Spring is here and I’ve been swamped with family responsibilities, springtime jobs around the house and a surge in interest in one-on-one mentoring, which is great – no complaints here. Ideas for blog posts bloom like the dandelions on my lawn, but setting aside the time to write has proven difficult. Fortunately, David Stanley has come to the rescue – even though he’s equally busy preparing his gardens for the season. “The more grocery prices go up, the bigger the garden gets,” Dave tells me. As you will read, planting more tomatoes isn’t the only way to fight inflation – Beating the TSX can be a big help for the individual investor.

One of the many great things about my friendship with Dave is that he will frequently share good content that he discovers. Dave’s keen eye for what is interesting and relevant to DIY investors combined with his decades of experience with BTSX and a penchant for no-nonsense writing means that we can all benefit from his insights.

This time Dave shares his take on a recent Globe and Mail article by Rob Carrick about dividend ETFs. I’ve added my two cents at the end.

David Stanley on BTSX vs. Dividend ETFs

A few days ago, I read an article in the Globe & Mail by Rob Carrick entitled “Why dividend growth investors may want to pass on ETFs”. Of course, a title like that will grab my attention at any time, and I have in the past found Mr. Carrick a very strong advocate for the individual Canadian investor. The essence of Mr. Carrick’s opinion is as follows: Dividend growth is a profitable method to follow since it benefits not only from the dividend yield of the companies in which they invest but also from the usual yearly increases in those dividends.

However, he points out, dividend growth ETFs are composed of a portfolio of stocks based on certain rules and are rebalanced, usually on a yearly basis. For example, stocks may be dropped if they fail to increase their dividends for a specified period. Thus, stocks may be promoted or demoted and it would become extremely difficult for an investor to precisely calculate their expected income. This, of course, is in contrast with BTSX in which dividend income is easily estimated.

It would be unwise to disagree with this article as the conclusion is obvious, and I have no intention of doing so. However, it might be useful to see how Canadian dividend growth ETFs stack up against BTSX.

I will say in passing that some investors have questioned me about the absence of a factor to account for continuing rising dividends in our calculations. My reply is that since we are dealing with the bluest of blue-chip Canadian stocks one can be assured that dividend increases will occur in a timely fashion.

Looking at this year’s BTSX portfolio shows many companies that have excelled in growing their dividends.

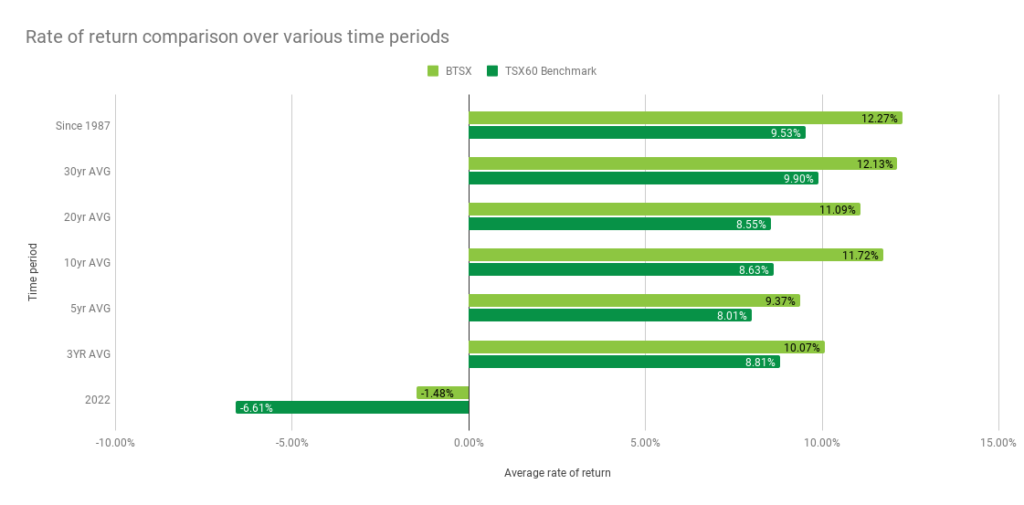

According to Y Charts (ycharts.com), VDY, a Vanguard ETF (MER = 0.22%), XIU, a Blackrock ETF (MER = 0.18%), and CDZ, an iShares ETF (MER=0.66%) are the three best-performing dividend growth ETFs. As of the end of 2022, the 30-year average rate of return using the “Beating the TSX” method was 12.27%, compared to the benchmark index (XIU, which was launched in 1999, is now used as the benchmark), rate of return was 9.53% over the same time period.

Neither VDY or CDZ have been around as long as BTSX but this table shows comparable data:

Fig 1: BTSX vs. VDY & CDZ (AVG. ANNUAL RETURN) | ||||||

BTSX vs. VDY (10 Yrs.) | BTSX vs. CDZ (5 Yrs.) | |||||

BTSX | VDY | BTSX | CDZ | |||

11.72% | 9.96% | 9.37% | 7.06% | |||

Beating the TSX surpassed both these ETFs and XIU handily. A lack of consistent income growth along with management fees cut significantly into ETF returns.

The conclusion of this work should be apparent. While ETFs purport to save the investor time and increase results by professionally selecting a group of dividend growth stocks, it is clear that the BTSX method of investing provides not only higher total returns but a much easier way to track your results.

There is a place for ETFs in the portfolios of individual investors but I lean towards simple, low MER index funds. I remain convinced that BTSX has been proven superior to any alternative when investing in Canadian dividend stocks.

Matt's thoughts on BTSX vs. Dividend ETFs

I love ETFs and I love blue-chip dividend-paying stocks, so you might think that an ETF of blue-chip dividend-paying stocks would be the holy grail for DIY investors. Unfortunately, as Carrick writes in his final paragraph, “. . . dividend growth investors may not find what they’re looking for in dividend ETFs.”

If you are a pre-retirement investor in your accumulation years, chances are you’re looking for growth. As David Stanley has pointed out, the total return of BTSX has outstripped all of the dividend ETFs mentioned. For a look at BTSX’s long-term performance, go HERE.

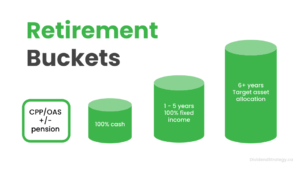

But for retirees, income is often priority #1. I have written about the research showing that retirees are generally reluctant to sell assets in order to generate income. This is why dividends are often so attractive. The ideal situation is to have a portfolio that generates a safe, steady and reliable stream of income that increases over time at or above the rate of inflation.

Unfortunately, big dividend ETFs like CDZ and VDY stumble when it comes to providing consistently growing income to investors. Over the last three years, CDZ’s monthly distributions have vacillated between $0.075 to $0.109. VDY is even more volatile with distributions anywhere from $0.089 in July 2021 to $0.207 in September 2022. Month to month they’re all over the place.

How does this compare with Beating the TSX? As we’ve seen this year with AQN and in 2020 with IPL, no dividend strategy is immune to dividend cuts but BTSX has provided remarkably consistent dividend income alongside its impressive total return numbers.

For the purpose of this post, I recalculated the dividend growth rate for BTSX. As of the end of 2022, the 5-year dividend growth rate for BTSX was 5.99% and the 10-year growth rate was even better at 6.07%. What about AQN’s dividend cut in early 2023? Accounting for this we still get a 5-year growth rate of 5.06% and a 10-year of 5.61% – well over double the likely long-term inflation rate.

Conclusion

Individual investors, and retirees in particular, need both capital appreciation so they don’t run out of money, and income so that they can pay for their living expenses. Dividend ETFs offer a simpler approach than buying individual stocks but, as Rob Carrick points out, “Unfortunately, dividend growth in the stocks held by a dividend ETF doesn’t always translate into dividend growth for investors holding the fund.” This makes cash flow planning in retirement very difficult.

I hope Carrick’s article and this post are helpful in understanding why dividend growth investors might want to pass on ETFs. The good news is that BTSX may provide a better alternative. For those investors who are willing to put in a little more time and effort, BTSX offers a simple, rules-based method that has provided superior total returns and relatively stable, growing income over the years.

If you are just starting out on your investing journey, feel free to use all the resources on this site completely free of charge. If you’re a little further along and would like to support my efforts, click this button to make a donation.

Thank you for this post Matt,

I’ve held VDY few years back in my portfolio only to drive me crazy with its distributions so I got rid of it and bought the top holdings and never looked back since. I hold all the companies in BTSX except for AQN which I sold few months ago but I’m holding the rest.

There’s nothing like getting a raise every year without even asking and those BTSX companies know how to reward us every year.

Hi Gus, thanks for sharing your experience. That’s the funny thing – it’s quite easy to simply buy the top holdings in a fund yourself, particularly those funds with little turnover, thereby saving fees and improving dividend stability.

Hi Matt, Thanks for another relevant blog post. I adopted a hybrid approach whereby I invest using the BTSX method as my core investment method and I anchor my portfolio using Dividend focused ETFs. I believe this anchor approach was mentioned in MyOwnAdvisor’s blog. I am a retiree looking to generate stable income with moderate growth. I currently invest in 9 of 10 BTSX stocks plus a few other TSX 60 stocks and 2 REITs. This makes up 85% of my TFSA. The other 15% is in a Canadian TSX 60 Dividend focused ETF which gives me exposure to a broader base of the market. This is also a place where I can reinvest some newly earned Dividends and use this “dry powder” to eventually reinvest when some TSX 60 stocks “Dip”. In my RRSP I also invest in US ETFs to broaden my exposure. I would be interested to hear your thoughts on this approach. Thanks again for your informative posts!

Hi Mike, if I am understanding you correctly, it sounds like a reasonable plan overall. Of the dividend ETFs Dave mentioned, XIU, which tracks the TSX 60, has a lot going for it in terms of steadily increasing dividend payouts over time. Throughout the year I will often put money in XIU rather than letting it sit in cash – it’s a handy tool.

As for stocks or ETFs that pay foreign dividends, it makes sense to hold these in an RRSP/RRIF to avoid the dividend withholding tax.

“Broad exposure” is another way of saying diversification and it’s extremely important. There are a few popular dividend investors who downplay the importance of diversification, but those opinions fly in the face of the best evidence. Thus, the first question when building a portfolio is asset allocation, the second is geographic allocation, the third is sector diversification, and fourth is company diversification. Stick to this framework and it’s hard to go wrong.

Hi Matt, new subscriber here. Thanks for the post. As a newbie dividend investor (about to be) wondering if you can clarify something for me: I understand the concept behind BTSX, I am just wondering about stock price growth. If I invest in the top 10 stocks with the highest yield, then my understanding is the yield is high due to price depression. So if the same 8 or so stocks keep re-appearing on the list yearly, does that not mean it’s because the stock price remains low? So is my stock price remaining stagnant overall?

Not at all! But this is a great, insightful question. Are you sure you’re a newbie??

If you look back to the long term results of BTSX vs the benchmark, you will see that it is the total return (price appreciation PLUS dividends) that is tracked. On balance, BTSX companies are big, stable, and have growing profits. Some of those profits are used to pay dividends and some are reinvested in the company to ensure future profits, thereby increasing stock prices.

You’re absolutely right that there is a value component to the BTSX method, but this is just one factor among many that is contributing to the long-term returns. Sometimes it is those stocks that have shot up in price and dropped off the list that drive a particular year’s returns (long-tail phenomenon). Sometimes stocks remain on the list because BOTH their price and dividend have increased. In either case, the BTSX investor is rewarded.

Great question. Welcome to the site, Irene.

Hey Matt,

This sort of begs the question why there isn’t a BTSX ETF? What are your thoughts on that?

Good question. Too simple to duplicate on your own therefore can’t justify an MER? Worried they’ll be sued because we’ve been writing about it for so long? Just guessing.

Hi Matt,

Thanks for the great post.

You mentioned that investors may be better off to follow BTSX vs the dividend ETFs on the Canadian market.

How about the US market? The US market does offer some dividend ETFs (ie SCHD) with both consistent annual payout and growth. How do you rate this against BTSX?

Honestly, I wouldn’t compare US stocks to Canadian stocks at all because it’s not an either/or decision – we should have both. This is part of being properly diversified, which is VERY important.

I suppose using a US dividend ETF might be a reasonable way to access the American market, but I prefer simply buying an all-in-one ETF that buys the rest of the world of stocks but excludes Canada (eg. XAW) for my non-Canadian holdings. Not only does this keep things simple and organized, but also ensures diversification outside of Canada because I’m getting entire indices and not just dividend-payers.

Methinks too many Canadian investors have this undying love affair with the U.S. stock market. I call it recency bias.

Go back further to the inception of the relatively low MER TD e-series index funds in 1999 and the Canadian index outperforms all TD American index offerings.

https://www.td.com/ca/en/asset-management/funds/solutions/mutual-funds/

…..and since the BTSX handily beats the Canadian index over the last twenty plus years, it’s no contest.

Sure I invest in the Canadian market where I use only individual companies that pay dividends, but I also invest globally using a couple of ETF’s (XDG and ZBAL).

I’ve been investing long enough to see part of the rise in Japan’s market through the 80’s until the start of the eventual fall in 1989. Still hasn’t recovered to it’s past stock market high, even though it’s the third largest economy in the world.

This is exactly why international diversification is important. History is full of examples of countries that appeared stable and prosperous and then, sometimes very rapidly, everything changes. As much as we hate to admit it, it could even happen to Canada.

No one should invest in anything because of “love” or any other emotion. Invest in assets/countries/companies that fit your investment plan. International diversification is a key part of that.

Thanks for the comment, DividendsOn.