Many of you will already know David Stanley as the original author of the Beating the TSX series in the Canadian Moneysaver. Since agreeing to take on that role myself, I’ve had the pleasure of meeting Dave in person and the benefit of countless email exchanges. His dedication to financial literacy is inspiring and if this blog is of any value, it is largely due to the patience and kindness he’s shown me as a mentor.

I am thrilled that Dave accepted my invitation to write a guest post and hope that it is the first of many.

Matt

When Matt contacted me about his new blog I responded that perhaps one thing that I could add is a sense of history, of placing BTSX and dividend investing in general, into the big picture of how individuals approach the problem of preparing for retirement. This seemed a reasonable task since the data are very persuasive and, of course, anyway that you look at it, dividend investing comes out on top as a low cost, low risk way of achieving steady returns that outperform the index.

As readers of this blog already know, I met Matt through the Canadian MoneySaver when he took over the ‘Beating The TSX’ column from Ross Grant. I was very pleased that Matt had agreed to carry on BTSX that I began writing in 1996. So, the three of us have combined for 23 years of carrying on the tradition. (Still a long way from Tom Connolly’s report that began in 1981, the same year as the Canadian MoneySaver, and is sadly coming to an end after 38 years)

After meeting Matt and then following his family odyssey for the past several months I have been very impressed with his ability to write clearly and meaningfully about the changes they are all going through. And I appreciate the opportunity to join in occasionally on this blog as we try to work through the essentials of dividend investing.

So, let’s get started. The first questions we need to explore are why are dividends so important to individual investors and why are they often ignored by financial advisors.

Why are dividends important?

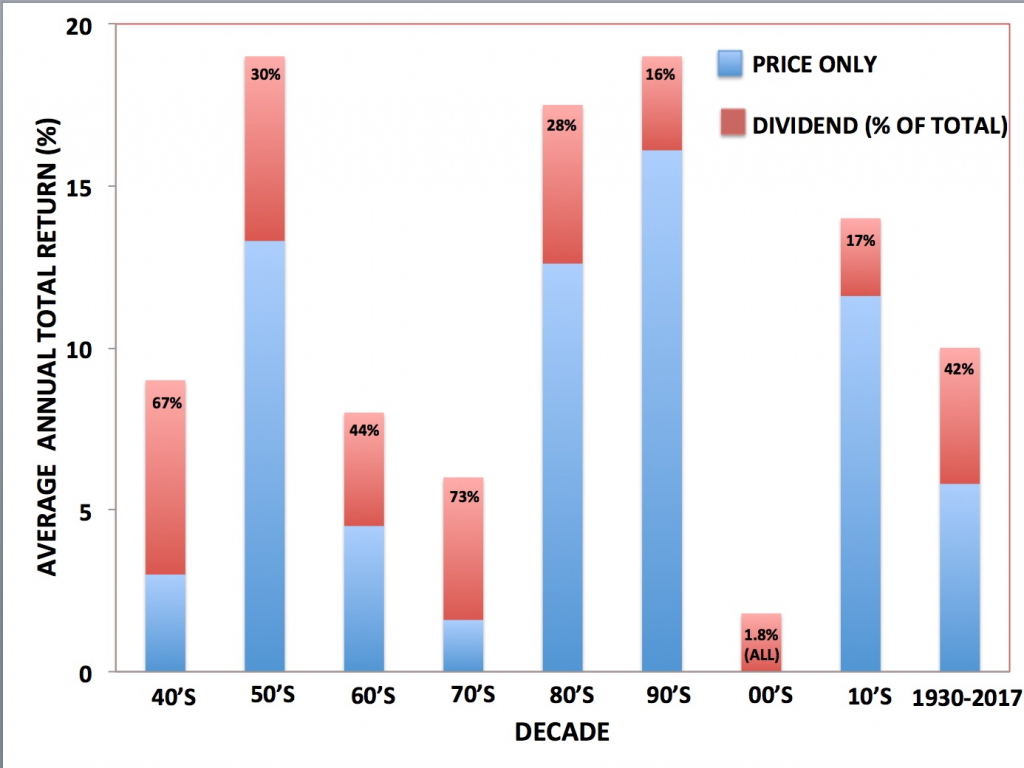

The first part is simple; dividends contribute a very large part of the total returns of the stock market. Here is an example: “From 1930–2017, dividend income’s contribution to the total return of the S&P 500 Index averaged 42%.”(1). And that is for the index as a whole.

FIGURE 1. Contribution of dividends to total return of the S&P 500 Index by decade. Redrawn and data approximated from Reference 1. Note — Total Return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualized return over the decade.

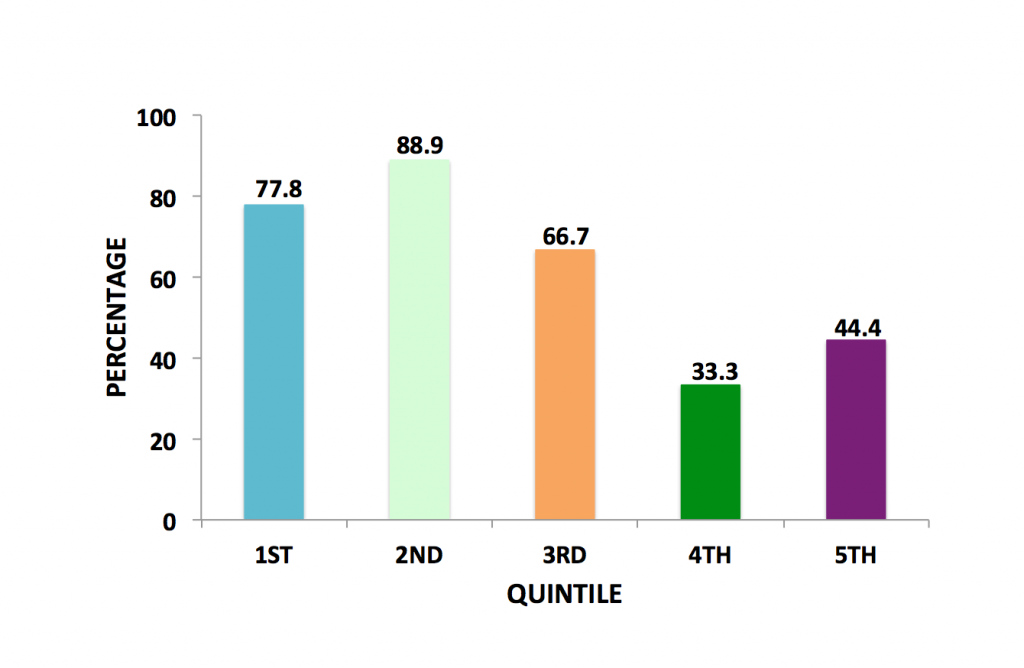

What about a portfolio consisting of high dividend payers? If we divide the whole S&P Index into five equal groups (quintiles) by dividend yield and then see how often each quintile outperformed the whole index from 1929 through 2017, we find that the top two quintiles averaged out-performance 83.4% of the time while the lower two quintiles only outperformed only 38.9% of the time (1).

FIGURE 2. Higher dividend payers outperform lower dividend payers. Column captions show percentage of time dividend payers placed in quintiles by dividend level outperformed the S&P 500 Index from 1927 through 2017. Redrawn using data from Reference 1.

The data is very convincing; investors achieve higher total returns when they hold dividend-paying stocks.

Why aren’t the “experts” doing this?

Now, if this is so obvious, why don’t financial advisors concentrate more on dividends? Here is my answer to that question — you have to think about how advisors get paid. Do they emphasize capital gains or total returns?

My experience is that capital gains are more important to some brokers. Why? Because their clients (admittedly unfairly) often look at their returns on a quarterly basis and start calling their advisors if they don’t see improvement in their portfolios. Thus, advisors are under the gun to perform if they want to keep getting paid and this is why they often load up their holdings with so-called ‘growth’ stocks, stocks that have an expectation of growth and, hence, price appreciation.

It may or may not be a corollary that growth investing involves a much higher turnover in portfolio constituents and, accordingly, higher commissions paid to the broker.

Conclusion

All of my work and experience has shown me that individual investors are much better served by buying dividend stocks and holding on to them for a long period of time. It is much easier and safer to amass wealth slowly over time. Compounding works for you but stock picking works against you.

More next time. If you have any questions or comments please add them below and I will try to reply.

Here is the reference to the data and images I quoted above. It is a downloadable pdf so take a look at some of the other factors that support the dividend investing approach.

https://www.hartfordfunds.com/dam/en/docs/pub/whitepapers/WP106.pdf

I want to purchase these high dividend stocks but most are at their 52 week highs. Would it be prudent to wait until they come down a bit? Let’s say 5% of the 52 week high? Thank you for your advice.

Thanks for the question. Yes, I think the market is high right now. Just a few days ago the TSX made a new high. Not, in my opinion, the best time to purchase stocks. I do use 52-week highs and lows as an indicator, but also the current dividend yield. As you may know, the BTSX system is based on purchasing stocks when their yields are high since this implies that the stock price is low. If you know how to use this system you can prepare your own list of stocks to see what seems reasonably priced now. I have added my own additional screener and I only consider what I term TURF stocks. TURF stocks are Canadian blue-chip stocks that are in either the Telecom, Utility, Real estate, or Financial sectors. After all this, you may decide to invest now, invest partially now, or wait for lower prices. That decision is up to you. One thing that might influence that decision is the knowledge that now the money you have for investment is not earning much in the way of interest. If that is a concern you may wish to take a look at ‘banks’ such as Tangerine, Canadian Tire bank, or credit unions such as DUCA that can give you a better rate of interest. Dave

Thanks to Dave for fielding this question – great points. I have a bit of a different take that I’ll throw out there. As Dave and I would both agree, there is plenty of room for a variety of approaches.

Many, many studies show that market timing does not work. It looks easy, but is very hard (and risky).

The problem is that stocks can stay at those highs and go higher for far longer than you would expect (years).

In the long run, I believe training yourself NOT to time the market will be far more profitable than eeking out an extra 5% now.

Probably not what you wanted to hear, but it’s the truth as I see it 🙂

Here’s a good article on how difficult it is to use valuation for forecasting: https://www.aaii.com/journal/article/valuations-usefulness-for-forecasting-and-setting-asset-allocation

This blog concentrates on the role of dividends in individual investing. Here is a great reference for that and it’s free! Lowell Miller has written a book called “The Single Best Investment, Creating Wealth With Dividend Growth”. Although his examples are all U.S.-based, the theory and application are equally valid in Canada. In a few words his thesis is: Buy high quality stocks that exhibit high current dividends and high dividend growth and let compounding work for you. In my opinion that is the best approach for most investors planning for retirement. Here is the website where you can download this book at no cost:

http://www.mhinvest.com/files/pdf/SBI_Single_Best_Investment_Miller.pdf

In this article https://www.finiki.org/wiki/Beating_the_TSX it states that the performance of BTSX is very dependant on the start date and rolling three-year return analysis shows significant overperformance and underperformance depending on the start date. Does your analysis show similar results? Do you agree that this is a drawback of the BTSX approach?

Hi Tim — Thanks for your comment. First, we have to understand that the article you mention is a part of Finiki, the Canadian financial wiki, which is written by members of the Canadian Financial Wisdom Forum (FWF), a group of individuals that meet on an online forum, and one that I visit almost daily. As you might imagine, members use any moniker they chose and are not obliged to reveal anything about their background or credentials. The reason I visit the forum, and encourage others to, is that there are, to my way of thinking, some very intelligent contributors with some excellent insight into Canadian individual investing. On the other hand, as with any public forum, there are folks who, for a variety of reasons I expect, are what I would call disruptors. All this is by way of saying that I really can’t comment on what someone said on FWF unless there are some data to upon which to comment. You will notice that the reference given in the article does not work.

What I can comment on is the general idea promulgated in the reference, namely that results are influenced by the starting month. Frankly, I don’t believe it, because it makes no sense and is, to me, illogical. I have always said in my writing that the time to begin is whenever you want to. The original “Beating The Dow” by Michael O’Higgins, started on the first of the year. My BTSX began on the May 24th weekend, simply because that is when my data set started, which coincided with the beginning of the old TSE 35 Index. Both these methods have done very well in terms of beating the index they were coupled with. I have spoken with a large number of Canadian investors who have used BTSX and none of them indicated any trouble with their starting date. I think I know the literature in this area as well as anyone and I have seen nothing to convince me otherwise. But, am I ready to accept the hypothesis that starting date matters? Of course, just show me the data.

Finally, and I can’t stress this enough, BTSX is a means, not an end. The idea of looking at the results of BTSX vs. the index, year after year, and seeing that BTSX outperforms the index handily, is OK. Keeping track of the data, year after year, and seeing how an initial nest egg grows as a result of compounding is better. But the most rewarding is using BTSX as a tool to build up a portfolio of Canadian blue-chip, high dividend paying, high dividend growing, common stocks that will help finance your retirement is priceless. Dave

Thanks again to Dave for his generous answer to this question. Tim – it’s a good question because it brings up the difficulty we all have in sorting through the Internet of Conflicting Claims.

I did a little digging. The link was broken, but I was able to find the post that made this claim: BTSX temporarily underperforms the index less than half the time, depending on start date. It was accompanied by a homemade bar graph but no supporting data. Without the data – and this would be A LOT of data that is extremely difficult and tedious to obtain retrospectively – we can not validate or refute this claim. I followed the thread and the actual data was never offered: we don’t know if the numbers are correct, the formulas are valid, if there were calculation errors, etc. – i.e. the claim is worthless.

But just in case someone is still tempted to believe this is a strike against BTSX, here are more reasons I don’t:

1. Given that BTSX (and dividend investing) has beaten the index overall, even if there is some variation of returns with start date, that should not affect our decisions now. It also means most start dates will result in even better returns than what has been published.

2. Even if the data is true (which I doubt), if you performed the experiment in reverse (i.e. compared index investing with BTSX and altered the start date), the results would show that index investing has underperformed BTSX the majority of the time – and the underperformance is permanent.

3. This is an example of more data, less information. Anyone with enough time on their hands can massage past data to make it say all kinds of interesting things. But it’s all retrospective. BTSX is compelling because David Stanley (then Ross Grant and now me) has been prospectively testing it for over twenty years. And all of our data is accessible in past issues of the Canadian MoneySaver.

In a nutshell, as Carl Sagan might say, this is an extraordinary claim that requires extraordinary proof – proof that is not given. But even if it was true, because it is based on retrospective data, it has no utility for real life decision making.

Dave, must say this was a great answer to the question! My family’s portfolios using BTSX have displayed wonderful returns each year and I do try to get all the buying and selling done in the first few days of the year but I have noticed doing this in May could be just as good. ‘Doing it’ is the key! All the agonising about timing is mostly just that -agonising.

Patricia

Hi, great article! I don’t know if this was addressed before, but I am curious if you think that an investor should make this 100% of of their portfolio. Would that be a reasonable thing to do? Funding retirement income with dividends is enticing.

-Terry

Hi Terry and thanks for your question. I have never advocated for BTSX to be anything but part of an overall portfolio designed to meet someone’s specific retirement requirements. Investments such as non-Canadian equities, fixed-income holdings, preferred shares, a reserve fund, etc. could all find their way into a retirement portfolio. For me, retirement has meant taking less risk by adding more blue-chip dividend payers and conservative preferred shares, but also matching my spending to my available resources. I have found my TFSA a very useful tool in this regard. Dave

Hi Dave,

Tha is so much for your answer. That places the strategy in perspective for me. I do feel however that the risk in investing in some of the stocks on the list would have to be quite low given that some of them have been paying dividends since the 1800’s. I also checked a few to see what happened during the 2008 fiasco and they kept right on paying those dividends.

By the way, I used to read your column in Moneysaver and always enjoyed it so it is great to be able to actually contact you with questions. Thanks again – Terry

Pingback: Investing with Dividend Funds (by David Stanley) —