Building on last month’s post which addressed how we might tackle investing in a potentially “over-valued” market, I thought I would explore one of the most common cognitive biases that undermines good financial decision-making: confirmation bias.

About a year after the last big stock market crash in 2009, I got it in my head that we were all in for a “double dip” and that the second crash was not only imminent but that it would be worse than the first. After all, this had happened before: the infamous stock market rout of 1929 was only the beginning; after a temporary rebound, the market dropped further, not finding it’s bottom until three years later in 1932.

The similarities between 2009 and 1929 fascinated me. Unwittingly, I sought out these commonalities – and the bearish “experts” who perpetuated them – and convinced myself that the prudent thing to do was sell my stocks and wait. So, that’s what I did: I waited. And waited. A year later, after missing out on a 15% gain in the markets, I did one of the hardest things I’ve even done with our money, and I bought back in.

In many ways, it would have been easier to continuing waiting; to wait until I was proven right. Instead, I admitted that I was wrong. I realized that I had fallen into a trap, that there are always experts predicting the next crash right around the corner, and that I (and they!) don’t have the ability to time the stock market.

There are many ways in which our minds undercut our investing goals; sunk cost fallacy, loss-aversion, hindsight bias . . . But perhaps the most common and insidious of all is this: Our tendency to overvalue information that confirms our beliefs and undervalue that which challenges them. This is called “confirmation bias”.

Investors do this all the time. Think XYZ Corporation is the next big thing? When you Google it and review the results, are you more likely to click on “XYZ is the next ten banger!” or “Struggles ahead for XYZ”?

Or perhaps you know someone who claims to have gotten rich by reading charts and are wondering if you should try to emulate her results. What you choose to Google matters. You can try this yourself. Try Googling “The advantages of technical analysis” vs. “technical analysis debunked” and see what kind of results you get. We tend to find the information that we want to find. This is why unstructured research often leads to biased conclusions.

Don’t fool yourself: you, me and every expert out there is suffering from confirmation bias. None of us are immune. These days, after a decade-long bull market, many of us are expecting the next crash. Of course, it’s coming . . . sometime – we just don’t know when. And neither does anyone else.

Our friend, David Stanley sent me this list of doomsday predictions spanning the last decade. Some big names making bold predictions, none of which – so far – have come to pass. It’s illuminating to see them all in one list. For me it reveals that they are little more than unsubstantiated opinions.

May 20, 2010 Nouriel Roubini “There are some parts of the global economy that are now at the risk of a double-dip recession. From here on I see things getting worse.” – CBS

June 4, 2011 David Rosenberg “Another recession is coming, and soon. So says Gluskin Sheff economist David Rosenberg. Rosenberg, a longtime bear on the economy and the stock market, now says he is 99% sure we will have another recession by the end of next year.” – Fortune

August 9, 2011 Jeff Gundlach “It seems suicidal to buy a broad-based basket of stocks or economically sensitive commodities or emerging markets stocks – all of which are very leveraged to economic growth” – Kiplinger; and “Sell everything, nothing looks good” in July 2016 – Reuters

February 24, 2012 Lakshman Achuthan “Lakshman Achuthan, co-founder of the Economic Cycle Research Institute, said on Friday that his research firm is sticking with the forecast it made in September: A new recession is inevitable, despite improvement in highprofile economic indicators, such as job creation and unemployment, and a stock market rally. Achuthan said data gathered since his September forecast only confirms his view that economic growth has slowed to such a degree that a downturn is now unavoidable, likely by late summer.” – CNN

May 25, 2012 Marc Faber “I think we could have a global recession either in Q4 or early 2013. That’s a distinct possibility.” When asked what were the odds, Faber replied, “100%” – CNBC

November 12, 2012 Robert Wiedemer “The data is clear, 50% unemployment, a 90% stock market drop, and 100% annual inflation starting in 2013.” – Newsmax

March 31, 2013 David Stockman “When the latest bubble pops, there will be nothing to stop the collapse. If this sounds like advice to get out of the markets and hide out in cash, it is.” – Business Insider

April 25, 2013 Albert Edwards “We repeat our key forecasts of the S&P Composite to bottom around 450 (-70%), accompanied by sub 1% US ten year yields” – CNBC, following on Edwards’ “ultimate death cross” in July 2012

May 30, 2013 Peter Schiff “We’ve got a much bigger collapse coming…I am 100% confident the crisis that we’re going to have will be much worse than the one we had in 2008” – Marketwatch, and “The crisis is imminent. I don’t think Obama is going to finish his second term without the bottom dropping out. And stock market investors are oblivious to the problems.” – Money Morning

October 15, 2013 Tom DeMark “DeMark’s Dow Jones Index chart covering the period from May 2012 to the present seems to be tracking, almost precisely, the months leading up to the 1929 stock market crash.” “The market’s going to have one more rally, then once we get above that high, I think it’s going to be more treacherous… I think it’s all preordained right now.” – Bloomberg

November 6, 2013 Bob Janjuah “We see a significant risk-on top before giving way, over the last three quarters of 2014 through 2015, to what could be a 25%-50% sell-off in global stock markets.” – Marketwatch

July 24, 2014 David Levy “David Levy says the United States is likely to fall into a recession next year, triggered by downturns in other countries, for the first time in modern history. “The recession for the rest of the world … will be worse than the last one,” says Mr. Levy, whose grandfather called the 1929 stock crash . Mr. Levy predicts a US recession will throw its housing recovery in reverse, and push home prices below the low in the last recession. He says panicked investors are likely to dump stocks and flood into US Treasuries, a haven in troubled times, like never before.” – The Independent

September 29, 2015 Carl Icahn “I see real tremendous problems ahead and I don’t think we are handling it right and nobody really wants to talk [it] out… We are headed toward a strong correction and possibly a complete meltdown but not systemic like 2008. It won’t threaten the system, it’s just going to threaten your livelihood and net worth….I do think you are in a very massive bubble and when it bursts it isn’t going to be pretty, it could be a blood bath.” – Forbes

January 7, 2016 George Soros “Global markets are facing a crisis and investors need to be very cautious, billionaire George Soros told an economic forum in Sri Lanka on Thursday…”China has a major adjustment problem,” Soros said. “I would say it amounts to a crisis. When I look at the financial markets there is a serious challenge which reminds me of the crisis we had in 2008.” – Bloomberg

January 18, 2016 John Hussman “A broad range of other leading measures, joined by deterioration in market action, point to the same conclusion that recession is now the dominant likelihood.” – Hussman Funds

October 31, 2016 Simon Johnson “Mr. Trump’s presidency would likely cause the stock market to crash and plunge the world into recession…antitrade policies would cause a sharp slowdown, much like the British are experiencing after their vote to exit the European Union.” – New York Times

November 9, 2016 Paul Krugman “It really does look like President Donald J. Trump, and markets are plunging….So we are very probably looking at a global recession, with no end in sight. I suppose we could get lucky somehow. But on economics, as on everything else, a terrible thing has just happened.” – New York Times

BTSX portfolio update

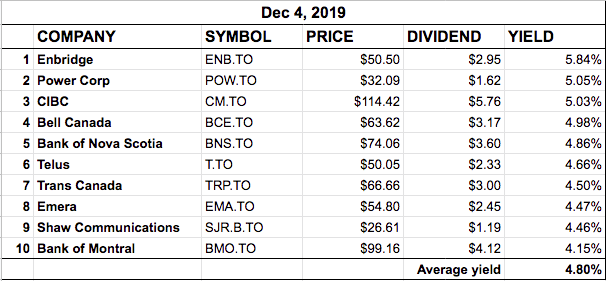

If you’re looking for December’s list of BTSX stocks, here it is. Telus bumped up it’s dividend to $2.33 annually from $2.25, but otherwise little to report. I will mention, however, that as of January 2020 I will be including previous income trusts like IPL and PPL which have until now been excluded. You can read here and here for my take on the fundamentals of these companies and why I think they’ve earned inclusion.

Hoping you and yours are enjoying the changing season and will be able to spend some quality time with people you love over the holidays.

Completely agree with including IPL and PPL into the portfolio.

Thinking about your comment and a big market crash – it is hard to imagine the stock market ever going away. Too many people now rely on it for income and, also, so many young people seem to see they have to save for a better life further on than relying on the government. Senseless to lose sleep over it. There is now an attitude of buy the dips rather than sell everything.

Personally I have been investing since 1994 and seen a lot and I have never had any regrets about being in the market. Yes, read all these ‘masters’ over the years, on supposed market crashes and paid no attention and the market always comes back.

That’s a great attitude to take. The problem with timing the market is that you have to get it right twice: when to sell AND when to buy back in. It’s hard enough to get one of those calls right.

Thanks for the words of wisdom, Patricia.

Unfortunately ‘Confirmation bias’ is almost inevitable. Just as social media makes everyone an expert, investors can narrow their research down to the input that confirms their bias. Unfortunately I go back to the era of the Vancouver venture exchange where promoters made cold calls to sell you stock. I like to think I have learnt a little since then. As a fundamental investor I like to look at the numbers but allocation has become a big factor. That and the idea that I want to be paid (dividends). Yes, I have been confirmed!

This is an important point you make, CT: just because this is a site focused on dividend investing doesn’t mean we are any less susceptible to confirmation bias. It’s important to listen openly to the arguments against dividend investing too – sometimes there is some merit to them and we can learn valuable lessons from our detractors, like not to chase yield and to be cognizant of under-diversification. I cringe at dogmatic approaches to anything – even dividend investing. I believe the effort to be rational, even if imperfect, predisposes us to financial success.

I agree with your comments…….never try to time the markets and as far as the crystal ball…it does not exist. Ignore the noise and stick to your stragedy you will prevail. Great to see you add IPL, been in my portfolio for a couple yrs now. Cheers and have a great holiday with your family.