Almost everything we value in life requires some kind of maintenance. A house will need a new roof every decade or two. Our cars need oil changes and brake jobs. Our bodies need healthy food and regular exercise.

If we don’t take care of our stuff, our stuff won’t take care of us.

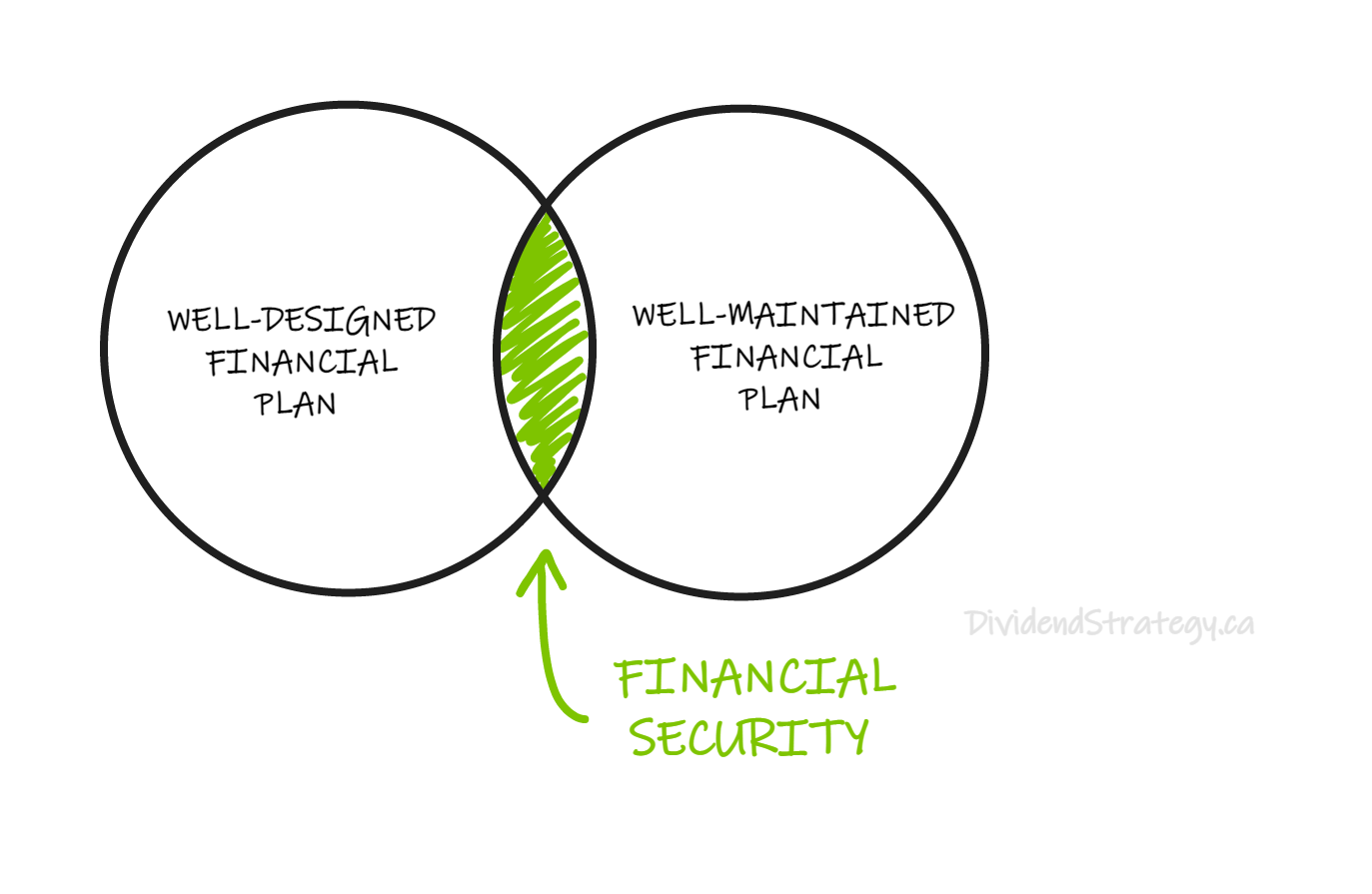

Our financial plans need maintenance too. The good news is that, once you have a good financial plan in place, compared to home, vehicle, and health maintenance, it’s not too time-consuming and makes you money, rather than costs you money.

The end of the year is a good time to tackle this job. Here’s a checklist to make the process as painless as possible.

Income review

If you want to understand your cash flow, the balance between what is coming in vs. what is going out, start with your income. How much did you make this year? Include all sources of income, not just regular employment.

But here’s the important part: calculate your net, after-tax income. HERE is a handy online calculator to get a good estimate of your income tax bill. Seeing that tax bill can be a great incentive to top up that RRSP. And seeing that after-tax income can help keep spending in check.

Expense review

Speaking of spending, now’s the time to have a look at yours.

I’m not a fan of budgeting – few of us have the time or inclination to track every purchase – but I am a huge fan of spending reviews. If you’ve never done it before, this will probably sound horrible. If you have done this before, you will know that it’s probably the most important part of personal finance. It also feels surprisingly good because it’s the easiest way to get a sense of control and direction in your financial life.

So, gather up all your credit card and bank account statements, your computer and a glass of spiked eggnog. You don’t even have to make your own spreadsheet – I made one for you that you can keep and use for free. It will even summarize and illustrate your data in colourful charts. It lives HERE.

This task is intimidating for a lot of people, but I guarantee you will be glad you did it and it is absolutely essential for your financial health.

Net worth calculation

Your net worth is simply your assets minus your liabilities. In other words, what you have vs. what you owe. Calculating it is usually an interesting exercise, but tracking it over time is the really valuable part. Yet another reason to do annual financial check-ups.

Make a list of all of your accounts – those are your “capital assets”. Next, list your “real assets” – that’s your property. Last, subtract what you owe on any loans, mortgages, or lines of credit. While working, your net worth should be growing. In retirement, your net worth can shrink, as long as it is shrinking at a sustainable pace.

The make-up of your net worth is also important and crunching the numbers will provide some good insight here. Your financial situation will be more resilient if your capital assets are greater than your real assets (i.e. avoid being house poor).

Insurance needs

Unless you are already financially independent, you likely need life and disability insurance. In both cases, it is a matter of having enough, but not too much, so don’t just listen to insurance salespeople – do your own research.

For most people with dependents, a simple term life insurance policy will be perfectly adequate. Beware products that combine insurance and investments like whole or universal life. Disability insurance is more expensive but very important. As your assets grow, your insurance needs will shrink. Play with some online calculators to determine how much you need.

Because insurance needs change over time, list your policies, premiums, and benefits to see if they’re still right for you.

TFSA contributions and withdrawals

‘Tis the season to top off your TFSA if you haven’t done it yet. The contribution room for 2022 was $6000 and for 2023 it’s going up to $6500. But don’t worry, your unused contribution room is carried forward.

I encourage people to think of TFSAs as investment accounts rather than savings accounts. But if you do need to withdraw money temporarily, make sure you wait until the next calendar year to replenish those funds, otherwise, the CRA will penalize you for over-contributing. Thus, if you are planning a temporary draw on your TFSA in 2023, you might consider pulling that money out in 2022 instead. This way you can re-contribute as soon as possible without worrying about penalties.

RRSP contributions

Technically, you have until March 1st, 2023 to contribute to your RRSP and still claim it as a tax deduction for 2022, but why wait? The earlier you can get your long-term savings into a tax-deferred account, the better.

There is a never-ending debate between whether to prioritize RRSPs or TFSAs, but here’s the quick answer in three parts:

- Use both if you can

- RRSPs are slightly better than TFSAs if you’re in a higher tax bracket now than you will be when you take the money out, and vice versa

- But don’t sweat it – you really can’t go wrong either way

Look at your last notice of assessment for your contribution room. You can also find it on your “My CRA” online account. Like the TFSA, RRSP contribution room is cumulative and can be carried forward but when you withdraw from a RRSP, that contribution room is gone forever.

Remember that your RRSP must be converted to a RRIF by December 31st of the year you turn 71. If you don’t, the RRSP will be de-registered and you’ll be in for a nasty tax bill. If you are turning 71 in 2023, put this on your to-do list now because the process can take a little time.

RESP contributions

If you are saving to pay for post-secondary education for any children in your life, it’s tough to beat an RESP (registered education savings plan). For a clear explanation of how these accounts work, go HERE. Once you understand how they work, this post discusses ways to optimize the use of your RESP.

Don’t forget to make your annual contribution because the government will chip in an additional 20% (called the CESG – child education savings grant) up to a maximum of $500 per year per child ($7200 total per child).

Tax-free First Home Savings Account

There’s a new type of account, rolling out in 2023, so now is the time to make yourself aware of it. It’s called the Tax-free First Home Savings Account and if you’re saving for your first house, this will be the account to use. Here is a summary:

- For first-time homebuyers only who are over 18 years old

- $8000 per year contribution room

- $40 000 maximum contributions

- Contributions are tax-deductible

- Contribution room up to $8000 can be carried forward

- Investments grow tax-free

- Funds can be removed tax-free if used to purchase a first home

Combining the best of both RRSPs and TFSAs, these TFFHSAs will be the go-to vehicle for first-time homebuyers to save for their first home. $40 000 isn’t much of a downpayment these days, but it will certainly help. For an in-depth explanation, I suggest this article.

Investment portfolio

Last, but not least, it’s time to refill that eggnog and tackle your investment portfolio.

Before you even look at your investments, though, take some time to reassess your overall investment plan:

- What asset allocation (broadly speaking, the ratio of stocks to fixed income) is appropriate for your stage, goals, and risk tolerance?

- What is your target geographic diversification?

- What is your target sector diversification?

Here’s a tip: Answer these questions as if you were designing a portfolio for someone else in your position. You’ll make better decisions that way.

Once you have your plan, then make a list of all your investments on one spreadsheet. This is the best way to make simple but important calculations.

First, determine how your asset allocation has drifted over the year and what you need to get it back in balance. Then determine how your geographic diversification has drifted over the year and what needs to be bought/sold to rebalance there. Finally, have a look at any individual stocks you have; is your sector diversification reasonable? Hopefully, you have a process for determining what to buy and/or sell.

Whether Beating the TSX is part of that process or not, these decisions are no different from decisions about asset allocation – they should be made based on a pre-determined plan rather than on your impressions or predictions at the time you do your portfolio maintenance.

Rebalancing a portfolio with individual stocks gets easier with practice, but it can be a little tricky, especially when those stocks are spread across a variety of accounts. To make your life a little easier, I created another resource for you: a portfolio rebalancing tool (use it for free, or donate if you feel like it). Instructions are on the first tab and the tool is on the second.

One last note on portfolio maintenance: tax-loss harvesting. If you have non-registered equities that you are selling at a loss when rebalancing, those capital losses can be used against capital gains this year, any of the three preceding years, or carried forward indefinitely. This is an important tax-saving strategy. Just remember, make your rebalancing decisions before tax decisions, not the other way around.

One last thing

Congratulations, you’ve done all the hard work. But I have one last suggestion:

Look at your financial picture and pick one thing to fix or improve.

Did you wait until the last minute to make your RRSP contributions? – “pay yourself first” with automatic transfers every month.

Was your spending a little out of control? Commit to reviewing your expenses monthly, perhaps using an app like Mint or YNAB. If that doesn’t work, put yourself on a cash budget for a month or two.

Still haven’t gotten around to making or updating your will? Take the first step by calling the lawyer for an appointment.

If you make just one improvement in your financial plan every year, the benefits will compound just like investment returns. Your wealth will grow faster and, more importantly, so will your peace of mind.

If you’re really serious about getting your financial house in order this year and are looking for unbiased advice from someone who is knowledgeable and objective, feel free to contact me. You can learn more about how I help DIY investors HERE. Scroll to the bottom of the page to read testimonials from past and present clients.

Either way, I hope this checklist is helpful. Please let me know in the comments and feel free to add any additional tips you have found valuable over the years.

All the best in 2023!

A wonderful article, thank you!

You’re welcome – I hope it’s helpful!

Thank you for sharing.

That is a wonderful way of giving.

Aside from your material things you are a very rich man.

Best.

Yes, I feel that. And the really cool part is that giving makes one feel richer, in the best possible way.

Thank you Matt for this great article! I honestly need to work on few of them specially the budgeting which I’m really terrible at thanks to the lack of discipline.

Hope you had a Merry Christmas and all the best to you and your family in the new year!

Thanks, Gus. Whether it is food, oil changes or spending habits, the simple act of tracking or measuring a thing usually leads to improvement.

Most people don’t have to budget, but using an expense tracker like Mint, YNAB or Quicken, can make a big difference with very little effort.