Happy New Year, dividend investors! I’m looking forward to crunching the numbers for our complete 2021 BTSX update over the next few days. In the meantime, if you’ve been paying attention to your dividend announcements, you might already have a smile on your face: Canadian dividend investors got a big raise in 2021, and Beating the TSX stocks led the charge.

BTSX stocks grew their dividends in 2021

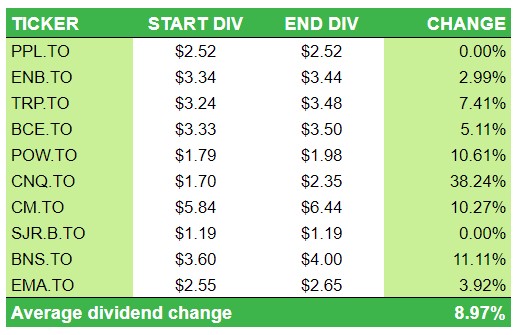

Eight out of our ten 2021 Beating the TSX stocks raised their dividends, with an average dividend increase of 9% – well over the rate of inflation. CNQ shocked a few of us with a 38.24% annual dividend increase, while our three financials, POW, CM, and BNS came in with impressive 10-11% raises. Only PPL and SJR.B did not raise their dividends. There were no cuts.

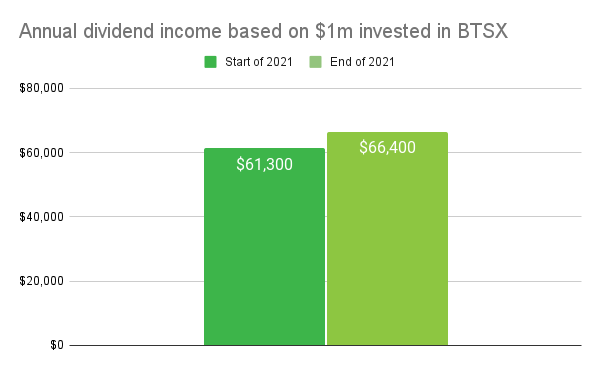

The total dividend yield at the beginning of 2021 was a healthy 6.13%. If you were lucky enough to have $1million evenly invested across those stocks, assuming none cut their dividends, you would have enjoyed a passive income of $61 300 for the year – not too shabby. With the dividend increases, however, that income rose to $66 400. That’s $182 of income every single day for doing nothing.

Is this dividend growth normal?

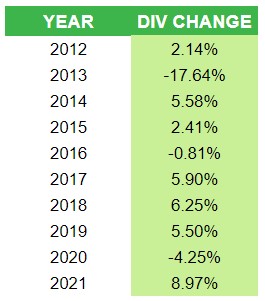

Such juicy dividend raises inspired me to investigate a simple question: What is the average rate of dividend growth for BTSX stocks? To answer this question, I looked back at the last ten years of BTSX dividend data. I expected an average dividend growth rate of 4-5%. The actual average annual dividend growth rate? Only 1.4%. Ouch. I dug deeper.

Here are the average annual dividend changes over the last ten years.

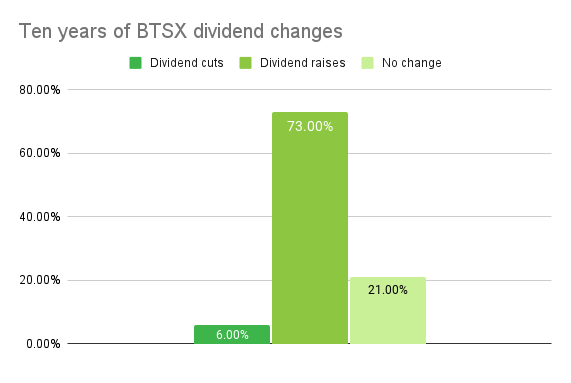

But the story is not in the averages, it’s in the individual stocks. Specifically, it’s about the dividend cutters. Over the last ten years, 73% of BTSX stocks have increased their dividends, while only 6% of BTSX stocks have cut their dividends.

But here’s the kicker: The average raise was 7.34% – wonderful. In contrast, the average cut was a devastating -66.07%. That’s not a papercut; that’s a chainsaw injury.

Don’t ignore what you don’t want to see

As you can see, 2013 was a particularly bad year. Even though half the BTSX stocks raised their dividends (BMO, NA, CM, BNS, and BCE), three put their dividends on the chopping block (IMG, ABX, TA). Average BTSX dividends that year fell by 17.64%. That kind of portfolio injury can be disabling if not planned for.

The other three BTSX stocks to cut their dividends in the last ten years? CVE in 2015. POT (now NTR) in 2016. And IPL in 2020.

There are plenty of bloggers drinking the Kool-aid and pounding the table extolling the virtues of their chosen investment strategy while ignoring potential weaknesses. Even some of the big names in Canadian dividend investing haven’t been immune. It’s a great way to grow an audience (and a profit). But I refuse to do it because it’s also a great way to hurt investors. If I make a little money at this blog, that’s great, but what I really want is for you to make a lot of money. I believe the best way to help you do that is to help you understand the whole picture.

Can we learn from the cuts?

If dividend investing was a slam dunk, everyone would be doing it. It’s profitable because there are trade-offs. We have to be willing to examine our weaknesses if we are to find ways to compensate for them.

Here’s the bottom line: our 9% dividend growth in 2021 was great, but dividends are not a sure thing. Dividend cuts happen and it’s foolish to think you’ll always see them coming.

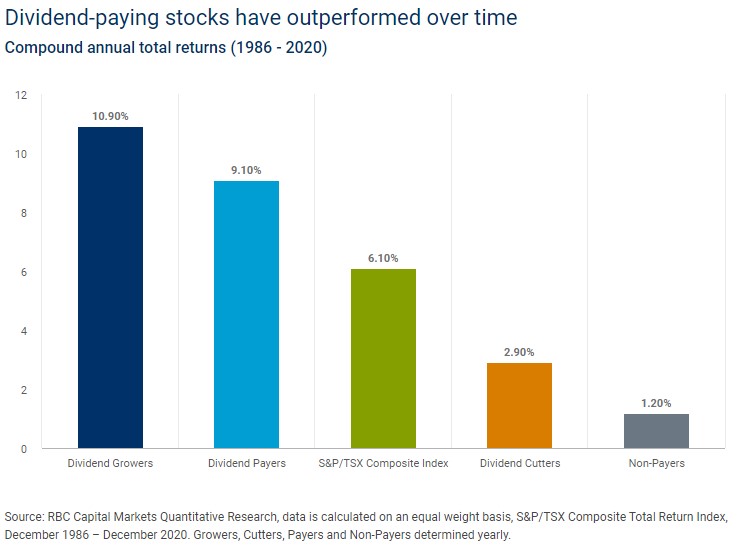

The long-term total return of dividend-paying stocks is truly impressive. Since 1986, dividend-payers in Canada have had average annual total returns of 9.1%, beating the S&P/TSX index by 3%. But dividend cutters have underperformed the index by 3.2% annually with compound annual returns of only 2.9%.

Dodging punches

The obvious question is whether or not we can identify those companies that might cut their dividends and choose not to invest in them. That’s easier said than done. You can, and should, look at dividend history and payout ratios, not to mention free cash flow and earnings growth, but even these metrics are only marginally helpful. I can see at least two caveats.

1. Where do you draw the line? Because BTSX selects for stocks with high yields, it is biased toward those companies with depressed stock prices (yield = dividend/price). Why are the prices depressed? There can be all kinds of factors, but there’s always some reason to worry.

Paradoxically, this is not a fault but a feature of the method. By selecting based on yield, we tap into the value factor. BTSX is, by nature, contrarian. Popularity and prices are correlated. Fortunately, there is ample evidence that, over time, unloved value stocks tend to outperform. The problem is, sometimes they don’t – and it can be hard to tell one from the other.

2. Running toward safety means running away from value. Choosing only “safe” stocks might exclude some of those deep-value stocks with the greatest upside potential. For example, the stock with the biggest total gain in 2021 was CNQ, which was up 80+% (74.7% capital gain + 5.5% dividend). How many of us were feeling that the oil and gas sector was a safe and secure place to invest our hard-earned money at the beginning of 2021? So, even if we can identify “safe”, “quality” dividend payers, excluding riskier stocks leaves little assurance that our returns will match up to the long-term performance of Beating the TSX.

Despite all of this, BTSX’s track record speaks for itself

Over the past 30 years (including 2021), BTSX has had an average annual total return of 13.13% vs 10.46% for the benchmark index. So, there’s certainly an argument to be made for simply sticking with the process; BTSX seems to be tapping into factors that lean toward outperformance.

But it also seems there’s a price to pay, and at least part of that price is the potential for dividend cuts. This is not a “bad” thing, simply an explanation for why BTSX works. It’s also something you need to be aware of if you are a dividend investor, in particular if you are relying on dividends to fund non-discretionary spending.

This data will not change the method I use to select BTSX stocks or to track the method’s progress, but it may change how individual investors choose to use BTSX as they build their portfolios.

Remember: BTSX was never meant to be followed dogmatically unless that is done with full awareness of the risks involved. Rather, BTSX should usually be used as a tool to identify potential investments. Personally, I would rather avoid stocks whose dividends appear at high risk, even if it means accepting a lower initial yield and lower upside potential. But that’s just me. I hope this post has given you a fuller understanding of dividend growth and dividend safety, especially as it pertains to BTSX stocks.

If you found this post informative and/or helpful, please consider donating to help with the cost of running this blog. Don’t forget, half of all donations are given to Doctors Without Borders.

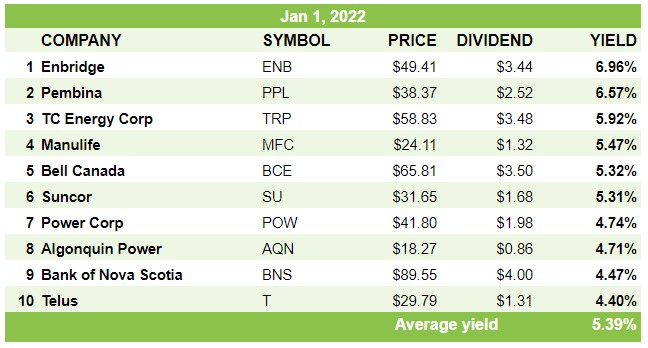

Here’s the list of BTSX stocks for 2022

So would you sell your BTSX stock during the year if it cuts it’s dividend? I have done this in the past following a pattern from a previous BTSX writer. Your thoughts?

Unlike Ross Grant, who you referred to and is a very accomplished investor, I don’t have a hard and fast rule about this. Within minutes of being announced, the cut is already priced into the stock. Instead, I re-evaulate whether or not I am still happy with the fundamentals of the company. This is not easy, don’t get me wrong. But I’ve been unable to find empirical data supporting a blanket “sell on the cut” strategy.

Good question. I’m interested to hear others’ thoughts.

Hi.

Just wondering if you have the yearly total returns on the BTSX portfolio.

Thanks

I do, but I have to ask you to wait a few days until I put together the full article! Here’s a hint though: BTSX beat the index 🙂

Great review and I do like the BTSX listing. Don’t agree with all of them but that can be put down to personal taste in some cases. I would rather hold BCE than T for the simple reason that they have fairly consistently paid between 0.5% and 1% more than T over I don’t know how many years. What do they say about compounding? 1% more per year can add up.

I had 6 of your 2021 BTSX and will have 6 of your 2022 BTSX.

I have enough oil so I am shying away from that sector for now so no Suncor for me at present. MFC might be of interest.

Presently retired so I am in drawdown phase and like the higher dividends. Eventually the draw down will exceed the divs but that is the way it is.

Excess withdrawals go in to the TFSA and non-registered portfolio which at present gives me an extra >$100 per month which should bump up to around $200 next year. That can pay a bill or two.

I had over 17K of IPL and sold them off and rebalanced my portfolios. I would have held them but the buyout took care of that.. That was one hell of a lot less oil in the portfolios (5)

CV-19 has shown how much money can be saved by simply staying at home even with a major expense for the house.

HAPPY NEW YEAR to all

Take care

RICARDO

Hi again, Ricardo. Thanks for sharing your approach. Sounds like you are doing exactly as I suggested: using BTSX as a tool rather than a recipe book. Interestingly, I feel the same way about SU and MFC.

Happy New Year!

Hi Ricardo,

I’m retired too, for 10 years now. I understand you preferring BCE over T due to the ~1% yield difference but have you considered the significant difference in dividend growth between the two? T’s annual DGR has generally been about 20% greater than BCE’s. Total returns have also been in T’s favour. I haven’t calculated how long but I’m pretty sure it wouldn’t take very long for T to overtake BCE in yield on cost (YOC) and put extra income into your pocket if the performance numbers continue to be in T’s corner. Here is a cut and paste taken from the Canadian Dividend All-Star List showing the large difference in DGRs across the board:

Ticker Company 1-Yr DGR 3-Yr DGR 5-Yr DGR 10-Yr DGR 15-Yr DGR 20-Yr DGR

T.TO Telus Corporation 7.3% 6.6% 6.7% 8.7% 10.1% 7.5%

BCE.TO BCE Inc 5.1% 5.0% 5.1% 5.5% 6.7% 5.5%

great article. Please publish the previous years list going back to times since the BTSX started or since is inception would be nice to see which stocks make in the most of those list since incesption 🙂

Thanks for the comment, Zasid. I will give this some thought. It’s always great to hear what you, the readers, are interested in seeing on this site.

Hi Matt – I appreciate the blog and have myself been following a dividend growth investment strategy for the last few years. I check back about once a week or so for new posts and look forward to the read.

Like you, I use the BTSX as a tool to identify potential investments and do not follow it dogmatically. My thought is that the high dividend yield for otherwise stable blue-chip Canadian stocks can be viewed as a proxy indicator that the stock is undervalued. Hence those following the strategy are rewarded with price appreciation once the stock moves towards a fair valuation while also benefiting from stable dividend payouts and growth.

I was curious on the math of what would happen to the overall yield if the average dividend payout were to decrease by 17.6% in a year. Assuming the year started with a 5% average yield, at the end of the year it would be down to a 4.12% yield (if my math is right). As you noted, a fall of 17.6% in one year would be difficult, but it would still leave the investor with a reasonable yield.

I did not personally invest in PPL, SJR and CNQ in 2021 because I wanted the companies that had the “wide moat”, to use a Buffet term, and could withstand unforeseen pressures the year would bring and continue to raise their dividend. Interestingly, not investing in SJR and PPL seemed a wise choice, but I lost out big in skipping CNQ.

And I second Zasid’s comment, and if possible, it would be great to see historical lists of BTSX stocks from previous years.

Thanks for continuing to share your insights. Much appreciated.

Hi Chris, great comments.

“My thought is that the high dividend yield for otherwise stable blue-chip Canadian stocks can be viewed as a proxy indicator that the stock is undervalued” – exactly.

“a fall of 17.6% in one year would be difficult, but it would still leave the investor with a reasonable yield” – If you are in the accumulation phase and don’t need to live on those dividends, I agree. But if you suddenly have to manage a 17.6% cut to income that you were relying on, that’s pretty tough.

I also missed out on CNQ last year, but I’m fine with that. I’m not under any illusions that I can predict these kinds of things.

All the best for 2022, Chris!

Thought I’d do a small comparison of your strategy to mine. I’ve owned 7 of the 10 high yield BTSX 2022 companies for over 10 years. I’m retired and have invested in dividend payers with a strong continuous history of dividend growth. For 2021, for the 7 that overlap BTSX, average yield was 5.3%. The average yield when compared to the original costs of purchase was 8.5%. The average yearly dividend growth rate was 7.7%. The average yearly price growth rate was also 5.3%.

Buy and hold or go for high yield each new year?

A total average return of 10.6% with that kind of dividend growth rate is great, Rocco. For comparison, the 5-year average dividend growth rate for BTSX was 6.0%, and total returns were 11.8% – but the stocks may feel a little more risky.

“Buy and hold or go for high yield each new year?” – to each his/her own, but I’m more of a buy and hold guy.

Thanks for the comment, Rocco.

Great post and thanks again for all of the wonderful work, and for running this site. Yes, it was a great year for BTSX. It was a great year for Canadian high dividend investing. When you do your total returns wrap, you might notice the returns are quite similar to Vanguard High Dividend VDY.

My Canadian Wide Moat 7 underperformed slightly. But all of the above trounced the market in 2021.

I will be sure to add your post link to my Sunday Reads this morning.

Thanks, Dale @ Cut The Crap Investing

Thanks for stopping by, Dale. It sure was a great year. I take no credit (or blame) for the performance of BTSX, but it even managed to edge out VDY last year. Will that continue – who knows? My own portfolio did well, but not that well because I decided not to buy CNQ or SJR last year.

Thanks in advance for the link, and all the best in 2022, Dale.

I check into your site every so often when I have cash to see if there may be any interesting equity to buy or add to from your list.

Generally that would be the four sectors of energy, financials, power utilities, and telecom. I also own company shares in three other Canadian sectors that would rarely if ever enter the BTSX list since they are generally lower yielding. Consumer discretionary, consumer staples and industrials.

I treat all our companies the same. If any cut their dividends, I’ll sell. Last one was IPL in 2020. If they were increasing the dividends, and then stopped increases for a few years, I’ll also sell. SJR.b from a couple of years ago and RCI.b this year, would be prime examples. I always like to keep companies in the portfolio for many years that seem to be investor friendly. The dividend and what management does with it has always been a signalling device for me. Not perfect, but the best I’ve got.

Thanks for all your great work on the site Matt.

It would be an interesting bit of research to look at the stocks that have cut their dividends to see if selling on the cut announcement was more profitable than holding until the end of the year.

Thanks for dropping by.

Pingback: How to use BTSX in real life — DividendStrategy.ca

Pingback: How to Beat the TSX (BTSX) - My Own Advisor