In a recent post we talked about why investing in the stock market during a market correction can be one of the best investment decisions one can make. But what about dividend paying stocks? Data shows that dividend-paying stocks in general provide superior returns in both bull and bear markets. But I was curious about Beating the TSX stocks in particular. How has BTSX performed after bear market corrections in the past?

The method: BTSX and the bad years

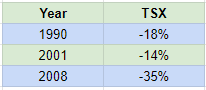

To answer this question I looked at the three worst years in the Canadian stock market in the last thirty years. These were 1990 (-18%), 2001 (-14%), and 2008 (-35%).

I then looked back at the total returns (capital gains + dividends) of the BTSX strategy vs those of the index for five time frames: in the year of those bear markets, the next year, the next three years, five years, and ten years. We know that Beating the TSX has outperformed the index over the long term, but I wanted to know what history has to tell us about what we might expect from here, in the short, medium, and long term.

Caveats

Two caveats. The first should be obvious: past results are not necessarily predictive of what will happen this time. Every bear market is different. Second, I am using results published in The Canadian Moneysaver by David Stanley. These are accurate to the best of his (and my) knowledge and published in the magazine for anyone with a subscription to confirm, but it should be noted that David used a May to May interval rather than the calendar year. Thus these results may be difficult to cross reference with data you might be able to obtain on the internet.

Nevertheless, let’s get into the results.

How did BTSX perform during bear markets

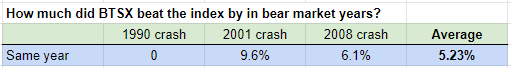

From here on in the numbers I am going to present are the difference between the total return of BTSX vs the total return of our benchmark index (currently the TSX 60, previously the TSX 35). Absolute numbers are interesting, but relative numbers are useful: has it paid to stick with Beating the BTSX through bear markets?

In the same year that these bear markets happened, here is the difference between the BTSX and the index. Positive numbers indicate higher returns for BTSX; negative numbers indicate under-performance relative to the index.

As you can see, in every bear market year BTSX has either matched or out-performed the index. Beating the TSX investors beat the index by an average of 5.2%.

BTSX after bear markets

The following year

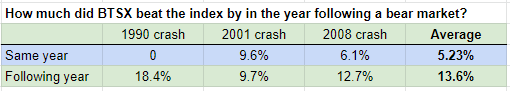

“But I don’t want to invest in BTSX stocks this year only to have them tank next year,” you might be saying. So, here is the difference between the BTSX portfolio and the benchmark index in the year following those bear markets:

This is where BTSX has really shined. In the year following every one of the last three bear markets, Beating the TSX stocks have outperformed the underlying index by 13.6% on average. I was surprised by this result at first, but upon reflection it makes sense: in times of uncertainty investors tend to seek the safety and stability of blue chip dividend-paying stocks. These numbers give me confidence in holding a BTSX based portfolio through the recovery phase of this bear market.

BTSX over the next 3, 5, and 10 years

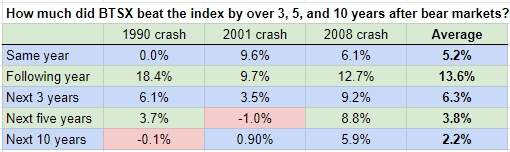

But I’m a long term investor. I don’t want to have to shift gears after a year or two if Beating the TSX has a trend of losing steam after a year or two. Fortunately, the data tells a different story. Here we will add three more rows to our table showing that with only two exceptions, BTSX has continued to outperform in the 3, 5, and 10 year periods following the last three bear markets.

As you can see from our table, the average out-performance of BTSX over the benchmark index in the three years following a bear market was 6.3% – this was consistent across all three bear markets with a range of 3.5 to 9.2%.

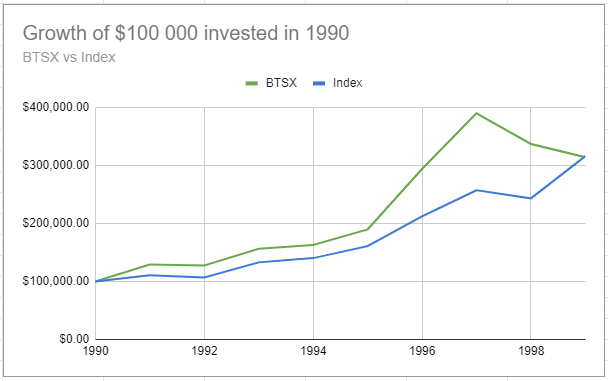

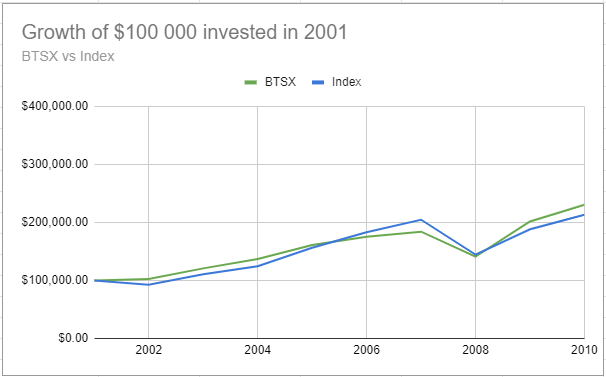

It is remarkable to me that there were only two times Beating the TSX didn’t outperform its benchmark index. The first was in the five year period following the brutal crash of 2001. But this was a temporary phenomenon because the ten year period following that same bear market saw BTSX outperform the index by an average of 0.9% per year. The second, was over the 10 year period after 1990, but this was due to the massive run-up in dot-com stocks in 1999. Up until 1999, BTSX had been handily out-performing the index and the very next year saw BTSX trounce the index by over 15%.

Ten year returns after bear markets

The numbers don’t lie: using Beating the TSX to select dividend-paying stocks in a bear market has been a winning strategy in both the short and the long term. In fact, the average annual advantage of BTSX over the index in each of the ten year periods following these bear markets was 2.2%. This is in line with BTSX’s long term trend.

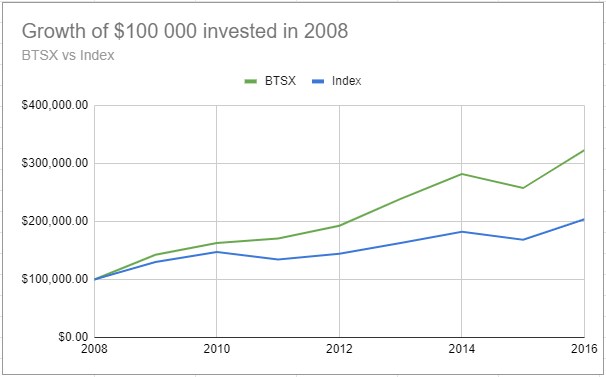

Here are three charts that illustrate the performance of BTSX vs the Index in each of the ten year periods following the biggest bear markets of the last thirty years.

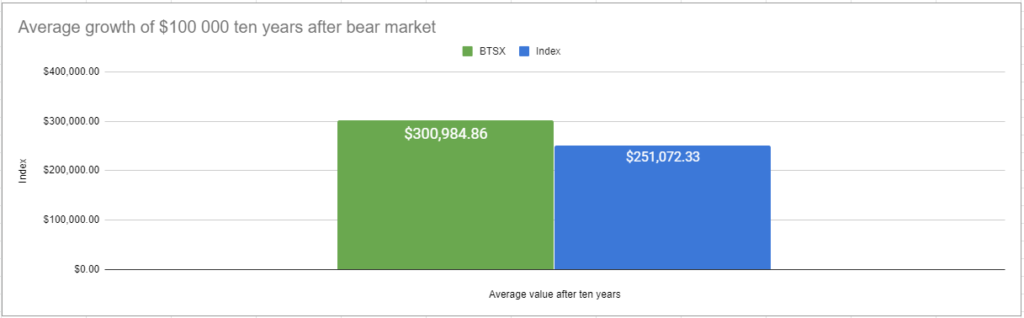

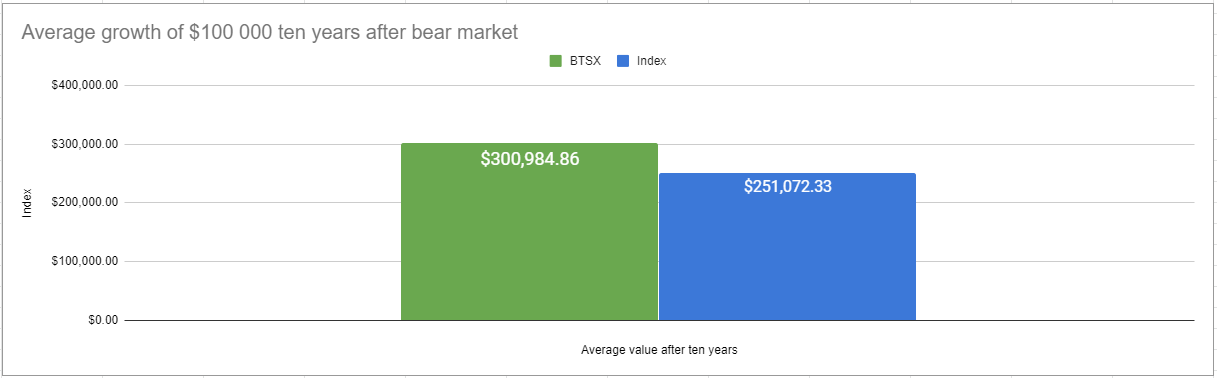

If we were to average the returns of Beating the TSX vs the benchmark index over the last three ten year periods following these bear markets, this is what an initial $100 000 investment would have grown into:

It never ceases to amaze me that an investment strategy so simple has been so effective through multiple market cycles. With so much uncertainty in the world and in the markets, I hope this data gives you some peace of mind when it comes to your dividend-based investment strategy.

Thanks for putting all the info together Matt. It’s interesting to see the comparisons!

My pleasure – genuinely interesting and useful, I think.

Hi, I follow your what you have written for years. Thanks. Just a quick question: Are these numbers strictly based on stock prices? or have you included dividends when calculating the difference in returns over the years? Maybe I overlooked if you have mentioned about it somewhere in your article. Again, thanks a ton for your site/picks/advise.

Great question. These results include dividends – both for BTSX and for the benchmark index. I think it is the total return that matters to investors. I will edit the post to reflect this.

Great Post,

BTSX is the best way I know for a new investor to start building a portfolio without paying high fees. And listening to so many different opinions of advisors that need to charge these fees. Well said.

I appreciate the comment, DivInvestor

Hello,

Hope all are safe. I am a new self investor. I have had advisors for several years at a cost. Most recently I have been making adjustments to the stocks I was put in. I was relieved that our lists were similar and my thoughts inline with the BTSX rules. I still have questions though. 1. do I sell stocks at a loss to buy stocks on the list? The loss in a bad stock outweighed by the potential gains of a good one. 2. How do bond funds work and are they worth having, at present I hold some in an rrsp. 3. should one hold stocks inside an rrsp or is it better outside of, to take advantage of the tax benefits?

It is unsettling to see the charts go from green to red, but knowing the same payout in the form of a dividend is coming helps.

For the run down of the BTSX workings, one buys in equal portions the 10 recommended stocks. Then yearly when a new list is generated one updates their list. Selling those that no longer make the list, adding those that now make the list and doing so in equal portions with the monies available at said time.

I appreciate your feed back.

Hi Jeff, Al is correct re selling (or not) stocks that fall off the list – thank you, Al.

Re bond funds – the mechanics are beyond the scope of this forum; perhaps a topic for a future post. Worth having? – depends on your situation, but if you want to hold bonds it is a good way to do so.

Re RRSP vs unregistered – again, depends on your situation. Ask your accountant or read one of the thousands of articles tackling the TFSA vs RRSP topic. There is not a one-size-fits-all answer as it depends very much upon your income now vs in retirement, among other things.

Hope that helps.

As far as I understand the process and I believe that Matt has stated this before, no, do not automatically sell the stocks that have dropped off the BTSX list, rather add the new stocks to your list with new money if you can. just because a stock drops out the top 10 list does not exclude it from a list of stocks to consider buying, and vice versa, just because a stock appears in the top 10 list does not mean that it is a good stock to buy. only buy a stock if you are comfortable with owning it, regardless of its position on the top 10 list. IPL topped the BTSX list in January 2020, this is one stock that I would consider to be in the “think long and hard about” before I would buy it, then and now.

Al

If anything, articles like this just provide further proof that what we do works. High quality dividend paying equities provide lower volatility while enhancing long term returns. And what’s better? It’s a simple strategy that just plain makes sense—no need for a computer algorithm to make sense of it.

Through the COVID-19 crisis, I’ve loved doubling down on my stake in TD; picking up that high quality name in the ~$49 range isn’t something I was ever expecting to have the chance to do again. Beautiful for the compounding.

Take care,

Ryan

Agreed, Ryan. Nothing fancy. It just works.

Interestingly, I’ve also picked up some TD recently – it was at $49 all too briefly, but I wasn’t too far off. And since I don’t plan on selling, the rising and compounding dividends over the coming years will make the purchase price less relevant in any case.

Thanks for the comment and welcome to the blog.

Pingback: Retirement and Financial Thoughts in the year of COVID – 2020 – Dividend Cafe

Pingback: Beating the TSX 2020: looking back and staying the course —

Pingback: Retirement and Financial Thoughts in the year of COVID – 2020