Segregated

adjective

set apart from each other

Segregated funds

noun

products designed to separate investors from their money

Would you like an investment that has the potential to make you money with no risk? Who wouldn’t? This is the sales pitch for segregated funds, and it sounds like a no-brainer. Unfortunately, while segregated funds make lots of money for the agents and companies who sell them, they are almost never a good idea for investors. Should you invest in segregated funds? Read on to learn why the answer is likely a resounding, NO.

What are segregated funds?

Disclaimer: It was difficult to find clear, unbiased information about segregated funds, possibly because they are unique to the Canadian market. I have done my best to be thorough and fair in my information gathering and analysis but if you find anything in this post inaccurate or misleading, please let me know so that I can correct it. Now, on with the shakedown.

Segregated funds are the insurance industry’s version of mutual funds. Essentially, they are insurance vehicles used to manage variable annuity insurance products.

Although details vary from product to product, the general idea of segregated (“seg”) funds is that the investor gives a lump sum of money to an insurance company. Those funds are locked in for a period of at least ten years during which the insurance company invests most of that money in a mutual fund. At the end of ten years (or upon death), the investor is guaranteed at least 75-100% of their principle back – more, if the fund returns are higher than the fees (important).

Because they are insurance products, if held in an unregistered account, segregated funds offer creditor protection and avoidance of probate. Importantly, however, registered accounts like RRSPs and TFSAs are not subject to probate, as long as a beneficiary has been named, and have built-in creditor protection.

A worthless guarantee

All investors hate the thought of losing money and advisors who sell segregated funds play on this fear by guaranteeing 75-100% of the original funds, as long as the seg fund is held to maturity – 10 years.

And that’s the kicker. Ten years. If you had invested in an index fund or dividend paying stocks, what are the chances that you would lose money in any given ten year period? 50%? 20%? 10%? The fact is that since 1900, there have only been two ten year periods when the S&P500 has lost money. That’s two out of 120. So, more than 99% of the time that principle guarantee that seg funds advertise would be totally useless.

Would you give up 70% of your gains for this guarantee? That’s how the math works out, as we will see in Case 1 in a moment.

Remember: when someone offers a guarantee, it’s usually in their best interest, not yours. That’s why extended warranties are good for the companies that offer them and not for most consumers. Insurance companies are profitable because they know exactly how little they can guarantee the customer while charging premiums for that same guarantee. Segregated funds are just another iteration of this theme.

Who’s making the money? (hint: it’s not you)

But downside protection might still be appealing if the upside potential was high enough. Unfortunately, segregated funds are guaranteed to lose on the upside due to their astronomical fees, which are often over 4% per year. When reasonable annual estimates of future stock market returns are only 6-7%, such high fees are offensive, borderline criminal.

Don’t be fooled by the justifications; that the fees are worth it because the mutually funds are “professionally managed”, or that higher fees are justified by the principle guarantee. Over the last ten years 97% of actively managed Canadian mutual funds have underperformed the index (SPIVA scorecard), so there’s little chance these will be any different. Furthermore, the way the policies are written, you would only get back 100% of your principle if the final value is over 75% of the original capital, otherwise, you’re stuck with only 75%. As you can see, the devil’s in the details – and the devil’s everywhere with segregated funds.

Obfuscation, penalties, and false hope

Before we get into a few scenarios, here are a few more details investors need to be aware of if considering segregated funds.

- Conflicts of interest. Don’t be surprised if advisors or agents are pushing seg funds hard. They have a lot to gain if they manage to convince their clients to invest in them. First, there’s likely a signing bonus when the policy is initiated. Then there are trailer fees the agent receives every year. Finally, the fact that the funds are locked in means that once you’ve signed the contract, they can spend less time on your plan and still collect a fat paycheck year after year.

- Penalties. The fact that investors are locked in for ten years should not be overlooked. Such lack of liquidity can have a huge impact on one’s life if their situation or priorities change and realize that the segregated fund is no longer an appropriate investment for them. If investors want to get out early, they should be prepared for stiff penalties, further undermining any advantages there might have been. Think about it: if the product was so good, why would they need penalties to keep people from pulling out?

- Misleading tax savings. Investors who are considering segregated funds as an estate planning tool might be tempted by the promise of avoiding probate on those funds. Unfortunately, this is just another misleading selling feature. First of all, probate is only applicable in unregistered accounts. Second, probate is only about 1% – compare this to seg funds’ 4% fees every year. Third, for investors who are really worried about the size of their estate, they would be far better off using the money they would have spent on fees and buying a term life insurance policy, the value of which would far exceed the cost of probate.

- Non-disclosure. Unfortunately, the new CRM2 fee disclosure rules don’t apply to segregated funds. This allows the salesperson to avoid potentially challenging conversations about fees.

- Taxes. Investors in segregated funds (in unregistered accounts) are often issued tax slips, even if the value of their units has gone down. This is because the manager of the fund is actively trading, triggering capital gains, dividends and interest income that is then taxed in the hands of the unit holders. Isn’t tax time complicated enough?

If all these details sound overwhelming, the complexity of these products themselves should dissuade you. Don’t invest in what you don’t understand. Perhaps a few quick scenarios will help illustrate the temptations and challenges of segregated funds.

Case 1: Dave

Dave is a seventy-two year old retiree with $150 000 cash to invest. He already has a portfolio with some stocks, some ETFs and a few mutual funds, but his advisor is pushing him to “diversify” by investing the $150k into a segregated fund. Dave likes the idea of leaving some money to his kids in his estate but is primarily concerned with making sure his funds will last him his lifetime.

What Dave needs to know:

If Dave puts his $150 000 into a segregated fund, there is a >99% chance he will not need the principle guarantee.

If Dave had invested in a plain vanilla 60/40 portfolio returning 6% over that time frame, at the end of ten years he would have $269 000.

Even if the returns of the segregated fund matched those returns (unlikely) before fees, once the 4% fees are accounted for, Dave would only have $183 000 – that’s a 47% difference.

Comparing gains only (i.e. excluding the original capital), Dave would have gained $119 000 using a 60/40 portfolio versus only $33 000 in the segregated fund. In other words, he would have given up 72% of his gains.

As for the diversification argument: it is far simpler, cheaper, and easier to diversify with an all-in-one ETF like VBAL.

Case 2: Linda

Linda is a sixty-five year old planning to retire next year. She has saved a nest egg of $1.2 million that should last through her retirement, but is nervous that the markets will tank soon after she stops earning a paycheque. As such, the principle guarantee is quite appealing, but she is particularly interested in a product that offers a “guaranteed” 4% income.

What Linda needs to know:

The 4% “guaranteed income” payments are often generated by the redemption of fund units. Unless the fund has performed so well that it can pay its hefty fees AND Linda’s income (in which case, simpler alternative investments like blue chip stocks or ETFs would have performed even better), those payments to Linda are coming from – you guessed it – Linda’s capital.

To make matters worse, as those payments erode her investment, they also bleed out the sacred cow of segregated funds: the principle guarantee. You’ll find such nasty details in the fine print.

To make Linda’s situation even more tenuous, that “guaranteed income” is not guaranteed for life, rather only until something called the Guaranteed Minimum Withdrawal Balance (GMWB) is exhausted. The GMWB is based on the investors original capital and investment gains, but is decreased as fees are taken and/or funds are withdrawn.

It sounds complicated, but it’s not. This is what the insurance company is saying (based on 4% fees): “Give me your $1.2 million. After I take $48 000 every year, I guarantee I will give you $48 000 year too – until your money runs out.”

If safety and income are Linda’s priorities, she would be better off buying a simple annuity or a basket of quality dividend-paying stocks.

Conclusions

Segregated funds are wonderful products – for the companies that sell them, not investors. The sales pitch is undeniably tempting, but if you scratch the surface, the same old rottenness that we’ve seen over and over again from the insurance and investment industries comes oozing out.

Bear in mind, the people selling these products might not fully understand them either, so the hard sell might not be intentional deception. But if something is too good to be true, it probably is – and that is certainly the case with segregated funds.

A sincere thank you to those who have already donated – I process each one individually and appreciate your generosity. It takes time and real money to maintain this site. If you find this information useful, please consider donating to keep DividendStrategy.ca ad-free. I’m not trying to get rich . . . 20% of donations are given to Doctors Without Borders. Thank you!

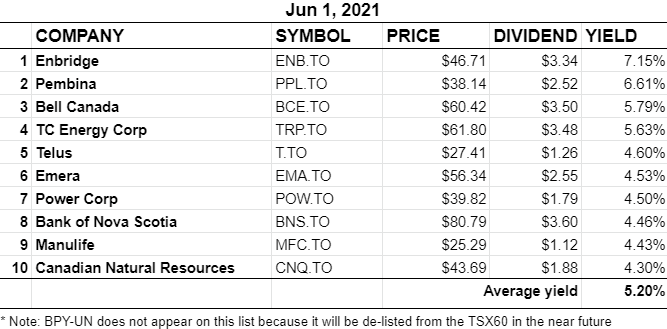

BTSX portfolio update June 2021

Very informative. With in-laws that have a segregated fund that did last (so far) for many years I have wondered if I should choose this option over my dividend investments. Glad to read that I chose the right one! Thanks.

Thanks for the comment, Maureen. The inspiration for this post was that a relative, who is a DIY investor, was tempted by stories of this “too good to be true” product. He had a hard time finding good, clear information, so I investigated and wrote this piece. I hope it helps readers make good decisions, and maybe offer better counsel to non-investor friends and family who might be tempted by segregated funds.

Pingback: Weekend Reading – Become Your Own Advisor edition - My Own Advisor

Hi ,

Thank you for this blog post .I’m new into investing so I did not know what segregated funds were when I first came across them by peeking at my brother s brokerage account. They certainly look promising but you did a great job at debunking them. Honestly I had assumed they were great products ( “gives you peace of mind “.. sight )after I had googled the meaning but now I now better.

Thank you

SM

I’m so happy this post is doing some good. Thanks for the comment.

Thank you for taking the time to do all this. Very much appreciated. There is so much fluff out there and your posts help a lot in saving our hard earned money