What a month. Humanity is living through the worst pandemic in a century. Canada’s oil and gas sector is on the ropes. And our investments have taken a beating. Is this a good time to invest in stocks?

I think so. In fact, now might be the best time to invest in stocks.

Before I explain why, first we have to acknowledge two simple but important facts:

- Timing the market is a bad strategy: we don’t know where the bottom is or when it will happen, and

- Historically the stock market has provided superior returns to other asset classes and is very likely to continue to do so; i.e. the markets will recover.

If you think you can time the market or that you’re better off burying gold in your backyard, stop reading; this is not the blog for you. But if we can agree that the stock market will likely continue to provide the highest long term returns in spite of its volatility, and that we are incapable of predicting that volatility, read on.

Think differently and prosper

As I wrote two weeks ago, stock market corrections are not a flaw of the system, but a feature. Because the stock market is a giant weighing machine, balancing fear and expectations, when fear goes up and expectations go down, stock prices sink.

But, as they say: the stock market is the only business where things go on sale and the customers leave. Humans are short term thinkers – even professionals – and we can capitalize on this fact by thinking long term. Fear and uncertainty are at their highest now, but a year or two from now it is unlikely we will be gripped by this level of instability, and the markets will reflect that.

The key question: time to recovery

So, I have a question for you: How long do you think it will take for the market to get back to where it was on February 20, 2020, it’s last high? The average time to recovery after a bear market is about 18 months, but every one is different. Whether you think it will take one year, 3 years, or 5 years, we can use those numbers to calculate our expected rate of return.

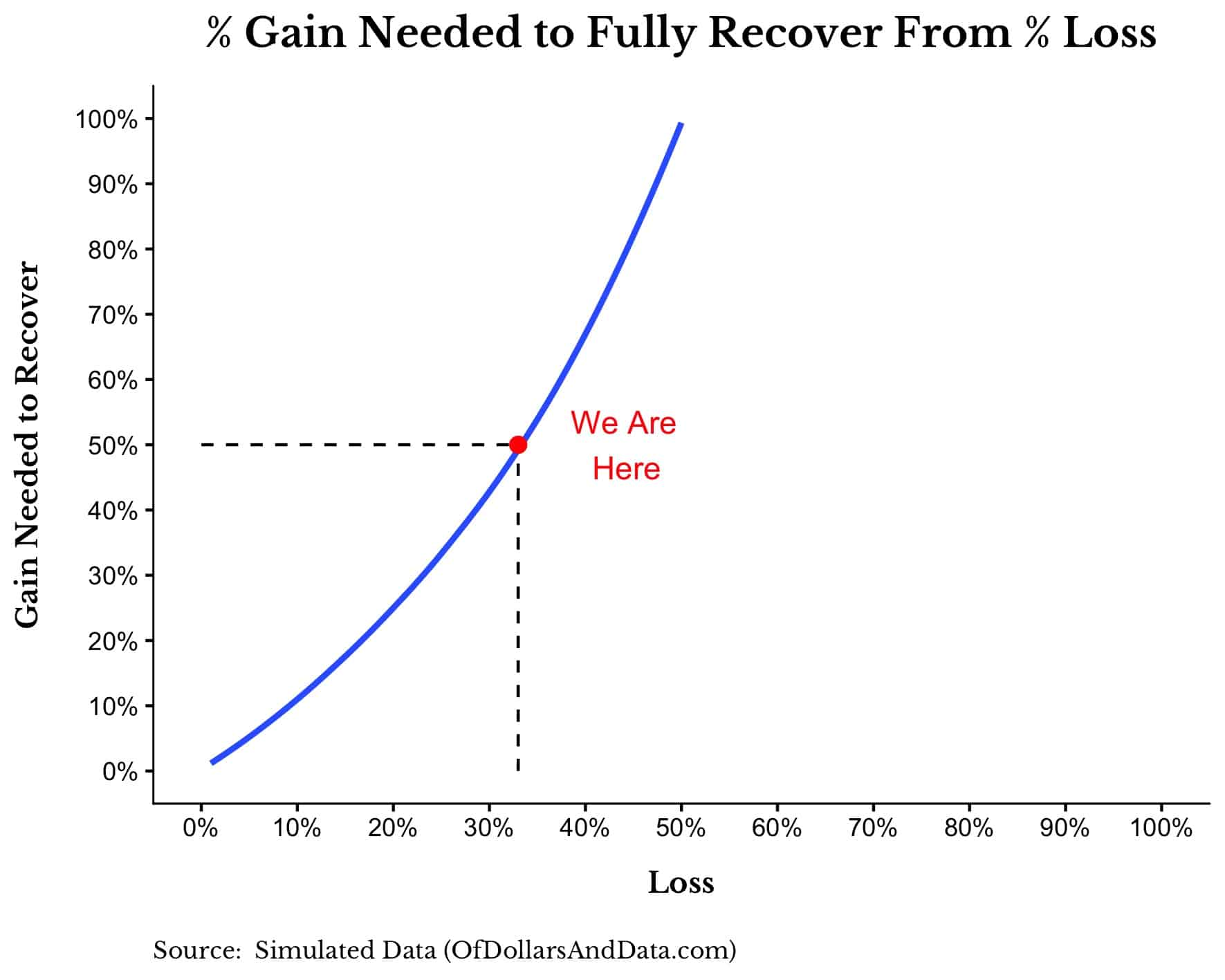

At the time of writing this post the S&P/TSX is down by about 33%. Using that as a starting point, it is simple to calculate our expected rate of return based on how long it might take the stock market to recover:

| Time to recover (years) | Rate of return |

| 1 | 50% |

| 2 | 22% |

| 3 | 14% |

| 4 | 11% |

| 5 | 8% |

To many investors who are anxiously watching their balances decline, these numbers might be shocking. Losses hurt, but the flip side of that coin is opportunity. If you have money to invest, the near-term upside rarely looks this good.

Sequence of returns

Not sure about these numbers? At first it might seem strange that a 33% drop is offset by a 50% gain, but it is easy to illustrate why this is the case. Say you started out with $100 000 before the correction. After losing 33%, you would be left with $ 66 666. To get back to your original $100 000 requires a gain of $33 333, which is 50% of $66 666. If that happens over one year, your rate of return would be 50%. If it takes two years, your average rate of return would be 22% due to compounding; and so on. This is sequence of return “risk” flipped upside down.

Nick Maggiulli wrote about this concept in detail on his blog, Of Dollars and Data. His post is excellent and well worth reading. This graph illustrates the relationship more visually:

Where else can we get returns like these? Money invested now will reap greater returns than money invested a month ago: it’s a mathematical fact. If you are still a little tempted to try to time the bottom of the market, you must weigh that against the risk of missing out on returns like these.

It’s hard to buy low

Even before all this happened we knew that, in theory, a bear market provides great buying opportunities. What many are realizing is that theory and practice are two very different things and it is difficult to pull the trigger when there is so much uncertainty and volatility. I hope this post helps explain why buying during a market correction is not as crazy as it might feel.

On the other hand, it’s important not to get greedy. Some will salivate at these numbers and be tempted to over expose themselves to the stock market, ignoring sound asset allocation or even using borrowed money. Don’t go there. Stick to your plan. This could take a while and the time may come when you need liquidity. Your investment decisions mean little if your personal finances are not in order.

BTSX portfolio update April 2020

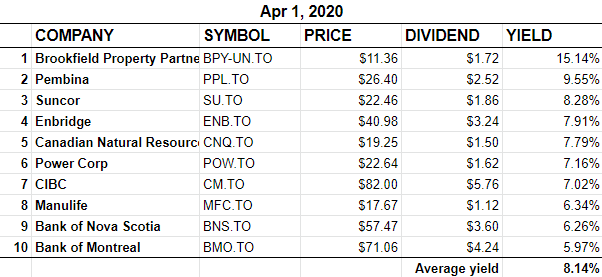

Here is our BTSX portfolio list. This one deserves some commentary.

The cuts are coming

Don’t be fooled by these yields: they are based on the last dividends announced and many of these companies have not made dividend announcements since the recent market carnage. Case in point: IPL, which pays out monthly, just slashed its dividend two days ago.

The massive yields on some of these stocks are due to massive stock price declines, and indicate companies in trouble. It seems likely that some of them will cut their dividends completely in an effort to shore up their own balance sheets – a prudent business decision in many cases.

Dividend cutters as investments

Because of these impending dividend cuts, I am expecting next month’s portfolio to look very different from this month’s. Does that mean you should sell those companies who cut their dividends? I don’t know. The evidence shows that dividend cutters under-perform in the long term, but those calculations depend entirely upon the time frame in which they are measured. The chronology goes like this:

business is fine > bad news > stock price plummets > yield goes up > dividend is cut

Notice the order of events. The stock price goes down before the dividend cut is announced simply because markets react much faster than boards of directors. That is why I don’t think its possible to make an investment decision based solely on dividend cuts – the price is already down. It is very possible that the market has not only taken the cut into consideration, but oversold the stock due to all kinds of other fears. Part of being an investor is assessing these changes and evaluating them in terms of our own investment plans.

No easy answers

From a behavioural finance point of view, it is well established that investors tend to hold losing stocks too long (and sell winners too quickly). On the other hand it pays to be “greedy when others are fearful, and fearful when others are greedy.” As you can tell, I don’t have any easy answers for you, but as for BTSX calculations, the annual review will use whatever stocks were on the list at the beginning of the year even if they cut their dividend.

Stay safe out there.

I thought that normally a stock was dropped from the BTSX when it cut it’s dividend. From your post it sounds like you don’t necessarily do this. Will you continue to hold BTSX stocks that cut their dividend?

Hi Lawrence,

For the majority of the history of BTSX, companies were not cut from the list when they announced a dividend cut. Ross Grant introduced this practice in 2013 (I think), but would admit himself that it was based on personal preference and not on hard evidence.

Historically, stocks that cut their dividends perform poorly. The problem we face as investors is that by the time the cut is announced, the stock price has already taken a beating – the market has already priced in the dividend cut. Sometimes the stock price actually goes up when the cut is announced simply because it is seen as prudent business practice.

I am not aware of any evidence supporting the practice of selling when the cut is announced. Furthermore, such a strategy would require frequent checking of one’s holdings which is usually counter-productive. Lastly, it significantly complicates both the BTSX method and the performance calculations. For these reasons, I will be sticking with David Stanley’s approach of annual re-balancing, even in the face of dividend cuts. As always, individuals must determine the strategy that works best for them.

Matt is quite correct that I did this as a personal preference although I did notice a pattern that did seem to repeat it self during my unscientific observations. It seemed that if a company cut it dividend it was common that it would do another cut within about 18 months. This was reflective of the the challenges that the company was facing that caused the first cut.

Matt is also correct that selling the dividend cutting stock mid year makes the calculations for the annual return quite difficult. I agree that it is much simpler to change the stock at the end of year. The stock may actually do well now that the fear of a dividend cut is off the table.

I own IPL and will make an acceptation to my rule and keep this stock as it is in the pipeline category. Pipelines generally are good income providers over the long term. Hopefully that pattern will not get too disrupted with the current low energy prices.

Re: BTSX – dividend cuts

David Stanley the originator of BTSX in 1986 or 87 followed a strict policy of buy and hold. There were no changes made with the list upon dividend cuts. If companies were removed from the TSX for whatever reason, ie; were acquired, they were removed from the BTSX list as well but not replaced. Stanley also had a policy of disregarding current and former unit trusts when making his lists.

Reply to Bernie: Yes, you are correct. On the other hand, during the ensuring 34 years I have changed my views about certain aspects of BTSX. Including former income trusts in the list is an example that the blog has discussed recently. Like Ross, I will continue to hold IPL. Let’s face it, we are now in uncharted waters and facing what could be some quite serious conditions for dividend investors going forward. But, as I look at today’s stock market I would very much rather be holding my blue-chip TURF dividend payers than any other segment of Canadian stocks. I should disclose that so far I have neither bought nor sold any stock in my portfolio.

I have some differences as an investor in that I only buy Canadian dividend growth equities in seven sectors, but on the other hand some similarities to the BTSX strategy as well.

I’ll just relate to Ross Grant in that in the past I would normally sell immediately a stock if the management cut it’s dividend, but that was in a bull market. Things are completely different now. I own IPL and after the cut I had no inclination to sell. On the other hand though, I have no plans to add to IPL at the moment either.

Excellent site. One quibble: “timing the market.” Every buy and sell decision presupposes an element of “timing.” The question is, in what contexts is it appropriate to pay attention to market timing, and in what contexts is it not?

I would respectfully disagree. We are talking about market timing as a mentality; i.e. the investor adjusts his/her behaviour based on predictions of what the market is going to do in the near term. The fact that every trade must be made in time does not presuppose market timing as a strategy. The mathematically optimal way to invest is to do it whenever you have the money. During a market correction, however, many investors are tempted to NOT invest because of high levels of uncertainty. The motivation for this post was to show that expected returns during times like these are higher than you might think.

Hi. Thanks for the site.

One request, would it be possible to have the posting date next to the article title? Might be helpful for us reading older posts with statements like “2 days ago” or “last week” to get some context?

Fair enough – done.

Hi, I’ve been investing following the Beating the TSX strategy for about 5 years. Given the current exceptional market circumstances, I haven’t adjusted my portfolio y/y yet as I would have to sell 5 out of the 10 stocks right away. Given the big swing in the market, would it also be a strategy to simply hold to last years (2019) list of 10 stocks which still return an annual yield of 6.1% vs. the 8.1% you indicate above… and align to the BTSX list next year again, hopefully, in calmer waters?

Hi Robert, It’s important to remember that BTSX is simply a tool to help us build a portfolio of quality dividend-paying stocks. You don’t have to sell any stocks that fall off the list or buy any that appear there. Maybe this post will help: https://dividendstrategy.ca/how-to-use-btsx-in-real-life/

This is great. Many thanks for sharing the other post which is immensely helpful.

You’re welcome!

I am currently in the process of reducing the weight of BNS in my total investable assets from 35% to about 10%. I sold about 3500 shs last week, and had planned to re invest into BTSX securities, when the rally pushed prices higher than expected,and the current market uncertainties is making pressing the buy button a more difficult decision. Is this a time to wait on the sidelines?

35% of all your investable assets in one stock is too much, so good move to get that down to about 10%. Your question: “Is this a time to wait on the sidelines?” . . . If anyone tells you they have the answer to that question they are either delusional or deceiving you. No one knows what the stock market is going to do in the short term. No one.

The annual re-alignment of my Beat the TSX portfolio takes place in April each year. I have therefore done so in the last couple of days. A few changes have taken place compared to previous years. For the first time, a pipeline, Pembina (PPL) was added to my Portfolio. Had my re-alignment taken place one month earlier, I would have added two pipelines instead of one, which would have been excessive in my view for a somewhat conservative strategy. Historically, the Beat the TSX strategy was somewhat overly dependent on the financial sector, as often pointed out by Mr David Stanley in the past. So, adding a pipeline will be interesting and provide some diversification. My second observation refers to the fact that I had to sell 4 stocks as a result of the re-alignment. I was a bit reluctant to do so, but I did it. In past years I would replace one, perhaps two or rarely three stocks max each year. It will be interesting to see what these changes do to the portfolio in the years to come. I should also point that I did not include Brookfield Property (BPY-UN) in my review. I chose BCE instead.

Yes, these are certainly interesting times for all of us.

To be clear, using the BTSX strategy does NOT mean we have to sell stocks that fall of the list; in fact, most of the time I will hold on to those stocks for three reasons:

1. They’re usually good investments that will continue to pay dividends

2. There’s a good chance they’ll reappear on the list

3. Tax implications of selling investments (in non-registered accounts)

But the main thing is to be invested, and dividend-paying stocks are, in my opinion, the way to go.

Not necessarily selling stocks that fall off the BTSX list makes sense to me. If NOT selling those stocks do you then rebalance by contributing enough additional cash to the account to be able to buy the new stock(s) that have been added?

Yes, if possible. In general there are three ways to make new purchases that I use:

1. New cash (either new contributions or accumulated dividends)

2. Sell some shares of stocks that have gone up

3. Move money from bonds into stocks (i.e. if stocks have gone down, re-balance to your target asset allocation)

Hi, first of all thanks for this content it’s very interesting. I’m in a position where I am looking to start some self-directed dividend investing and came upon the BTSX model. Right now I’ve got some mutual funds with one of the big banks and will likely leave as is until things stablize. I do have some cash to invest but I’m wondering whether the current BTSX portfolio represents a prudent starting point or whether it has been skewed by recent market events? In other words, if you were starting off a portfolio right now, would you rely on the current portfolio or lean more heavily on a historical context of the BTSX portfolio?

Thanks!

Good question, James. This might be a subtle point, but I appreciate that you asked what I would do rather than what is the best thing to do. No one knows what the best strategy will be until the day you sell. In this case, however, I would make a few adjustments to the current list of ten stocks for myself. These adjustments would be based largely on two things: decreasing exposure to stocks that are likely to cut their dividends (ex. BPY), and increasing exposure to other sectors (telecoms, among others). In these situations, the full list of TSX 60 stocks can be very useful to identify alternatives.

To be absolutely clear, this is what I would do personally. It has nothing to do with the actual BTSX list which is, as it has always been, generated based on rules rather than opinion.

Hope this helps, James.

Thank you for the response; helpful indeed! At the risk of succumbing to confirmation bias, I was thinking more or less the same thing. 😉

Pingback: BTSX after bear markets —

The BTSX portfolio performed about the same as the TSX60 (or its equivalent back in the day) for the years 1989 to 2008 then started to beat the TSX60 increasingly from 2008 to present. Interest rates dropped from over 4% in 2008 to about 0.5% by 2009 following the Great Recession. And they have remained below 1% for about 11 years (from 2010 to today). People living off yields, especially those who have retired from the private sector, started turning to large cap high dividend paying companies to survive. This rapidly growing demand over the period 2008 to present has driven up the values of large cap high dividend paying stocks relative to other TSX60 stocks. I would be very cautious in applying the BTSX strategy in a rising interest rate environment. I am quite sure that having made money from applying the BTSX was a matter of being in the right place at the right time and not the deployment of a sound long term investment strategy.

Well, John, I think we need to be very careful about the things we’re “quite sure” about. I put a lot of work into making this site as evidence-based as possible and though I encourage discussion of alternate points of view, the discourse is only useful if those views are also supported by evidence.

In this case, I will do the research for you. Here’s the summary:

1. Did BTSX perform about the same as the index until 2008, as you claim? No. In fact, $10 000 invested using BTSX would have grown to $65k vs only $53k for the index (total returns) in that ten year time frame – that is a 22.6% difference. You’re right though, it has done even better since then.

2. Do dividend paying stocks truly under-perform the index in a rising rate environment? Not according to this research. In fact, high dividend stocks outperformed the index by 3% on an annualized basis in rising rate environments.

3. Predicting interest rates is a fool’s game. We might not be in a rising rate environment for decades. Think that’s not possible? Look at Japan who have had rates under 2% for 25 years.

Please show us the evidence that there is a superior long term investment strategy for Canadian DIY investors. If you can, I will be happy to publish it. If not, well, I wish you all the best in whatever alternative you choose.

I don’t follow the BTSX, but I do hesitate to suggest that a stock should be sold because of a dividend cut. My preference is to select your dividend growth stocks with care, before buying. Hopefully, if your stock selections have been screened and you have confidence that they are quality dividend growth stocks, then one should monitor their portfolio to ensure the companies continue to pay and grow their dividend. By doing so, there are usually signs or at least a few things which might suggest that the company is having difficulty and that the dividend may not be as secure as it has in the past. That is the time to access the situation and decide if you still have confidence in the company and would be wiling to continue to hold the stock, even the dividend is cut.

If you own quality dividend growth stocks, and a company cuts their dividend, even if the price drops, one might still be better off to continue to hold the stock and possible even buy more shares. Each situation must be looked at separately.