I remember opening my first investment account – an RRSP with CIBC almost twenty years ago. You could tell I didn’t really know what I was doing by the contents of that account – high MER mutual funds that were better for my advisor’s wealth than mine . . . . ugh. But I had to start somewhere.

Just like we all have to start somewhere with investing, blogs have to start somewhere too. I began this one when I was asked to take over writing the “Beating the TSX” series for The Canadian Moneysaver. Given the growing popularity of that series over the last several decades, I figured it was about time the Beating the TSX strategy and portfolio were made available online. Now that my first “Beating the TSX” article has been published, this site has seen quite a bit of traffic and subscribers. Clearly there was a need and I am honoured to be in a position to help fellow DIY investors.

So, this is me introducing myself, my values, and my vision for this site.

Who am I?

First of all, my name is Matt. I’m a husband and a father of four and a physician by training. Perhaps when I mention the ‘doctor-thing’, images of long hours, big houses, and fancy cars flash through your mind. I want to set the record straight – that’s not me. My amazing wife stayed at home to raise our four kids while I worked in a lower-paying specialty (ER) for thirteen years. Several years ago I decreased my hours to spend more time with family and pursue other interests.

I like money just as much as the next person, but I don’t care to be the richest man in the graveyard. I feel strongly that money is a means to an end. If we aren’t intentionally organizing our financial lives around our values, then we aren’t being financially responsible – even if you have millions in the bank.

A good investment plan starts with values

If you don’t set your priorities, someone else will. We’ve worked hard for our money, so we should use it to create the kind of life we want. Here is what is important to us:

- financial security

- shared experiences/adventures with family and friends

- self-improvement/skill development

- health and fitness

- contributing to a cause larger than ourselves

While I understand the financial realities of professionals, we have chosen a lifestyle that is less about luxury and more about our values. This was achievable because we did three simple things:

- Avoided debt

- Spent less than we earned

- Invested the difference using a solid investment plan (Beating the TSX)

Financial independence = choice

Beating the TSX has been so effective for us that we achieved our version of financial independence (FI) about a year ago when I was 41 years old. It changed everything. I quit my job, we sold our house, and took the kids out of school to travel the world for a year. What’s next? Hard to say – financial independence means freedom to make life decisions independent of job constraints. What we do with financial freedom is up to us. Our family felt compelled to do something epic – and we blog about our travels HERE – but the point is that financial independence is about choice.

The path to FI is paved with dividends

I believe dividend investing, and Beating the TSX in particular, is an extremely powerful and effective tool to achieve financial independence. There are plenty of great FI blogs out there touting the benefits of index investing, plenty of others diving deep into fundamental analysis of dividend-paying companies. But there is a group of DIY investors who are looking for an alternative to both mutual funds with high fees and the lackluster performance of index funds, but are apprehensive about getting started.

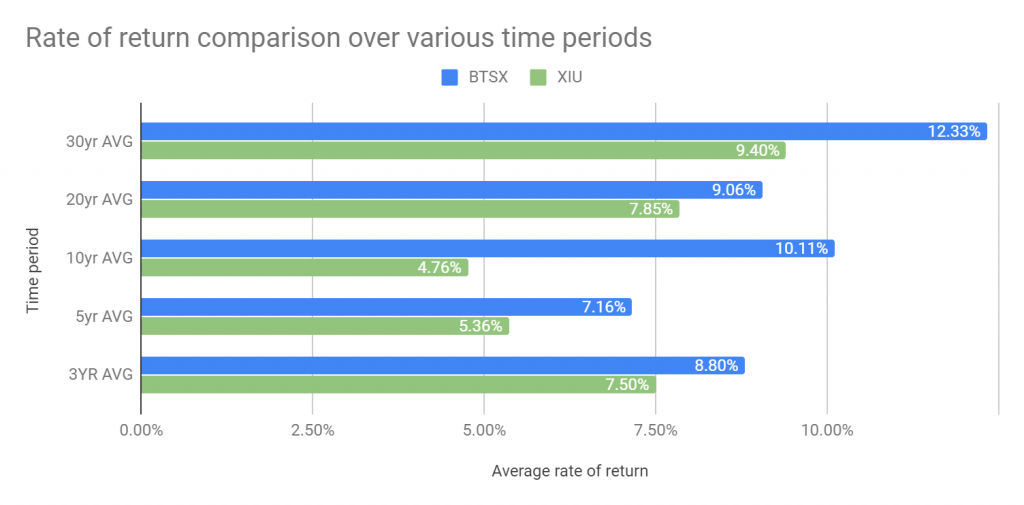

12.33% over 30 years

The Beating the TSX strategy has been around for a long time. In fact, thanks to Professor David Stanley who originated the series, and his successor, Ross Grant, we have thirty years of data to look back on. The most important and striking number that emerges from this data is the 30-year compound annual growth rate: 12.33% (vs. 9.4% for the benchmark index). I am not aware of a single Canadian mutual fund with a track record like this. In real terms, over the last thirty years, $10 000 would have turned into $230k using BTSX, compared to $106k investing in the benchmark index (see Fig 1).

But I’m also a realist. Just because the BTSX method has produced superior returns over 30 years, doesn’t mean the last five, ten or twenty year intervals have been similarly impressive. So, I ran the numbers for the last article.

Is BTSX too good to be true?

Turns out, the Beating the TSX method has consistently outperformed its benchmark index and the S&P/TSX over each of these time periods (Fig 2). Can we expect this to continue? No one knows, but here’s why I am sticking with the BTSX plan:

- Very low cost – less than $100/year in trading fees

- Very low maintenance – just a few hours per year

- Portfolio contains big, quality companies with durable economic advantages (wide economic “moats”, as Ben Graham would say)

- No performance drag by lesser-quality companies (Indexers are, by definition, buying positions in struggling, unprofitable companies that make up a large part of the index)

- steady stream of dividends PLUS capital gains

- the strategy is easy to stick to because dividend yield is much less volatile than stock prices

Getting started with dividend investing

Beating the TSX may not be for everyone. Some people can’t sleep without the security of a financial advisor to turn to; others distrust any method other than indexing. That’s okay! The best investment plan is the one you can stick to. For many of us, dividend investing is the foundation of that plan.

My hope is that this site will give you clear and practical information that will help get you started with dividend investing. How you use this information is up to you but I’m genuinely excited to be sharing it. Feel free to subscribe, share this page with your DIY investor friends, and send me a message with questions, post ideas, or just to say hi.

Good morning Matt.

As a DIY , I am very interested in learning more about investing and sharing ideas with other fellow DIY.

Thank you for that opportunity and looking forward to future communications .

Good luck .

First comment – thanks, Leonard! We’re all getting better by learning from each other – I’m looking forward to the future of this site too 🙂

Many thanks for your information and “story”.

It really is my pleasure. I hope it sets the tone of openness and accessibility to solid, helpful information for DIY dividend investors.

Hi Matt, I am quite familiar with the Beat the TSX Strategy. I was first introduced to it by Mr. Stanley who originated the Canadian version many years ago.. I was a first time user of an investment strategy at that time and also a new investor in stocks. I used the strategy for 10 years and my annual rate of return was approx 13% since the dividends were constantly reinvested via a Trustee. The method which I used at the time was more demanding in that you had to keep a very good accounting record for CRA purposes. That is the reason why I gave it up after 10 years. In 2017 I renewed the strategy from scratch using a simpler mehtod, i.e.; I now only buy a given stock in multiples of 100 shares, and the dividends are deposited in my discount broker’s account, and not reinvested. This latter method is much simpler in terms of “administration”. In conclusion I do not need to be convinced of the efficiency of the Beat the TSX strategy. I believe strongly in it. I wish to thank you for publishing the list of ten stocks on a monthly basis since the Globe and Mail has stopped doing so in November 2017.

Hi Roger – thanks for the note. We all owe a huge debt of gratitude to David Stanley. Over the course of many emails and one face to face meeting, he has been instrumental in helping me fill out and tighten up my knowledge around dividend investing. Big shoes to fill, indeed. As far as I’m concerned, he has set the standard for openness and generosity of knowledge when it comes to DIY investing. I would be remiss if I did not also mention Ross Grant who has been an enormous help in this effort too. I’m lucky to be in touch with both of these fine gentlemen on a fairly regular basis.

Glad to hear that you have re-adopted the strategy, Roger. Yes, it really is simple. I would wager that if more people understood how simple it is, we would have more investors using the strategy and accomplishing their financial goals sooner.

Hi Matt, Congratulations on launching the site. It looks great and has captured so many of the ideas and thoughts of why BTSX has worked so well for us. By sharing the concept of dividend investing I hope others will be able to benefit as much as we benefited from David Stanley’s articles.

Ross Grant

Thank you, Ross. I’m looking forward to exploring in more detail why dividend investing works so well. As the last author of the Beating the TSX series, we will all benefit from having you a part of the discussion.

Hi Matt,

Have you back tested this strategy in other markets (i.e. S&P500)? If it provides similar results across markets I think that would give it more validity going forward.

Thanks for sharing your ideas and life story!

Hi Geoff, thanks for the comment.

Beating the TSX is modeled after “The Dogs of the DOW”, originally described by Michael O’Higgins in the early 90’s. The performance of that strategy has been good, but not as good as BTSX over the years. I think that’s because of unique economic oligopolies that exist in Canada for its telecom, utility, and finance players – i.e. the companies that end up on our wonderful little list. For a good review of the Dogs, go here: https://www.fool.com/investing/2019/01/13/here-are-the-2019-dogs-of-the-dow.aspx

I’m not sure it’s reasonable to expect similar results across markets. It is the very characteristics of these TSX 60 stocks that contribute to the success of the strategy, i.e. large companies with a long history of high, increasing dividends (not to mention the economic advantages these companies enjoy due to the Canadian regulatory environment). I think this explains past performance and gives me plenty of hope that future performance will be similar.

Validity is a measurement of data quality – thanks to David Stanley and Ross Grant, we have that. Going forward we must use the best available data to make our decisions. I hope this blog helps in that regard.

Hi Matt,

I am a diy guy at heart and try to do as much as possible to financially independent.

I have read thousands of blog postings and I can’ t wait to read all of your future blogs.

We live in a golden age where you can truly diy finances without having to pay an arm and leg to get crappy advice.

My wife was a planner, but gave up when it became more of a sales job than a financial planning job.

Hi Mike, thanks for the comment and I couldn’t agree more. For most topics I think there is almost TOO MUCH information available online, but for Beating the TSX and getting started with dividend investing in Canada, I thought there was a hole that needed filling.

Fascinating that your wife was a planner who gave it up on principle. Not everyone is built for DIY investing so lots of people are still in need of financial planners with integrity. I’m curious to know if she sought out any job options that jived with her sense of right and wrong.

Hi Matt

I have been doing the Beating the TSX since reading in about 2002 “Beating the Dow” by Michael O’Higgins long before I was Introduced to CMS. I used the TSX 30 at the time & when it became 60 I tried it with the TSX Titans. I use another method that he has in his book. I take the top 10 highest Dividend paying stocks but only buy the 5 cheapest. I believe he either said that it didn’t make much difference or that it out performed the buying the 10. I will have to read the book again. I have done well by this method. Unfortunately I have not kept any statistics on this. I am so glad you have taken on this job of following this strategy because it does work & is simple to do. Look forward to more on your blog.

Hi Ann – thanks for commenting. It is wonderful to hear from DIY investors who have been using the Beating the TSX method (or something close) successfully for many years. I believe the variation you are referring to is called the “Puppies of the Dow” or “Small dogs of the Dow”. In the US, I think it has done slightly better than the regular Dogs of the Dow. The point is to have a plan that you will stick to, and it sounds like you’ve found that.