Inflation. It’s the boogeyman, the grim reaper, the silent killer of investors’ retirement dreams. A survey by Leger recently showed that 84% of Canadians are worried about inflation. Another survey south of the border revealed inflation as the top concern for 2022 – ranking well higher than the pandemic. And there is reason to be fearful. Readers of this blog will know that inflation represents a double-whammy of badness. Everyone knows that inflation means higher prices, but history tells us that periods of high inflation are also associated with lower real returns for stocks and bonds. Are you nervous about inflation? Do you know how to invest during periods of high inflation? Read this before changing your investment plan.

My inflation isn’t necessarily your inflation

The first thing to understand about inflation is that it is individual. The most recent news is that Canada’s inflation rate just hit 5.1% – the highest it’s been since 1991. This number represents the consumer price index (CPI) and it’s a hypothetical basket of goods and services that the average Canadian might expect to pay.

But you might not be average. Your personal inflation rate might be higher or lower. Fortunately, there’s an app for that, The Personal Inflation Calculator, that will allow you to calculate your personal CPI.

Why CPI over-estimates real inflation

Just like our spending habits are individual, our responses to increasing prices are also individual. The CPI assumes we’ll all keep buying the same stuff at the same places, but that’s not necessarily true. When the price of beef is up 20%, while the price of fish is only up half that, a lot of people are going to eat more fish. The same thing goes for the wine we drink, the clothes we wear and the cars we buy. This is called item substitution and it’s something the CPI doesn’t account for.

The other thing the CPI doesn’t account for is vendor substitution. When your weekly grocery bill at Whole Foods is up 15% and you’re feeling the squeeze, what do you do? You start shopping at No Frills or Costco when the items are generally less expensive.

Because of these two responses to inflation, studies have shown that CPI overestimates real increases in the cost of living by about 0.5%.

Who is most vulnerable to high inflation?

Retirees are typically identified as the group most exposed to the ravages of inflation. In fact, Gordon Pape recently wrote an article for the Globe & Mail entitled, “The worst nightmare for income investors is coming. Here’s how to prepare.” He makes it sound like the zombie apocalypse.

The reality may not be so sinister. Why? Because studies have shown that inflation-adjusted spending actually decreases during retirement by about 1% per year. This means that if inflation is 2.5%, the average retiree’s spending will also increase, but only by about 1.5%. This is called the “retirement consumption puzzle“. Combined with the CPI’s over-estimation of real-life inflation, many retirees will feel the sting of inflation less than they might have anticipated. And don’t forget, CPP and OAS are indexed to inflation, as measured by CPI.

But still, there’s no getting around the fact that a prolonged period of higher-than-expected inflation could have a major detrimental effect on investors in terms of purchasing power and investment returns.

What should investors do?

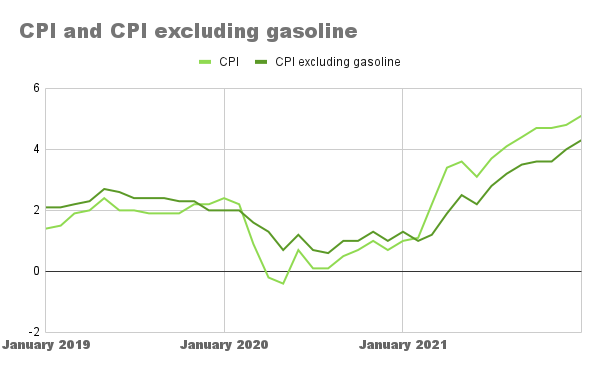

High inflation is here and part of the reason it’s so scary is that we didn’t see it coming. In fact, for a long time, the greater fear for policymakers was deflation, which would have been a far bigger problem for the economy. This is what the CPI has done over the last two years.

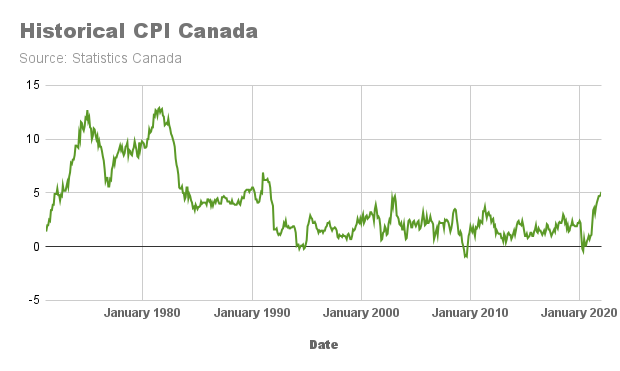

It feels like inflation is going up and might keep on going up. But inflation is a complicated beast, it’s unpredictable. The truth is, we don’t know where inflation is going to be a year from now. One of the many cognitive biases that humans suffer from is recency bias which causes us to give greater importance to more recent events. In other words, recent events cause us to lose sight of the big picture. To help you put recent inflation numbers in perspective, here is a chart of what CPI has done over the last 50 years in Canada:

As you can see, inflation can move sharply in either direction. I’m not one to make predictions, but as life returns to “normal” and supply chain issues are resolved, there are certainly reasons to believe high inflation will also resolve.

In any case, there are two things to take away here. First, inflation is unpredictable. And, second, expected inflation is already baked into asset prices. All of this data is known and markets are more or less efficient, so hedging against unexpected inflation must be framed accurately – it’s a gamble.

But, say you wanted to. Say you wanted to protect yourself against inflation that is even higher than what is widely expected. What are your options? Gold? Crypto? Real return bonds? Dividend-paying stocks? Let’s look at these, one by one.

Gold

This shiny yellow metal has traditionally been considered a hedge against inflation, but as inflation has shot upward from its March 2020 lows, the price of gold has been relatively unchanged.

So, gold isn’t the answer. Everyone and their dog is talking about crypto – what about that?

Cryptocurrencies

While cryptocurrencies are touted by some as the “new gold”, the verdict is out on whether or not they will serve as an inflation hedge. So far, the results are not encouraging. Over the last three months when inflation has been at its highest, the value of Bitcoin has dropped by 40%. With six crashes of greater than 50% in the last ten years (and many more that were less than 50%), it’s definitely not the safe haven for me.

Real return bonds

Real return bonds are bonds issued by the government of Canada in which both the principal and interest payments are adjusted for inflation. Sounds perfect, right? Not so much. The big problem is that they are only a suitable hedge against inflation if your time frame matches that of the individual bonds, and their duration is very long (30 years). Do you expect high inflation to last that long?

What about ETFs that hold real return bonds, like XRB? Similar problem. Unlike buying bonds directly, with a bond ETF you aren’t guaranteed your principal. In a rising interest rate environment, the fund may have to sell bonds at a lower price than what they were bought for in order to manage the ETF. Funds holding long-term bonds, like real-return bonds, are the most susceptible to losses. XRB, for example, has a weighted average maturity of 18 years and has lost 8.7% over the last six months.

Dividend-paying stocks

So, we are left with stocks – blue-chip dividend-paying stocks in particular. If your portfolio already contains an appropriately diversified selection of equities, including Canadian dividend payers like telecoms, utilities and financials, chances are your best move in response to higher inflation is to do nothing.

“But this is the highest inflation rate we’ve seen in thirty years and it could go even higher! Why would I do nothing?” Here’s why:

There are two problems with inflation: things cost more and investments tend to earn less. What if there was a way to increase cash flow and optimize total investment returns over the long haul without taking on unnecessary risk? What if it was simple to do and didn’t involve paying high fees? What if your existing plan was already accomplishing this?

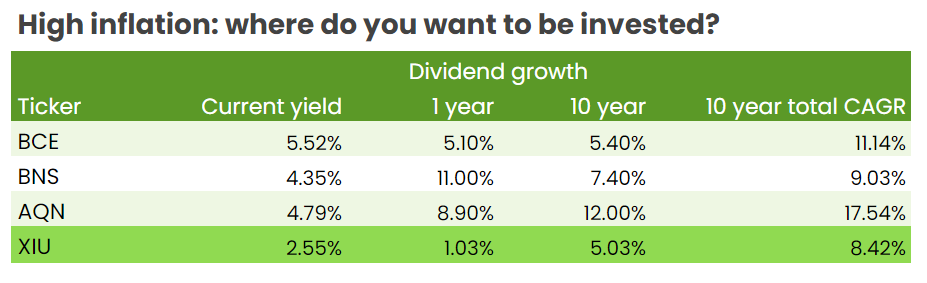

In my opinion, dividend investing using BTSX as a stock selection tool, is about as solid an inflationary investment plan as you’re going to find. We have more than three decades of better-than-average total returns (BTSX has averaged 13.13% vs. 10.46% for the index), including periods of rising interest rates. And we also have stocks that pay a generous dividend and increase those payments over time. Let’s take three examples from our current BTSX list, each from a different sector: BCE (telecom), AQN (utility), and BNS (financial).

Inflation-beating BTSX stocks

BCE is the stalwart of Canadian dividend investors – boring as dirt, but great things grow from good quality dirt. BCE just raised its dividend again, this time by 5.1%. This is inline with it’s 10-year dividend growth rate of 5.4%.

BNS is currently the only one of the big six banks on the BTSX list. They raised their dividend by 11% recently which contributed to a 10-year dividend growth rate of 7.4%.

AQN is a newcomer to the BTSX list this year, but in my opinion, it belongs in the portfolio. With an 8.9% dividend raise this year and an impressive 12% dividend growth rate over the last ten years, I’m quite happy to own this stock.

Here is how each of these stocks compare to the TSX 60 benchmark (which itself is likely a far better investment than gold, crypto, or real return bonds):

The bottom line

Financial events like high inflation numbers can throw investors off balance, making us feel like we should do something. I hope this post helps us remember that we were already investing with this possibility in mind and the best thing to do is to stick with a simple, evidence-based investment plan. There is no magic bullet, no antidote to the uncertainty that inflation represents, but you can help yourself by keeping a level head, holding a diversified portfolio of reliable dividend-paying stocks, and, if necessary, adjusting discretionary spending to a level you are comfortable with.

Please feel free to share your thoughts on investing during high inflation in the comments.

If you found this post informative and/or helpful, please consider donating to help with the cost of running this blog. Don’t forget, half of all donations are given to Doctors Without Borders.

So how diversified should one be? I remember reading an article a number of years ago that stated the average do it yourself investor only needed 10 – 15 stocks in their portfolio. The thinking was any more than 15 would be too many to keep track of for the average investor. It went on to state that if you had good blue chip dividend paying companies, some of which had operations throughout the world, the investor would be diversified sufficiently. Would u agree?

If only there was a simple answer to this question! Unfortunately, there are many factors and thus, many opinions on the matter. Seems to me it really boils down to whether or not you are being compensated for not just buying index ETFs and owning the entire universe of stocks – this is ultimate diversification.

If you own less stocks, you are theoretically increasing your “idiosyncratic” risk – i.e. the non-systemic aspect of risk, and should be compensated for this with higher returns than what you would get as an index investor. This is why I found my research for the following post so fascinating: https://dividendstrategy.ca/risk-adjusted-returns/ Beating the TSX portfolios have not been all that well-diversified, certainly compared to index funds, BUT they have delivered such excellent returns that investors have been more than compensated. One of the big reasons for this is that dividend-paying stocks tend to be low beta, i.e. low volatility.

So, the bottom line in my opinion is that there is no magic number of stocks. It depends entirely on whether the expected returns from that portfolio will compensate you for potentially higher idiosyncratic risk. Personally, I own about 20-25 stocks plus a few index funds for international exposure.

Hi Matt, Thank you so much for today’s column-for years I’ve kept two portfolios-one DGI and one tech.

Yours is the third discussion I’ve read this week concerning inflation, etc.

Already had BCE/AQN (and BMO) in mind to change over to from APPL/AMAZ/ZQQ/MSFT.

At my being 67,and you being an emergency doctor, I think you can understand!

In any case, my main portfolio is 90% DGI-and has done much better than my tech RRSP.

So I’m moving this RRSP to DGI where I’m much more familiar with the territory.

Thank you again, my broker will surely be happy! Keep up the excellent work, it is very appreciated.

Hi Russell – thanks for the comment. I am so happy to hear that my work and writing are helping you.

Matt thank you so much for this article which it came at a perfect time for me and I’m sure for many Canadians.

Reading your article gave me more comfort that I’m on the right path since I’m fairly a new DIY investor and yes I’ve got a big chunck of my portfolio in a solid dividend growers Canadian companies so like you said best thing to do is sit and do nothing and let this storm passes us by.

Matt I know you mentioned once that you don’t invest in Reit and I was wondering why , and the reason why I’m asking is that we’ve just sold a rental property that its price appreciation was incredible and a lot of talks are now how real estate is a good investment in high inflationary periods so i was thinking to put some of the money either in reit specialy industrial or to again reinvest in a pre-sale property.

Hi Gus, thanks for the kind words!

REITs – big topic, so big that I will have to admit that I am no expert in it. But that’s part of the problem: REITs are one of those investments (actually there’s huge variability among REITs, which is part of the problem), that seem simple to understand, but really aren’t, especially in the context of a complete portfolio. Even though I won’t be able to adequately address the REIT question now, here are two posts that are really worth reading:

https://rationalreminder.ca/blog/2019/8/23/reconsidering-reits-in-your-investment-portfolio

https://www.managementstudyguide.com/problem-with-reits.htm

Hope those resources help with your specific situation.

Thanks for your insight!

I always learn something from your posts.

Much appreciated.

Tom

Great to hear, Tom!

Good article. Totally agree with the idea that dividend investing is the best option. The best thing to do, is nothing.

But as far as inflation is concerned, we didn’t see this coming? Here I would like to add something.

When we got hit with COVID and the government started giving out unprecedented amounts of money, we knew this would lead to inflation. Then they saw this as their opportunity to implement all kinds of free benefits that will continue to take a lot of money. Of course supply issues play a great part here, but we should not under estimate the lack of monetary control by this government.

Thanks very much for the comment, DivInvestor, and I’m glad you found the article worthwhile. Although many people anticipated inflation with all the money that was pumped into the economy, no one knew when it would happen, how long it would last, how high it would get or whether the economy would be hobbled by deflation first. I believe it’s very important to realize how prone we all are to hindsight bias – the tendency to overestimate one’s ability to have foreseen the outcome after the fact. With respect to your comments around government policy, I hope everyone understands that I would rather keep this blog, and the discussion herein, non-political.

Thanks again for your thoughts.

This is not meant as a political comment. All I am saying is that everyone is overlooking the obvious when talking about inflation. How much money is inserted into an economy has consequences. Supply issues are partly also created by money looking to be spent.

Pingback: Weekend Reading - Hot real estate edition - My Own Advisor