There are no solutions, only trade-offs.

Thomas Sowell

You can only calculate risk in hindsight. You can’t calculate actual risk going forward because you don’t have the data yet. Things change. The best you can hope for is a fuller and more accurate understanding of the range of outcomes from any given decision. Past data can be helpful, but good decisions are usually the result of deep reflection more than spreadsheets.

Four years ago I decided to leave my career in medicine to travel around the world for a year with my family. Some people thought I was brave, which I’m not. More people thought I was crazy, which I’m also not (although my kids may disagree). Fellow physicians couldn’t wrap their heads around my decision, particularly when they found out I had no concrete plans to return to medicine and no alternative career lined up.

“You’re only 42 – you’ll never make this kind of income doing something else!” True.

“What if something bad happens out there?” Yes, that’s possible.

“How do you know this is the right thing to do?” I don’t, and I’m good with that.

It was a big decision. It would have a huge impact on our lives – in fact, we hoped it would. But “big” doesn’t mean dangerous. The truth is that, once we finally decided to leave, it didn’t seem nearly as risky to me as it seemed to other people.

I felt neither brave nor daring. Sure, we were excited, but leaving medicine to travel truly felt like the most logical thing to do given the circumstances. What I realized was that assessing risk and opportunity can be as simple as assuming our gut feelings are right, but, when it comes to big decisions – including financial decisions – our outcomes will likely be better if we take a more holistic approach.

Risk vs. opportunity

Big decisions are really about two things: risk and opportunity.

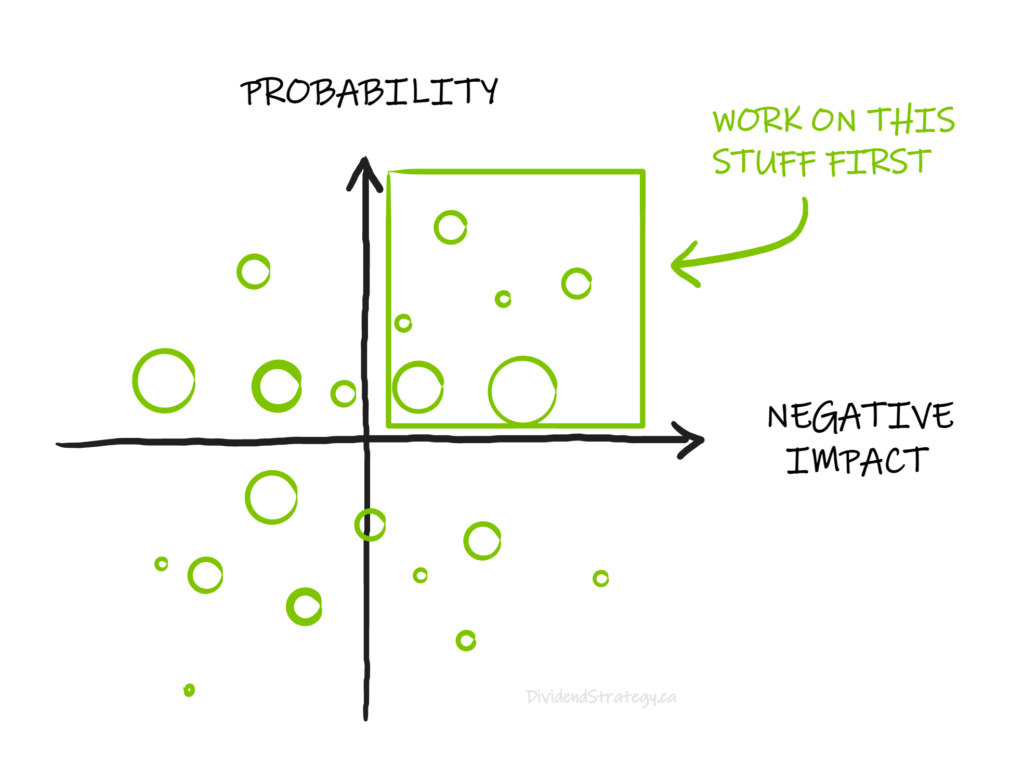

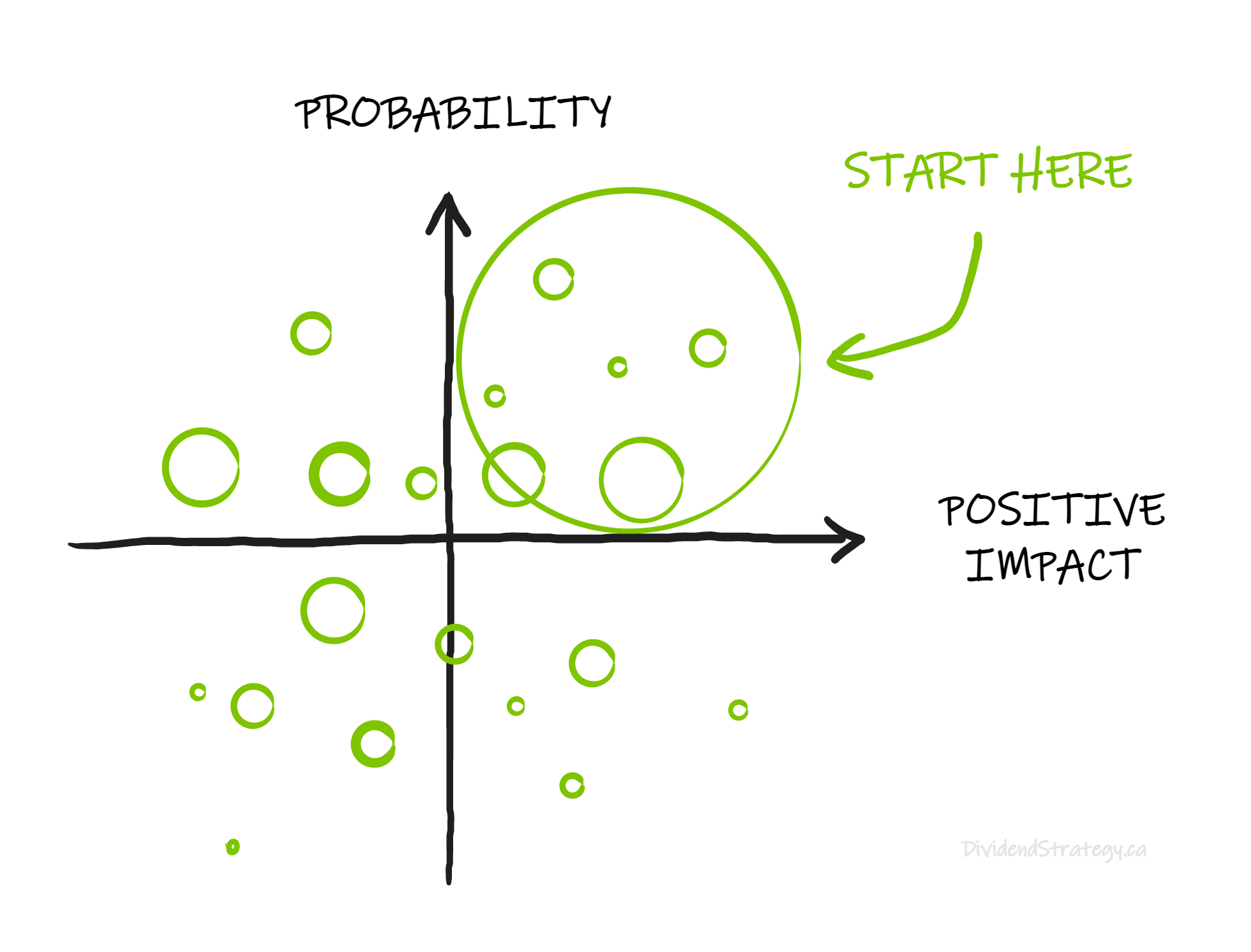

The risk of a bad outcome has two components: the probability that the bad outcome will happen and the magnitude of the negative impact it would have. They both deserve your attention.

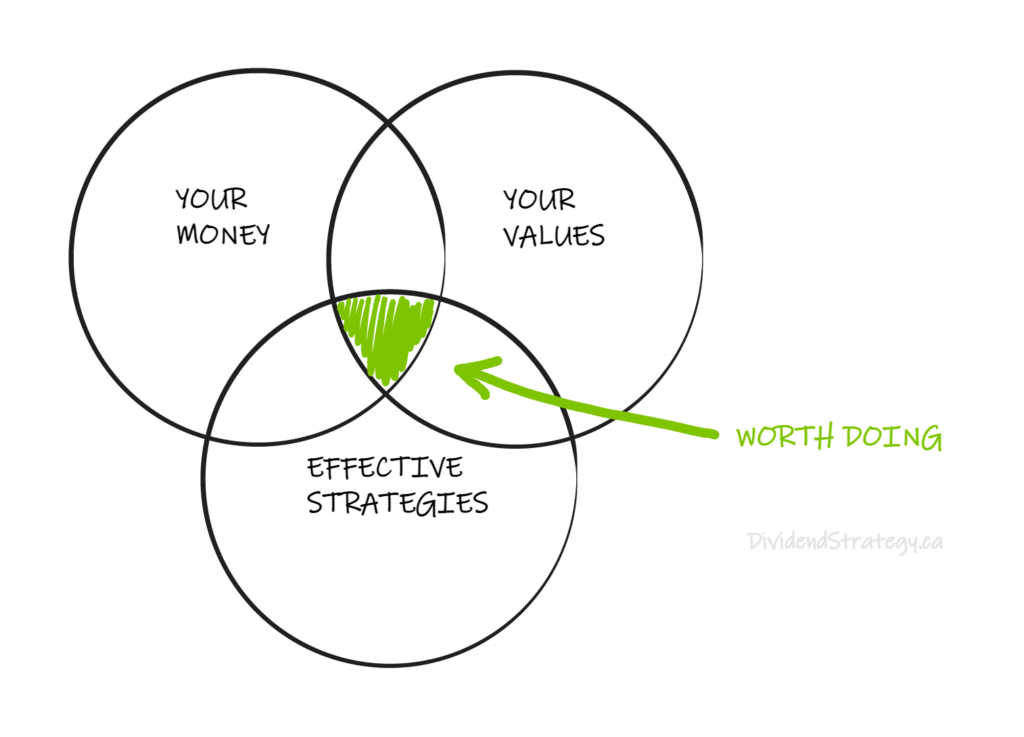

You can think of it like a matrix that looks like this:

Making good decisions means finding ways to lower the probability and/or severity of bad outcomes.

The bad outcome I was trying to avoid as a physician was burnout and the collateral damage it would cause for our family. I spent years doing everything I could think of decrease the chances of it happening: I cleaned up my diet, I exercised, I had hobbies, I decreased my shifts – I even changed hospitals. But, as many physicians now understand, burnout is primarily a system problem, not an individual problem. I’m glad I made those changes, but I couldn’t reverse the slide toward burnout.

The worst outcome of not practicing medicine? Losing the income. Here is where our decisions had a real impact. We had been taking steps for years to decrease the financial impact of the worst-case scenario by keeping our spending in check, saving aggressively, and investing rationally. Eventually, the money we thought was going to be for retirement in our 60’s reached a point where we realized we had choices now. I no longer had to work as a physician, as long as we continued to make financial decisions intentionally going forward.

That was a magical moment. I had been working my @ss off at the not-so-fun job of mitigating risks. Finally, we could focus on something completely different and much more exciting: opportunities.

Dreams are not enough

But how do we assess opportunities in our lives? This also deserves some reflection. It cost our family of six about $100,000 to travel around the world for a year. Guess how much the average Tesla costs? Nothing against Teslas, but how would you weigh those choices?

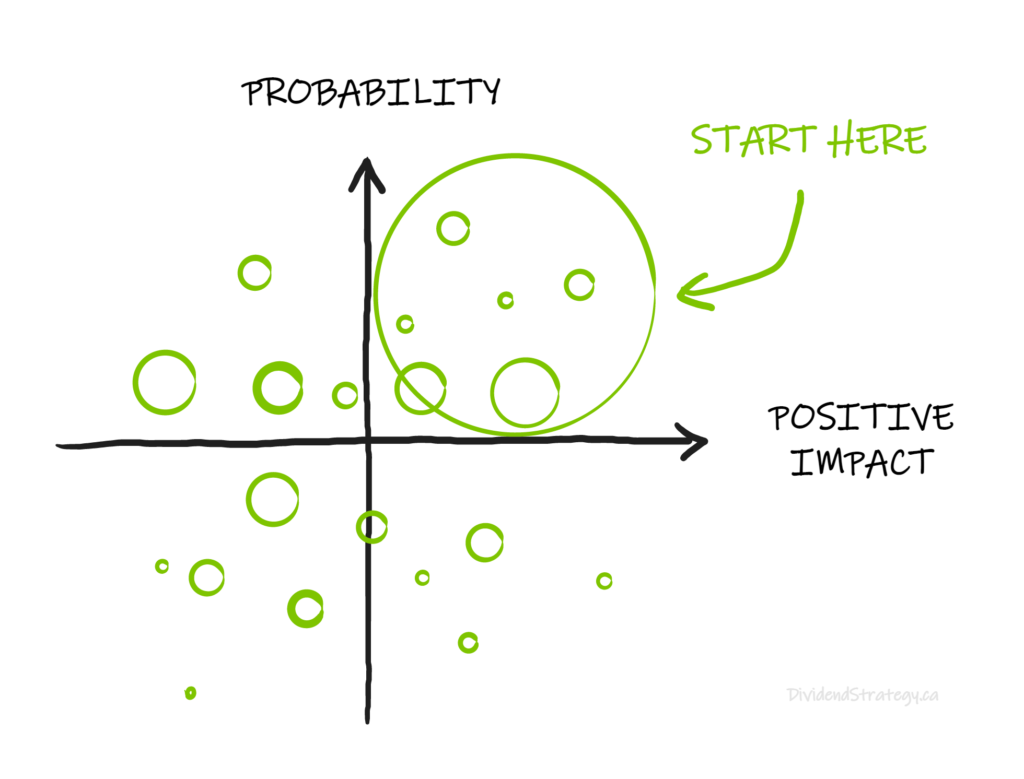

We can think of an opportunity matrix like a risk matrix: there is the probability that the desired outcome will happen and the magnitude of the positive impact of that positive outcome.

The correlation between luxury cars and happiness is dubious, at best. Whereas sharing meaningful and novel experiences with people we love is strongly correlated with life satisfaction.

Since we had achieved at least a baseline level of financial independence, our situation could be summarized like this:

- The potential negative impact of leaving medicine to travel was less than that of continuing to work

- The probability of a negative outcome by continuing in medicine was much higher than the potential of a negative impact from travelling.

- Any positive impact of remaining in medicine was dwarfed by the potential positive impacts a year of travel might have for our family

- The probability of positive outcomes from travelling was much higher than the probability of positive outcomes from continuing in medicine (I could see where that train was heading)

We had more to gain and less to lose by travelling than we did by staying. A famous cliche comes to mind: “The definition of insanity is doing the same thing over and over again and expecting a different result.” The bottom line was that our desire to try something new trumped any need for the new path to be flawless.

Don’t get me wrong, we did not break out a spreadsheet to make our decision. We didn’t even make a list of pros and cons. We talked it out. We researched alternatives. We listened to each other and challenged each other until the conclusion was obvious.

It’s not that we had no fear. It’s just that we were more afraid of staying on the same path than trying something new.

Risks and opportunities in DIY investing

Where are you on your financial journey? Are you managing your risks and optimizing your opportunities?

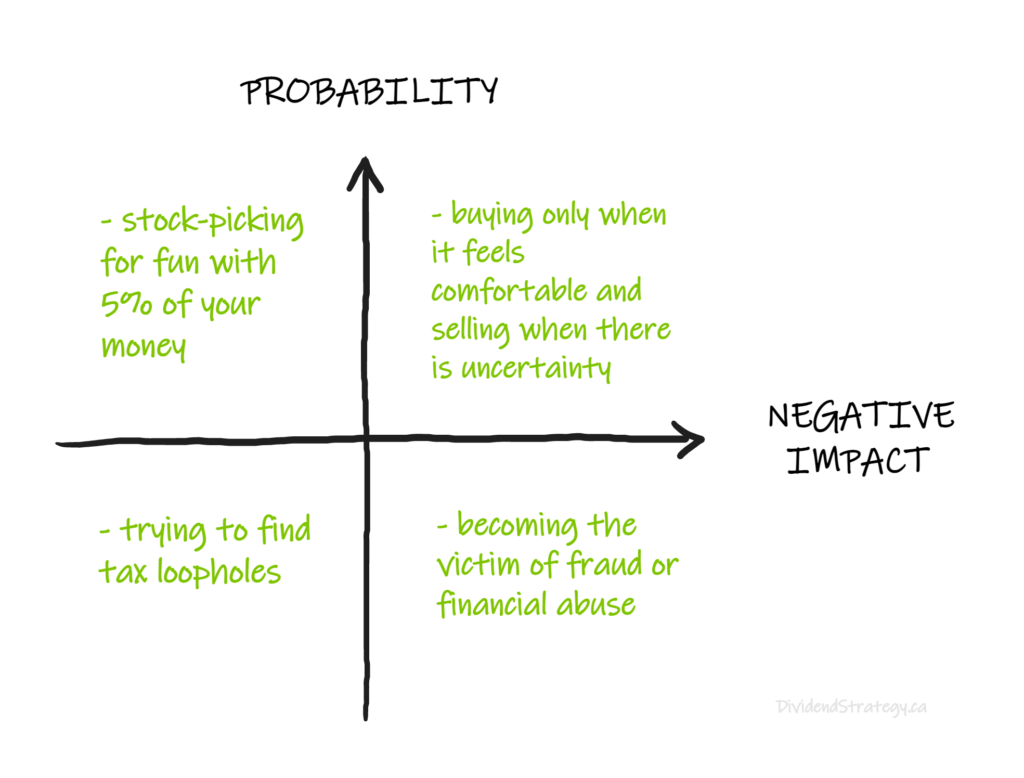

Self-directed investing is tiger country. There are a thousand ways to get hurt. Some risks are unavoidable (market risk, political risk, etc.) while others – many others – are layered-on based on the decisions we make (stock-picking, market timing, watching financial porn news, etc.).

How would some of the choices DIY investors make fit into the risk matrix? Just a few examples . . .

How can we shift these risks down and to the left? The best way is to create a rational and complete financial plan that will insulate you from both internal and external threats. This isn’t just about investing. It’s also about insurance, tax planning, estate planning and more.

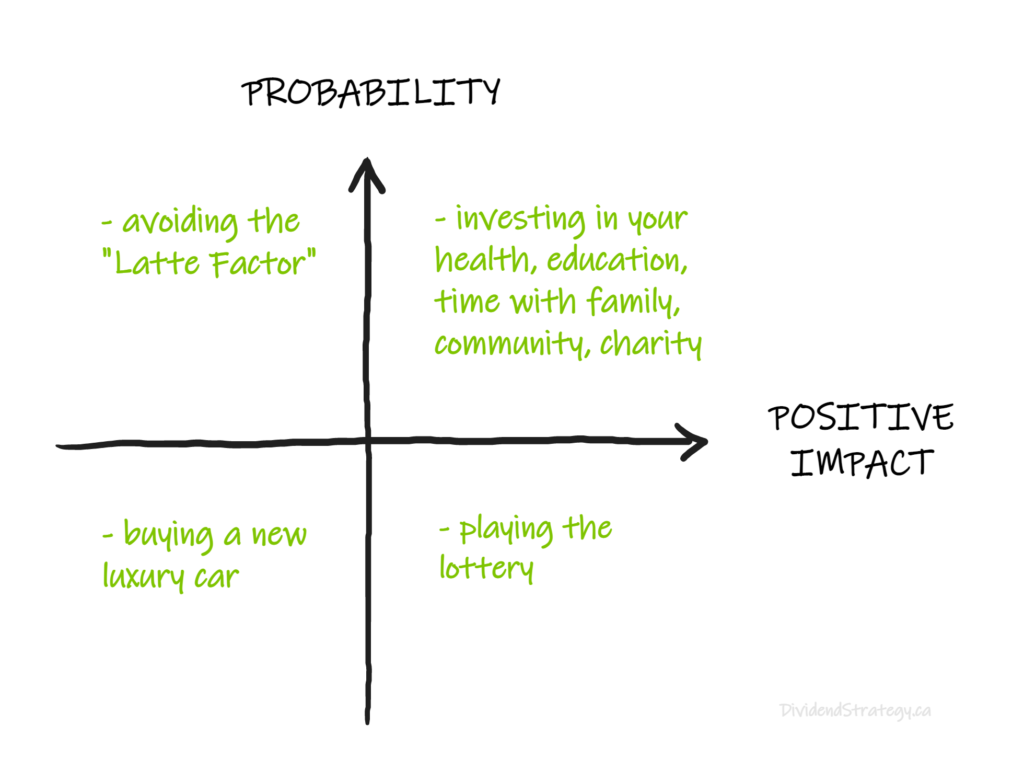

Self-directed investors also have many opportunities when it comes to how to use their money. How likely is it that these opportunities will improve your situation and how significant would the change be? It’s easy to spend time, energy and money on things that won’t move the needle of happiness very much in the end.

If you’re looking for the best credit card but are spending more than you make, you’re not focused on the right thing. If you’re patting yourself on the back for giving up Starbucks’ lattes but you’re using your line of credit for the bathroom reno, you need to take a step back. If you’re spending a bunch of time and energy agonizing over which of the big banks offers the best value, but your asset allocation is all wrong, you need to go back to your plan.

The author Ramit Sethi says, “Stop asking $3 questions and start asking $30,000 dollar questions.” Focus on what matters and what works. Money is a tool, not a goal.

Final thoughts

It’s impossible to calculate the future probability or impact that these risks and opportunities might have. We just don’t have the data. But that doesn’t mean we should simply go with our gut feelings. In fact, I think it means we should think even harder about our decisions.

Understanding the probability and impact of the risks and opportunities we face as DIY investors isn’t always easy. But it’s important. Spending our time and energy on low-probability risks and opportunities that would have a relatively small impact on our lives is a waste of time.

Helping DIY investors clearly see the risks and opportunities that are personally relevant to them is one of the most rewarding parts of financial mentoring. What should you focus on? What can you safely ignore? How can it all work together to accomplish your goals? Whether it’s a one-time retirement planning meeting or the more comprehensive money mentorship program, if you are looking for guidance, CLICK HERE to see how I might be able to help you.

Happy Holidays everyone!

Running DividendStrategy.ca costs money. If you would like to support my efforts, you can donate here (half of all donations are given to Doctors Without Borders):

Nice summary of what is relevant to life decisions Matt.

Thanks

RICARDO

Thanks, Ricardo. As Stephen Covey has said, “The main thing is to keep the main thing the main thing.” Everything else is details.

The problem is that money is proportionally tied to every single decision we make (big or small), and the all mighty dollar often skews the decision-making or even makes the final decision for you. Shouldn’t be that way but it is.

I’ve heard that the average Canadian makes 6 – 8 financial decisions every day. So, you’re right, money is a pervasive factor. On the other hand, because it’s so ubiquitous, understanding money becomes a very powerful tool.

Thanks for the comment, Sil.

Hello Matt,

Loved the article I had to read it twice 🙂 and also I watched your webinar on TD webbroker which i enjoyed as well.

Thanks x 2, Gus. How we make decisions is so interesting to me because, no matter what area of life we’re talking about, even a marginal improvement in our ability to make decisions will help us and the people around us. To bring it back to money – it’s an investment with a guaranteed high rate of return.

Matt your advice is much much more than financial and is so prescient in these times off financial instability and health care chaos and burn out. Thank you for always being a level headed thoughtful leader for everyone looking for advice on life, family and financial guidance .

Hi Benj – great to hear from you. I don’t know if I’m in a position to give advice, but I’m in a position to share things that I am thinking about and working through. I hope there’s value in that.

To be honest, I suspect a lot of readers come to the blog for more bread-and-butter financial topics, so I never know how these kinds of posts are going to land. But even if they’re meaningful for a few people and the rest are able to tolerate them, I’ll keep writing because they’re good for me too.

Thanks for the feedback, Benj, and Merry Christmas.