The punchline for May:

- No dividend cuts

- No dividend raises

- Manulife (MFC) drops from the list due to price accumulation (and Shaw [SJR.B] is back in)

*Note: we do not recommend that monthly changes in the portfolio should trigger any trading. Most BTSX users rebalance annually.

I made a mistake. For all my efforts to ensure the accuracy of the numbers and calculations for my first Beating the TSX article in the Canadian MoneySaver a few months ago, an error slipped through: The published stock prices for the portfolio were based on Dec 24th, 2018 (when I drafted the article), instead of the beginning of 2019.

The error was brought to my attention by a fastidious reader of this blog who noticed that the price column in Figure 5 of the CMS article did not match the prices in Table 3 of the article on this site, like they should. Fortunately, the results of this error are minimal: there is no impact on what stocks appear in the portfolio nor any of the performance calculations.

But that is not to say that the error is inconsequential. The consequence for me is embarrassment and a determination to do better. The consequence for you should be to understand that I, you, and all investors, professional or retail, are human and, therefore, fallible.

Not an expert

“It’s when you’re not humble that you end up doing things that will make you humble.”

Francois Rochon

What makes someone a financial authority? Turn on BNN or your favourite financial news station. Unfortunately, the impression of authority often arises from a river of bold predictions, overconfidence, and charisma. Occasionally, it is knowledge. Rarely, true skill.

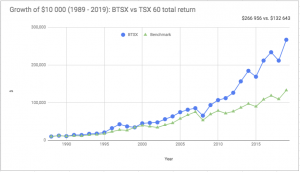

I, on the other hand, have none of these things. What I have is some experience and familiarity with an investment method that is simple, rational, and has a history of long-term out-performance. The superstar is Beating the TSX and dividend investing. I am the messenger – a DIY investor like you who happens to enjoy blogging. One of the best things about BTSX is that you don’t need to be an expert to get excellent results.

My many mistakes

In fact, my fallibility extends beyond technical errors like the one above. Errors of judgement are even more common and insidious. Here is a list of just a few of the errors I’ve made over the years:

- Paid high fees for actively managed mutual funds

- Was ignorant of financial advisors’ conflicts of interest

- Bought high, sold low (a few times)

- Thought I could be the next Warren Buffet

- Didn’t have a written investment plan for years

- Made trades based on “hot tips”

- Tried to time the market

- Let emotion influence investment decisions

- Wasted money on large, unnecessary purchases

- Chased high yield, ignoring fundamentals

Yes, that’s right. I’ve done all that and more. Despite these errors, the combination of a decent income, controlled spending, and, most importantly, a determination to learn from my mistakes, our family became financially independent when I was 42 years old. You don’t have to be perfect.

Re-framing financial failures

“The humility required for good judgment is not self-doubt—the sense that you are untalented, unintelligent, or unworthy. It is intellectual humility. It is a recognition that reality is profoundly complex, that seeing things clearly is a constant struggle, when it can be done at all, and that human judgment must therefore be riddled with mistakes.”

Philip Tetlock

Perhaps publicizing my mistakes will help you avoid them. On the other hand, I don’t know a single successful investor without their own colourful and entertaining history of foibles, large and small. Some people think that stepping in the mud, even falling face-first into it, early in your investing life might be the best thing that could happen to you. I tend to agree.

But that doesn’t mean the mistakes will stop, just that, hopefully, we will not make the same ones. The world doesn’t cease to be complex. We don’t cease to be human.

As for me, I have notified The Canadian MoneySaver of my error and am drafting a notification to be published as soon as possible. As a volunteer writer, I am hoping they will provide more editorial support, but ultimately the responsibility lies with yours truly.

Scientific proof of maybe

Ultimately, our goal is financial independence, not bullet-proof infallibility. We could walk our investment paths in isolation, but you’re here because you recognize there are benefits of a cooperative approach. It is my sincerest hope that this site is helpful in that regard, but we must be able to trust our sources of information: not their rightness, rather, as Tetlock says, their intellectual humility.

My background is in science. Most people trust the integrity of knowledge based on science not because it is free of error but because the method is, by definition, transparent, and open to scrutiny. It’s greatest strength is not in being “right” but the openness to being wrong and adapting.

This is a useful principle for life, in general, and investing, in particular: Make mistakes, own them, learn from them. I can’t commit to an error-free standard, but I will commit to that.

We are all human and I appreciate your honesty. I think this blog is great. Thank you for taking the time to do it. I will look forward to your next entry.

Thanks for the moral support, Ann.

Hi Matt, Keep up the good work. Mistakes are often evidence that you tried to do something! I really appreciate your directness and the non-use of those fancy terms used by some financial publishers. I would really appreciate a link to get the TSX S&P 60 list of dividends, price etc at no cost and that I could simple copy into Excel for my tracking and research. The only websites I find require a subscription! I have created my own list at my online broker watch list, but it is clunky and the actual dividend payout is way out of date. I have to pull up each individual stock. Kind regards, Geoff

Thanks for the comment, Geoff. As Alexander Pope said, “To err is human, to forgive is divine.” All those who are posting words of encouragement in these comments are showing more grace than I.

Re a convenient and accurate list of TSX 60 stocks by dividend yield . . . that is not so easy to come by. I used several sources, cross-reference, and make my own spreadsheet. It was one of the reasons I felt compelled to make this blog – something so simple as the top dividend payers of a smallish index is so hard to obtain. Now that I’ve started with the BTSX list, I think I will work on compiling the entire TSX 60 for those who are interested. If you are interested in getting a head start, I think Yahoo Finance is what I will be working with.

What I would really like is to be able to retroactively test other investment models (like top five dividend stocks, Canadian “small dogs”, etc.). I’d even be happy to pay a reasonable fee for accessible and easy to use historical price and dividend data, but I haven’t been able to find a Canadian resource yet. If anyone knows of one, please email me: contact@dividendstrategy.ca.

Matt and others,

to get the list of stocks in the TSX 60 index:

if you go to TMXMoney.com, and get the info for ^TX60, the stocks in the TSX 60 are listed under the Constituents tab just above the chart. Note that some changes were made just recently to the list of stocks in the index which definitely affects the top 10 list. I extract the list of stocks from this, and then use the Portfolio tab on ca.investing.com to list the data for these stocks, then process that info using Excel. In that way, I can generate my own list of Beat the TSX stocks and their info.

Al

Thanks, Al. Glad that you found a way to craft the list for yourself – and generous of you to share your process.

In an effort to make the data even more accessible, I spent a bit of time and made this: The Complete TSX 60 by dividend yield.

We all make mistakes. Not everyone can admit it. I will not stop reading your stuff. Congratulations on your excellent work. Have a good day

Thanks, Roger. I appreciate it.

Thanks for making the record straight .

Please keep up the good work !

I’ll do my best, Bruce.

This blog is working for me, new at this BTSX method,

Good job Matt

Welcome, K B. I’m very happy to hear that the blog is working for you. Feel free to email me with any questions or post in the comments so others can weigh in.

Matt I totally agree with Ann’s comments I look forward to reading more

Thank you, Denise. I’m a lucky blogger to have readers like you 🙂

Matt,

Thanks for taking up the job of BTSX grunt work. I am on my third year of doing the BTSX and for one appreciate your hard work. Looking forwards to the rewards of investing with BTSX.

You’re welcome, Mike. Thanks for the comment.

No problem. Humans make mistakes. Making a mistake is easy. The hard part is admitting to it and the proper part is correcting it.

An honest approach to investing is most refreshing. We are just so appreciative that the BTSX is being continued under your stewardship. Your blog which gives everyone an opportunity to participate is a super bonus. We are all in this together.

Well said – I am a steward of this information and will do my best to ensure the integrity of BTSX remains intact (even if it means eating humble pie every now and then).

People who don’t make mistakes are dead or on death bed or don’t do anything. Great blog.