Having children means planning for their future. Aside from being raised in a loving and supportive environment, one of the best things we can do for our children’s long-term success is to give them the means to access the educational paths they will need. Registered Education Savings Plans (RESPs) are one of the best ways to do this.

Parents aren’t the only ones who can open RESPs. Grandparents, aunts, uncles, even close friends can give the gift of access to higher learning – but there are some things we need to know. In this post we will cover everything you need to know about RESPs. In the next post, we will look at different RESP funding strategies to find the best one.

What are RESPs?

An RESP is an investment account that was designed to make saving for post-secondary education attractive for parents and/or other adults with an interest in the child’s future.

Features:

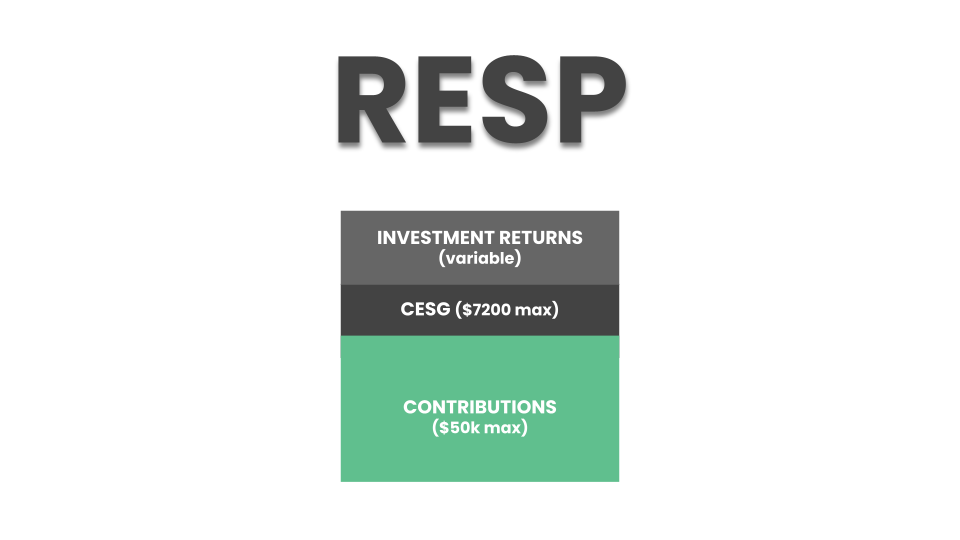

- Contributions up to a lifetime maximum of $50 000 per beneficiary. There is no annual maximum.

- Contributions are not tax-deductible, but growth within the plan is tax-deferred

- The first $2500 of annual RESP contributions per beneficiary will receive a 20% ($500) Canada Education Savings Grant (CESG) from the federal government, up to and including the year the child turns 17. The maximum lifetime CESG amount per beneficiary is $7200. Middle or low-income families may be entitled to more via the Canada Learning Bond (CLB).

- If the beneficiary has sufficient carry-forward room, i.e. the maximum CESG has not been received in previous years due to low/no contributions, up to $500 of CESG can be carried forward per year, for a total of $1000 in CESG in any given year (based on a $5000 contribution).

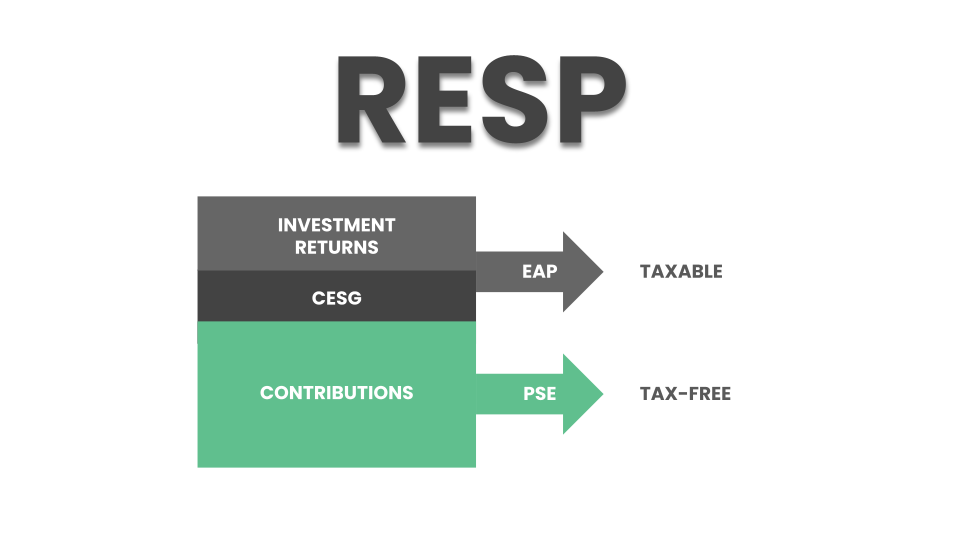

- The government considers the RESP funds to be in two main parts: contributions that have already been taxed, and grants + investment returns that have not been taxed. When the beneficiary enters post-secondary education, only the portion of withdrawals that have not been taxed, i.e. CESG and investment returns, are taxable. Because most students will have a very low income and be eligible for various tax credits/deductions, their tax bill will likely be very low or nil.

Benefits of RESPs

The main benefit of an RESP is that funds within it can grow on a tax-deferred basis. What this means is that the investment returns (capital gains and dividends) are not taxed as they would be in a non-registered account. Rather they can be reinvested leading to tax-free compounding of returns.

In most cases, funds will be withdrawn by the beneficiary virtually tax-free. Thus, from a tax perspective, RESPs function much like TFSAs, with the added benefit of the 20% CESG top-up.

Types of RESPs

There are two main types of RESPs: a family plan and an individual plan.

Family plans are usually the best choice for families with more than one child because the funds within the RESP can be used for any of the children in any ratio. The only additional restriction over an individual plan is that the beneficiaries must have a “blood relationship” to the contributor (also known as the “subscriber”), as defined by The Income Tax Act, i.e. children, stepchildren, grandchildren (including adopted grandchildren), brothers or sisters.

Individual plans are single-beneficiary RESPs, i.e. the funds can only be used for one child. The main benefit of these plans is that they can be funded by a contributor that is not directly related to the beneficiary.

What can RESP money be used for?

Beneficiaries are entitled to RESP funds when they are enrolled in an eligible post-secondary educational institution either part-time or full-time. This may be a college, university or other educational institution. It can even be outside of Canada (for a full list, go HERE).

Funds may be used to pay for any education-related costs such as tuition, books, accommodation, transportation, etc.

Making RESP withdrawals

Only the person who set up the account, the subscriber, is able to make withdrawals, not the student.

The RESP contains different “baskets” of money: your contributions, CESG, and investment returns. On the RESP withdrawal form, you can indicate which money you are withdrawing. Payments from your original contributions are called post-secondary education (PSE) withdrawals and are not taxable because you already paid tax on this money. Payments from CESG and investment returns are called education assistance payments (EAP) and are taxable in the hands of the student.

Usually, it makes the most sense to withdraw EAP first. Bear in mind that the maximum EAP withdrawal is $5000 in the first 13 weeks of schooling, after which there is no maximum.

What if my child doesn’t pursue post-secondary education?

Fortunately, you have options:

- Leave the money in the RESP. RESPs can remain open for 36 years. Maybe they’ll change their mind.

- Transfer the investment earnings to your RRSP. There are a few conditions, but if you have the contribution room, you can transfer up to $50 000 from the RESP’s earnings to your RRSP tax-free. These are called accumulated interest payments, or “AIPs”.

- Close the RESP. When this happens, your contributions can be withdrawn from the RESP tax-free since you already paid tax on this money. CESG money must be returned to the government. Investment earnings can be withdrawn if the plan has been open for 10 years and the beneficiaries are at least 21 years old. Note: The RESP must be closed by March 1st of the year following the first AIP withdrawal.

Bottom line

RESPs are a very effective way to save for a child’s post-secondary education. Not only does the federal government top-up contributions by 20% (up to a maximum of $7200), but the funds within an RESP are allowed to grow tax-free and can eventually be withdrawn in the hands of the beneficiary, usually with little or no tax owing.

But what’s the best way to fund an RESP? Some suggest a large lump sum as early as possible to maximize tax-free growth over time. Others advise using smaller regular contributions to maximize CESG. In the next post, we’ll look at a few strategies and compare outcomes.

If you found this post informative and/or helpful, please consider donating to help with the cost of running this blog. Don’t forget, half of all donations are given to Doctors Without Borders.

Thanks for a GREAT summary

You’re welcome!