I am a firm believer that anyone with a little interest and a moderate helping of self-discipline can be a successful investor. But here’s a warning: no matter what your age, there are some serious obstacles between you and financial success. Young investors frequently struggle with long-term planning and lack the experience of having lived through a few market cycles. In middle age we have more expenses than at any other time – mortgages, vehicles, kids’ activities, etc. – making it hard to save, and are often so busy with jobs and family to engage in sound financial planning.

I used to think that older investors, if they’d been successful up to that point, had it made. But past success merely starts them on the right footing; cognition declines, aversion to adverse outcomes increases, skepticism decreases – we become vulnerable, to ourselves and to others.

I am very pleased to welcome David Stanley back to the blog. He is a man who has lived through all of these stages, established himself as a dividend investing authority in Canada for the last several decades and has earned the right to now call himself a successful “aging investor”. When David talks, I listen. Here’s what he has to say on the subject of how aging influences your investing skills.

Matt Poyner

Canadian investors have been facing some strong headwinds this year, most of which have resulted from the unprecedented pandemic currently enveloping the world. No one can predict accurately how or when this will abate and I continue to believe that the best option for individual investors is to stay the course and not to do anything out of the ordinary in terms of portfolio changes. You, of course, can do your bit as a responsible individual by obeying what our health officials recommend.

Rather, I am going to talk about an important subject you can do something about, the effect of aging on your ability to make good investment decisions.

The risk is real

I became interested in this topic a few years ago when I was running a ShareClub in a senior’s home. I heard some horrific stories of financial elder abuse, many coming from within the family, and resulting from the senior’s insistence that they were still able to handle their own affairs coupled with their children’s lack of oversight. Now that I am into my eighties this is a subject I find myself thinking about a great deal.

Let’s start with the science, such as it is. Overall we know very little about brain deterioration over time and what we do know is not very encouraging. Here is a quote from the NYT: “Studies show that the ability to perform simple math problems, as well as handling financial matters, are typically one of the first set of skills to decline in diseases of the mind.”

What can you do to protect yourself?

What can we do to fight back against aging and what should our children do to help us? A good place to start learning about financial planning and abuse is HERE.

In the first place I would expect and hope that the vast majority of us have in place a ‘Continuing Power of Attorney for Property’ (as it is called in Ontario) that takes over when things really get desperate. Their duty is to make decisions in keeping with your values, not theirs, but at that point it is often too late in the day to undo some of what might have gone on before.

Here are some things that we can do in an ongoing manner to either delay cognitive errors or at least find them out before too much damage has occurred.

1. Monitor yourself

We are and must be the gatekeepers of our own health. Try to keep an impartial eye on your brain function. In Ontario, drivers over the age of 80 must undergo a licence renewal program every two years. Part of that program is successfully completing two exercises designed to catch cognitive impairment. Go here and take a look at these problems. That’s right, these two screening tests have proven effective in measuring the cognitive skills necessary to drive.

If you want a more in-depth test try this. But remember the huge problem with self-diagnosis: The human race has an infinite capacity to delude itself. Ask yourself if you are becoming more impatient, emotional and overconfident in your decision making.

2. Suppose you do find that your skills are eroding, what then?

Here are some things to try:

A. Get some help from within your family. Remembering that since in the fullness of time you will be obliged to let go of the financial reins, doesn’t it make sense to get others involved in the process as early as possible? Can you work with your spouse and/or your kids to pass on to them your financial plans?

B. Get some help from outside your family. There are many competent and trustworthy financial advisors who are trained to take over for you. The only problem is finding one who shares your view and who will faithfully execute your plan. A big stumbling block in this process is the lack of a mandatory fiduciary duty obligation on the part of the advisor. Yes, that is correct, a financial advisor has no fiduciary duty to place your interests above his/her own. Make sure you cover this point when you are considering hiring an advisor.

C. Find someone to monitor your financial decision making. From within or outside of your family use someone close to you to keep and eye on your accounts. Make sure they get copies of your banking and financial transactions so they can check for aberrant activity.

Conclusion

I know that many of you will find all of these suggestions repugnant but let me leave you with this thought. Wouldn’t it be better to employ one of these options now rather than be forced into it because you can no longer look after your finances on your own?

BTSX portfolio update for December 2020

At age 80 I have more time to devote to rigorously researching the markets, digesting the information and clearly seeing where I, as a DIY investor could benefit, without taking undue risk. During the years of earning a living and raising a family it was often an afterthought in comparison to today when it is a stimulating pass time and enjoyable hobby. I respect David Stanley and have followed his editorials in CMS for several years. Much of what I deploy now with finances is based on his wise writings.

I, too, am grateful for the wise counsel of David Stanley and for Matt continuing in his footsteps. Picking stocks in old age is in itself a multifaceted way of engaging one’s cognitive abilities while controlling one’s emotional responses. And having a vested interest in a variety of companies makes one feel connected to the wider world which in itself is an antidote to the possibility of social isolation.

I have known David since 1994 through the original Money Savers magazine. I have also, met David on a number of occasions in various conferences. Thanks to him and the Connolly Report I learned and practiced dividend investing since about mid 1990. He has done a great service to many of us. Thank you David and welcome back.

Definitely a subject that too many leave too late or worse don’t have anyone to turn to for help. I’m going on 79 and my wife just turned 77, but she showed signs of Alzheimer’s at 67 and we immediately got Enduring POAs. Fortunately I’m able to continue to manage our portfolio, but I’ve left written instructions to my daughter and husband on how to continue to manage my our portfolio, should something happen to me. What makes me confident that she’ll not run into difficulty is that our portfolio income far exceeds our expenses, and therefore there should not be a concern about selling or a loss in value should the market crash again. Another advantage of Income Investing, over Capital Appreciation or Total Return.

Thanks for posting this concise and informative article.

Kudos to Eve Hoch’s comments on her experience. I hope I can still be at in 19 years.

Thanks to all of you for your favourable comments. It is feedback like this that keeps me inspired to continue contributing. And thanks to Matt for providing a forum where these topics can be considered. I turned 81 recently and I am very appreciative that the BTSX methodology requires such a minimal amount of cognitive input on my part. But, I suppose I will have to give it up when I no longer have the strength to open the dividends envelopes!

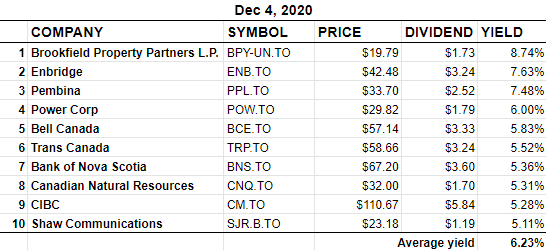

Subject: BTSX December 2020

David, you have far more experience than me. However I have concerns with your ten stocks. 3 in energy? I believe in fossil fuels and pipelines but it has become a high risk sector would you agree? So to put 30% of your allocation in it when ithe sector is close to only 10% of the TSX has me worried. Ask yourself, if in years and if we are using fossil fuels 10% less; 20% less or even 50% less, how will these companies grow dividends, let alone sustain them? I believe the BTSX is a potential big risk. Its designed to be a sleep at night portfolio where continuous analysis unnecessary. Energy is risky. It needs close attention I believe.

My rule of thumb for dividend safety is a minimum of 30 equities spread across mostly financials, utilities, pipelines and some misc. But im growing very weary of annual share proce declines in the pipelines and oil stocks for 4-5 years now. Ive been waiting for the rebound that is not coming. Constant regulatory hurdles and social protests. Are they truly a good idea in a prudent ‘seniors’ portfolio today? Perhaps not at 30%. I would think 10% is my stomach capacity today. What do you think? How about at BTSX that excludes Energy? There is a reason the energy stocks have high yields.

Last question, where can I find the list of highest to lowest yields on the TSX.

From David Stanley:

1. It is what it is. One of the major advantages of BTSX is that it is an objective process. No human influences the results. So, if there are 3 energy stocks then there are 3 energy stocks. You, of course, are free to purchase or not purchase any of them. I can only tell you that I now hold 5 Canadian energy stocks, and that I have held them all for many years, and that I have no plans for selling them since they all provide me with very nice dividends.

2. If you are interested in yields for the entire TSX Comp. index, which Is around 300 stocks, I can’t think of a source for those data. Matt provides dividend yields for the TSX 60 index (HERE) but beyond that I am not aware of any other place to direct you.

Thank you for replying. I have 15 of the top 20. Including the 3 pipelines but they have performed poorly for over 5 years now apart for the dividend which share price could get even worse due to government policy against fossil fuels. Im tempted to seek safer pastures amongst the top 25 or so. That said I have about 50 holdings including tech, etfs, prefs too. Its a nightmare to manage. At this time of year i review how to invest TFSA cash, an inheritance to invest and other dormant cash. Ive put in at least 4-6 days on it. Lots of work to even rebalance. Do you seriously carry only ten stocks at 10% each. Are you perhaps backed up by an employment pension which is like some people I know, who are more willing to take risks ( like only having ten stocks) Years ago I read that as a rule of thumb, hold 30 stocks and target a 3% allocation with no more than 5% in any. Im sure you have seen that advice. But its a lot to manage.

Hi Steve,

If you want a list of highest to lowest yields on the TSX you can try barchart.com/ca

Click on TSX Composite under INDICES.

Under TSX Components click on Fundamental.

On the right hand side of the page you’ll see the title Div Yield

Click on it and you should get a list of highest to lowest yields.

Thanks DividendsOn – Took a little effort, but I was able to get it.