Confidence is one of biggest challenges in investing. Too little and you’re paralyzed, impressionable, and ineffective. Too much leads to poor judgment, risky tactics, and devastating outcomes. The worst part is that it’s almost impossible to know when we have too little, too much, or just enough.

Market returns and investor confidence move together. The longer markets rise, the more confident and comfortable investors get. It’s like the turkey farmer who feeds his nervous turkeys day after day, month after month; slowly they trust him more and more. The turkeys grow fat and happy. When are they at their most comfortable? The day before Thanksgiving. Chop, chop.

When markets fall, confidence falls too. In fact, confidence falls first.

The confidence paradox of long-term stock returns

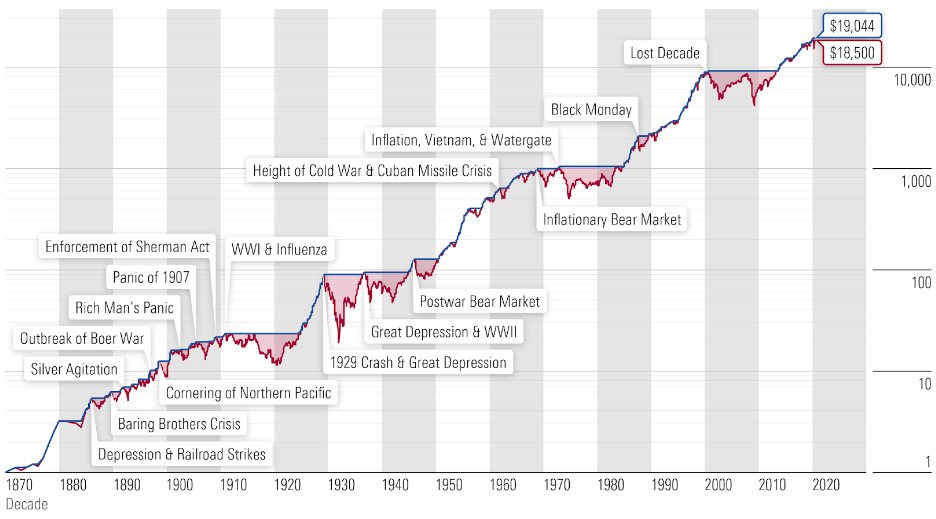

What makes stock investing different is that losses are temporary, not permanent. Do nothing and your portfolio will come back stronger. This is a chart of the last 150 years of stock market returns. The captions show all the reasons investors had to be fearful. The shaded red areas show that the market spends most of its time below a previous high. And yet, look at the overall trend.

Every stock investor knows, rationally, at least, to expect markets to fall 10, 25, even 50%, on occasion. Yet, for some investors, as soon as it happens, doubt and fear hijack well-thought-out plans. Suddenly all we can think about are all the reasons not to be invested, forgetting that we knew this would happen, that we planned for it, and that lower prices actually increase future expected returns. When markets are falling, confidence feels foolish and fear feels rational.

Investors need not be turkeys. We can’t avoid our “Thanksgivings” – it’s foolish to try – but we can design our portfolios to survive and thrive through them. We’re not wired for this, I get it, which is why it’s important to adopt an investment strategy that is not just evidence-based for maximizing returns and minimizing risks, but also one that helps us behaviorally. When confidence is hard to hold on to, dividend investing can be a light in the dark.

Dividend portfolio face-off

John Heinzl just published an article in the Globe and Mail titled, “Markets are falling, but my dividends keep going up”. In it, he provides an update of the performance of his “Yield Hog Dividend Growth Portfolio”, as compared to the S&P/TSX benchmark index. Good timing, John. Given that we’re halfway through 2022, why not throw the BTSX portfolio into the ring and see how it stacks up?

First, how did the benchmarks do? If you’re reading this blog, it’s likely not a surprise to you that markets have been suffering of late. The S&P/TSX Composite Index is down 9.9% (total return) year to date. The TSX 60 Index is only marginally better being down 9.6% (total return) year to date. Ouch.

No refuge in bond funds

Index investors who use bond funds to balance the volatility of their equity holdings got an especially nasty surprise this year with the broad-based bond funds posting returns even worse than the indices. Two of the biggest, XBB and ZAG were down 12.3% and 12.7% respectively.

It’s no wonder index investors get shaken up so easily. When all you have to focus on are prices, the cold rationality of long-term index investing can be of little comfort. Fortunately dividend investing provides an income alternative to bonds and a an effective way to shift investor focus away from volatile prices.

Related: Do bonds belong in my portfolio?

“Yield Hog Dividend Growth Portfolio” mid-year results

In his article, Heinzl is right to point out, “This year, dividends have been one of the few bright spots for investors.” Heinzl’s portfolio of 22 Canadian dividend-paying stocks is down 4.3% (total return) for the year – not great, but still about 5% better than the benchmark indices. Taking a longer view, Heinzl points out that if one had invested $100,000 in the portfolio at its inception in October of 2017, with reinvested dividends, the balance now would be $148,036 for a compound growth rate of 11.85%.

To be clear, this is not a competition, and I love that Mr. Heinzl promotes dividend investing. But you’re probably curious – How does this compare with Beating the TSX?

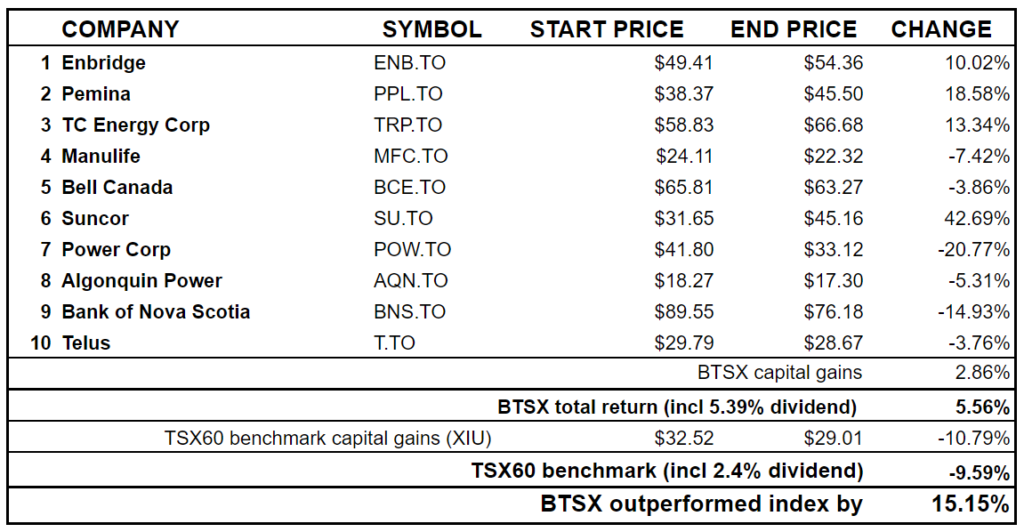

BTSX mid-year results

After the epic returns of 2021, I was bracing myself for some pain this year but, yet again, BTSX has shown its strength. So far, in 2022 BTSX is up 5.92% (total return) vs. – 9.24% for the benchmark index. Yes, even with the war in Ukraine, inflating prices and deflating real estate, BTSX is outperforming the index by 15.15% and John Heinzl’s portfolio by 10.2%.

Just as important, six out of our ten companies have increased their dividends in 2022. Non have cut their dividend.

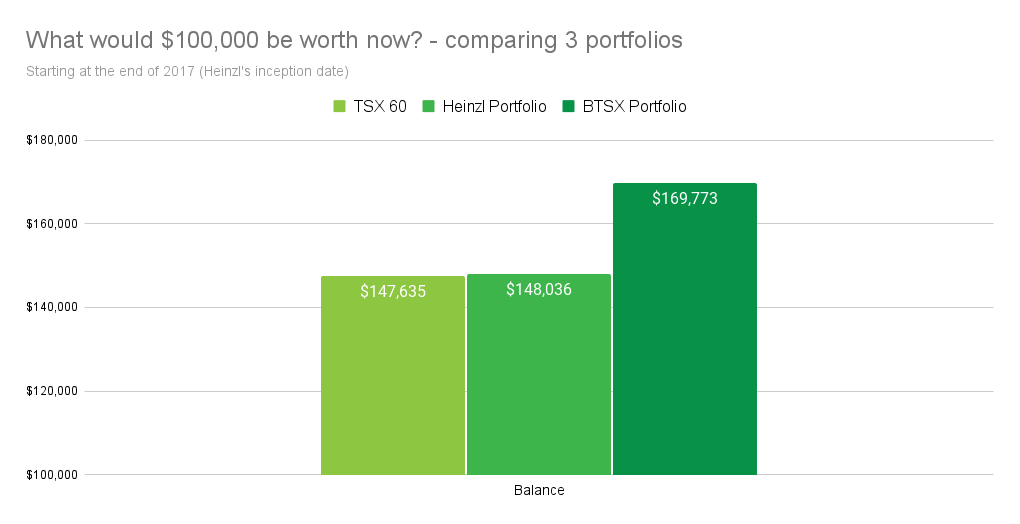

Comparing three portfolios

If one had invested $100,000 in the TSX 60 index, Heinzl’s portfolio, and BTSX at the end of 2017 (approximately the inception date for Heinzl’s “Yield Hog Dividend Growth Portfolio”) the final balances as of July 1, 2022 would be:

Unfortunately, compared to the TSX 60, the Yield Hog Dividend Growth Portfolio merely kept pace. We’ll see what the future brings for Mr. Heinzl’s portfolio. In the meantime, over this time period, Beating the TSX, a simple method that requires no expertise, has left both of the other portfolios in the dust.

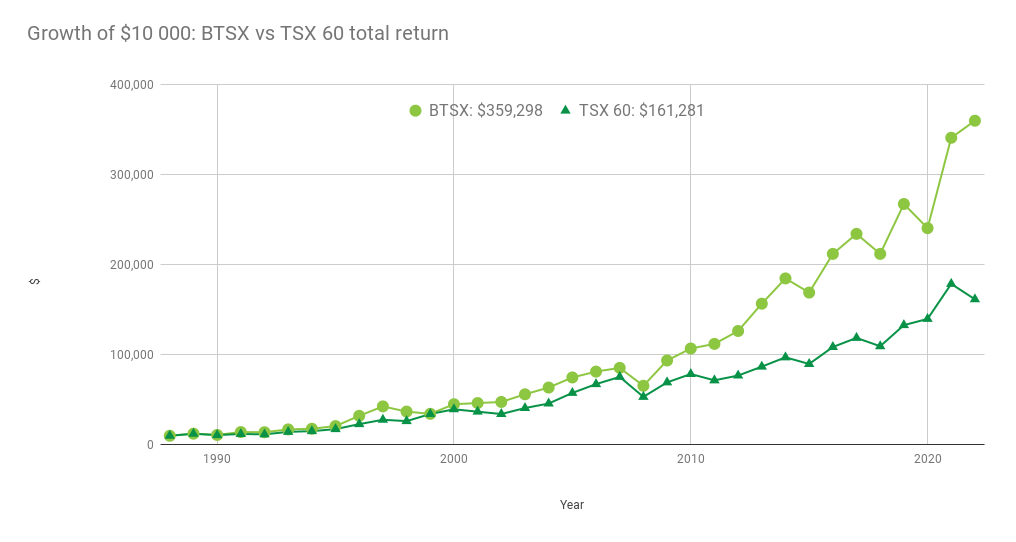

But it’s the long-term that matters, so I have updated what might be the most important chart on this site: the performance of BTSX vs. the benchmark TSX 60 index over the last 35 years:

To me, this chart really says it all. Perhaps I need a contact at the Globe and Mail.

Confidence: A question of “when”, not “how much”

I started this post writing about confidence and the Goldilocks challenge of having just enough but not too much. But perhaps it’s not a matter of the right amount of confidence, but rather where it is placed. I have zero confidence in my ability to predict individual stock prices. I also have zero confidence in my ability to know what the stock market is going to do over the next 1 – 5 years. Learning when not to have confidence is essential.

But I have a lot of confidence in my process of dividend investing, using BTSX as a tool to build a strong portfolio. Not confidence in my abilities, but confidence in my method.

I’ve written a lot about investment returns here, but none of that matters if you don’t have confidence in your plan. Whether you are using index funds, John Heinzl’s portfolio, Beating the TSX or another method, the important thing is to make sure it is evidence-based, and that your confidence in it will carry you through uncertain times like these.

Thank you so much to those of you who have chosen to support me and this blog with your donations. The fact is that as the blog grows, it gets more expensive to run. I want you to know that your generosity and the thoughtful notes that are often attached to them have a huge impact on the quality of this site.

If you are so inclined, no matter the amount, you can support this site by clicking here:

Great blog post Matt! For me it is just further proof that human stock picking loses out to a method of systematic passive approach like BTSX. All the Behavioral Finance research and all the SPIVA reports show conclusively that active stock picking is bad for your financial health. Dave Stanley

I couldn’t agree more, Dave.

Very Impressive Matt, I’m glad that I’m holding 9 out of the 10 companies in the BTSX and I’m planning on holding for the long term because they’re all solid companies.

“I’m planning on holding for the long term” – that’s the key right there, Gus. Thanks for the comment.

Thanks for the good news update Matt. So glad that we stumbled upon you and BTSX this year – just wish it had been 10 years sooner! Joanne and John

I think we all suffer a little with “if only – ” syndrome every now and then! Thanks for the comment, Joanne.

I have 8/10 and am quite happy that I generally follow BTSX for buy points. Generally hold them forever unless there’s a dividend cut, to reassess. I didn’t cut Suncor when they announced their cut during Covid, and it’s mostly recovered to this point, dividend and price. I think laziness helps long term too… ; )

Keep the site up fine sir. It’s a great resource.

I’m not too good with numbers, but how do you arrive at 5.56% based on 2.86% capital gains and 5.39% dividends?

Good question – because this is a mid-year analysis, I only include half the dividends for both BTSX and XIU. I will add a footnote to clarify this – thank you.

Hi Matt. I usually ignore the noise and ups/downs of the market. But AQN has seen some big swings. With their current price, I’m expecting a dividend cut sometime in the future.

You had mentioned that they were a stock that you intend to hold forever. Do you feel that will continue to be he case going forward?

This is the hard part of investing in individual stocks vs index funds. I didn’t feel like there was a need to be concerned buying AQN when it arrived on the BTSX list, and I still hold it. I don’t think it was an error in judgement, just a situation in which this outcome was particularly unpredictable (even though it’s always possible with stocks). They may cut their dividend – probably should, to be honest. But I think the price already reflects that likelihood and the stock price might even go up when/if they do. Is the business sound? I think so. The relevant data is priced in. Personally, I’m holding, but I wouldn’t blame other investors for selling.