Status: How much do you have saved? – list assets by account. How much are you earning? – include all sources of income. High interest debt? – pay it off before you start investing.

- Objective: How much do you need to be financially independent – one million, two million? (This calculator might help) Are there other areas you need to fund first, like a wedding, house down payment, or your emergency fund?

- Time frame: How long will it take you to save that amount? Be conservative in your assumptions about future returns (I use 6%). How long will that amount need to last?

- Savings target: How much of each paycheque will be saved? – savings should be automatically transferred, like paying a recurring bill. Into what account(s) will the funds be deposited?

- Asset allocation: Are you a traditional 60% stocks, 40% bonds person? How much in Canadian vs. international? Have an idea of your tolerance for risk and volatility.

- Strategy: Notice this is the last step. What are you going to invest in? Mutual funds? – I hope not. Index ETFs? – good for many DIY investors. High quality dividend stocks? – that’s how I roll. A combination? – sure! Here’s one example – at the beginning of every calendar year buy and hold the BTSX portfolio (50%), a US index fund (20%), an international index fund (20%), and a bond fund (10%) . Use accumulated dividends to rebalance every six months.

*Note: this is a hypothetical plan for illustrative purposes

Step 2: Open a discount brokerage account

It is easier than ever to do your own investing. Multiple discount brokerages are vying for your business and they’ve made it cheap and easy to set up your investment accounts with them. RRSPs, TFSAs, unregistered accounts can all be set up from scratch or transferred from another institution. Sometimes there are even financial incentives to do so. A single login will get you access to all your accounts along with myriad tools and resources to transfer funds, track performance and research potential investments.

I use QTrade, but there are numerous good options out there. The point is to get started. The sooner you start investing your own money, the more you will save in advisor fees and MERs and the better you will feel about taking control of your financial future.

Step 3: Choose dividend-paying stocks

Imagine owning a portfolio of safe, profitable companies that will generate income for you no matter what the market does and with no additional work by you. This is what being a dividend investor is all about.

Beating the TSX is a simple method to identify high-yield Canadian blue chip stocks. I track the performance of the stocks annually using the list as it appears on January 1st of each calendar year. But prices and yields change over time, so I also maintain a Current BTSX list for those who are investing at other times during the year.

For some, the BTSX list is all they need; the long term performance is very compelling. Others will look at the list and see companies they are not comfortable owning. I don’t buy stocks just because they’re on the list and neither should you.

In addition to BTSX stocks, you might add stocks from other sectors or other countries. You might choose some stocks with lower yields, but higher dividend growth rates. You might choose to improve diversification by investing in index equity or bond funds. These details should be laid out in your plan; follow your plan.

For more details on my investing practices, read this.

Step 4: Buy your stocks

This is the easy part – just buy your stocks. The way BTSX is tracked over the years is to assume that equal dollar amounts are allocated to each of the ten stocks and held for the duration of the year. For example, if you had $100k to invest, $10k would be allocated to each of the ten different stocks.

But this is just one way to do it. You might decide to allocate less to a stock you feel is more risky than the others or more to stocks you are more comfortable with. If you are struggling with these decisions, go back to your plan.

Since I publish an updated BTSX list with every monthly blog post, I am often asked if I would recommend adjusting the portfolio monthly according to these changes – I don’t. Limit your buying and selling to once or, at most, twice a year. Investments tend to do worse the more attention that is paid to them because we’re tempted to make changes when we should leave well enough alone. Any good dividend investment plan involves three magic words: buy and hold.

Step 5: Adding funds

If you are in the accumulation phase of your financial life, you will either have funds to add to your investment accounts or accumulated dividends that you don’t need for your living expenses. How do BTSX investors handle these additional funds? There are three main options:

- Hold the funds in cash until your scheduled portfolio maintenance (see next section)

- Purchase a low fee index fund (like VGRO, VBAL , or a bond fund) and hold until your scheduled portfolio maintenance

- Use the funds to rebalance your portfolio, adding to quality stocks that have gone down in value. For example if you bought $10k of ENB at the beginning of the year and it went down to $8k, you could use $2k of cash to bring it back up to the level of your other holdings. This is a good way to buy stocks “on sale”, as long as the companies are still fundamentally solid long term investments.

Step 6: Annual maintenance

We are investors, not traders. We buy quality companies and hold them for the long term. There is no need to check your portfolio frequently. In fact, there is good evidence to show that less attention to markets and less account activity leads to better returns.

I also believe that an investment plan is more likely to be followed, and therefore more likely to succeed, if it is both simple and easy. A few hours once a year is all you need.

Here is the portfolio check-up I do on an annual basis:

- Re-read my investment plan. Does it still make sense given our situation? Adjust as needed.

- Assess what our investments have done over the past year. How has our net worth changed? Is there a reason to sell any stocks? Reasons might include new fundamental weaknesses in the business, dividend cuts, or, if we’re lucky, the stock price has gone up so much it appears over-valued.

- If there is anything to sell, sell it. I don’t sell a good stock just because it is not on the current BTSX list. In this way, I develop a portfolio of more than ten stocks (currently we own 22). If a good stock has gone up significantly, however, I might sell a portion to get it back in line with our other holdings (for example, if ENB went from $10k to $13k, I might sell $3k).

- Update my spreadsheet that lists our accounts, their holdings, dividend payments, and total cash balance.

- New purchases. Beating the TSX is the first tool I use to identify potential investments. If there is a stock on the list I don’t already own, I will strongly consider buying it. Alternatively, I may add to positions we already hold, bringing our positions into better balance. Finally, I may choose to purchase dividend-paying stocks that are not on the list but improve our diversification and/or dividend growth prospects.

- Update our dividend income spreadsheet. This is the best part. Record all our holdings and the dividend income they generate. It always puts a smile on my face to see this “paycheck” we don’t have to work for. But there is an enormous psychological benefit too: focusing on dividend income rather than price fluctuations makes it easier to stick to our investment plan.

Once you’re up and running with a discount brokerage account (I use QTrade and love them) and a written financial plan, it only takes a few hours a year (at most) to tune-up a solid dividend-paying portfolio of quality stocks. The average financial advisor charges 1-2% of assets under management (AUM) every year to do the same job, and usually with lower total returns to boot. What would 1-2% of your portfolio be? You’ve worked hard for your money. Instead of throwing it away, put it to work using BTSX to build your portfolio. It’s probably easier than you think.

It takes time and real money to maintain this site. If you find this information useful, please consider donating to keep DividendStrategy.ca ad-free. Thank you! (I’m not trying to get rich . . . 20% of donations are given to Doctors Without Borders)

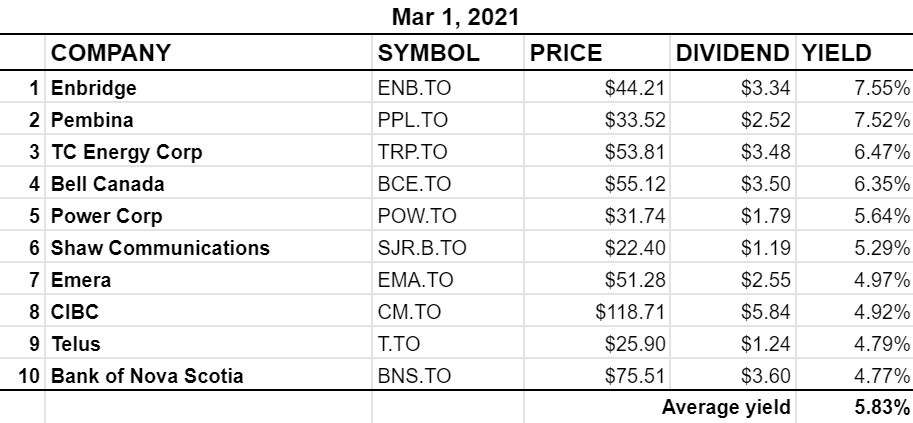

BTSX portfolio update for March 2021

TC Energy Corp increased their dividend by 7.4% to $3.48 – a reassuring development. Average yield remains very strong at 5.83%.

as always great post and information Matt thank you for all your work

Thanks, Benj. I hope this is helpful.

Thank you Matt for all your work. Just wondering why Emera is not in the BTSX portfolio?

Computer glitch – fixed and updated. Thank you so much for pointing that out, Alvin.

I’ve read in a few publications over the years a DYI only needs 10 to 15 stocks to diversify and do well. To many can be hard to keep track of and really don’t improve returns. Your thoughts?

I don’t have strong opinions about this. Somewhere between 10 and 30 makes sense to me. Enough that you are reasonably diversified (I’m not a fan of hyper-diversification), but not so many that you become disorganized. With 20-ish stocks I plan to hold for a very long time, I don’t find our portfolio hard to keep track of.

Good question, Geoff.

This is a great article!

Thanks!

Nice article.

In retirement I keep it even simpler than that.

I have more than this number but in the taxable portfolio I now focus on eighteen Canadian equities (a few from the TSX Composite, not just the TSX 60) with a dividend yield of well over 3%. I take a look at my personal spreadsheet and whichever stock has the lowest percentage allocation in this portfolio gets any extra savings added to. Buy and hold, except for any dividend cuts. My monthly brokerage statement show me the dividends received for the previous month and I just average them out on a calculator and they do climb year by year.

In the registered portfolios it’s one all-in-one balanced indexed ETF and that’s about it.

Savings for emergencies in a HISA.

All super simple and very effective which is just the way I like it.

Super simple. Super effective.

When it really is this easy, it’s a travesty that so many interested and capable people are essentially donating money to the already bloated financial services industry.

Thanks for the comment.

Using data from Kenneth French, Norm Rothery at ndir.com has reconfirmed what pioneer investor David Stanley, then Ross Grant and now Matt Poyner have been saying for years. Over the long term, high yield Canadian dividend equities outperform.

http://www.ndir.com/SI/articles/GraphingDividends21-1.pdf

If you can access beyond the paywall at globeinvestor you can find more information there from Norm’s Feb 22nd article “Where things stand in Canadian dividend land – and why high yielders may now be your best bet”

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-where-things-stand-in-dividend-land/

With the recent jump in Shaw due to the Rogers proposed take over, the expected dividend rate has dramatically dropped.

How would you propose handling the situation? Selling Shaw and replacing it with something some other higher dividend paying stock such as BPY-UN:TSE ??

Just holding onto Shaw seems opposed to the strategy of dividend generation.

SJR-B has done almost nothing for a very long time. Shareholders have been waiting for some good news like this. If I owned SJR-B, which I don’t, I would be selling.

I love you list and I use it. Have you ever think about doing one for US stocks too ? Thank for the work !

Glad you like the site. This is where you can find the US equivalent of BTSX: https://www.dogsofthedow.com/

Matt, you have a fantastic site here! I wasted so much time on other sites. I wish I found yours sooner!

I have just cashed out all our Mutual Funds our financial advisor had us in, and moved everything to Qtrade. (I don’t even want to mention the $30K in fees we have paid since 2016!) I now have over $500K across six registered accounts to invest and I am going to use BTSX. I have about 10 more years before I would need to actually use the dividends, so I plan to reinvest the dividends until then.

Although I know not to time the markets, most stocks are pricey right now. Should I use ‘Dollar Cost Averaging’ (DCA) to make my buys, or go all in with the full $500+K?

If I were to DCA, what percentage and interval should I use? I was thinking 25% one a month?

Keep up the excellent work!

Love to get comments like these. So happy to hear that this blog is making a difference.

Your question is a good one because it’s a scenario that many face and triggers so many common investor concerns. As you might imagine, however, it doesn’t have a simple answer. Statistically speaking, because we know that time in the market is the greatest driver of returns, putting it all in at once is, mathematically, at least, the “right” answer. BUT, psychologically, dollar cost averaging into our investments is often far easier to stomach and, therefore, less prone to fear-induced errors of judgement. Both strategies have benefits and drawbacks, but it sounds like you might be more comfortable with dollar cost averaging. If that is the case, make a plan to do that and stick with it (which can also be hard); 25% each month for four months is reasonable, but there are other intervals that would be equally reasonable such as 1/3 every 2 months or 1/4 every quarter. You get the point.

Thanks again for the kind words, excellent question, and generous donation 🙂 All the best.

The very next day after posting my question to your blog, an article popped up in one of my news feeds: https://www.cnbc.com/2021/08/12/which-investment-strategy-is-better-lump-sum-or-dollar-cost-averaging.html

It is from the US (CNBC), but I presume it would be safe to extrapolate the findings to the TSX. The key takeaways:

“New research looked at rolling 10-year returns on $1 million starting in 1950, and compared results between an immediate lump-sum investment and dollar-cost averaging. Assuming a 100% stock portfolio, the return on lump-sum investing outperformed 75% of the time.”

Nice bit of serendipity there.

It’s also important to note that, even though valuations feel quite high to most of us right now, the findings of this study (and others like it) still hold true.

Even so, dollar cost averaging with a plan can work very well. Just accept that you might be trading a small fraction of returns for better sleep. Not a bad trade in my books 🙂