Beat the TSX Gained 16% in 2024

But Still Couldn't Beat The Index

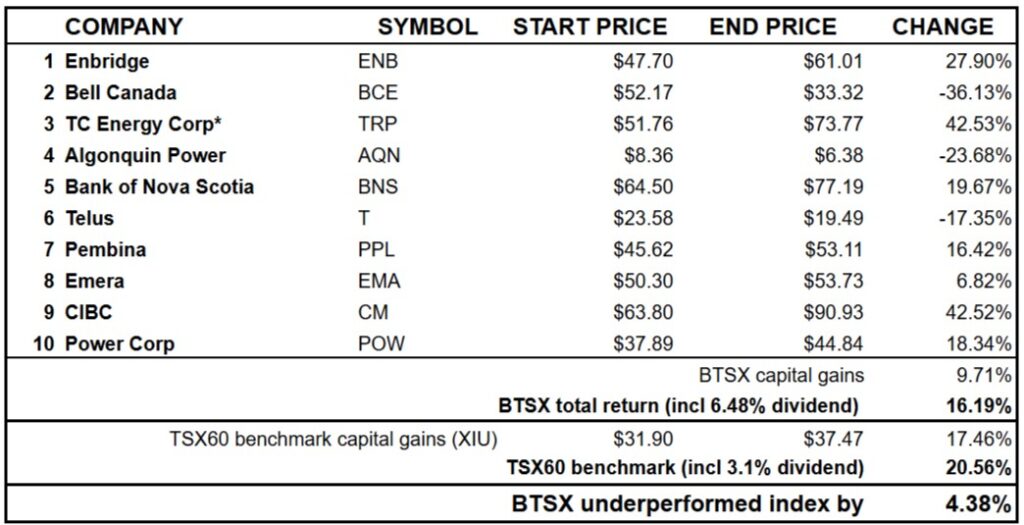

It will likely be no surprise to dividend investors that the Beat the TSX portfolio lagged its benchmark index in 2024. BCE (BCE Inc.), a stalwart dividend stock for decades, has been crushed to prices not seen since 2010. And AQN (Algonquin Power & Utilities) continued the brutal slide it began in 2022 with another dividend cut and accompanying price drop.

Perhaps the real surprise was that BTSX held up as well as it did, marking a 16.19% positive return for the year. Offsetting BCE and AQN, we had two stocks with price gains over 40% and two more with gains of 20-30% – which doesn’t include dividends.

It was a wild year indeed but before we get into the details of this year’s results, however, let’s review the method and rationale behind Beat the TSX.

Beat the TSX: How it works

BTSX is a simple method that anyone can use to identify Canadian blue-chip dividend-paying stocks that might be worthy additions to your portfolio. It was created by David Stanley in the 1990s and I’ve been using the method personally since 2008. There are just three steps to the BTSX method:

- List the stocks on the TSX60 by dividend yield

- Purchase the top 10 yielding stocks in equal dollar amounts

- Hold for a year and repeat

The method usually results in a portfolio of stocks with several appealing characteristics:

- They are large and usually stable companies with low volatility

- They have a high dividend yield

- Most have a long history of stable and growing dividends

- They are often purchased when their stock prices are depressed

Beat the TSX 2024 Results

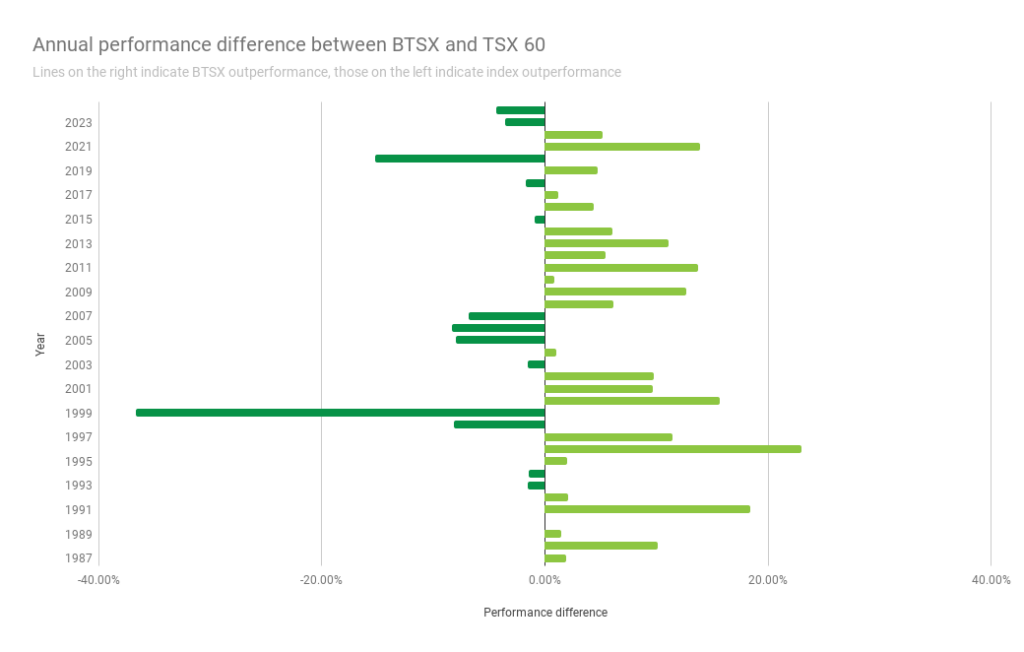

2024 marked the second consecutive year that the BTSX portfolio failed to beat its benchmark, the TSX60 index. Every good investment strategy will have periods of underperformance but this is the first time since 2006/2007 BTSX has done so for two years in a row.

As you can see in Figure 1, the results for individual stocks were all over the place but at the end of the year, total returns for BTSX were 16.19% vs. 20.56% for the benchmark index.

* TC Energy Corp spun off its Liquid Pipelines business, South Bow. TRP shareholders received 0.2 shares of SOBO for every share of TRP. The value of these shares has been included in the share price here.

** Note that the TSX 60 benchmark is represented by the XIU ETF which tracks the TSX 60. The dividend yield for both BTSX and TSX 60/XIU is as of Jan 1st, 2024.

Thirty-seven years of BTSX returns

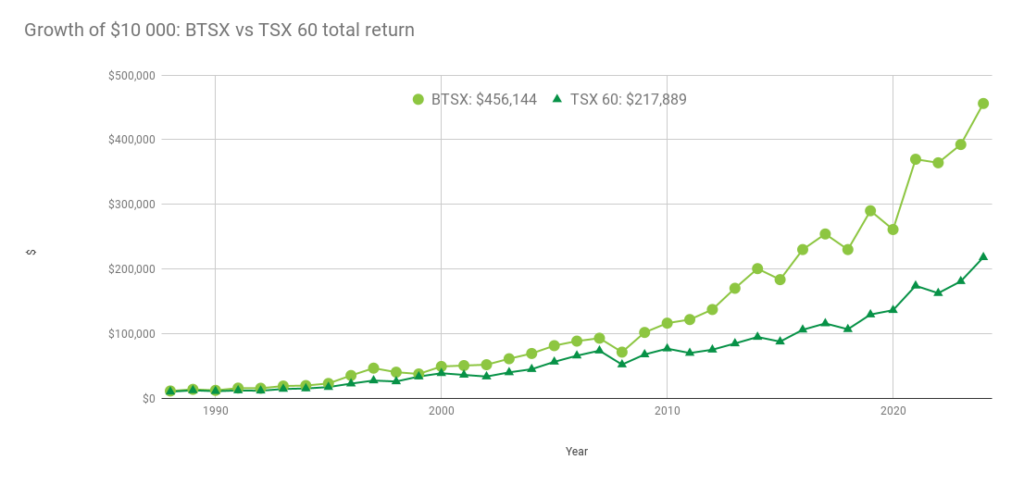

If you’re tempted to dismiss Beat the TSX based on the last two years’ performance, let’s put them in context. When it comes to investing, it’s decades that matter, not years. Since its inception in 1987, BTSX has outperformed the TSX 60 by an average of 2.47 percentage points per year (12.50% vs. 10.03%). This means that, if you had invested $ 10,000 in BTSX stocks 37 years ago, you would now have $456,144 – over double what a TSX60 index investor would have (in both cases total returns re-invested).

Figure 2: Growth of $10,000 using BTSX vs. the benchmark TSX 60 index

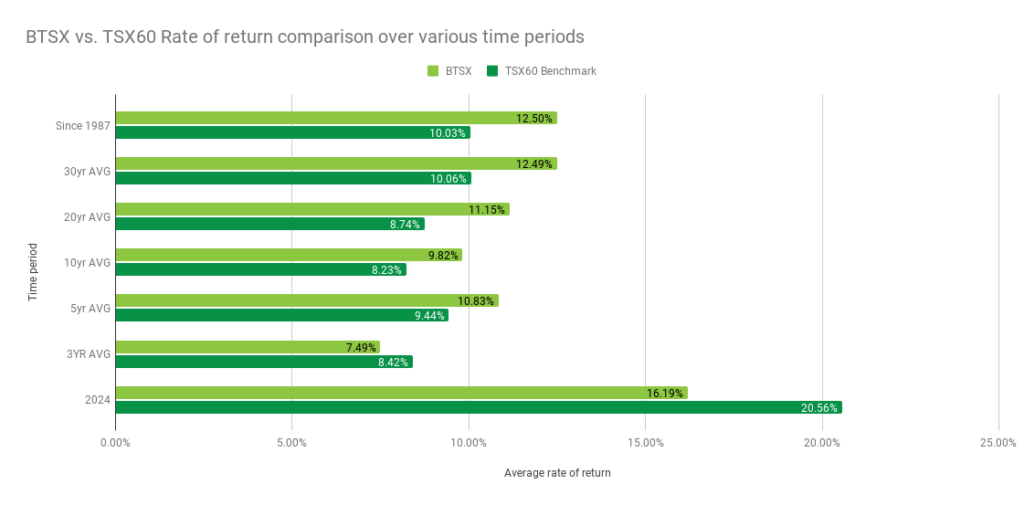

What about periods less than 37 years? Even though Beat the TSX fell behind the index recently, it has still beaten the benchmark over the last 5, 10, 20, and 30-year periods. How many mutual funds do you know of with a track record like this?

Figure 3: Average rate of return over various periods; BTSX vs. the benchmark TSX 60 index

BTSX: Strengths and Weaknesses

Performance is just one factor that investors must consider. Beat the TSX stocks offer many advantages including:

- They tend to be large, stable, profitable companies

- They are purchased at attractive valuations

- They provide high dividend yields

- They tend to raise their dividends over time

But BTSX has limitations as well, including:

- The possibility of dividend cuts

- Suboptimal sector diversification

- Not all BTSX stocks will be winners

- The BTSX portfolio doesn’t always beat the benchmark

If you’re going to use Beat the TSX successfully, you need to be aware of these limitations. Perhaps one of the most important considerations is to ensure BTSX stocks occupy an appropriate place in an otherwise broadly diversified portfolio. Low-cost index funds are great for this.

But that’s not all – you need to stick to your investment plan. Have a plan for dividend cuts and understand there will always be individual stocks and individual years that will take some of the shine off the method. The only way to benefit from long-term performance is to prepare yourself for temporary underperformance.

The following chart will help you understand the ups and downs of BTSX’s performance over time. It shows how BTSX has performed relative to the TSX60 index year by year; 2024 is at the top and 1987 is at the bottom.

Figure 4: Annual outperformance vs. underperformance of BTSX vs. TSX 60 benchmark

BTSX Dividend Income

Many investors are attracted to Beat the TSX because of the dividend income. Not only are dividend-paying stocks less volatile than non-dividend-paying stocks, but investing for income helps many investors stick to their plan. Even when markets are down and the headlines full of doom and gloom, dividend investors are incentivized to hold rather than sell. In fact, as prices fall, reliable dividend payers get even more attractive because their yields go up.

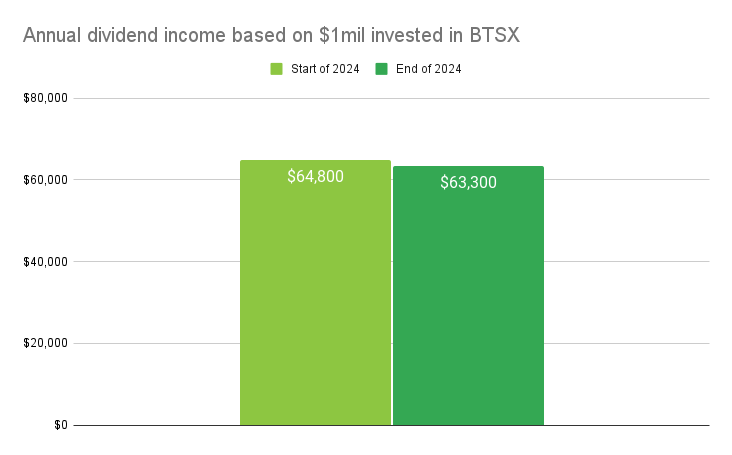

BTSX started 2024 with an average dividend yield of 6.48%. With the exception of AQN and TRP, every other BTSX stock either maintained or raised its dividend, resulting in an end-of-year yield of 6.33%. What this means in real dollars is that if you had $1mil invested in the ten BTSX stocks, your annual dividend income would have gone from $64,800 at the beginning of the year to $63,300 at the end.

Figure 5: Annual dividend income based on $1mil invested in BTSX

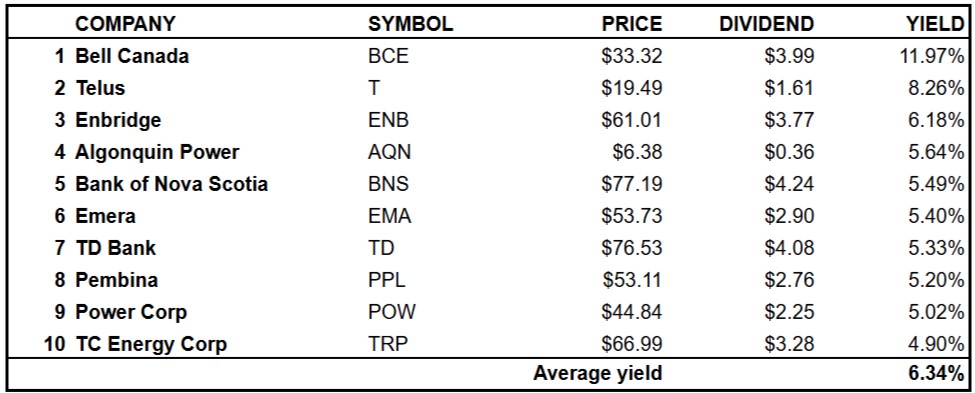

Beat the TSX 2025

Interested in Beat the TSX for 2025? Here is the new list of stocks including their forward dividends.

As always, this list is for information purposes and is not investment advice. You must do your own due diligence. Case in point: BCE and AQN are still on the list and may be most at risk of a dividend cut. If you’re not comfortable with these stocks (or any of the others), you can always skip them and select the next highest dividend-payers.

Are you passionate about dividend investing?

As much as I have enjoyed running this site over the last six years, for purely personal reasons, it is time to pass it on. If you love dividend investing and are looking for a place to write about your ideas and connect with other investors, reach out to me at: matt@poynerfinancial.ca

16% is still very good ! Way to go.

I deserve exactly zero credit but I agree, 16% isn’t bad!

Hi Matt, sad to see you go. Thanks for all you have done. Much appreciated.

Thanks for the kind words, Warren. Thought I’d put out the invitation, but if the right fit isn’t found I might just keep it rolling 🙂

Glad to see you’re OK….I was beginning to worry about you

No need for explanation

Don’t worry, all good around here, Ian – thanks though. The biggest reason I’m soliciting interest is because I’m just too busy with my financial planning business and don’t have the time to post regularly. This site has so much potential for the right person. It’s a great community.

Forgive me, I’m old and impatient. I have invest since I was 10, mainly in banks and utilities. I have owned most of the stocks in your portfolio at one time or another. My question is, how often is the portfolio rebalanced? AQN, for example, might take years to reach its previous highs, and is really not suitable for a conservative investor, like me. When a company is not performing “properly” are you obligated to hold it for a certain amount of time? Thanks. JHC

Thanks for the question. In my opinion, two things are true here: One, you should determine what your investing method is going to be and stick with it. And, two, you should only invest in things that will let you sleep at night. Buy, hold, and don’t react. Either buy AQN to hold it long term or don’t buy it at all.

All the information you need about BTSX is on this site. The foundation is under the “Beating the TSX” heading at the top of every page. You may also find these two posts helpful:

https://dividendstrategy.ca/how-to-use-btsx-in-real-life/

https://dividendstrategy.ca/method-vs-madness-the-benefits-of-rules-based-investing/

Really hoping you will keep the site going Matt. Always enjoyed reading your articles & learning from them. Thank you for all your time and efforts.

Glad to hear it’s been helpful for you.

Hey Matt,

I’ve been wondering why I hadn’t received a post notification in a while.

I’ve been a fan of the site and I hope you find a suitable replacement. I think it’s an invaluable tool that I have used to guide many of my investment decisions.

I hope to enter retirement in 2-3 years. I’m grateful for the help this site has provided along the way.

Best of luck to you in the future.

Regards,

James

There are a handful of names I know have been here from the beginning and yours is one of them, James. I appreciate the feedback and will do my best to ensure these resources remain available, one way or another.

I wasn’t interested in holding BCE or Telus so I substituted CPX and CU for them. I did DRIPs for those that allowed it and put the other dividends into VDY. In spite of AQN’s results, the portfolio yielded 37%, which did beat the TSX60 index.

Seems you timed it right!

Thank you for all your insights over the last couple of years Matt! Sad to hear your thinking of shutting down. I’m always checking for new updates and blog posts, they’re always interesting and informative. Selfishly hoping that you will keep the site going 😂. Also understand completely that life gets busy and it’s easy to get stretched too thin.

Thanks again for all of the work you’ve done for us.

Regards,

Lewis, Lyndsey, and Lucy

Great to hear from you, Lewis, and I really appreciate this feedback! I hope you and your family are doing well and will keep in touch.

Glad to hear your financial planning business is doing well. I enjoyed the video session we did a year ago. I would highly recommend it to your readers.

Hopefully Beating the TSX continues, even if just twice yearly. That would still be useful.

Thanks for the comment, Geoff. I enjoyed working with you too.

Yes, one way or another, I would like the most important information to remain available.

I appreciate your tip in a past blog about not always selling companies that drop off the list. I kept Manulife from last year, which bolstered the return to about 13.5% (before dividends)! I was also glad to have a sizable chunk of VFV that I was holding on to. The diversification did help me with the portfolio’s underperformance for the year. I just need to hope BCE and AQN have a positive future.

Thanks for the helpful content and tips you create with this blog 🙂

Yes, it’s really important to see BTSX as a tool to identify potential new investments rather than as a prescription for what to do. International diversification (likely with index funds) is also critical, in my opinion. Thanks for the comment.

Hello Matt.

I’m a first time poster who’s been on your site frequently throughout the years and have found your words very helpful in my investing. I thank you so much for sharing your insights with us. You also do it with such grace and humility. You are an amazing person to have done this for free for so many years.

I’m happy to hear you have a thriving financial advisory business. You absolutely deserve it.

My question to you is, have you thought about writing a book? Many of us would not only buy in a second, but would recommend it to others. I wish you all the best in 2025!

You made my day with your comment! I’ve thought about writing a book many times, actually. The advice I’ve received from published authors is generally encouraging but also cautionary – it’s a lot more work than you think it’ll be!

I’m curious – What kind of book do you think I could write that doesn’t already exist?

Hi Matt,

Thanks again for you annual BTSX update – and thank you for all your work over the years. Like others here, sad to see you go but I get it – life is an ever-changing adventure.

I always do my own math but then of course look at it beside your results –

My question: I am wondering why you don’t have CNQ in the mix. By my math, it pays an annual dividend of $2.25, price on Dec 31st was $44.38. Gives a yield of 5.07% which is higher than TRP.

I absolutely realize I may have screwed up the math (did I miss a dividend change as I’m doing this on Jan 16?) – but looking for your feedback.

Thx

Chad

Hi Chad, thanks for the comment and I welcome corrections when I’ve made a mistake. In this case, Yahoo! Finance seems to be a little behind on updating CNQ’s dividend and, for consistency, that’s where I get my figures from. You are correct, though, the dividend is now $2.25 and I have updated the TSX60 and Current BTSX lists accordingly. Thanks again.