Retirement planning is a multi-billion dollar industry. If you are conscientious enough to save, there’s a good chance you are saving for retirement. Have you asked yourself, Why? Is retirement the right goal for you, or just a cultural norm that has been accepted prima facie? I think it’s time to stop saving for retirement and start saving for financial independence.

In this post we are going to uncover the psychological factors that may or may not support retirement as a valid goal, how retirement affects physical and mental health, and I’ll tell how shifting my savings goals from retirement to financial independence literally changed my life.

But first, let’s take a trip back in time to see where this idea of retirement came from.

Are we wired to be retired?

Homo sapiens have been around for roughly 200 000 years. Ninety to ninety-five percent of that time we were nomadic, traveling in tribes of 100-200 people, competing and cooperating for safety, hunting and gathering for sustenance. Money did not exist. “Saving” resources would have meant extra burdens to carry and hoarding at your community’s expense – not a winning evolutionary strategy.

We did not evolve to save. This is why it feels hard.

But we did evolve to contribute to our tribe up until the day we died.

About 12 000 years ago, our circumstances changed. We learned how to plant crops and domesticate animals – the agricultural revolution planted us in one spot. Suddenly, we had to plan for the future because, even though we’d learned how to extract more from the land, the seasons made that bounty inconsistent. If we didn’t stockpile for the winter, we died. If we didn’t plan for bad years, we died.

Twelve thousand years wasn’t long enough for genetic adaptation, but our big brains provide another advantage: behavioural adaptation.

Bartering to satisfy short term needs expanded to accommodate long term needs, and ultimately, about 5000 years ago, money was born. Longer term planning prompted the use of currency that would represent value and could be exchanged for other things of value when the need arose at some future date.

Retirement was invented

But still, the idea of “retirement” did not exist until 1889. At the time, German Chancellor Otto von Bismarck was battling high rates of unemployment among the young, so he gave the elderly a way out.

“Those who are disabled from work by age and invalidity have a well-grounded claim to care from the state.”

He set the “retirement” age at 70, paying the old to leave the workforce and making room for younger, healthier workers. Politically and economically, it was a good idea. Other countries followed suit. The new concept of retirement quickly became an entitlement, and as the decades passed we wanted it earlier and earlier and more and more luxurious.

The paradox is that we evolved to contribute to the well-being of our family and tribe and also to be seduced by the idea of worry-free rest and relaxation. This is the set-up for a fundamental conflict between our present self and our future self.

The psychology of saving

You are a product of your experiences – that vast timeline of events that stretches out behind you like the contrail of a jet. The end product is the unique, complicated individual you think of as yourself. At least that’s how it seems.

The truth is, you are not a final product, and your path is not a straight line. Your situation, your wants, your needs, your priorities could change significantly in a week. It’s even more likely in a year. And it’s almost a sure thing in ten years. We take for granted the changes that led up to now and underestimate the changes that are yet to come. The you of now is just a single point on the meandering line of your life – and you don’t know what zigs and zags are coming.

The End of History Illusion

Psychologists call this cognitive blind spot “The End of History Illusion” and it is vital to understand if you are saving for the future. We think we know what’s going to make us happy, but we don’t. We tend to think that our priorities now will be our priorities forever. But the you of 2040 will be as different from you in 2021 as you are from the you of 2000.

Don’t believe me? Try writing your future self a letter sometime. How will your kids or grandkids have changed? Will you be dealing with new health problems? Is there a new COVID-19 to deal with? Who has died? Who has been born? Once you start thinking about all the things you don’t/can’t know, it becomes clear that you also can’t know your future self because those things will change you. And yet, you are responsible for the you of the future. In fact, you are responsible for that entire timeline of unknown selves that is yet to come.

This is as important as it is metaphysical. It’s the real reason to save. Not for some fantasy of retirement but because you don’t know what’s coming. You don’t know what your priorities will be, but you’ll be damn glad to have the financial resources to pursue them.

Stop saving for retirement

The “Freedom 55” lounge-chair-on-a-beach idea of retirement might sound nice, but it makes some big ugly assumptions about human nature.

First, it assumes that we’re happier living a life of leisure. In fact, the opposite is true. Retirees have a 40% increased risk of depression. Humans are wired to work. The ultimate goal should not be to stop working but to choose what we work for.

Second, it assumes that we’re healthier when we’re not working. Wrong again. Retirees have a 60% increased risk of receiving a physical diagnosis than non-retired people. We need to be physically, socially, and cognitively active.

Third, it assumes that we’re capable of making the transition. When the goal becomes a luxurious retirement as early as possible, we tend to overwork. Brought down by fatigue, we try to pick ourselves up by buying nice things. The relief is short lived, but the hit to our savings is permanent. Even as our happiness and savings rate decreases, we get used to more and more luxury. So we have to work harder, not just to maintain our current lifestyle, but the one that we think will make us happy in retirement. It’s a truly vicious cycle. And the real factors that lead to long, healthy lives – fitness, relationships, meaningful hobbies – are often neglected.

Retirement is a social experiment, and the results aren’t encouraging.

If not retirement, then what?

Okinawa is a Japanese island with some of the longest living people on earth. More importantly, they have the longest disability-free lifespan on the planet. Do you know what their word for retirement is? They don’t have one – not a single word describing the concept of stopping work completely.

What the Japanese do have is another word, ikigai (pronounced “icky guy”). Ikigai translates to “a reason for being”. For some this might be a dedication to community, for others a dedication to self-improvement. Either way, those who have ikigai, enjoy the drive and ability to willingly undertake activities that are meaningful to them.

Sounds nice, but does it make a difference? Yes, a big one. A study of 43 000 Okinawans found that those with ikigai had higher levels of education and employment, and lower levels of stress. They lived longer and were healthier – without retiring.

Our nomadic ancestors would hunt big game by chasing it. The bigger the prey, the longer the chase. We’re chasing something too – happiness and meaning – and we think it comes with retirement. We chase it until we’re collapsing with exhaustion only to find that, much of the time, it’s a hollow shape of the thing we needed. Those who successfully navigate retirement are not those who become sedentary in mind and body, but those who re-engage in new and meaningful ways. Ikigai.

My story: saving for financial independence

I just turned 45 years old and have been thinking about saving and investing for decades. Having a wife and four kids matured that mindset rapidly. I always liked the idea of wealth, not so much for the things we could buy but for the security and opportunities it would afford us.

Until about five years ago, I thought I was saving for retirement. Then my job as an emergency physician, which was always hard, started to become exhausting. Patients deserve caring, engaged doctors, so when I couldn’t recover between shifts, I knew I had to make a change. My wife and I looked at our savings and the equity we’d built up in our home with fresh eyes. “Retirement” was one way to use that money, but we had a better idea. We found our ikigai.

This might sound crazy, but we sold our house, our cars and most of our accumulated possessions, bought backpacks for all six of us and traveled around the world for a year as a family.

Perhaps the biggest lesson we learned was that we don’t know what’s coming. Looking back, all of the most important events in our lives were unpredictable. What were the chances we would meet at a house party in Vancouver in 2002? It was a pleasant and profound surprise that we were blessed with four kids. It was somewhat disappointing that my career in medicine would be short. We certainly didn’t know we had it in us to travel the world for a year with young kids. And, even though we love our small town Ontario life now, we joke that we’re “five year” people – every phase is an experiment, and that keeps us both humble and flexible.

Saving for what matters . . . even if we don’t know what that will be

So, we organize our finances appropriately. A big house and nice cars don’t matter, but family dinners and being around when the kids need me matters a lot. I make things out of wood and that is starting to bring in a little money. I’m also developing a financial education course for physicians that is all about improving wellness through financial independence. It is sorely needed and deeply satisfying. And, of course, there’s this blog.

The really great thing, financially, is that if the work you enjoy doing provides you with a modest income, that decreases how much you need to draw from your investments and, therefore, how much you need to save in the first place.

Some people are dying to retire. Others could take it or leave it. For the first time, I’m realizing I don’t want to be retired at all. Fulfillment comes from pushing at the boundaries of what I can do to make myself a little better and help those around me become a little better too. That’s not easy. It’s work. But it’s damn good work.

If you are beginning your investing journey, please make use of the free content on this site and grow your portfolio. If you have achieved financial independence and have a few dollars to spare, I hope you will consider supporting DividendStrategy.ca. I’m not trying to get rich . . . 20% of donations are given to Doctors Without Borders. Thank you!

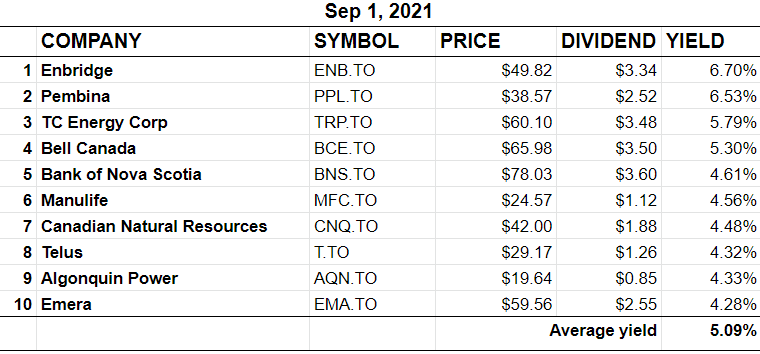

BTSX portfolio update September 2021

Matt, an excellent post and I agree wholeheartedly. Having recently retired and living almost entirely on dividends, we find that the ability to control our time and focus on what is important at the moment is hugely rewarding.

All the best on your journey,

Adrian

Thanks so much for the comment, Adrian. I’m so happy you’re making it work.

Nice post, and maybe this story will provide a real-life example of the rewards of planning for financial independence. I just came in from the garden where I had spent most of the day (in hourly stints) getting it cleaned up and ready for winter. It has been a good gardening season this year but one that was quite different for me.

Last year, with the ravages of COVID, market gardeners (e.g., those growers that sell their produce at a local farmer’s market) were battered back and forth since some weeks the markets were open and sometimes that had to be closed. This left growers with an overproduction problem. I have such an operation close to me; she looks after the garden, he is a certified arborist, and together they raise their three boys. She (I’ll call her Sarah) called me up one day because the local market had been shut down without any notice and she had a load of totes filled with vegetables and flowers, and she knew of my connection to a nearby senior’s home. I loaded up the totes in my truck and quite a few of the resident’s had fresh vegetables for a change (Digression: One of the biggest problems seniors face is getting proper meals at a reasonable cost. Too often it is easier to settle into an inadequate ‘tea and toast’ diet with the concomitant loss of muscle mass and associated physiological and medical problems).

That happened several times last summer and it worked out well for everyone. And then, about a year ago, Sarah called me to say that she had made the decision to enter EMT training but she still wanted to plant her garden and give the produce exclusively to the senior’s, and would I help? Well, you probably know the answer to that already. Using produce mainly from her garden with a little bit from mine we were able to reach about 80% of the seniors and provide free produce and flowers over the summer months. Monday was out last delivery and we celebrated with an outdoor ice cream social where I was able to give everyone some of my homemade black raspberry ice cream. And, even though we stressed that the everything we brought in was free, many of the residents voluntarily donated a total of $600 that we were able to give Sarah to help defray her school expenses. For me it was a fantastic summer, a perfect example of volunteerism, and something I could not have done if I had to work instead. Soon we will start planning for next year’s garden. Being 81 years old and still able to contribute to a project like this is the best reward for saving for financial independence.

Such a great story, Dave. You have contributed so much to the DIY investor tribe over the decades, and now embracing serendipity to nourish and brighten the days of the residents of the senior’s home. Incredible and inspirational. Thank you for what you do and for sharing it with us.

Great..Post, Hats off to Matt and family, I believe this is the greatest gift anyone can gave and share with all,helping people to D I Y. Always looking forward to your posts. And also nice to hear from Dave Stanley,I sure appreciate what I have learned from his hard work ,via CanadianmoneySaver, Thanks Again Matt for your hard work.

Thanks for the kind words, Sam. I’m honored to be able to build on Dave’s legacy.

Great story by David Stanley. I started investing(?) back in the old days of the VSE when promoters would cold call investors(?) to sell them mining stock. Over the years I have learned a lot and been successful enough to retire early. At 70 I am involved with Rotary and we do many community projects. We just completed a swing set for a community playground.

I currently own 7 of 10 on the BTSX. Always read your emails with great interest Matt. Thanks for all your work.

I retired sixteen years ago at the age 56. I won’t go into detail, but I worked in a large organization for many years, and I was never happy there. I’m the introverted loner type and many people in life don’t like that. In the end I was sick of them and they were sick of me so it was mutually beneficial that I leave with a reduced pension. Not having any worthwhile skillsets, in the early years I was concerned that I may have to go back to work at a minimum wage job. Never happened, so I lucked out.

I’m also lucky that with my wife we can still both save and invest even in retirement. We’re just starting to make the mandatory withdrawals from our RRIF’s but from dividends and savings we’re both able to easily finance the maximum to our TFSA’s each year. The non-registered portfolio also gets added to every month or two with combined savings and dividends to create even more dividends. The miracle of compounding.

On top of that, we both give to our favourite charities each year.

It’s so difficult to feel trapped in an environment that is suffocating rather than stimulating. I’m so happy to hear that financial independence has liberated you from that situation.

Pingback: Weekend Reading – Core and explore edition - My Own Advisor

Thank you Matt for this great article , I like to ask if you do own CNR in your portfolio and the reason why is because I bought few shares of CN few months back on the dip and last week the share price spiked up so now I’m thinking of selling CN and add more to my Enbridge holding and one of the reason is that in order to drip one share of CN you need about 42k invested in the company so do you believe in companies like CN with low dividend yields but capital appreaciation or you just like to stick to a better yield companies like ENB and BCE.

Thanks in advance

Thanks for the comment, Justin. Hope you will understand that I can’t give specific investment advice. In general terms, however, I have no problem with companies that pay lower dividends if they a good long history of raising those dividends at a healthy rate. This post might be informative: https://dividendstrategy.ca/should-you-invest-for-dividend-yield-or-dividend-growth/

Really enjoyed this post. It is so true that financial independence gives us freedom to do what we want. I was always saving for retirement but what I really wanted was the choice to do what I wanted. The BTSX strategy is a really simple way to get anyone on the path to FI. We created our own dividend portfolio before I heard about the BTSX, but has achieved similar results. Not having to go to work is wonderful. We have more than replaced my salary with dividends and the portfolio continues to grow.

Another success story – I certainly agree that dividend investing + understanding that the target is financial independence, not retirement, makes true success much more likely. Thanks for the comment.

Good article and I learned some things about retirement.

I’d love to hear more about the around there world adventure! I plan to live overseas like I did as a kid once both my kids are over 5, so they can remember their adventures.

Thx!

BTW, it really seems like there are a lot of physician personal finance bloggers. Is it mainly due to burnout?

Sam

Hi Sam, you can read our travel blog here: http://www.bigfamilysmallworld.com

Yes, there certainly are a lot of physician finance bloggers. And, yes, I tend to think it has a lot to do with the fact that medicine is now less a calling and more a job – a very frustrating and exhausting one, no matter what side of the border you’re on. So, people are looking for a way out (or at least a way not to feel so trapped) and financial independence is probably the best way to achieve that. The other reason that comes to mind is that doctors tend to be more skeptical than the average person, and that makes them wary of the conflicts of interest inherent in the financial services industry.

Thanks for stopping in.

Pingback: Saturday Linkage: – 39 Months

Such a great view point that I share. Retirement is completely outdated and needs a rethink. You guys have done a great job.

Pingback: Fawcett’s Favorites 9-27-21 – Financial Success MD