No one likes to lose money. It would seem totally reasonable, then, to use stop loss or stop-limit orders to protect ourselves against investment losses. Unfortunately, more often than not, these strategies backfire. Rather than protecting us from losses, they are more likely to lock in losses, exclude us from rebounds, incur taxable events, and generally increase the complexity of our investment plan. If you are asking yourself, “Should I use stop loss orders?”, read on for essential information you need to know.

What are stop loss and stop limit orders?

Both stop loss and stop limit orders aim to limit losses by selling a stock once it has dropped to a pre-determined price point, but they differ slightly.

Imagine you buy ENB today at $50, but want to limit your losses to 20%. If you input a stop loss order for $40, once ENB drops to $40, your brokerage will sell your shares at the next available price. What this means is that a precipitous drop past $40 might mean your shares get sold at a much lower price than what you had anticipated.

In contrast to stop loss orders, stop limit orders mitigate this risk by triggering the sale of your stock at a set price, rather than the market price. The danger with stop limit orders is that a rapid price decline may blow through your limit price without actually triggering the sale of your shares. In the end you are left with some or all of the shares you wanted to sell.

For the rest of this post, we will use “stop loss orders” to refer to both stop loss and stop limit orders.

Why do investors use stop loss orders?

I will get to all the reasons I think stop loss orders are counter-productive in a minute. First, we should give fans of stop loss orders their fair shake.

Investopedia has an article called “The stop-loss order: make sure you use it”. Ironic that the article clearly states that “if you are a buy-and-hold investor, your stop-loss orders are next to useless.” Furthermore, about half the article discusses the disadvantages of stop loss orders. In any case, here’s a list of those potential “advantages” – quoted directly from the article – and my responses to them:

Claim 1: “You don’t have to monitor how a stock is performing daily.”

If you feel like you have to monitor your stocks daily, you are a speculator who thinks they can time the market, not an investor who knows they can’t.

Claim 2: “It allows decision-making to be free from any emotional influences.”

To the contrary: using stop loss orders indicates an investor is under the influence of cognitive biases, especially a very powerful one called “loss aversion”.

Claim 3: “Stop-loss orders are traditionally thought of as a way to prevent losses. However, another use of this tool is to lock in profits.”

The idea here is that the investor is happy that Stock ABC has gone up in value, but not happy enough to either sell and enjoy the profits or hold on to a solid long term investment. They would rather sell their “winner” when it goes back down. Strange.

Claim 4: “The most important benefit of a stop-loss order is that it costs nothing to implement.”

Really? This is the most important benefit? Here’s a strategy that’s also free and is proven to outperform: buy and hold.

Seven reasons you should avoid stop loss orders

It’s not just that stop loss orders don’t accomplish what investors want them to – they actually cause harm. Here are 7 reasons to avoid stop loss orders.

1. They ignore stock fundamentals

Stock prices reflect what others are willing to pay for a stock, not whether or not that stock is a good investment. Using a stop loss order to sell a stock simply based on price completely ignores whether or not you think it’s a good investment. If you are uncomfortable holding a stock through a price dip, sell it now before the price goes down.

2. Stop loss orders lock in losses

This should be obvious. Good stocks go down in price sometimes. Selling on the dip just locks in losses.

3. They exclude investors from rebounds

I am equally transparent about the wins and losses of BTSX and one of our big losers last year was IPL. It started 2020 at $22.05 and ended it at $12.83, with a painful dividend cut (announced after the huge price drop) to boot. As I write this, the stock price is $18.00 – up nearly 50% from the end of last year and nearly 300% from the lows. Automatically selling IPL would have excluded you from this rebound.

4. Stop loss orders exclude investors from buying more when stocks are on sale

I own shares of big stable companies that pay dividends. If there is a drop in price, these companies (and their dividends) are essentially on sale; I’m not selling, I am looking for ways to buy more.

5. Interrupted dividend income

If you owned 1000 shares of ENB on Jan 1, 2020, they would have been worth $53 800. Two months later, they would have been worth $41 000 – a 24% drop. If you sold those shares automatically with a stop loss order, by now you would have missed out on over $3200 in dividend payments.

6. Stop loss orders complicate investment plans

The most effective investment plans are the simplest investment plans. This is why buying and holding Canadian blue-chip dividend-paying companies is such an effective long term strategy. Stop loss orders are just another flavour of market timing, adding complexity and uncertainty to an otherwise sound investment plan.

7. They trigger taxable events

Selling an investment should be a carefully considered decision based on a thorough assessment of the underlying fundamentals and the tax implications of the sale. Managing taxes is an important part of financial planning.

Conclusion

The implicit belief behind stop loss orders is that the price decrease is likely to continue and that somehow the investor can take advantage of that situation – a combination of crystal ball speculation and overconfidence. I understand the appeal of minimizing losses, but stop loss orders will not accomplish that goal.

In preparing this post I had an opportunity to discuss stop loss orders with the originator of Beating the TSX, David Stanley. Here is what he had to say:

“I am dead set against stop loss orders . . . A waste of money and will not do what they promise to do . . . Stop loss orders lead to increasing costs and reflect the buyers’ lack of conviction when they bought the stock to begin with.”

Avoid the temptation. Only hold investments you would be happy to buy more of if they go down in price. Simplify your investment plan and stay focused on dividend income, not stock prices.

It takes time and real money to maintain this site. If you find this information useful, please consider donating to keep DividendStrategy.ca ad-free. I’m not trying to get rich . . . 20% of donations are given to Doctors Without Borders. Thank you!

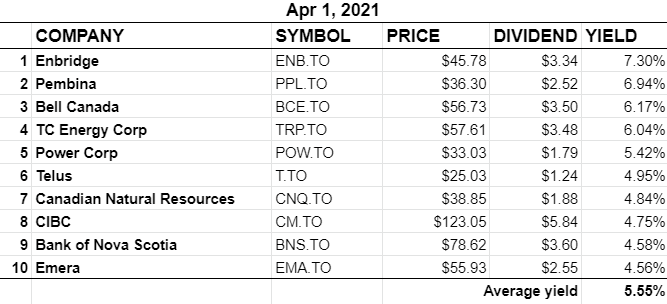

BTSX portfolio update for April 2021

Excellent blog on stop loss orders. You have, with clarity, answered all my questions about the subject. Thanks for including David Stanley’s view as it is always the unvarnished truth. Kudos!

That’s great feedback – thanks Ms. Eve 🙂

I don’t use ‘stop loss’ selling. I agree that with my blue chip dividend payers a drop in price is more an opportunity. However, my portfolio has a 25% weighting to low to non dividend payers. Most of this is material stocks. These are usually not long term holds and are more a market timing play. Perhaps ‘stop losses’ have more of a roll here. To date I have paid dearly for not moving out of my gold stocks.

I have been considering using options to generate more income from my blue chip stocks. I have not researched enough as yet.

I was never interested in using stop loss orders. I still remember before the 1987 crash many pros were using “portfolio insurance” which was a hot topic at the time. Only problem is as many investors found out after Black Monday it didn’t work. In fact some amateur investors who used leverage as well, found themselves wiped out financially and still owed money.

On pages 246 -247 of “One Up On Wall Street” here’s a small part of what Peter Lynch has to say about stop orders.

“If you can’t convince yourself “When I’m down 25 percent, I’m a buyer” and banish forever the fatal thought “When I’m down 25 percent, I’m a seller,” then you’ll never make a decent profit in stocks.”

Great comment. Strange things happen in the stock market (like Black Monday) that can/will ruin investors who try to outsmart it. The biggest advantage DIY investors have is to take the long view.

Totally agree with Peter Lynch. Stop loss orders are the antithesis to how we should be thinking/investing.

as always great article…Timely based on last years dip being a prime time to buy more stock when market was down.Need to keep the “faith” so to speak…Thanks Matt