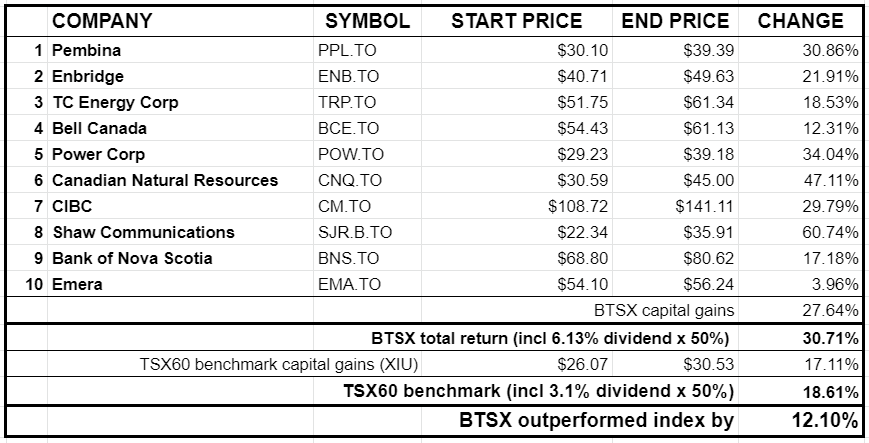

2020 was a tough year for dividend investors and those of us who use the BTSX method took a beating. Fortunately, the tides have turned and Canadian blue chip dividend-paying stocks are back on track. In fact, as of July 1, the 2021 BTSX portfolio is up 30.7% compared to 18.6% for the benchmark TSX60 index. It’s time for a BTSX mid-year update.

In my 2020 annual update six months ago, I had three messages for Canadian dividend investors:

- Don’t be blinded by short term numbers

- Beating the TSX tends to shine after bad years

- Dividend investors have the luxury of focusing on dividend income rather than stock prices

Now that we’re midway through 2021, let’s see how we’re doing on these points.

1. Put short term results in perspective

Every sound investment strategy will have periods of underperformance. Everybody knows this. Fewer possess the fortitude to endure the hard times. I think dividend investors, by and large, are a confident and committed bunch, but 2020 may have tested you.

With a 2020 annual return of negative 10% and underperforming the index by 15%, no one could blame you for indulging a little self-doubt. I hope you read the update, reassessed your portfolio, and stayed the course. For those who did, BTSX stocks have rewarded them handsomely.

Every single stock is up on the year so far with total return on the portfolio (including six months worth of dividends) of 30.7%. That’s a 12.1% absolute advantage over the TSX60 benchmark’s total return.

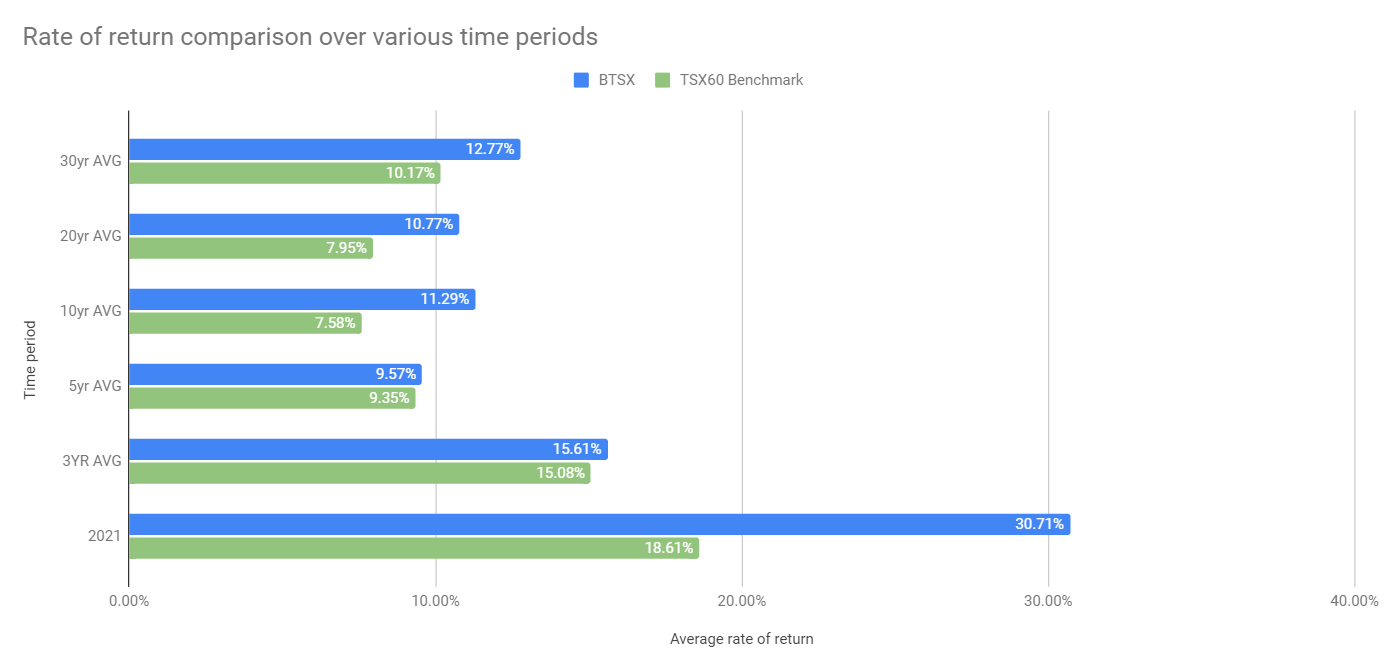

But, as always, it’s the long term data that matters. Since the rebound in Canadian dividend-paying stocks, here is what the 1, 3, 5, 10, 20, and 30 year data looks like:

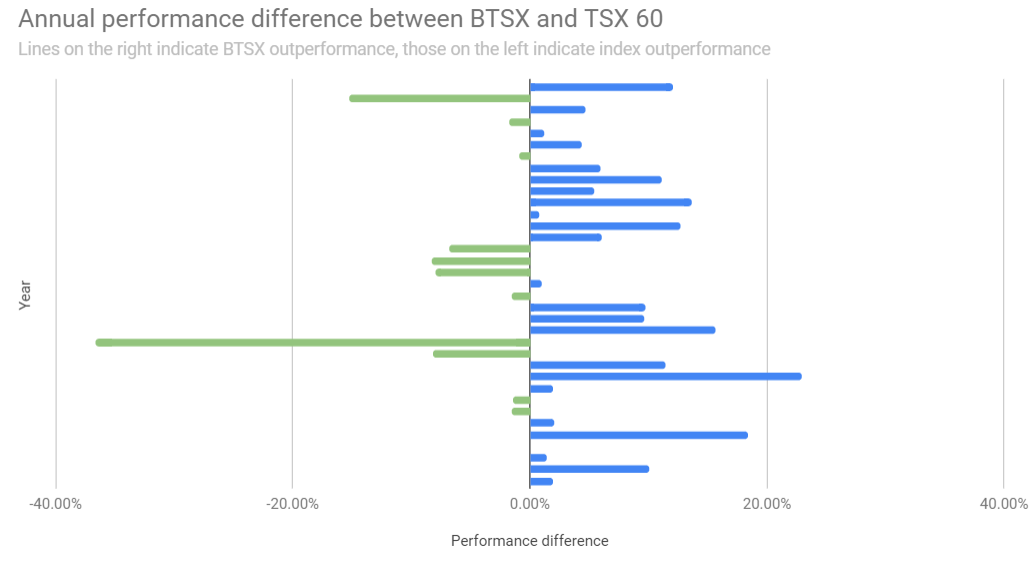

Once again, the BTSX method is outperforming the benchmark in every time frame. To be clear, however, BTSX has years when it underperforms. The following chart can help us manage our expectations. 2021 is at the top, 1989 is at the bottom; green lines indicate years when BTSX underperformed.

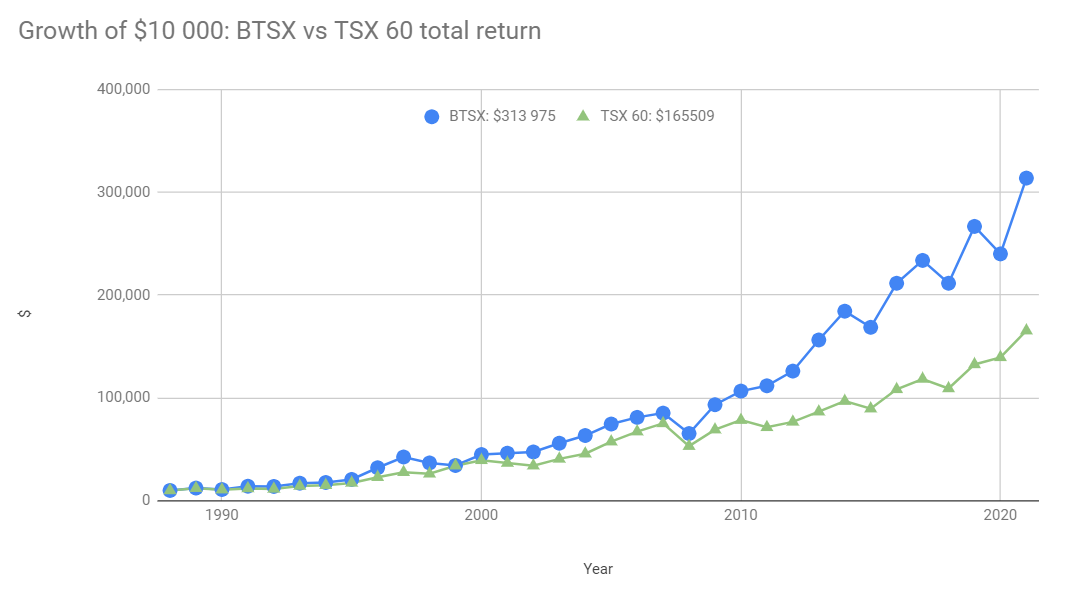

Perhaps the most meaningful way to view this data for long term investors, however, is to show how $10 000 dollars would have grown over the past 32 years using BTSX versus the benchmark index.

As you can see, $10 000 invested in BTSX thirty-two years ago would be worth $313 975 now, versus only $165 509 for the benchmark (total returns).

2. BTSX shines after bad years

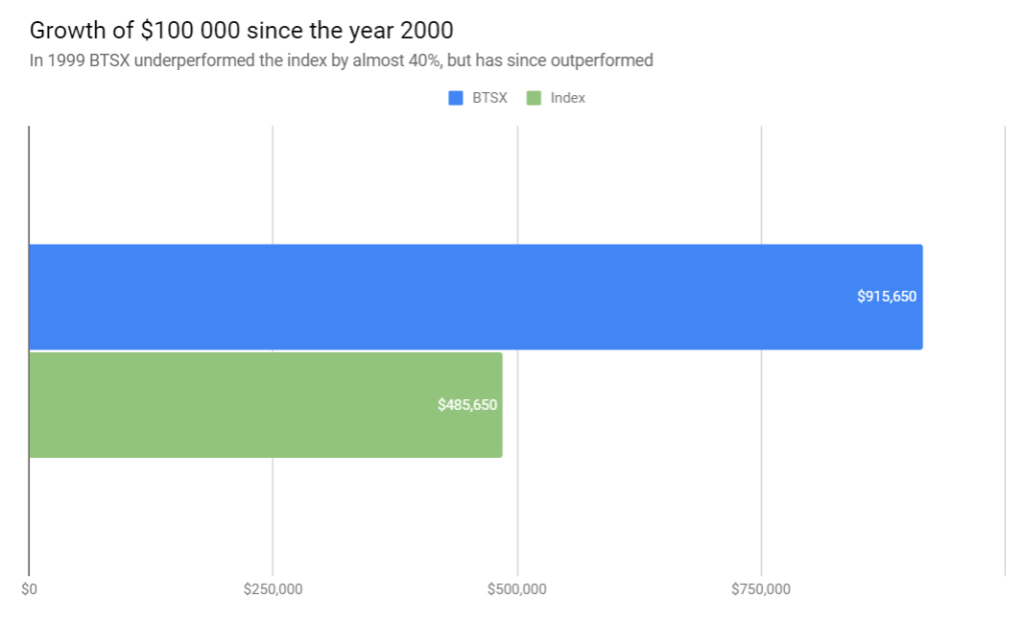

2020 was Beating the TSX’s second worst year ever. The worst? – 1999. In that year, BTSX underperformed the index by 37%. Horrible, yes, but if one had invested $100 000 using the BTSX method starting right after this horrendous performance, by now it would have grown to $915 000 vs. only $485 000 if one had chosen an index fund. Beating the TSX has an incredible track record of bouncing back after bad years.

I wrote this six months ago, but it bears repeating: A good investment plan is not one without periods of underperformance, but one that is durable enough to recover and outperform. BTSX fits the bill.

3. Dividend investors have the luxury of ignoring stock prices

Regardless of whether stock prices have gone up or down in any given year, dividend investors enjoy a special luxury: we can ignore the noise and focus on dividend income. As I described in this post, it’s the dividend payments that matter.

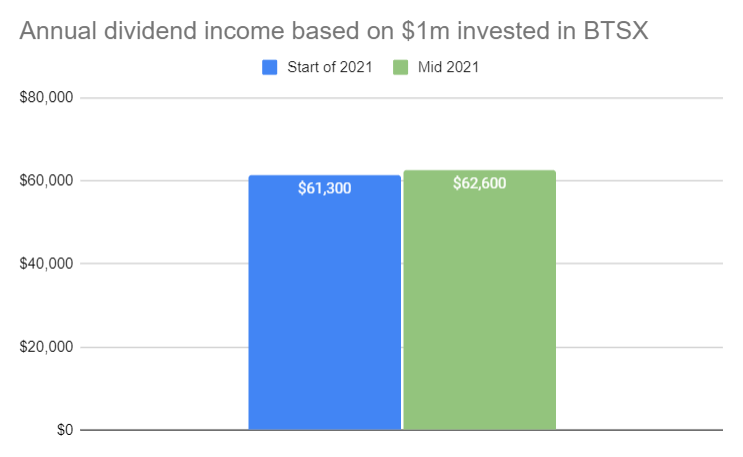

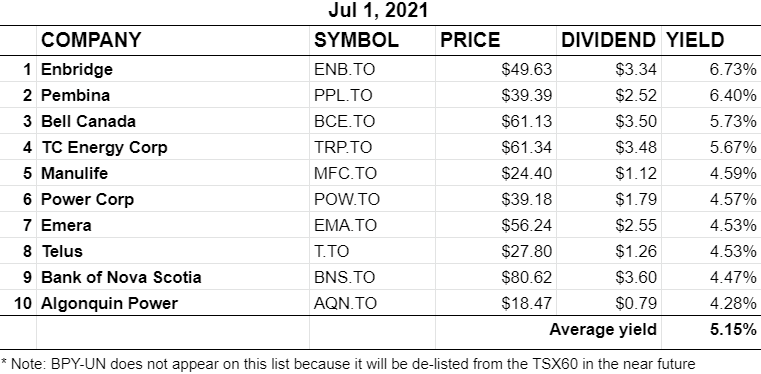

New BTSX investors started 2021 with a very generous 6.13% yield. The cherry on top is that, as usual, several of these quality companies have raised their dividends even further in the last six months. This means that if you’re lucky enough to have $1 000 000 invested in the portfolio, your annual dividend income has grown from $61 300 to $62 600 – an incredible rate of return to start, plus an extra $1300 just for sitting tight. Are bond investors enjoying that kind of inflation protection?

Conclusions

Beating the TSX doesn’t always beat the index, but it has shown incredible resilience to reward investors who keep a level head during tough times. As hard as it was, I view 2020 as a lesson in investing with three key takeaways:

- Have a plan and stick to it; BTSX bounces back

- Ignoring short term volatility is both our greatest challenge and our greatest advantage

- Focus on dividend income, not stock prices

If you are beginning your investing journey, please make use of the free content on this site and grow your portfolio. If you have achieved financial independence and have a few dollars to spare, I hope you will consider supporting DividendStrategy.ca. I’m not trying to get rich . . . 20% of donations are given to Doctors Without Borders. Thank you!

BTSX portfolio update July 2021

Having just started following in April of this year I am super pleased to read this article. Thank you for your work.

You’re welcome. And thanks for your comment.

I was a non beliver for years. Then it hit me. All funds in TFSA invested in BTSX stocks will produce 5-6% annual income which will be 100% tax Free and non reportable. I will be 53 this November and had $86000.00 in my TFSA basically doing nothing. (why do Candians not take advantage of the single best investment vehichle they have?). I now embrace the BTSX strategy and have purchased the current protfolio in equal amounts. I have added a DRIP to all eligeable stocks (some of which provide a discount to closeing prices for DRIP’s) and will only start to use the income from the TFSA when I am 65. Assume average retrurn of 11% and $6000.00 per year additional funds I will have aproximately $4050,000.00. At 5-6% annualy and you have an additional $25,000.00 per year tax free.

Awesome, David! Sounds like you’ve got your plan in place and are on track to accomplish your financial goals. It’s shocking that less than half of Canadians have TFSA’s and only 1 in 10 of those max out their contributions. Is there a way this blog could help?

Yes I think the blog could certainly help. I know I always find it helpful. For instance my quandary with the TFSA is when to allocate to it vs RRSP and at what point in life to taper off RRSP contribution and focus on TFSA? I’m sure others have lots of questions as well. Thanks for such a great resource for Canadians.

This blog has helped and inspired me. In the past year I’ve reallocated most of my household’s portfolio to a modifeisd BTX which includes some additional stocks that don’t quite make it into the top 10. I’ve also created the spreadsheet you posted about that highlights the annual dividend payout of my portfolio. This has helpdd me stay focussed and aim for new goals. I had some unforeseen medical expenses over the past two years that decomated my TFSA. Thanks to your blog, I’m back on track towards maximg out my TFSA.

As for Canadians’ low partipation rate in the TFSA, I believe that reflects a general disinterest in saving and investing. There’s a huge tendency to view the stock market as a betting venue to make quick gains. I referred a 20-something coworker of mine to this blog a few months ago and gave him a basic intro to the merrits of investing in blue chip dividend stocks. I was so wxcited for him because he was getting such an early start on his portfolio. My excitement turned to disappointment when I learned a few weeks ago that he decided to cash in on some of his BTX stocks. Inthink many young people are looking at rising home prices and thinking they need to make big gains in order to slap down a downpayment for a home. There’s a real now or never attitude when it comes to real estate out there.

I think some of the main takeaways from your blog are patience and discipline, two qualities which are diametrically opposed to the current swell of FOMO investing.

This is why I work so hard on this blog. I really appreciate that you took the time to write this comment. It’s clear that you have put together an excellent plan based on a real understanding of the essential concepts. If the words on this blog had a small part in that, I am beyond thrilled.

With respect to your 20-something co-worker, give him time. I don’t know a single investor who didn’t need to make their own mistakes, myself included. Now, at the ripe middle age of 44, I’ve realized that knowledge is only the first step of change. You have to have knowledge, yes, but also understanding of how that information works in the real world. But even understanding isn’t enough if you don’t believe that it’s the right course of action. And when it comes to investing, you have to believe it strongly enough to overcome the inevitable waves of fear and greed that will come your way. If you have knowledge, understanding, and belief, then you can act with confidence.

FOMO is poison. KUBA is the antidote – it just takes time.

Pingback: Weekend Reading – Tax Free Investing Power edition - My Own Advisor

I am new to investing. In the past, I just put my RRSP money into a mutual fund at my local Credit Union. I discovered your strategy Feb-2021 and started to move my funds over to a low-cost trading platform. I invested most of my funds in your BTSX portfolio. I also picked one or two of my own like (GEI). Using your strategy, I am thrilled that my investments have grown 11% since March. The juicy dividends are nice, I just wish I had more room in my TFSA.

Question for you. Since Shaw has been bought by Rogers the share price jumped 60%. Is it worth holding it anymore? I mean, should I move those funds to a stock with more growth potential like PPL?

Thank you!

Sorry I can’t give financial advice, i.e. I can’t tell anyone what they “should” do. But I can tell you that SJR won’t be eligible to be on the BTSX list once the deal is complete and if I did own SJR, which I don’t, I would be selling.

Glad to hear you’ve escaped mutual funds early in your investing career 🙂

If someone wanted to start the btsx strategy today .. would you buy the current list or select a new list based on the stocks meeting the btsx criteria today .. or sit out until January ..

It’s very important to remember that BTSX is a tool. Two people with the same hammer will build different houses depending on their preferences and priorities. The same goes with BTSX – it is not an instruction manual, merely a tool to build a dividend-paying portfolio.

I think this post will help you with some of the details: https://dividendstrategy.ca/using-btsx-to-build-your-portfolio-a-step-by-step-guide/

I very much enjoy reading your blog. I have been following ‘Beat the TSX’ since David Stanley started the concept in Canadian MoneySaver.

I am copying a quote from your ”’Beating the TSX: Is it for you? ”’

BTSX: a history of outperformance

For new readers, Beating the TSX was originally published in the Canadian Moneysaver by David Stanley in the late 1990’s (and continued by Ross Grant in recent years). With data going back to the late 1980’s, the strategy now has a 30-year track record. Over that time, the method has returned an average of 12.33% annually. The benchmark index has returned an average of 9.40% (dividends included).

I recently came across the material set out below.

”’https://www.finiki.org/wiki/Beating_the_TSX

Criticism of performance report

It has been pointed out by forum member nisser,[6] that BTSX is very dependent on start date. A 3-year rolling-return analysis of BTSX from 2003 to 2018, offset by one month, reveals that the median backtest barely beat the market. Starting on the wrong month would have underperformed the TSX market by up to -34%. A lucky start month would have delivered an excess return of 48%.

The above comments are based, I believe, on the following comment from ‘nisser’ which I

found on the website set out below.

https://www.financialwisdomforum.org//forum/viewtopic.php?p=621141#p621141

‘’Re: Guilty Pleasures: Dividend Paying Stocks We Should Sell But Don’t

• Quote

Post by nisser » 08 Oct 2018 16:52

longinvest wrote: ↑08 Oct 2018 11:30Why hasn’t anyone launched a BTSX ETF yet?

How do you exit and enter large positions without moving the market?

I’ve posted this before but BTSX is very dependent on your start date. Here are the rolling excess 3 year returns from 2003-2018 offset by 1 month:

Dogs of TSX, max period 3y1m.png (50.17 KiB) Viewed 2264 times

You can see that the median backtest barely beats the market. If you start at the wrong time you can underperform the XIC by up to -34%. You could also have excess returns of 48%.

You have to stick to the system for 9 years in order to have 100% probability of beating the index, if you decided to start off at the worst possible time.’’

Here’s my question: I can’t understand how or if both quotes set out above are accurate. If both are accurate, can you explain it so that I hopefully can understand the resolution of the two apparently contradictory statements.

Thanks for the question. Both Dave and I have seen this before and put absolutely no stock in it. You can see our responses from a few years ago when another reader brought it up in the comment section of this post: https://dividendstrategy.ca/the-case-for-dividends-by-david-stanley/

After reviewing that thread again, here’s a summary of my thoughts:

1. Where is the data? A chart and an opinion are totally insufficient to draw firm conclusions. That is why scientific papers (AND this blog, in fact) have separate sections for methods, results, and discussion/conclusion. Without all three the conclusions cannot be verified. There are all kinds of potential errors that can lead to erroneous results. In this case, I wonder if the data the poster used accounted for dividends. I suspect not, but can’t confirm – this is the problem.

2. The negative interpretation just doesn’t make sense. Given that BTSX (and dividend investing) has beaten the index overall, even if there is some variation of returns with start date, that means half the start dates will result in even better returns than what has been published.

3. The bias of the poster is obvious. “You have to stick to the system for 9 years in order to have 100% probability of beating the index, if you decided to start off at the worst possible time” – this is a negative? Think about it: Even if you start at the “worst possible time”, in 9 years you would have still beat the index – that’s AMAZING.

4. His own data actually supports the BTSX method. “I think most individuals would like to be aware that there’s a ~30% probability of them under-performing XIC after 3 years of sticking with a strategy.” Again, it’s important to look at the content of the poster’s comment, not just his/her interpretation. This means that there’s a 70% chance of out-performing the XIC by sticking to the strategy for 3 years. Again, that’s INCREDIBLE.

I don’t know if dividend investing will continue to out-perform in the future. My role is to share information, not sell a fantasy. Unlike “nisser”, I try to keep my personal biases out of it. But the fact is that the BTSX data Dave and I have used has always been publicly available and the results speak for themselves. If you participate in that forum, feel free to share this response. Most of all, I hope these points help you and other readers make better decisions.

Why 10 stocks?

Why not 15 or 20?

Rebalance quarterly or biannually?

Back testing?

I know that the top 10 will produce the most dividend income but will 15 or 20 produce a better return if capital appreciation is also factored in ?

Thanks Matt

Hi Niall, thanks for the questions. We’ve been following the same methodology for over thirty years. It is based on the “Dogs of the DOW” method invented by Michael O’Higgins in the early 90’s. I think it’s really important for an investment method to be both evidence-based and simple. Ten stocks is what we have the most evidence for and simple enough that anyone can do it. That’s not to say it wouldn’t be interesting to see the data on other variations, but, frankly, I don’t have the resources to do that. If you do, please send me your findings!