In the world of DIY investing, particularly when it comes to dividend investing in Canada, there are diverse opinions on the best strategies to employ. Recently, I came across a blog post by a fairly prominent Canadian dividend investor that challenges several well-accepted principles of investing. His self-confidence is certainly impressive:

“I’m not saying that anyone who disagrees with my investment strategy is dumb, but I’m only interested in helping or talking to those whose [sic] are interested in learning, or considering that there might be a different way to invest then [sic] how most do. For the rest, the hell with them!”

What exactly were this blogger’s detractors saying that justified such vitriol? He went on to include a laundry list. Here’s a sample of financial principles this author takes offence to:

- That one should always take into account their adversity to risk or risk tolerance.

- That one should maintain an asset allocation, and rebalance their investment to maintain a reasonable percentage in each category.

- That one should not be 100% invested in just Canadian stocks.

- That it is important to be invested in different markets because Canada only represents a small percentage of the global GDP.

- That other countries have outperformed the Canadian markets.

- That the best way to diversify one’s portfolio is to own some ETFs.

- That no one stock should exceed 5% or so, of your total holdings

- That one should invest across various sectors, and markets to minimize potential losses from market fluctuations.

While I respect differing viewpoints, I believe that some of the advice given could potentially mislead investors and lead to suboptimal outcomes. Here’s why I think it’s important to consider risk tolerance, asset allocation, and diversification in your investment strategy.

1. Risk Tolerance

The author claims that considering risk tolerance is bad advice. However, understanding your risk tolerance is crucial to maintaining an investment strategy during market fluctuations. Risk tolerance is about knowing your comfort level with potential losses, which helps prevent panic selling during downturns. Studies have shown that investors who align their portfolios with their risk tolerance are more likely to stay invested for the long term, which is key to achieving financial goals.

Reference: Investopedia. “Understanding Risk Tolerance.”

2. Asset Allocation and Rebalancing

Maintaining an asset allocation and rebalancing are foundational investment principles. Asset allocation involves spreading investments across various asset classes (stocks, bonds, etc.) to balance risk and reward based on an individual’s goals, risk tolerance, and investment horizon. Rebalancing ensures that the portfolio stays aligned with the desired risk level. Without these strategies, an investor may unintentionally take on more risk than they can handle, especially if one asset class outperforms others.

Reference: Vanguard. “Principles for Investing Success.”

3. Diversification Beyond Canadian Stocks

Being 100% invested in Canadian stocks is risky due to the lack of diversification. Canada represents only about 3-4% of the global equity market and is dominated by financials, energy companies and telecoms. Over-relying on a single country’s market exposes investors to country-specific risks, such as economic downturns, policy changes, and sector-specific issues. Diversifying internationally can mitigate these risks and provide exposure to more diverse and faster-growing economies.

Reference: Harvard Scholars at Harvard. “The Value of Diversification”

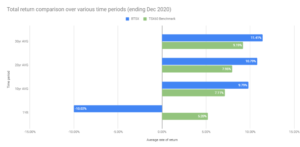

4. Importance of International Markets

While the author suggests that other countries have not consistently outperformed Canadian markets, historical data indicates otherwise. For example, the U.S. stock market has outperformed Canadian markets over several decades. And it’s a little known fact that the Danish market has done even better. By investing in international markets, investors can take advantage of growth opportunities that may not be available domestically.

5. ETFs for Diversification

The use of ETFs (Exchange-Traded Funds) is an efficient way to achieve diversification. ETFs allow investors to own a broad range of stocks, bonds, or other assets within a single fund. This diversification reduces the impact of any single asset’s poor performance on the overall portfolio, thereby lowering risk. They are a particularly efficient way to get international equity exposure. As much as I love Canadian dividend-paying stocks, the evidence is clear that indexing works.

6. Stock Concentration Limits

The advice against any single stock exceeding 5% of your total holdings is a standard risk management strategy. Concentrating too much in one stock can lead to significant losses if that stock performs poorly. Canadian dividend investors have seen several examples of this in the recent past with BCE, AQN, etc. Diversifying across a larger number of stocks reduces this specific risk.

Reference: Kiplinger.com. “How Many Stocks Should You Have in Your Portfolio?”

7. Sector and Market Diversification

Investing across various sectors and markets is crucial for minimizing potential losses from market fluctuations. Different sectors (e.g., technology, healthcare, financials) perform differently under various economic conditions. By diversifying, investors can smooth out returns and reduce the overall volatility of their portfolio.

Reference: Fidelity. “Why Diversification Matters.”

Conclusion

In conclusion, while it’s important to consider different perspectives in investing, not all opinions are valid. Adhering to fundamental principles like risk tolerance, asset allocation, and diversification is crucial for long-term success. These strategies help manage risk and ensure that investors are not overly exposed to any single market, sector, or stock. I encourage investors to critically evaluate any advice and consider the broader context and historical performance before making investment decisions.

Thank you so much to those of you who have chosen to support me and this blog with your donations. Your generosity has a huge impact on the quality of this site. You can support this site by clicking below or by sending an e-transfer to contact@dividendstrategy.ca. Half of all contributions are donated to Doctors Without Borders.

Good Morning Matt,

Thank you for your insight.

Very thoughtful, Matt, as usual. There are a lot of strongly held investing perspectives out there and in these complicated times in the world simple foundational principles of investing in the context of personal risk tolerance will allow careful investors who stick to them to do really well in the medium and long term…and sleep well at night on the way there.

Hi there!

Retired underground gold miner here from Yukon,Canada. I like your common sense out look on Diy investing and agree with your advice.

I rebalanced my portfolio when I reached that age where I don’t have mega time to recover from a crash in the market so I de risked it by buying boring higher paying dividend stocks both in the US and Canada and 1 or 2 spec stocks for fun. I started late in the game (wild miner lifestyle:) but have done ok since I faced up to the fact the job was wearing out my body out and I couldn’t survive on the cheap pension from the Government. Hey you like the outdoors, if you’ve ever considered coming this way shoot me an email and I can give you some tips. Been here and NWT all my life with the exception of a 2year stint in Costa Rica

Best Regards,

Kirk Smeeton