Managing our own investments does not have to be complicated. Most of the time a simple strategy will outperform a more complicated one. But I haven’t met a single DIY investor who wasn’t intimidated at the start. At some point, most beginners will ask themselves: How can I expect to invest well when there are so many funds and products out there; so much information pouring from the financial media firehose; and so many “experts” on Bay Street and Wall Street (who usually fail to even obtain market returns) to compete against.

And yet, we exist. Relative to the large number of people who put their faith in financial advisors and “hope for the best”, we are few. But successful DIY investors are everywhere, quietly enjoying lives of financial independence, and, I believe, the numbers are growing.

How do DIY investors become successful?

Do we pursue the same training as professional financial advisors? – I don’t know of a single DIY investor who attributes their success to formal training.

Do we hire a financial advisor to learn the necessary skills and strategies? – I hope this happens, but the majority of DIY investors I’ve spoken to share stories of loss and grief rather than profit and empowerment.

Do we engage in a process of self-education and smoothly transition from naive neophyte to confident and competent DIY investor? – Every single successful DIY investor I know has a collection of struggles and errors that were instrumental in the development of their financial wisdom.

So, here’s the million dollar question: Are we doomed to either engage the financial services industry with their high fees and rampant conflicts of interest, or muddle through ourselves, making costly mistakes until we learn better?

Why DIY investors are a rare breed

When considering managing one’s own money, most people survey the vast amount of information out there, mentally file personal finance into the “difficult and boring” category, and do one of two things: hire a financial advisor and offload the responsibility; or don’t invest at all, hoping things will just work out. There is a lot of great information out there, but most people don’t have the willingness or ability to filter out the bad stuff, process the good stuff, and apply it to their own unique situation . . . at least, not without making some costly mistakes along the way.

If you have decided to take control of your own financial destiny, you’re way ahead of most people.

The sticking point: bridging the gap between general information and an individual plan

When I started writing articles for the Canadian Moneysaver as a DIY investor, I got a few emails from readers asking for advice on their own situations. When I started this blog, those requests increased substantially. Clearly, there is a great need for individual advice.

Most people, understandably, need help bridging the gap between general information and actionable steps appropriate to their scenario. Most of them had already been burned by a financial advisor at some point and were sufficiently disillusioned with the financial industry to avoid it, but lacked the confidence to execute their own plan, or even to make one. Some sat for years on large sums of money doing nothing, paralyzed by indecision.

There had to be a better way.

At first I politely declined these requests for individual help. Part of that was a lack of confidence that my own knowledge base was applicable to others. Part of it was anxiety that I might be held responsible for events beyond my control (market crashes, a period of underperformance, etc.). But as I talked with more people, gave presentations, and wrote articles, I realized that many people out there are on the cusp of being great DIY investors – they just need a mentor. Someone who has been down the same path, with a little more experience, to guide their decision making.

A new path to successful DIY investing: mentorship

And so, with a little trepidation, a few months ago I said yes to one of these requests. We talked on the phone, got to know each other, and created a plan to move forward. I would charge hourly. They could pull out at any time. It was an experiment.

And it worked.

From the outset, I told them my goal was to set them up with the knowledge, process, and supporting spreadsheets so that, when they were ready, they’d be able to do everything themselves. In other words, I was trying to work myself out of a job. Over several weeks we discussed their goals, gathered information, formulated a plan and executed it. The whole thing cost far less than even a cheap financial advisor would charge on an annual basis; and they are empowered to maintain and update the plan going forward. This is what they had to say about the experience:

Over the last 4 years we met with several different financial advisors and investment representatives, but did not feel comfortable with the direction they recommended or pressure tactics they used. We cold called Matt to ask a few basic questions and was impressed with Matt’s approach so suggested we both talk to him.

We had a general idea of what we wanted to do and after just a few discussions with Matt, he presented us with a plan and options that confirmed that he had really listened and “got us”. It was important to us that we still had control over our investments, but we really needed Matt acting as a coach to get us moving in the right direction. He tailored investments to our goals and risk tolerance and even walked us through buying and selling stocks on our investment platform to achieve the portfolio that met our needs. We had some anxiety about such a big buy in (especially as the markets had a bit of turbulence as we were implementing the plan) but Matt got us focused and made sure we were comfortable with everything as we did it.

Matt will continue to be a valuable resource to us and we have already recommended him to family and friends.

H&G from BC

At this point you might wonder if this post is an elaborate advertisement. It’s not. In fact, this post was triggered by an unfortunate event.

A parting of ways

About a week ago, a reader emailed a question about her personal situation to both David Stanley and I. David asked if I would respond because he prefers to distance himself from giving individual advice. No problem, I said, I’ve been doing a little work on the side developing individual investment plans and have found it very rewarding.

The fact that I am choosing to provide this mentorship service on a limited basis for a fee does not sit well with David. In fact, he has asked me to make it public that he will no longer be associated with this blog. David has spent decades donating his time and energy to furthering financial literacy and has said that he does not wish to be connected to any endeavour in which someone is making money from the provision of financial information.

Thinking twice

I respect David Stanley enormously, so his reaction made me think. Is fee-based mentorship service unethical? Am I setting up a conflict of interest with the rest of the blog? And, perhaps most importantly, is a mentorship program valuable enough to the community of DIY investors to justify pursuing?

So many people want to manage their own money but are held back by fear of making mistakes. They have access to mountains of general information, but struggle to apply it with confidence to their own situation. Short of discovering a pool of successful DIY investors who are willing and able to spend the necessary hours with individuals for free, a mentorship program is the best solution I can think of.

I would appreciate your honest feedback on these issues. If I am going to pursue this path, it is important that it is done with honesty and integrity. Feel free to comment below or send me an email at contact@dividendstrategy.ca.

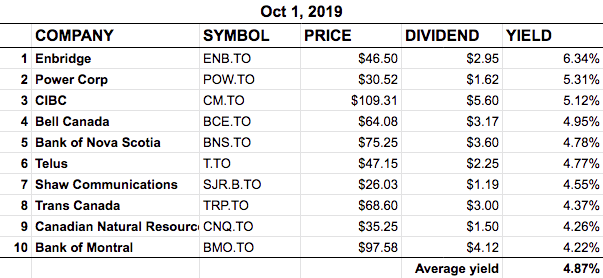

BTSX Update

Little to report on our BTSX portfolio this month. With the elimination of Husky Energy from the TSX60, there’s room for a third big bank (BMO) on the list. None of our top ten changed their dividends, but for those who hold other TSX60 stocks, there were a few recent dividend raises (EMA, NTR, and FTS). These have been reflected on our complete TSX60 dividend spreadsheet.

How else or why would you put in the time and effort if your basic cost not covered. Something about no free lunch comes to mind. I cheat by having a paid advisor for part of my portfolio but manage the rest. Another aspect not being discussed is aging. Many of us DIY investors are getting older. Some of us have not enthused our children enough to have a informed 2nd generation. David might consider this.

I am interested in your venture and would like to discuss your views on my situation. I am in Europe right now but will be back after the 15th.

Best Regards,

Casey Messinger

Hi Casey, thanks for the comment. Somehow there is a fundamental difference between the time, effort (and money) I spend to maintain this blog vs that spent with individuals. In my mind, these are separate ventures and I am fine donating my time to the former.

I know of several others who hack the system by employing a paid advisor only for a portion of their portfolio – it’s a smart way to pay a more reasonable price for advice.

Hi Matt,

I can appreciate that you would like to get paid for your services but unfortunately, I have to agree with David Stanley. I have been following your blog for the past few months and enjoy your posts along with those from David. As a dividend growth investor, I like reading about what other like-minded individuals are doing with their dividend investments be it through BTSX or other strategies of dividend investing.

By reading your posts I had the feeling that you were someone who really wanted to help others as David has done in the past and not to turn this blog into a financial avenue for you. Just for the heck of it, I googled “paid financial mentorship”. I’m sure you won’t be surprised that in a mere 0.57 seconds there were 20,200,000 results. Looks like there is quite an abundant amount of people/firms willing to provide this service already.

I don’t mean to be critical of you here but the reason I looked forward to your articles is to hear from someone who wasn’t trying to sell me something. I will miss David Stanley’s input and am sorry to see him leave. As for me, I will probably continue to read your blog for the time being but with not the same enthusiasm as before.

Sincerely,

Alan

Thanks for commenting, Alan. I want to keep this open for discussion, but do feel the need to clarify something.

The blog will remain free along with all the valuable information about Beating the TSX and dividend investing. In fact, I have and will continue to pay for the running of the blog out of my own pocket because I take pride in the fact that there is no other source of accessible BTSX info out there, not to mention all the other content here. I believe this information is truly valuable; before this blog it was only available once per year, by subscription only to the Canadian Moneysaver. It is now free, updated monthly, and available any time to anyone who needs it.

I would imagine most of us are quite sensitive to potential conflicts of interests. So, to be crystal clear: I have no plans to monetize this blog. The mentorship experiment is just that – a side experiment that will not influence the content of the site.

Thanks again for weighing in, Alan.

Generally offering investment advice requires credentials and comes with risks- both exceeding your legal scope of practice and financial . As well every financial column, for example in the Globe and Mail, ends with a disclaimer to do your own research. Will you be liable for advice that leads to losses even if they occur due to larger economic/political events? This is a risky situation that you are exposing yourself to with probably very small remuneration. It also tends to taint the quality of the blog IMO.

Richard

I would hate to live in a world in which everyone’s behaviour is driven by the letters behind their name and the held back by the fear of litigation. And yet, sadly, this is (increasingly) the world in which we live. I thought I was too old for idealism – perhaps not.

Hi again, Richard. The legal risks would definitely be a concern for me but after some digging, I am unable to find any reference to laws in Canada requiring credentials for the giving of financial advice. What is coming through the pipes now is that, for the first time, the titles of “financial planner” and “financial advisor” will be protected and regulated. I think “mentor” is a more accurate description in any case. But if you or anyone has evidence that it is unlawful to provide mentorship for a fee (without credentials), I would really like to know!

I would have to agree completely with Alan’s comment. I will truly miss David’s contribution to this blog.

This article reminds me of the commercial run on tv recently about the record executive trying to brainstorm how to sell CD’s, when an accountant suggests steaming content online. She is immediately questioned how her plan will sell CD’s.

For me this website is the “streaming service” in that it gave me the confidence and resources to rake the leap and trust in myself. I had tentatively began DIY investing but continually questioned myself. This site and resources found through it convinced me I was on the right path and to commit to myself and leave the financial planners and products behind.

You have a great resource here and a limitless ability to affect, help and change peoples financial lives through this site. These blogs allow you to mentor untold numbers of people without the moral and legal issues that the mentoring for fees introduce.

Thank You for the great resource and the services you are already providing. I hope that it will continue to grow and develop. And I for one would love to see David return.

Rob

I’m happy to hear that you value our little blog so highly, Rob. It’s purpose is to help DIY investors, not to sell anything. The mentorship idea sprung from the requests of readers who really felt they needed help. I was hoping that this post would help others put themselves in the shoes of those who, for their own reasons, can’t quite make the leap to DIY investing. Mentorship is (potentially) something extra, NOT the primary purpose of dividendstrategy.ca. Of course, I can see how the optics of this situation might be misinterpreted; all you have to go on is my word.

Hello Matt, I have to agree with Allen, I will truly miss David Stanley!! If you enjoy doing this blog just stick to what you have been doing which has been great. I enjoyed you and your family World Travel Blog, how many people take on such an adventure. Keep up the good work and good health and good luck!! Herb

Matt, I do not have any problems with your approach of giving advice for a fee to folks who lack a bit of confidence when it comes to investing. I have been investing on my own(DYI) for more than 15 years. I do not need your advice personally but I enjoy reading your blog. It keeps me informed. I also use your listing of “Beath the TSX” and appreciate the work that you put into its preparation. But, why would people expect you to mentor folks for free when they are willing to pay you for such a service. It is their decision. I have no issue with your proposal as long as your blog remains advertising free

Hi Matt,

I’ll throw in another point of view. I’m a physician and I just started my own practice last year. I found your website and emailed you a number of questions which you answered thoughtfully and in detail.

I for one would be happy to get some advice from you about my particular situation for a fee. You have the added advantage of being a physician and having some knowledge of corporate investing. Certainly, that is worth something to me and it does not detract from the benefits of your blog.

I don’t have a problem with anyone offering advice for a fee, as long as one is transparent and follows it with an acknowledgement that one cannot guarantee results. Many do even suggesting outrageous promises.

Whats the difference between collecting a fee for service or in my case offering for sale a book on investing. I don’t provide advice or recommend specific stocks, rather provide and recommend an investing process.

Not to knock David, but did he not get paid to post articles on the Moneysaver?