There are some questions that are difficult for DIY investors to answer themselves. One that comes up fairly frequently when I mentor people who are close to retirement is when to apply for Canada Pension Plan (CPP) retirement benefits.

Consider this simple case:

Peter is a 57-year-old sales rep who plans to retire in three years when he turns 60. He makes $65 000 per year and has saved $825 000 in his RRSP. He owns his home, but has no other assets or liabilities. He is healthy and expects he’ll enjoy an average lifespan, maybe longer. When should Peter take CPP?

First of all, if you’re asking this question, congratulations – you’re already way ahead. Many advisors and investors think of the Canada Pension Plan as a simple and static top-up to other sources of retirement income – simply apply at the standard age of 65, or earlier if retiring early, and enjoy the additional inflation-adjusted income until death. But this is not the whole story. CPP can be taken as early as age 60 or as late as age 70, and that decision can have a big impact on both your lifestyle and peace of mind in retirement.

Some things you might not know about CPP

- CPP is a contributory plan meaning it is financed through contributions, not tax revenues. It is managed independently of the government and is in very good shape – i.e. it will be around when we need it

- Employees and employers contribute equally to the plan (self-employed individuals have to contribute both parts). Contributions are compulsory for Canadians between 18 and 65 who have earned more than the “year’s basic exemption” (YBE), which is $3500 in 2022.

- You can find out what your CPP payments will be by creating/logging on to your My Service Canada account

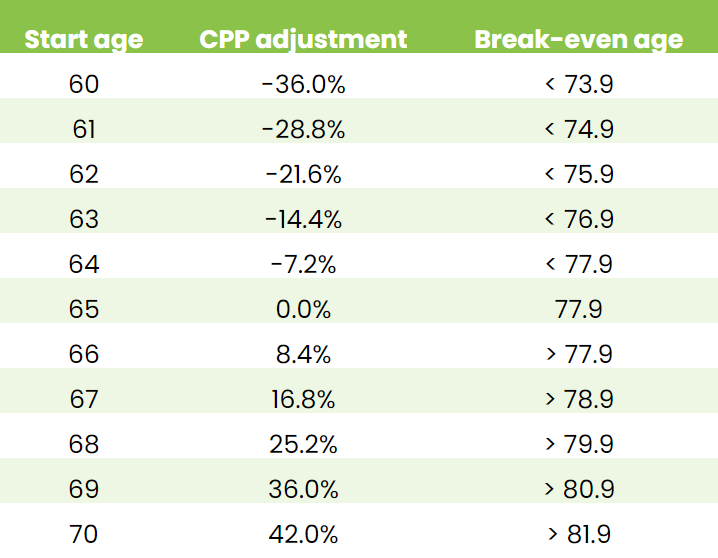

- For every month CPP is taken earlier than age 65, the amount is decreased by 0.6%, i.e. taking CPP at age 60 will result in payments that are 36% less than they would be at age 65

- For every month CPP is taken later than age 65, the amount is increased by 0.7%, i.e. taking CPP at age 70 results in payments that are 42% more than they would be at age 65 (Actually, because of the way CPP is calculated, this report shows that delaying CPP until age 70 results in payments that are about 50% more)

- CPP has a disability benefit if a contributor is disabled during the contributory period

- CPP has a survivor benefit, which is usually 60% of the deceased contributor’s pension, not exceeding the maximum CPP benefit amount (if the survivor is > 65)

When should Peter start his CPP?

Now that you know how CPP works, let’s look at three scenarios from Peter’s case above. For each of these scenarios, we will assume Peter has an 80/20 portfolio in his RRSP, and that his CPP contributions have resulted in CPP payments that are 75% of the maximum (if taken at age 65). We will also assume Peter is going to live until 90 years old, that inflation averages 2% per year, and that his main priority is cash flow in retirement, not the size of his estate.

One of my favourite features of the planning software that I use is that I can calculate the sustainable level of annual spending for any given client scenario – i.e. how much one can safely spend without running out of money. We can use this feature to make direct comparisons between different CPP start dates for Peter.

1. Start CPP at age 60

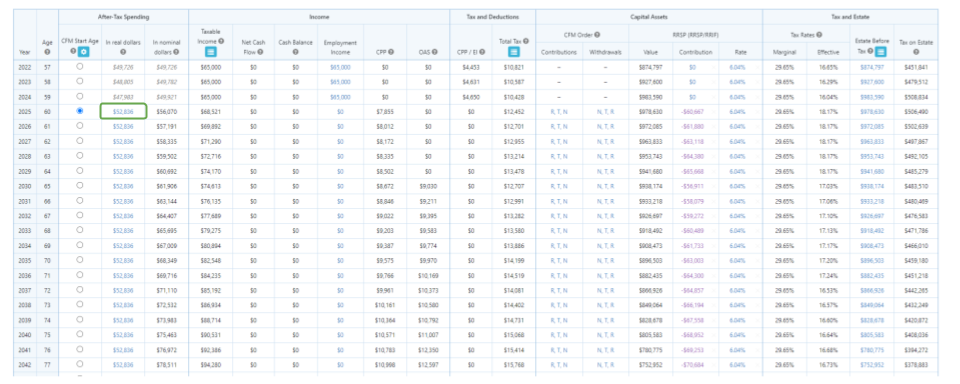

Most people simply start receiving CPP when they retire. Since Peter is retiring at age 60, let’s see what his sustainable income would look like if he started his CPP at the same time.

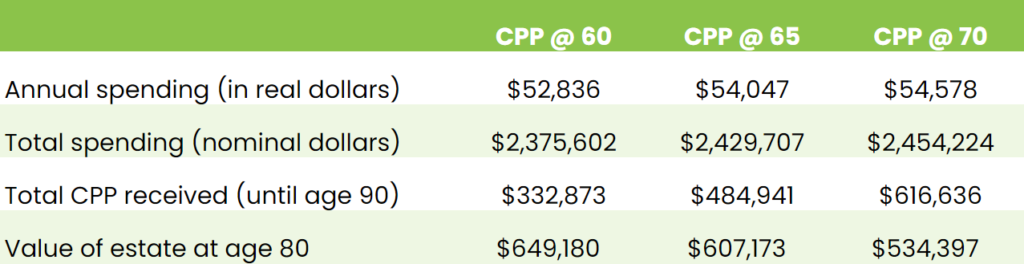

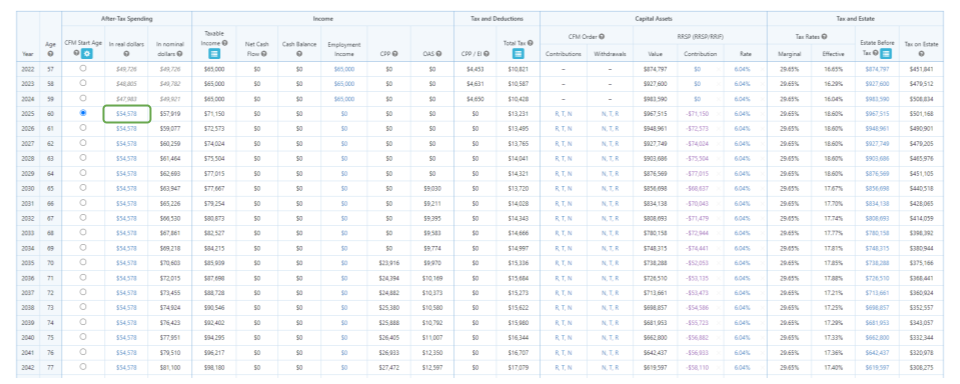

My apologies for all the small numbers – this is the back end of the planning software that I use; it’s powerful, but it’s busy! In case you can’t make it out, Peter’s sustainable after-tax spending in real dollars would be $52,836 annually if he were to start drawing on CPP when he retired at age 60. In nominal dollars, he’d be able to spend $2,375,602 in total during his retirement, $332,873 of which would come from CPP.

2. Start CPP at age 65

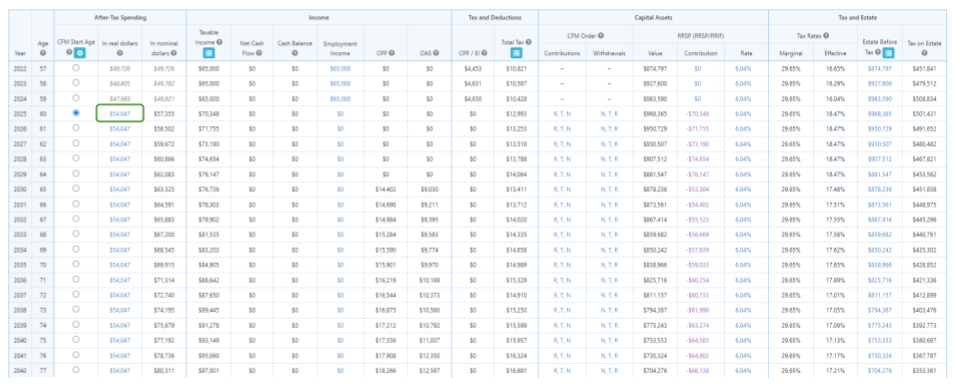

Many people are tempted to take CPP early because they think they will be able to enjoy higher spending levels early in retirement. I understand this perspective but if you also want to ensure similar levels of spending through your 70’s and into your 80’s, taking CPP early can be counter-productive. If Peter were to defer his CPP payments until the usual age of 65, he can actually spend more, not less.

As you can see, by delaying CPP payments by 5 years, Peter’s sustainable after-tax spending in real dollars would be $54,047 annually if he were to start drawing on CPP 5 years later at age 65. In nominal dollars, he’d be able to spend $2,429,707 in total during his retirement, $484,941 of which would come from CPP.

3. Start CPP at 70

Less than 5% of Canadians defer CPP/QPP payments past age 65, and fewer than 2% choose to delay until age 70 (source). I get it – it’s counter-intuitive to draw down the RRSP you’ve worked so hard to build and, at the same time, defer a government benefit that is there for the taking. But by running the numbers we can see that deferring CPP can actually put more money in our pocket during retirement.

If Peter were to defer his CPP until age 70, he’d be able to safely spend even more through his retirement.

By delaying CPP payments until age 70, Peter’s sustainable after-tax spending in real dollars would be $54,578 annually. In nominal dollars, he’d be able to spend $2,454,224 in total during his retirement, $616,636 of which would come from CPP.

The main trade-off of delaying CPP is that the value of the estate is lower. This is because RRSP funds are used to “bridge” until the increased CPP payments start coming in. Only you can decide if retirement income or the size of your estate is the greater priority.

Here is a comparison of all three of Peter’s scenarios. (I have compared the value of Peter’s estate at age 80 since that is his approximate life expectancy.)

More advantages of delaying CPP

The advantages of delaying CPP don’t stop at increased retirement spending. One common headache for some retirees is when mandatory minimum RRIF withdrawals are in excess of what they require for their lifestyle spending needs. Sometimes this means increased OAS clawback, and it always means more income tax to be paid. Delaying CPP means drawing down the RRSP balance before conversion to RRIF status at age 71, thus lowering subsequent minimum withdrawals, potentially saving tax and preserving OAS.

What is the biggest risk that retirees face? – the risk of running out of money (longevity risk). Thus, the more of your annual retirement income that is guaranteed, the better. One under-appreciated but incredibly important benefit of delaying CPP is that it essentially converts risky assets (the securities in your RRSP) into a guaranteed income stream (CPP payments).

What would this mean for Peter? In his 80th year, 41% of Peter’s income would be coming from guaranteed CPP/OAS payments if he deferred CPP until age 70, vs. only 25% if he chose to take CPP at age 60. If Peter is concerned about running out of money in retirement, delaying CPP gives him a simple and effective way to address that fear. To me, this is one of the biggest reasons to delay CPP.

Related: Dividend investing and risk-adjusted returns

Should everyone delay CPP?

Let’s be clear: this doesn’t mean everyone should delay CPP. If you’ve been forced to retire early and simply have no other way to support yourself, CPP payments in your 60’s may be essential. But the biggest reason to take CPP early, and my apologies if this sounds morbid, is if you don’t expect to live an average (or longer) lifespan. All of our scenarios above assumed that Peter would live until 90, but what if he had a medical condition that lowered his life expectancy?

Here is a table showing the “break-even” ages for starting CPP at various ages. The “break-even” age is the age beyond which you would have been better off delaying CPP.

So, if you have no reason to expect you’ll survive past 74, perhaps taking CPP at 60 would be a good idea. But if you survive beyond 82 years old, it’s usually in your best interest to delay CPP until age 70, thereby increasing all your CPP payments by 42%. (Of course, situations vary with respect to taxes, claw-backs, and other sources of income, however, so this should be confirmed on an individual basis.)

But here’s an important point: it’s not really about how long you expect you might live, but rather to what age you are making your financial plan, i.e. How long do you want to ensure your money will last? For example, you might not expect to live past 75, but you might not sleep well at night unless your financial plan is secure until the age of 85. If that’s the case, delaying CPP can still make a lot of sense because your CPP payments would be 120% higher by taking CPP at 70 vs. 60.

Why don’t traditional advisors suggest delaying CPP?

If delaying CPP is so advantageous for so many people, why don’t financial advisors suggest it? As usual, the answer lies in how they’re paid. Unless advisors charge a flat fee, their compensation is based on commissions for products they sell or is based on the balance of your accounts with them. Either way, spending down your RRSP early in retirement is not in their best interest, so, unfortunately, there are very few who will recommend this strategy.

How to know if delaying CPP is right for you

The choice of when to start CPP can be a tough one for many self-directed investors. I hope that this article is helpful in that regard. If you think you’d benefit from some one-on-one help running projections with your own numbers, my recommendation is to seek out a flat-fee financial advisor or coach. You can find out more about my financial mentoring options HERE.

If you are just starting out on your investing journey, I sincerely hope that the free information on DividendStrategy.ca is helpful for you. But if you are financially secure and are looking for a way to support my work, you can safely make a donation by clicking this button. Half of all contributions are donated to Doctors Without Borders.

This perspective on delaying CPP is based on a traditional definition of retirement which includes a straightline lifestyle, spending pattern, and investment strategy throughout retirement. What if someone wants to be more active in the first 10 years (i.e. travel, hobbies) and for this needs a higher income for the 60-70 age range? Then a steadily more simple and low-cost retirement for the subsequent years, meaning a lower income needed. This makes it more beneficial to take CPP at 60. Another scenario: Take CPP at 60 when you don’t need it all and invest the difference, compounding your gains for 10 years, say. Again, better to take CPP early. For many people a “straightline” retirement until death is no longer the goal, as it was for most of our parents. The means a re-think of investing, retirement spending patterns, and when retirement income is received, such as CPP.

Thanks for the comments, Paul. You’re absolutely right that the “straight-line” retirement projection that I have presented is not necessarily realistic for many retirees. In fact, what the research says is that our spending in retirement tends to decrease by about 1% per year.

Having said that, even if you want to spend more in your first ten years, if you have an average or longer life expectancy, you’d still be better off delaying CPP. I ran a few numbers to confirm this; for simplicity, if Peter were to decrease his spending to $40 000 per year starting at age 80, he’d still be able to spend more in early retirement AND end up with a slightly larger estate if he delayed CPP to 70 rather than if he’d started CPP at 60.

With respect to your second point about taking CPP early and investing the difference, I’m not sure that is a viable strategy because every year you delay CPP from age 60 – 65 you get a guaranteed 7.2% rate of return, and from 65 – 70, an 8.4% guaranteed rate of return. That is simply not feasible anywhere else to my knowledge.

Don’t get me wrong – I really appreciate your point that spending in retirement is often far from homogeneous. Thanks again for starting the discussion.

Thanks Paul for a different point of view on this subject. The numbers favour Matt’s point of view, but not by that much with the reinvestment strategy you present.

I am 82, and took CPP at 60, retired at 56 (with Defined Benefits) and took CPP at 60. Regrets, none, really. The key factor, which is not widely touted, is that I was much more active from 60 to 70 than from 70 to 80, and even more so than currently. Annual hiking trips in New Zealand and the UK? no problem. Today I am nursing a knee replacement; hiking trips are not in my future. I am saving not spending money. CPP is not just a financial decision.

Hi Doug, I’m happy that you are happy with your decision. I thought this post might be a little challenging for those who have done things differently, but thought that it was important to write about nonetheless.

Please see my previous response to Paul – after running some additional numbers, it is still more beneficial for most people to delay CPP, even if they plan on spending more in early retirement – as long as they have the “bridging” RRSP funds necessary to do so. The other thought I have about this is that, even though we may plan to spend more in early retirement, sometimes unanticipated expenses come up in late retirement like long-term care homes, medical care, etc. So, I’m not sure that counting on lower spending later on is always a good idea.

“CPP is not just a financial decision” – absolutely, but I hope that clarifying the financial aspects is helpful for my readers. All the best.

Thank you Matt for this great post.

It kind a struck me twice lately how two of my coworkers dealt with their CPP , one started collecting his at age of 60 just because his accountant advise him to do so and he was happy with it because he said the future not guaranteed and the second took his CPP and OAS when he turned 65 but he still working full time and when I asked him why he didn’t delay them to avoid taxes he said he didn’t even know he could such a thing.

It goes to tell you how a lot of people are so illiterate when it comes to financing and here I wanna thank you Matt and few other Canadian bloggers that are helping a lot of people to make a wise decision about their future.

Good for you for having these conversations, Gus. Given how few people delay CPP, it seems clear that there is a real lack of awareness – even among professionals in the industry.

Matt,

From a slightly different point of view, I was a very low income person, with a very irregular monthly income, sometimes none at all, and an elderly parent to look after.It took me a long time to finally own my own home by dint of a number of different jobs, and though I would have loved to have waited until I was 65 to claim CPP, the fact that at 60 I could claim my CPP, was an absolute boon to know that I had a definite amount of money coming in every month, even though it was minimal, for the rest of my life. This is from the view of someone who had not had a steady, guaranteed income for a long time, so even though I knew waiting another 5 years would garner me a higher monthly payment, I felt that the little bit of peace of mind that that small , guaranteed sum of money brought me, was worth the difference. A balance between ‘wants’ and ‘needs’, perhaps!

Excellent point, Eleanor. Thanks for sharing your experience.

Great article Matt!

Thanks, Mike!

I took my CPP early because I have a significant amount in my RIF and I would rather take a lower amount for longer. The lower amount will reduce not only one’s OAS clawback but also increases the age exemption amount. Further higher CPP may also result in someone entering a higher tax bracket.

I can absolutely sympathize with the fact that delaying CPP can seem counterintuitive. As you mention, it would seem to make sense to take a lower amount for longer, decrease the OAS clawback, and keep oneself in a lower tax bracket. This is why it’s so difficult for self-directed investors to analyze this question properly – I’ll be the first to admit that I wouldn’t be able to do it without the help of my software.

The fact is, however, that having a significant RRSP/RRIF balance doesn’t change the math – mathematically, it’s still usually best to delay CPP. To test this, I increased Peter’s RRSP balance to $1.5 million and ran the scenarios again. Even though the OAS clawback and average income tax rate were slightly higher, the sustainable spending rate was still higher throughout retirement by delaying CPP until age 70. And, again, this is on top of the other benefits of increased CPP payments, namely lower longevity risk.

My apologies to those who took CPP early and are finding this article challenging, but there are still thousands out there who will be faced with this decision in the coming years and I want to arm you with good information. It is also worth noting that if you started receiving CPP payments less than 12 months ago, you can still apply to have them deferred. Beyond 12 months and you are committed.

Thanks Matt…the other factors that came into play in deciding to take CPP early is my wife and I also have defined benefit pensions plus other taxable dividend income. So my point is while I appreciate the software forecast I think everyone’s situation is different and needs to be looked at individually.

By taking CPP at 60 I will have received around $40,000 by age 65. It is reasonable to expect that by investing this it will have grown to $50,000. This extra $10,000 adds at least another year to the break even age. I also took into consideration my wife’s CPP benefits, which are at the max. When I die she would receive nothing of my CPP benefits because an individual can only receive up to the max and she is getting that already. She will, however, receive the extra $50,000 (which will keep growing) from my estate. In addition, because I am not receiving the max CPP, if she dies some of her CPP will flow to me.

Prioritizing how much money is left to a surviving spouse or heirs certainly changes the decision-making process. Difficult to model, mathematically, but good point.

One more advantage to delaying CPP until 70 is that it acts as a backstop in case your portfolio is mishandled (losses/stolen) as your mental faculties decline. My mother passed in 2018. Her investment portfolio was neglected for the last few years of her life only because her ability to manage it had also declined. (it still generated income. ) It struck me as I took over her finances how many stories I heard about family members and others “removing funds” for their own benefit from an elderly person’s savings. At least with a higher CPP, even if all savings got depleted, there is more money available to pay for basic living and retirement home costs.

Excellent point, Diana! Delaying CPP as a risk management strategy is perhaps the most important reason of all.

Great Article Matt,

I hoping you could address the following issue, we are planning on retiring in 2024 or Dec 31st 2023,

But we are delaying our CPP until we turn 65, planning on living off our RRSP’s for the 3 years prior to our 65th year.

The trouble most people have is figuring out what their CPP pension will be,

Sure in the government website My service Canada estimates what you will receive if you were to take your CPP at different ages, but it doesn’t really tell you what you will get if you stop working 3yrs prior to your 65th and still plan on collecting your pension at 65.

I have found no accurate way of really calculating your CPP other than calling My Service Canada, where they will estimate it will be $20-$30 less than what is projected if we were to continue to work until the age of 65.

Is there an accurate way of figuring out what ones CPP will be if they stop working 1-10 yrs prior to collecting their CPP at 65?

This is a very important question and not easy to answer, Tony. Fortunately, Canadians have access to a reasonably-priced expert resource named Doug Runchey. A few of my mentoring clients have contacted him and have always been very happy with the service.

https://www.drpensions.ca/

Thanks for the great overview. One bit of math might be a bit misleading, in particular, “delaying CPP can still make a lot of sense because your CPP payments could be 78% (36% + 42%) higher by taking CPP at 70 vs. 60.”

The chart above shows CPP at age 60 is 36% less than at age 65, and at age 70 is 42% more than at age 70. You can’t just add those percentages together, because one is a decrease and the other is an increase. Let’s call the amount of CPP available at age 65 “C.”

Then CPP at age 60 = (1-0.36)C = 0.64C

And CPP at age 70 = (1+0.42)C = 1.42C

Then the difference between taking CPP at age 60 and age 70 is not 78%, it is 122%:

1.42C/0.64C = 2.22

The formula for how much CPP you would have accumulated at age A, where A is an age over 70, is:

0.64C*(A-60) for those who have received CPP from age 60; and

1.42C*(A-70) for those who have received CPP from age 70.

It’s interesting to consider how long it will take someone receiving CPP from age 70 to “catch up” to someone who has been receiving it all along from the age of 60. To figure out the age where the amounts are equivalent, we set:

0.64C*(A-60) = 1.42C*(A-70)

and solve for A:

A= 78 years, 2 months.

Of course, from the individual point of view, this formula ignores the opportunity cost of not investing incremental amounts received between 60-70, and inflation of the CPP benefit over time (i.e., C is really a moving target that might be different due to inflation or government decisions 10 years later), but perhaps those factors roughly cancel each other out. But you might say that if you live past age 78 and 2 months, you will get more money from CPP if you delay until age 70. If there were a 60 year-old and a 70 year-old starting their pensions in the same year, both living to age 95, the 70 year-old would have 58% more at age 95 than the 60 year-old would have by the time he reached the same age.

Hi Dan – Thank you very much for writing such a detailed comment and explanation. You’re absolutely right about the 2.2x difference in CPP payments between age 60 vs. 70. Thanks for pointing that out – I will edit the post accordingly.

As you mentioned, it is difficult to determine the precise “cross-over point” for when delaying CPP becomes worth it. Even beyond opportunity costs and inflation adjustments, there are also considerations relating to how living expenses between age 60 and 70 are going to be funded (RRSP, TFSA, non-registered?), and potential implications for OAS clawback. This is where financial planning software really comes in handy.

Yes, 2.2x, or 120% more.

It’s so much harder to get the right answer for an individual. Yes, I’ve wondered if I should take it early, kind of against my better judgment in a way, to spread out the income over more time. Maybe paying more later is a sneaky government trick to get you to pay it all back in tax! Lol, you worked as a doctor, you would know all about the intricacies of having a lot of your income concentrated into relatively few years and the implications for taxation.

I think (hope?) I might have enough by then that my OAS will get clawed back either way; having OAS clawed back is from a certain point of view is perhaps a good problem to have!

I was a bit intrigued that the cross-over age illustrated above is pretty close to the average life expectancy of a Canadian male from birth. You’d think the government actuaries would use the average life expectancy from age 60 for their calculations, but maybe they bake in some more specific data they may have about people who choose to take the pension from age 60 to get a more precise picture.