A conversation with David Stanley

You can’t turn on the news these days without seeing another horrifying chart showing that inflation is at new highs. For many investors, this is new territory and it can be hard to make sense of it all. Dividend investors in particular can get a little skittish at the prospect of inflation and rising rates. I’ve written about this relationship HERE, but for this post I turned to David Stanley, the creator of Beating the TSX, to address a simple but important question: Is it time to sell dividend stocks and buy bonds?

Matt: Let’s start with a bit of background. What is the relationship between interest rates and inflation?

Dave: We all understand that interest rates are going up in an effort to rein in inflation. That is to be expected as the economy continually cycles back and forth between too hot and too cold. Economists talk about averages but these factors are continually on the move and only hit the ‘average’ on their way up or down. Thus, I think it is only a matter of time before the financial press begins to warn investors to ditch dividend stocks in favour of ‘100% safe’ government bonds because bond yields will be going up.

Matt: The relationship between bond yields and bond prices is inverse: yields go up as prices go down. Bond prices and bond ETFs have taken a huge hit recently which means two things: first, current yields are higher and, second, there is more room for bond prices to go up again in the future. This leads some market commentators to be bearish on dividend stocks. Do you think there is merit in that viewpoint?

Dave: I can see that the dividend stocks we all know and love will dip in price to some degree, probably in the summer sometime.

Matt: It will be interesting to see if that prediction comes true, but I know you well enough to know that this won’t be changing your investment strategy even if dividend stock prices fall. Can you explain why?

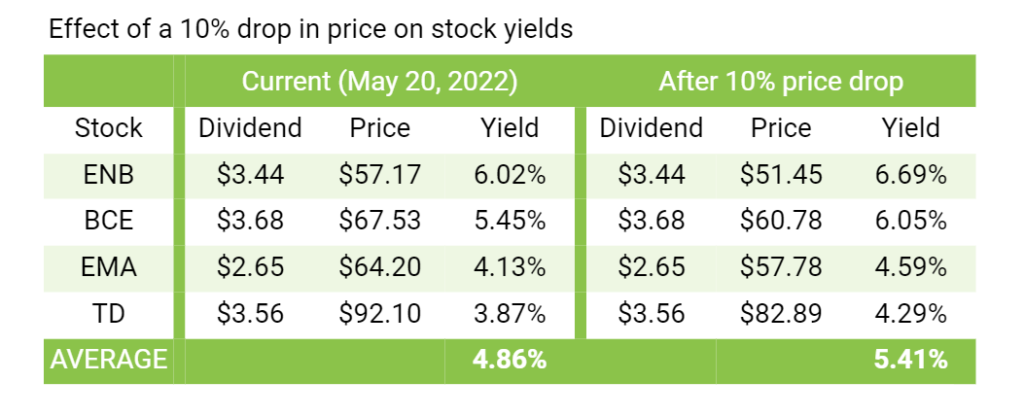

Dave: Let’s lay out a possible scenario: I picked four stocks from the current BTSX screen, ones that I happen to own, that encompass the pipeline, telecom, utility, and financial sectors. Suppose the share price drops by 10% but the dividend stays the same. The yields before and after would then look like this:

Next, we will allow the yield on a 10-year BOC bond to increase by 10% from its current 3.02% to 3.32%.

Now, my question is who would think it would be in their best interest to jettison their dividend portfolio with a yield of 5.41% and pile into bonds with a yield of 3.32%? I would hope no one!

Matt: Absolutely. Some might argue that government bond yields are safer than these dividends, but there are three important things to remember here. First, these kinds of stocks have a very long history of paying increasing dividends: ENB – 27 years, EMA – 30 years, BCE – 39 years, and TD – over 100 years! Second, quality dividend-paying stocks provide capital appreciation in addition to dividend payments whereas bonds do not. And, third, dividends are taxed far less than bond interest.

Still, short-term fluctuations can make investors nervous. What would your advice be for readers who might be feeling a little anxious?

Dave: Always in the past, the share prices on these dividend stocks have rebounded after a drop since the yields become too high to ignore. Momentary dips like the ones I have hypothesized should be viewed as buying opportunities. Blue-chip dividend stocks rarely go on sale but there might be one coming up. And remember, trying to pick the absolute top or bottom of stock price movements is a mug’s game.

Matt: Sound advice, Dave. I know I’ve been buying recently. There’s really nothing complicated about this, but it’s easy to get caught up in the movement of prices and rates, forgetting that, in absolute terms, dividend stocks remain the superior investment for most of us.

As always, I and our DividendStrategy readers really appreciate you taking the time to share your thoughts, Dave.

What I've been reading

Ben Carlson reflects on how predictable the commentary is during market corrections and reminds us that “I continue to believe buy and hold is the worst form of investing besides all of the others.” [emphasis mine]

In case you’re still tempted to try to time the market, read Nick Maggiuli’s piece Right Now, But Wrong Later – “If you do successfully time the market, you should take your victory lap and move on. Never do it again. Just quit while you’re ahead. Why? Because what you’ve done is like hitting the lotto. You’ve made money in a game (i.e. market timing) where you usually lose money.

Meanwhile, Dale at Cut the Crap Investing puts the current correction in perspective and curates a bunch of other good content on his most recent “Sunday Reads” post.

If you found this post informative and/or helpful, please consider donating to help with the cost of running this blog. Don’t forget, half of all donations are given to Doctors Without Borders.

Lastly, don’t forget that Qtrade has a fantastic offer for DividendStrategy.ca readers – 50 free trades for new accounts!

Thank you Matt and David, in a time like this I need to hear it from the experts that I’m on the right path and yes timing the market is impossible but if you’re buying solid companies like the ones in the BTSX one percent or two won’t make a big difference if you’re holding for the long term .

Has TD really been paying increasing dividends for over 100 years? It looks like that’s what you’re saying.

Here’s where I found that factoid: https://www.fool.com/investing/2017/01/31/this-bank-stock-has-paid-dividends-for-160-years-h.aspx

I guess I didn’t make myself clear before.

“First, these kinds of stocks have a very long history of paying increasing dividends: ENB – 27 years, EMA – 30 years, BCE – 39 years, and TD – over 100 years!”

You make it sound like those companies have, year after year, consistenly increased their dividends. But that’s not the case.

I apologize if I have made any kind of misrepresentation with respect to dividend history, but if you look at the long-term dividend history of these companies the growth is substantial even if the increases have not always occurred every single year. I think this is the important point for investors – nonetheless, I apologize if I confused anyone with my choice of words.